Beverage Packaging Equipment Market Size, Share, Trends, Industry Analysis Report

By Automation (Manual, Semi-Automatic, Fully Automatic), By Application, By Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 123

- Format: PDF

- Report ID: PM6355

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

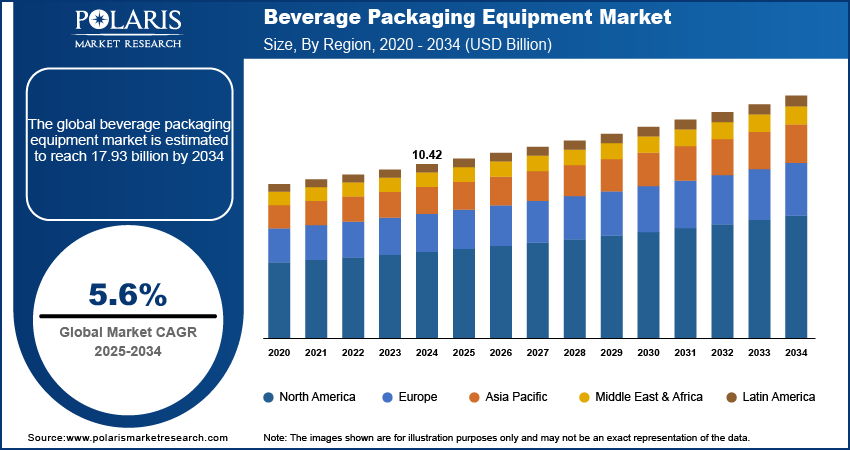

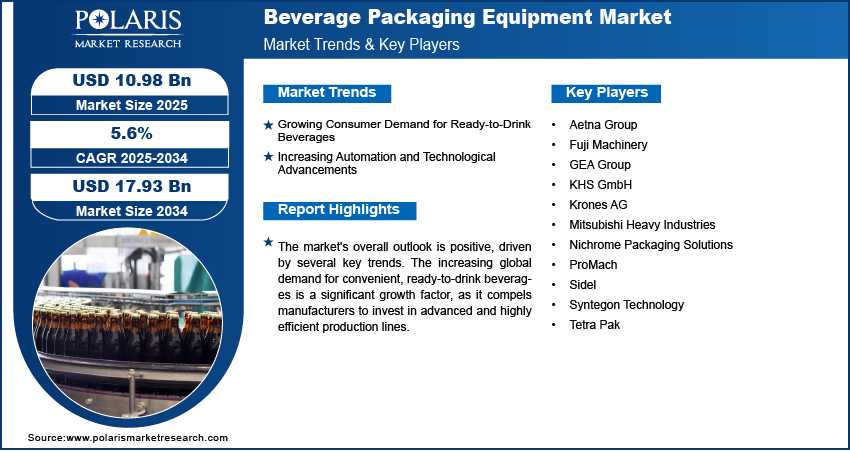

The global beverage packaging equipment market size was valued at USD 10.42 billion in 2024 and is anticipated to register a CAGR of 5.6% from 2025 to 2034. The increasing demand for ready-to-drink (RTD) beverages and the push for more automated production lines are key growth factors. Additionally, there is a growing focus on sustainable packaging solutions, which is also a significant trend.

Key Insights

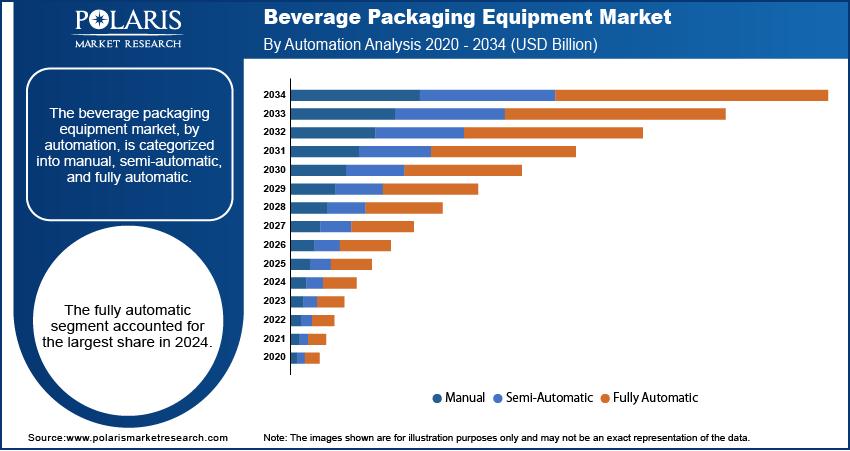

- By automation, the fully automatic segment holds the largest share due to its capability to handle large production volumes.

- By application, the bottled water segment is the largest application of packaging equipment, driven by the immense global consumption of packaged water.

- By type, the filling and capping machines segment dominated the revenue share as it is a core and essential component of almost every beverage production line.

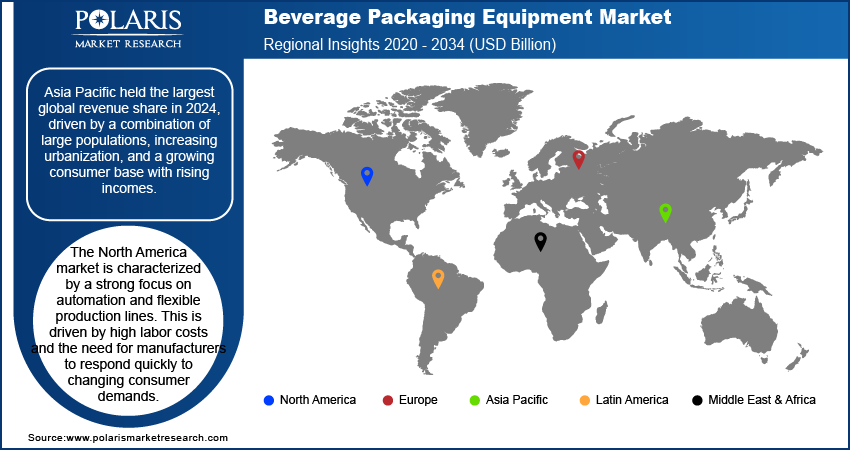

- By region, Asia Pacific holds the largest share, driven by rising beverage consumption, increasing urbanization, and growing investments in automated packaging technologies by manufacturers to meet high production demands efficiently.

Industry Dynamics

- The increasing global demand for RTD packaged beverages such as bottled water and energy drinks drives the requirement for packaging equipment. As consumer lifestyles become fast-paced, the need for high-speed, efficient machinery that can handle large production volumes and ensure product safety is essential to meet market needs.

- A growing focus on sustainability is pushing manufacturers toward greener technologies. The industry is seeing a major shift toward equipment that can work with recyclable, biodegradable, and lightweight packaging materials to reduce waste and comply with stringent environmental regulations.

- The rising need for automation and advanced technology in manufacturing plants is another important driver. Innovations such as AI, robotics, and smart sensors are being integrated into machinery to increase production efficiency, reduce labor costs, and improve overall product quality.

Market Statistics

- 2024 Market Size: USD 10.42 billion

- 2034 Projected Market Size: USD 17.93 billion

- CAGR (2025–2034): 5.6%

- Asia Pacific: Largest market in 2024

AI Impact on Beverage Packaging Equipment Market

- Artificial intelligence (AI) is reshaping the market for beverage packaging equipment in profound ways, driving innovation, efficiency, and sustainability across the industry.

- AI-powered robots are used to streamline various packaging tasks such as filling, sealing, labeling, and palletizing.

- Market players use AI technology to optimize material usage, which helps reduce excess packaging and adverse environmental impact.

- Predictive maintenance minimizes downtime by identifying equipment issues before they escalate.

The beverage packaging equipment is defined by the machinery and systems used by beverage manufacturers to package their products for distribution and sale. This includes everything from filling and capping machines to labeling and palletizing systems, all designed to ensure efficiency, safety, and hygiene in the production process. The industry is essential for the packaging of various liquid products, such as soft drinks, juices, water, and low alcoholic beverages, to safeguard products in the supply chain from the factory to the consumer.

One emerging trend is the increasing demand for flexible and customized packaging. As consumer preferences shift toward a wider variety of specialized and limited-edition products, manufacturers need equipment that can quickly adapt to different bottle shapes, sizes, and label designs without significant downtime. This focus on flexibility allows companies to respond to consumer trends faster and introduce new products more efficiently, giving them a competitive edge in a crowded sector.

Another driver is the growing public interest in health and wellness, which is leading to a rise in demand for low-sugar and non-alcoholic beverages. This change in consumer behavior is impacting the types of machinery manufacturers need. For instance, the World Health Organization (WHO) has noted a global push to reduce sugar intake, which encourages producers to create healthier drink options. This, in turn, requires new packaging equipment that can handle different product compositions and potentially smaller, single-serving sizes that align with a health-conscious lifestyle.

Drivers and Trends

Growing Consumer Demand for Ready-to-Drink Beverages: The increasing demand for convenience and the shift in consumer lifestyles toward "on-the-go" consumption are major drivers. Modern consumers, particularly younger generations, are seeking beverages that are easy to access and consume, resulting in an upsurge in ready-to-drink (RTD) products such as bottled water, juices, and specialty coffees. This trend places significant pressure on manufacturers to adopt high-speed, efficient packaging lines that can handle large volumes of a diverse range of products. The shift also requires equipment with greater flexibility to accommodate different bottle shapes, sizes, and materials to meet specific product branding needs.

In addition to convenience, the rise of RTD beverages is closely tied to growing health and wellness trends. Consumers are increasingly turning to healthier alternatives, such as low-sugar drinks, functional beverages with added vitamins, and non-alcoholic options. This behavior drives the need for packaging equipment that can handle sensitive ingredients and ensure product safety and shelf life. The World Health Organization (WHO), in its Global Status Report on Alcohol and Health 2024, has highlighted a global trend of declining alcohol consumption and an increase in consumers choosing non-alcoholic options. This shift points to a market where the packaging of non-alcoholic drinks is becoming more significant. The increasing preference for convenient and health-focused beverages is a powerful force driving manufacturers to invest in modern, adaptable equipment to keep up with consumer expectations and a constantly evolving product landscape.

Increasing Automation and Technological Advancements: The need for greater operational efficiency and cost reduction is a powerful driver for the adoption of automation and advanced technology in the sector. As labor costs rise and a skilled workforce becomes harder to find, manufacturers are turning to automated systems to perform repetitive tasks such as filling, sealing, and labeling. These systems reduce reliance on manual labor and minimize the risk of human error, leading to improved product consistency and quality. The integration of robotics and smart sensors into packaging lines allows for continuous monitoring and optimization, helping companies to achieve higher production speeds and better overall output.

Automation and technology advancements are crucial for ensuring the safety and sanitation of products. The use of advanced machinery reduces direct human contact with the beverages, which is critical for meeting strict health and hygiene standards. A report published by the U.S. Bureau of Labor Statistics (BLS) in its 2024 article "Industry and Occupational Employment Projections Overview" noted that automation in manufacturing is leading to an increase in productivity and a change in skill requirements for the workforce. This shift toward advanced machinery and automation is a clear indicator that the sector is moving to a new level of operational sophistication. The demand for higher productivity, lower costs, and enhanced safety is making the integration of automation and smart technologies a vital growth factor.

Segmental Insights

Automation Analysis

Based on automation, the segmentation includes manual, semi-automatic, and fully automatic. The fully automatic segment held the largest share in 2024. This dominance is a result of the widespread adoption of large-scale production facilities and the continuous push for efficiency and cost-effectiveness across the sector. Fully automatic systems are capable of handling high production volumes with minimal human intervention, making them ideal for major beverage manufacturers who operate around the clock. The reliance on these machines is also driven by the need for consistency and precision in packaging, which is crucial for brand image and consumer safety. Furthermore, these advanced systems are designed to integrate seamlessly with other smart technologies, allowing for real-time monitoring, predictive maintenance, and optimized performance. The significant investments in these robust and reliable systems by established companies have cemented their leading position.

The semi-automatic segment is anticipated to register the highest growth rate during the forecast period. This trend is largely fueled by the needs of small and medium-sized enterprises, as well as businesses that require more flexibility in their production lines. Semi-automatic machines offer a balance between manual labor and full automation, providing a cost-effective solution for companies that are expanding their operations but may have insufficient capital for a complete overhaul. They are particularly useful for handling diverse products and for small-batch runs where frequent changeovers are necessary. The increasing focus on product customization and the rise of craft beverages and specialty drinks have also contributed to the growth of this segment, as these businesses need equipment that can adapt to a wider variety of packaging types and sizes.

Application Analysis

Based on application, the segmentation includes bottled water, dairy beverages, alcoholic beverages, and others. The bottled water segment held the largest share in 2024. The widespread consumption of bottled water globally, driven by increased health awareness and the convenience of single-serve packaging, has made it a dominant force. The sheer volume of bottled water produced and distributed worldwide requires massive, high-speed, and continuous production lines. This demand has led to a significant investment in fully automatic equipment designed for efficiency, hygiene, and the handling of plastic and glass bottles. The focus on cost per unit has also driven manufacturers to seek out the most efficient machinery possible, further solidifying the bottled water segment's leading position.

The dairy beverage segment is anticipated to register the highest growth rate during the forecast period. The rapid expansion is a result of shifting consumer tastes toward healthier, dairy-based drinks such as flavored milk, yogurts, and protein shakes. The rise of plant-based dairy alternatives also falls under this category, further boosting demand for specialized packaging solutions. The products in this segment often require specific handling due to their sensitive nature, including aseptic filling and advanced sterilization techniques to ensure a long shelf life. As consumers increasingly seek functional and ready-to-drink dairy products, manufacturers are being pushed to invest in new, flexible machinery that can meet diverse needs while maintaining stringent safety and quality standards. This evolving consumer landscape is accelerating the growth of the dairy beverage application.

Type Analysis

Based on type, the segmentation includes filling & capping machines, labelling & coding machines, palletizing & depalletizing machines, conveying & handling machines, cleaning & sterilizing machines, wrapping & bundling machines, cartoning machines, and others. The filling & capping machines segment held the largest share in 2024. This is because these machines are a core, indispensable component of almost every beverage production line, regardless of the product. They are the primary technology responsible for accurately and hygienically filling containers with liquid products and then sealing them to ensure freshness and safety. Their widespread use is directly tied to the sheer volume of packaged beverages consumed globally, from bottled water to carbonated soft drinks and alcoholic beverages. The high-speed capabilities and precision of modern filling and capping machines are essential for meeting high production targets and maintaining the consistent quality standards expected by both consumers and regulators.

The labeling and coding machines segment is anticipated to register the highest growth rate during the forecast period. This accelerated expansion is a result of a number of modern industry trends that have made product identification and tracking more important than ever. The growing demand for product traceability, driven by both consumer awareness and regulatory compliance, requires advanced coding and labeling technologies. Additionally, manufacturers are using sophisticated labels for branding and marketing to make their products stand out in a competitive sector. The rise of e-commerce also plays a significant role, as products need to be equipped with QR codes, barcodes, and other technologies to facilitate efficient inventory management and logistics throughout the supply chain. These factors are all contributing to the growth of this segment as a crucial part of the overall packaging process.

Regional Analysis

The Asia Pacific beverage packaging equipment market accounted for the largest share in 2024. The region is a dominant and rapidly growing for packaging equipment, primarily due to rising populations, increasing urbanization, and growing disposable incomes. The demand for packaged beverages is soaring as more consumers in emerging economies adopt modern, fast-paced lifestyles. This rapid expansion is driving the need for new production facilities and a substantial increase in the installation of automated packaging lines. The market here is highly dynamic, with manufacturers seeking a balance between affordability, efficiency, and the ability to scale operations quickly.

China Beverage Packaging Equipment Market Insights

Within this region, China stands out as a major force in the market. Its massive consumer base and expanding middle class have created an enormous demand for a diverse range of packaged beverages. The government's push for industrial modernization and sustainability initiatives is also influencing the market, with a growing focus on advanced, automated, and energy-efficient machinery. Chinese manufacturers are investing heavily in a wide variety of equipment to cater to both the domestic market's vast needs and its growing export activities.

North America Beverage Packaging Equipment Market Trends

North America is characterized by a strong focus on automation and flexible production lines. This is driven by high labor costs and the need for manufacturers to respond quickly to changing consumer demands. There is a clear trend toward equipment that can handle a variety of packaging formats, from traditional bottles to modern cans and pouches. The emphasis on sustainable packaging materials is also a significant factor, with producers investing in machinery that can work with recyclable and lightweight materials to reduce their environmental impact.

U.S. Beverage Packaging Equipment Market Analysis

In the U.S., the demand for beverage packaging equipment is growing steadily. A key driver is the consumer preference for a wide range of beverages, including a surge in demand for ready-to-drink alcoholic beverages, functional drinks, and sparkling water. This diverse consumption pattern pushes manufacturers to adopt highly adaptable and efficient machinery. Furthermore, the push for automation is strong in the U.S. to boost production capacity and reduce operational costs, making fully automatic systems a common sight in large-scale beverage plants across the country.

Europe Beverage Packaging Equipment Market Overview

Europe is known for its technological innovation and strict regulatory standards regarding product quality and sustainability. Manufacturers in this region are leaders in developing advanced packaging solutions that enhance efficiency and align with the strong environmental policies set by governments. The focus on reducing carbon footprint and using eco-friendly materials is widespread, leading to a strong demand for machinery that can handle new and innovative packaging types. The landscape here is mature, with a clear move toward upgrading existing lines with smarter, more connected, and highly automated equipment.

Germany is a key hub for packaging technology across Europe. The Germany beverage packaging equipment market is driven by a strong industrial base and a reputation for engineering excellence. German manufacturers often lead in the development of sophisticated, high-performance machinery. The demand in Germany is particularly strong for bottling lines and palletizing equipment that offer precision, reliability, and high levels of automation. This is fueled by the country's large beverage manufacturing sector, which includes everything from world-renowned beers to mineral water and soft drinks.

Key Players and Competitive Insights

The competitive landscape includes major players such as Krones AG, KHS GmbH, Sidel (Tetra Laval), GEA Group, and Syntegon Technology. The market is highly competitive, with a few large, multinational companies dominating through their extensive product portfolios and global service networks. These large firms often provide complete, integrated packaging lines, offering a one-stop solution for major beverage manufacturers. This competition centers on innovation in automation, efficiency, and sustainability. However, a wide array of smaller, specialized companies also compete by focusing on specific types of machinery or niche applications, often providing more customized solutions and flexible service to smaller and medium-sized enterprises.

A few prominent companies include Krones AG, KHS GmbH, Sidel, GEA Group, Syntegon Technology, Tetra Pak, ProMach, Aetna Group, Fuji Machinery, Nichrome Packaging Solutions, and Mitsubishi Heavy Industries.

Key Players

- Aetna Group

- Fuji Machinery

- GEA Group

- KHS GmbH

- Krones AG

- Mitsubishi Heavy Industries

- Nichrome Packaging Solutions

- ProMach

- Sidel

- Syntegon Technology

- Tetra Pak

Beverage Packaging Equipment Industry Developments

May 2025: IMA Food North America introduced the Hamba Flexline, a high-speed cup fill-seal system equipped with integrated sterilization capabilities. Engineered for operational efficiency and hygiene, the system can produce more than 57,000 cups per hour.

July 2024: Coesia acquired a minority interest in PWR (Packaging with Robots) through a strategic partnership aimed at delivering fully automated packaging lines utilizing robotics and vision systems.

Beverage Packaging Equipment Market Segmentation

By Automation Outlook (Revenue – USD Billion, 2020–2034)

- Manual

- Semi-Automatic

- Fully Automatic

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bottled Water

- Dairy Beverage

- Alcoholic Beverages

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Filling & Capping Machines

- Labelling & Coding Machines

- Palletizing & Depalletizing Machines

- Conveying & Handling Machines

- Cleaning & Sterilizing Machines

- Wrapping & Bundling Machines

- Cartoning Machines

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Beverage Packaging Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.42 billion |

|

Market Size in 2025 |

USD 10.98 billion |

|

Revenue Forecast by 2034 |

USD 17.93 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.42 billion in 2024 and is projected to grow to USD 17.93 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific dominated the revenue share in 2024.

A few key players include Krones AG, KHS GmbH, Sidel, GEA Group, Syntegon Technology, Tetra Pak, ProMach, Aetna Group, Fuji Machinery, Nichrome Packaging Solutions, and Mitsubishi Heavy Industries.

The fully automatic segment accounted for the largest share of the market in 2024.

The dairy beverage segment is expected to witness the fastest growth during the forecast period.