U.S. Beverage Packaging Equipment Market Size, Share, Trends, Industry Analysis Report

By Automation (Manual, Semi-Automatic, Fully Automatic), By Application, By Type – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6356

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

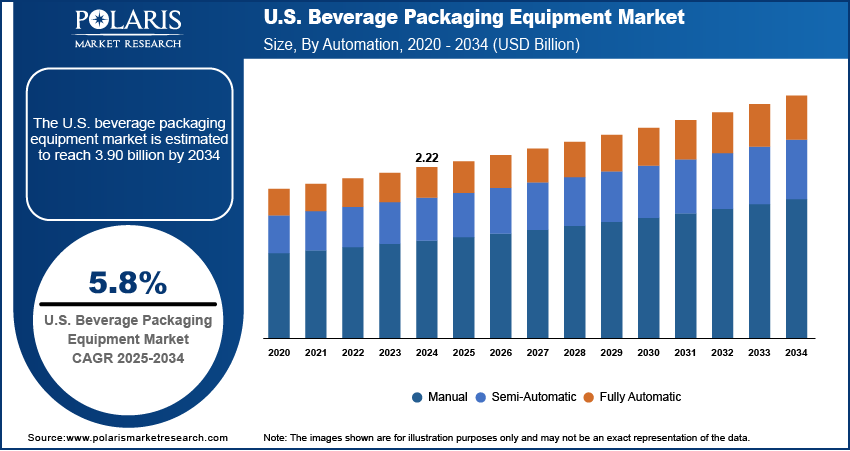

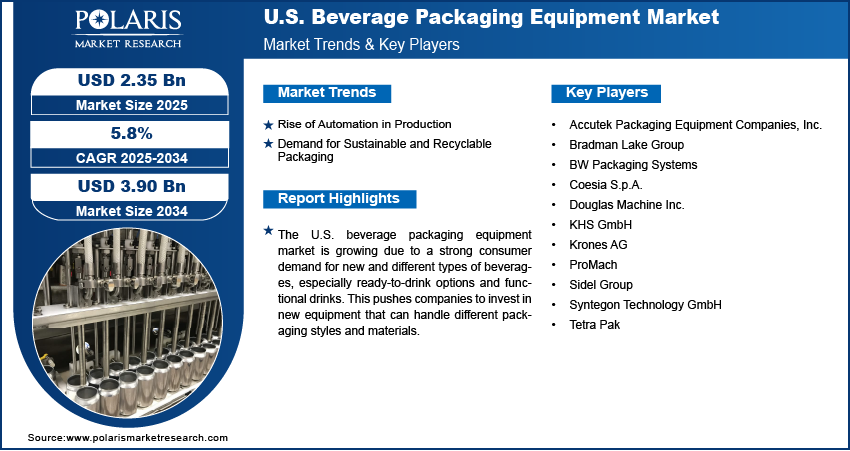

The U.S. beverage packaging equipment market size was valued at USD 2.22 billion in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The main growth factors for the market include the rising consumer demand for ready-to-drink (RTD) and functional beverages. A strong push for sustainable packaging solutions also drives investments in new machinery. Furthermore, increased automation in production lines is a key driver as companies strive to enhance efficiency and lower labor costs.

Key Insights

- By automation, the fully automatic segment held the largest share in 2024, driven by large-scale beverage producers in the U.S.

- By application, the alcoholic beverages segment held the largest market share in 2024, driven by increasing demand for craft beers, premium spirits, and ready-to-drink cocktails requiring advanced, efficient packaging solutions.

- By type, the filling and capping machines segment accounted for the largest market share in 2024, fueled by the need for high-speed, hygienic, and precise bottling processes in large-scale beverage production.

Industry Dynamics

- The increasing consumer preference for ready-to-drink beverages and various convenient packaging formats boosts the industry growth. This includes smaller, single-serve containers and eco-friendly options. As people seek more options that fit their on-the-go lifestyles, manufacturers need to invest in new equipment that can handle different sizes and materials efficiently to meet these demands.

- A growing focus on sustainable packaging solutions is also pushing the demand for new equipment. With rising environmental concerns, beverage companies are looking for machinery that can work with recyclable, biodegradable, and other eco-friendly materials. This shift is being driven by both consumer pressure and government regulations.

- The industry is seeing a strong move towards automation and smart technologies. This is happening as companies try to address labor shortages and increase production speed and accuracy. Automated systems, including robotics and sensors, help minimize errors, reduce waste, and improve overall operational efficiency. This allows for higher production volumes with fewer workers.

Market Statistics

- 2024 Market Size: USD 2.22 billion

- 2034 Projected Market Size: USD 3.90 billion

- CAGR (2025–2034): 5.8%

AI Impact on U.S. Beverage Packaging Equipment Market

- The U.S. leads in AI integration across the packaging industries, owing to its advanced tech infrastructure and strong R&D ecosystem.

- Beverage manufacturers across the country invest heavily in smart packaging systems. They are integrating AI with IoT, cloud-based analytics, and robotics.

- AI-driven equipment helps manufacturers enhance speed, precision, and consistency in filling, sealing, labeling, and palletizing.

- Interactive packaging such as QR codes and NFC tags—boosts consumer engagement and brand transparency.

- AI-tools help reduce packaging waste by optimizing material usage and design.

The U.S. beverage packaging equipment includes all the machinery and systems used to fill, seal, label, and prepare beverages for sale. This equipment is a major part of the production process for various drinks such as soft drinks, juices, bottled water, and alcoholic beverages. It helps ensure that products are packaged efficiently, safely, and in line with industry standards.

The growing trend of e-commerce and home delivery services has changed how beverages are distributed and sold. As more consumers shop for drinks online, there is a greater need for packaging that can withstand the rigors of shipping and handling. This is creating demand for new equipment that can produce more durable and protected packaging formats. For instance, the demand for single-serve and multi-pack options has grown significantly, which requires companies to use flexible machinery that can switch between different formats quickly.

Another factor is the increasing need for product differentiation and brand marketing through packaging. In a crowded market, companies are using unique packaging designs to attract customers. This includes using special bottle shapes, creative labeling, and advanced printing technologies such as laser marking and digital printing. To achieve this, beverage producers are investing in equipment that can apply complex labels, handle various container shapes, and offer more customization options. This gives them a way to make their products stand out on store shelves and online.

Drivers and Trends

Rise of Automation in Production: The increasing push for automation and smart technologies is a major driver of the U.S. beverage packaging equipment market. Beverage manufacturers are using automation to address labor shortages and boost efficiency, which reduces the reliance on manual work. This shift involves integrating robotic systems, sensors, and other automated processes to make packaging lines more precise and reliable. These modern systems can handle a higher volume of products with fewer errors and less waste, which is a significant benefit for companies seeking to reduce their operational costs.

According to the U.S. Department of Commerce National Institute of Standards and Technology in its 2024 annual report on the U.S. manufacturing economy, the beverage market, specifically in the brewing and soft drink industries, accounted for 18% of technology use in the food and beverage processing technology sector in 2023. Advancements in bottling and packaging technologies were the primary drivers for this. The push for automation is directly driving market growth as it requires beverage producers to invest in new, more advanced equipment to stay competitive and meet modern production standards.

Demand for Sustainable and Recyclable Packaging: The growing demand for sustainable packaging solutions is another key driver for the U.S. beverage packaging equipment market. As consumers and government bodies become more aware of environmental issues, there is a strong push to move away from traditional plastics and towards more eco-friendly materials. This includes a variety of materials such as recyclable plastics, glass, paper-based options, and aluminum cans. In order to use these different materials, beverage producers must invest in new and adaptable packaging machinery. This is leading to a major transformation in the industry.

To support this, a report from the U.S. Environmental Protection Agency (EPA) titled "National Strategy to Prevent Plastic Pollution" in 2023 highlighted the importance of shifting to more sustainable materials. The report noted that encouraging a change in packaging to more lightweight or efficient materials helps companies save money and reduce waste. The demand for new equipment that can work with these different materials is directly contributing to the growth of this market.

Segmental Insights

Automation Analysis

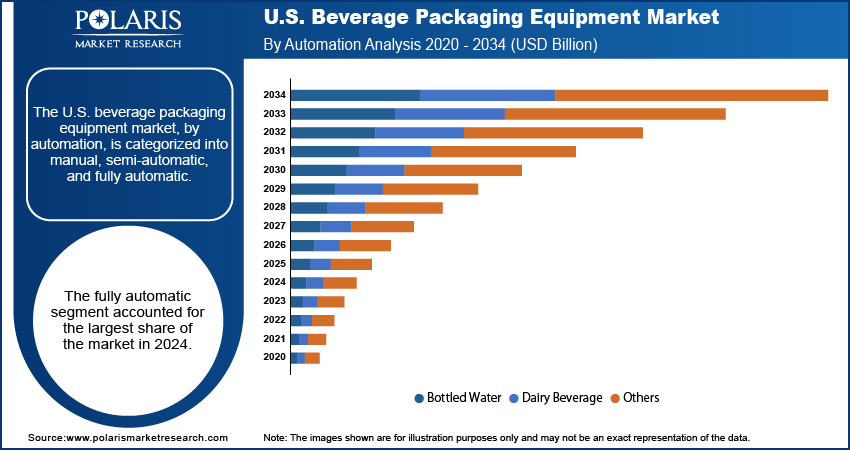

Based on automation, the segmentation includes manual, semi-automatic, and fully automatic. The fully automatic segment held the largest share in 2024. This is due to the rising demand for high-speed, efficient, and low-labor production solutions from large-scale beverage manufacturers. These systems use advanced robotics and smart technologies to handle all parts of the packaging process, from filling and capping to labeling and palletizing, with minimal human involvement. This level of automation enables companies significantly increase their production output while also reducing errors and maintaining consistent product quality. The investment in these high-tech systems is essential for major beverage companies to meet consumer demand and stay ahead in a competitive landscape, as fully automated lines are vital for large-volume production.

The semi-automatic segment is anticipated to register the highest growth rate during the forecast period. While fully automatic systems are the top choice for large companies, semi-automatic equipment is gaining popularity among small to medium-sized producers. These machines offer a good balance between the efficiency of automation and the lower cost of manual systems. They are also more flexible, which is important for smaller companies that may need to switch between different types of products or packaging formats more frequently. As the number of craft breweries, artisan beverage makers, and specialty drink companies grows, so does the demand for semi-automatic equipment. This allows smaller businesses to increase their production and improve their processes without incurring the large investments required for a fully automated line, thus driving strong growth in this segment.

Application Analysis

Based on application, the segmentation includes bottled water, dairy beverages, alcoholic beverages, and others. The alcoholic beverages segment held the largest share in 2024. This is because of the large and established alcoholic beverage sector in the country, which includes a wide range of products such as low-alcoholic drinks, beer, wine, and spirits. The demand for packaging equipment in this sector is very high due to the need for specialized machinery for different types of containers, such as glass bottles, aluminum cans, and even kegs. Additionally, the rise of craft breweries and distilleries has created a need for more flexible and small-batch packaging lines, further driving sales in this subsegment. The focus on unique bottle designs and premium packaging to attract consumers also plays a major role in keeping this segment on top.

The dairy beverage segment is anticipated to register the highest growth rate during the forecast period. This growth is being driven by the increasing popularity of different dairy products and plant-based milk alternatives, such as oat milk, almond milk, and soy milk. Consumers are looking for more options that align with their health and dietary needs. This trend is pushing manufacturers to invest in new, more advanced equipment that can handle a variety of liquid products with different viscosities and packaging needs. The demand for aseptic packaging, which extends the shelf life of these beverages without needing refrigeration, is also a key factor contributing to this segment's rapid growth. This allows for wider distribution and new product opportunities for both established and emerging brands.

Type Analysis

Based on type, the segmentation includes filling & capping machines, labelling & coding machines, palletizing & depalletizing machines, conveying & handling machines, cleaning & sterilizing machines, wrapping & bundling machines, cartoning machines, and others. The filling & capping machines segment held the largest share in 2024. This is because filling and capping are essential and non-negotiable steps in the beverage production process. These machines are at the very heart of any packaging line and are critical for ensuring products are filled accurately and sealed correctly to maintain freshness and safety. Large-scale production facilities for bottled water, soft drinks, and alcoholic beverages rely heavily on high-speed, reliable filling and capping equipment to keep up with massive consumer demand. The segment's dominance is driven by the fundamental role these machines play in ensuring product integrity and production efficiency across the entire beverage sector.

The conveying and handling machines segment is anticipated to register the highest growth rate during the forecast period. This is largely due to the increasing adoption of fully automated production lines. While filling and capping are crucial, the true efficiency of a modern facility depends on how smoothly products move between each stage of the process. As beverage companies invest in advanced automation, they also need equally sophisticated conveying and handling systems to link different machines together. These systems, including smart conveyors and robotic arms, are designed to transport a variety of package types and sizes with precision and speed, minimizing downtime and human interaction. The trend toward faster, more integrated production facilities is making conveying and handling machines an increasingly important and rapidly growing part of the market.

Key Players and Competitive Insights

The U.S. beverage packaging equipment market is home to a number of major players that specialize in providing advanced and reliable machinery. This market is highly competitive, with companies focusing on innovation, technology, and customer service to gain an edge. The competitive landscape is shaped by a mix of large, global corporations and smaller, specialized firms. Larger players often offer a full range of products and services, from single machines to complete, integrated packaging lines. Meanwhile, many smaller companies focus on niche areas, providing custom solutions or equipment for specific types of beverages or packaging materials. To stay competitive, companies are constantly investing in research and development to create more efficient, sustainable, and automated equipment.

A few prominent companies in the industry include Krones AG; KHS GmbH; Sidel Group; Syntegon Technology GmbH; Tetra Pak; ProMach; Coesia S.p.A; BW Packaging Systems; Accutek Packaging Equipment Companies, Inc.; Douglas Machine Inc.; and Bradman Lake Group.

Key Players

- Accutek Packaging Equipment Companies, Inc.

- Bradman Lake Group

- BW Packaging Systems

- Coesia S.p.A.

- Douglas Machine Inc.

- KHS GmbH

- Krones AG

- ProMach

- Sidel Group

- Syntegon Technology GmbH

- Tetra Pak

U.S. Beverage Packaging Equipment Industry Developments

October 2024: Sidel partnered with Twellium Industrial Company to build a new packaging facility in Ghana. The project involved installing two complete lines for bottling various products in different PET bottle sizes.

U.S. Beverage Packaging Equipment Market Segmentation

By Automation Outlook (Revenue – USD Billion, 2020–2034)

- Manual

- Semi-Automatic

- Fully Automatic

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bottled Water

- Dairy Beverage

- Alcoholic Beverages

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Filling & Capping Machines

- Labelling & Coding Machines

- Palletizing & Depalletizing Machines

- Conveying & Handling Machines

- Cleaning & Sterilizing Machines

- Wrapping & Bundling Machines

- Cartoning Machines

- Others

U.S. Beverage Packaging Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.22 billion |

|

Market Size in 2025 |

USD 2.35 billion |

|

Revenue Forecast by 2034 |

USD 3.90 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.22 billion in 2024 and is projected to grow to USD 3.90 billion by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

A few key players in the market include Krones AG; KHS GmbH; Sidel Group; Syntegon Technology GmbH; Tetra Pak; ProMach; Coesia S.p.A; BW Packaging Systems; Accutek Packaging Equipment Companies, Inc.; Douglas Machine Inc.; and Bradman Lake Group.

The fully automatic segment accounted for the largest share of the market in 2024.

The dairy beverage segment is expected to witness the fastest growth during the forecast period.