Energy Drinks Market Size, Share, Trends, & Industry Analysis Report

By Product (Nonalcoholic and Alcoholic), By Type, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 113

- Format: PDF

- Report ID: PM1606

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

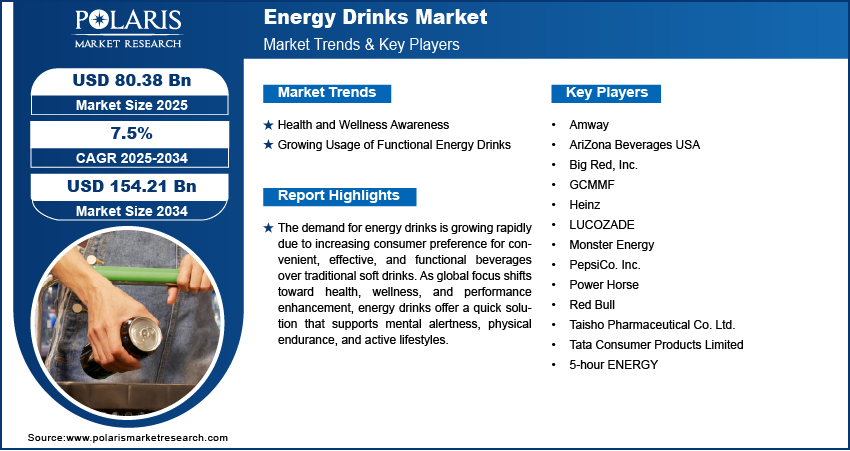

The global energy drinks market size was USD 75.28 billion in 2024, registering a CAGR of 7.5% during 2025–2034. The rising consumer demand for organic food and beverage products, especially functional beverages that boost energy, focus, and athletic performance, has contributed to their growing use. Additionally, this trend is fueled by a growing health-conscious population, urbanization, and aggressive marketing by leading brands targeting young adults and athletes.

Key Insights

- In 2024, the nonalcoholic market, worth around USD 72.25 billion, leads the worldwide energy drinks market with drinks aimed at improving physical and mental performance without alcohol.

- The natural segment is anticipated to attain a CAGR of 8.60% between 2025 and 2034 because it does not have synthetic additives, artificial sweeteners, or excessive amounts of processed sugar.

- Off-trade in 2024, which had a value of USD 49.71 billion, was the leading market segment covering the selling of energy drinks in retail stores for off-premises use.

- The market in Asia Pacific accounted for USD 27.03 billion in 2024, stimulated by a combination of demographic, cultural, and economic reasons.

- The North America energy drinks industry is expected to reach USD 43.48 billion in 2034, backed by increasing demand for functional drinks and lifestyle changes towards convenience.

- Europe accounted for 22.4% of the world's market in 2024, driven by growing demand for energy drinks among working professionals, students, and athletes seeking enhanced performance and concentration.

Industry Dynamics

- The presence of ingredients such as taurine, B vitamins, and herbal extracts enhances mental acuity and endurance, and energy drinks have become the go-to for those looking to reach peak productivity.

- With contemporary consumers looking to support their health, demand is moving toward more wholesome offerings, and manufacturers are responding with beverages that provide functional value above and beyond a mere energy kick.

- The increasing trend towards functional energy drinks, loaded with nutrients such as vitamins, adaptogens, electrolytes, and antioxidants, is a sign of increased consumer demand for wellness-promoting products that aid immune wellness, mental alertness, and physical recovery.

- A significant challenge for the market is the growing concern over the health risks associated with excessive caffeine and sugar consumption.

Market Statistics

2024 Market Size: USD 75.28 Billion

2034 Projected Market Size: USD 154.21 Billion

CAGR (2025-2034): 7.5%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Energy drinks have become a significant part of the global beverage industry, offering consumers an instant boost of energy and enhanced mental alertness. These drinks are formulated with caffeine, sugar, amino acids, and other stimulants that help improve concentration and reduce fatigue. The popularity of energy drinks has surged over the past decade, with a diverse consumer base ranging from athletes and students to professionals who require sustained energy throughout the day. With increasing lifestyle demands and a fast-paced world, energy drinks have evolved to meet the varying needs of individuals across different demographics.

One of the key benefits of energy drinks is their ability to enhance physical and mental performance. The caffeine content in these beverages acts as a mild form of central nervous system therapeutics by stimulating the brain, leading to increased alertness and improved reaction time. This makes them especially useful for individuals engaged in high intensity activities, whether in sports, academics, or the workplace. Additionally, the presence of ingredients such as taurine, B vitamins, and herbal extracts further contributes to cognitive function and overall stamina, making energy drinks an appealing choice for those looking to maximize their productivity.

Market Dynamics

Health and Wellness Awareness

Modern consumers are increasingly prioritizing products that align with their well-being goals, leading to a shift in demand toward healthier alternatives. This trend has prompted manufacturers to innovate and introduce beverages that offer functional benefits beyond merely providing an energy boost. For instance, the incorporation of adaptogens, herbal extracts, and organic ingredients caters to the growing segment of health-conscious consumers seeking products that support overall wellness. This heightened focus on health has led to the development of energy drinks with reduced sugar content, natural flavorings, and added vitamins or food antioxidants.

Consumers are now more discerning about ingredient lists, favoring products that are free from artificial additives and preservatives. Such preferences have driven companies to reformulate existing products and launch new lines that meet these clean-label demands, thereby expanding their market reach and appealing to a broader audience.

Growing Usage of Functional Energy Drinks

Consumers are increasingly seeking energy drinks that provide benefits beyond a simple energy boost. Functional energy drinks are enriched with additional ingredients that deliver specific advantages, such as enhanced focus, improved cognitive function, hydration, or athletic performance. These beverages often incorporate ingredients beyond traditional stimulants such as caffeine, including vitamins, adaptogens, electrolytes, and antioxidants. This evolution highlights the growing consumer preference for products that promote overall wellness, encompassing immune health, mental clarity, and physical recovery.

The appeal of functional energy drinks lies in their ability to cater to specific consumer needs, whether it's boosting mental performance during work or providing hydration during exercise. This targeted approach has allowed brands to differentiate themselves in a crowded market, offering tailored solutions that resonate with health-conscious consumers seeking multifunctional benefits from their beverage choices.

Segmental Insights

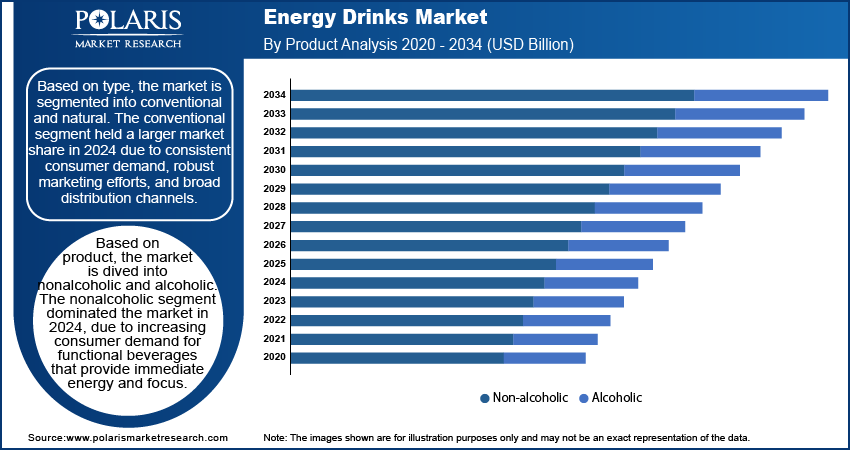

By Product Analysis

The nonalcoholic segment dominates the global energy drinks market. In 2024, the segment was valued at approximately USD 72.25 billion. Nonalcoholic energy drinks are beverages formulated to boost physical and mental performance without containing alcohol. They typically include ingredients such as caffeine, taurine, vitamins, and sugars or sugar substitutes to enhance alertness and energy levels. Brands such as Monster Energy and Red Bull have become prominent in this category, offering a variety of flavors and formulations to cater to diverse consumer preferences.

The global demand for nonalcoholic energy drinks has increased, driven by increasing consumer demand for functional beverages that provide immediate energy and focus. This surge is particularly notable among young adults, athletes, and professionals seeking alternatives to traditional caffeinated drinks. The market's expansion is further fueled by product innovations, including sugar-free options and drinks infused with natural ingredients, aligning with the growing health consciousness among consumers.

By Type Analysis

The conventional segment accounted for the largest share at 73.42% in 2024. This segment is characterized by products that typically contain caffeine, taurine, and other stimulants, often formulated with synthetic additives to deliver a quick energy boost. The segment growth is driven by consistent consumer demand, robust marketing efforts, and broad distribution channels. Conventional energy drinks are beverages designed to provide a rapid boost in energy and mental alertness, primarily through the inclusion of stimulants like caffeine and sugar. These drinks often contain synthetic additives, artificial flavors, and high levels of processed sugars to enhance taste and prolong shelf life. Brands such as Red Bull and Monster Energy have become synonymous with this category, offering products that appeal to consumers seeking immediate energy enhancement.

The natural segment is expected to register a CAGR of 8.60% from 2025 to 2034, as this segment avoids synthetic additives, artificial sweeteners, and high levels of processed sugars. The shift toward natural energy drinks reflects a broader consumer trend favoring health and wellness. Health-conscious consumers perceive these beverages as healthier alternatives, seeking products with recognizable and unprocessed ingredients to support a holistic approach to well-being. This demand has led to an increase in natural energy drink launches, with brands such as Purdey's, RUNA, and Tenzing offering naturally energizing options.

By Distribution Channel Analysis

The off-trade segment dominated the market, valued at USD 49.71 billion in 2024. The off-trade distribution channel encompasses the sale of energy drinks through retail outlets where products are purchased for off-premise consumption. This includes supermarkets, convenience stores, liquor stores, and online platforms. Consumers buying through off-trade channels typically consume energy drinks at their convenience, such as at home, work, or during activities such as sports and travel. This channel offers consumers the flexibility to purchase single units or in bulk, catering to various consumption patterns.

Off-trade channels account for the largest share of energy drink sales globally. The convenience of purchasing energy drinks alongside regular grocery shopping, combined with promotional discounts and bulk purchase options, makes this channel highly attractive to consumers. The rise of e-commerce has further bolstered off-trade sales, providing consumers with easy access to a wide range of energy drink brands and flavors with the convenience of home delivery.

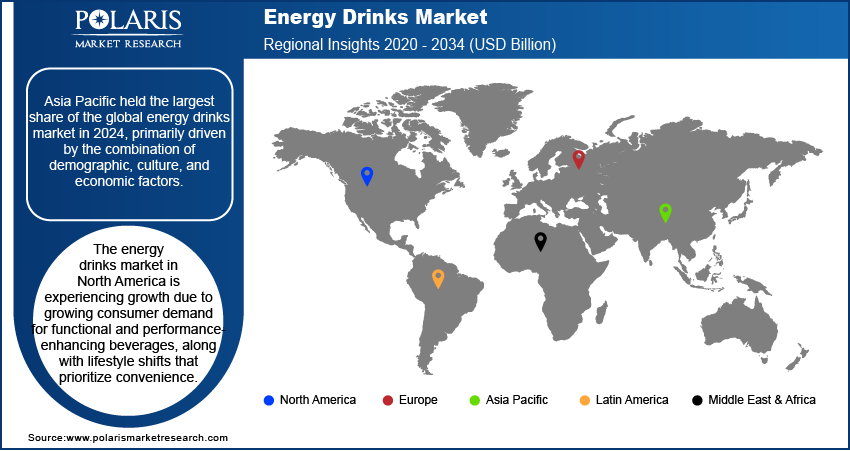

Regional Analysis

The Asia Pacific energy drinks market size reached USD 27.03 billion in 2024. The dominance is primarily driven by combination of demographic, culture, and economic factors. The region’s youth population, particularly from China, India, and Southeast Asian nations, is increasingly adopting fast-paced, urban lifestyles that fuel the demand for convenient, on-the-go energy solutions.

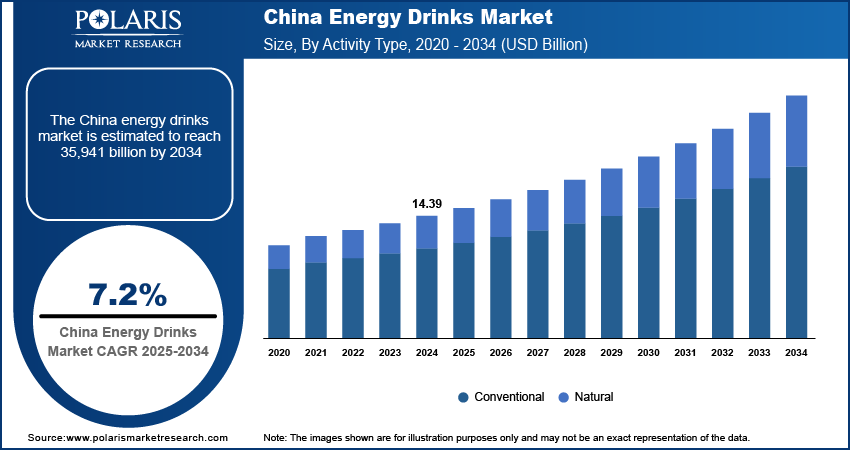

China Energy Drinks Market Insight

The China energy drinks market dominated in Asia Pacific, capturing 67.0% regional share, driven by evolving consumer lifestyle and rising demand for functional beverages. China’s youth population is embracing high pressure lifestyle that demands a quick energy boost and improved mental focus. This shift has led to growing consumption of energy drinks among students, professionals, and fitness enthusiast. The strong performance of local brands such as Red-Bull China and Hi-Tiger, which have adapted their marketing strategies to local preferences, has also played a critical role in driving market growth. Moreover, the rise of health-consciousness among Chinese consumers has spurred interest in functional energy drinks enriched with vitamins, herbal supplements including extracts, and natural ingredients.

North America Energy Drinks Market

The energy drinks market in North America is projected to reach USD 43.48 billion by 2034, owing to the growing consumer demand for functional and performance-enhancing beverages, along with lifestyle shifts that prioritize convenience. Additionally, the region has witnessed a rising health and wellness trend, prompting consumers to look for products that offer more than just caffeine. This has led to the rapid adoption of functional energy drinks enriched with ingredients such as B vitamins, adaptogens, amino acids, and natural caffeine sources. Brands are also focusing on offering sugar-free and organic variants to cater to the health-conscious demographic. The widespread availability of these beverages through both traditional retail outlets and expanding e-commerce platforms further supports industry growth.

In the North American market, the United States accounts for the largest share, driven by high consumer awareness and a strong fitness culture that fuels demand for performance-oriented beverages. U.S. brands are also leading innovation in the sector, introducing niche formulations and personalized energy drink options to appeal to diverse consumer preferences.

Europe Energy Drinks Market Overview

The Europe accounted for 22.4% share of the global market in 2024. The regional market growth is largely attributed to the rising demand for energy-boosting products among busy professionals, students, and athletes seeking enhanced performance, mental focus, and physical stamina. Additionally, the growing trend toward fitness and wellness has led consumers to favor energy drinks with added functional ingredients such as electrolytes, vitamins, amino acids, and natural stimulants like green tea extract and guarana. European consumers are also showing a strong preference for low-sugar, organic, and vegan-friendly energy drinks, prompting brands to innovate and diversify their product portfolios. Germany plays a pivotal role in the European energy drinks market, driven by a strong demand among health-conscious consumers and a vibrant sports and fitness culture. The country has also seen a surge in the popularity of clean-label and sustainably produced energy drinks, with local and international brands actively responding to these preferences.

Key Players and Competitive Analysis

A few key players in the industry include Amway; AriZona Beverages USA; GCMMF; LUCOZADE; Heinz; 5-hour ENERGY; Monster Energy; Tata Consumer Products Limited; PepsiCo. Inc.; Power Horse; Red Bull; Taisho Pharmaceutical Co. Ltd.; and Big Red, Inc. These players are focusing on strategic initiatives such as innovative product launches, mergers and acquisitions, brand partnerships, and diversification into functional and health-oriented formulations to strengthen their portfolios and attract a broader consumer base. Companies are also investing in R&D to develop energy drinks with cleaner labels, natural ingredients, and added health benefits such as hydration, mental focus, and immunity support. Marketing strategies involving celebrity endorsements, sports sponsorships, and influencer campaigns are being widely adopted to enhance brand visibility and consumer engagement.

Key Players

- Amway

- AriZona Beverages USA

- Big Red, Inc.

- GCMMF

- Heinz

- LUCOZADE

- Monster Energy

- PepsiCo. Inc.

- Power Horse

- Red Bull

- Taisho Pharmaceutical Co. Ltd.

- Tata Consumer Products Limited

- 5-hour ENERGY

Industry Developments

August 2024: Chicago Cubs and Kraft Heinz announced a new multi-year partnership, designating Heinz as the Official Condiment of the Cubs and Wrigley Field. This collaboration, while primarily focused on food products, indirectly benefits the energy drinks market by enhancing the overall fan experience at Wrigley Field, where energy drinks are commonly consumed.

January 2024: Rockstar Energy Drink unveiled this line featuring ingredients such as Lion's Mane and 200 mg of caffeine. The zero-sugar, calorie-free beverages aim to provide both energy and mental clarity, available in flavors such as Lemon Lime, White Peach, and Orange Pineapple.

March 2023: GURU Organic Energy introduced Theanine Fruit Punch beverage in Canada. It combines caffeine with theanine to enhance focus and mental performance, offering a fruit punch flavor with natural ingredients and only 50 calories.

Energy Drinks Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Nonalcoholic

- Alcoholic

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Conventional

- Natural

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- On-trade

- Off-trade

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Malaysia

- Australia

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Energy Drinks Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 75.28 Billion |

|

Market Size in 2025 |

USD 80.38 Billion |

|

Revenue Forecast by 2034 |

USD 154.21 Billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 75.28 billion in 2024 and is projected to grow to USD 154.21 billion by 2034.

The global market is expected to register a CAGR of 7.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Amway; AriZona Beverages USA; GCMMF; LUCOZADE; Heinz; 5-hour ENERGY; Monster Energy; Tata Consumer Products Limited; PepsiCo. Inc.; Power Horse; Red Bull; Taisho Pharmaceutical Co. Ltd.; and Big Red, Inc.

The conventional segment dominated the market in 2024.

The nonalcoholic segment held the largest share of the global market in 2024