U.S. Prescription Drugs Market Size, Share, Trends, & Industry Analysis Report

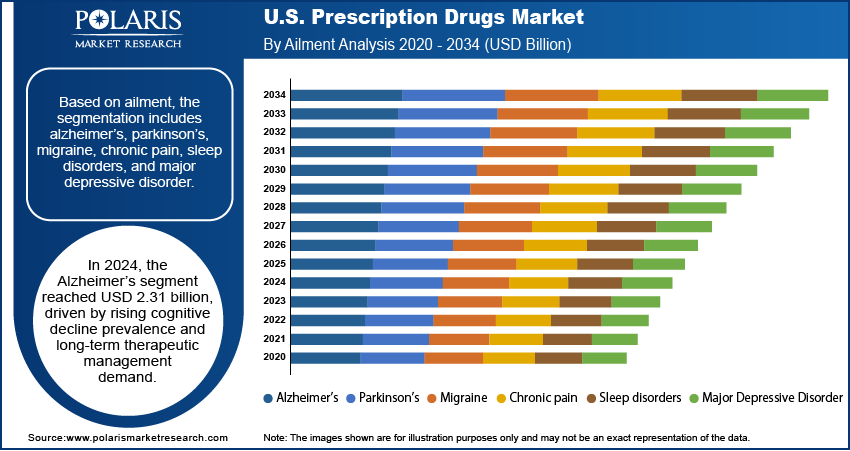

By Ailment (Alzheimer’s, Parkinson’s, Migraine, Chronic Pain, Sleep Disorders, Major Depressive Disorder) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6353

- Base Year: 2024

- Historical Data: 2020-2023

Overview

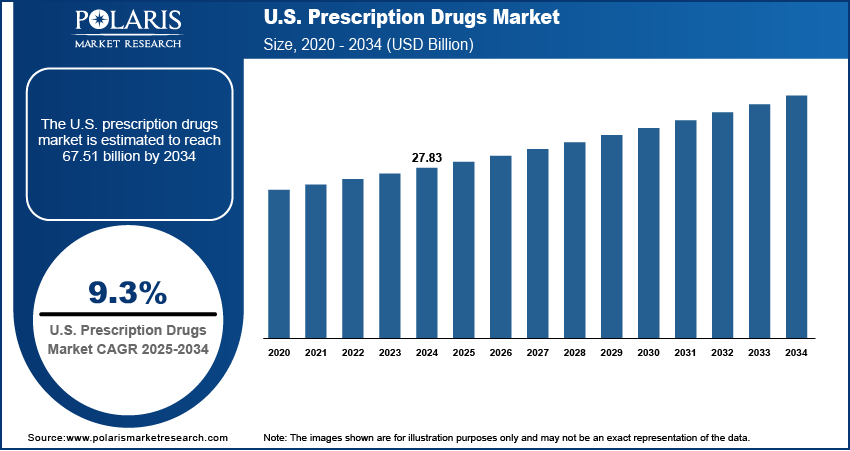

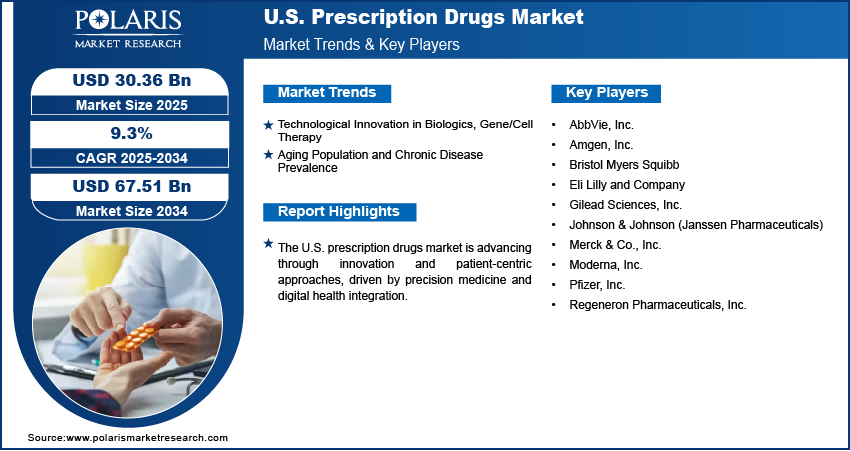

The U.S. prescription drugs market size was valued at USD 27.83 billion in 2024, growing at a CAGR of 9.3% from 2025–2034. Key factors driving demand include Accelerated FDA regulatory pathways. specialty and orphan drugs. technological innovation in biologics and gene/cell therapies, aging population and rising prevalence of chronic diseases

Key Insights

- The Alzheimer’s segment generated USD 2.31 billion in revenue in 2024, driven by growing rates of age-related cognitive decline and rising demand for long-term treatment solutions in the U.S.

- The Parkinson’s segment is projected to grow at the fastest rate with a 9.5% CAGR, fueled by increasing diagnosis rates and the need for more effective symptom management therapies.

Industry Dynamics

- Innovations in biologics and gene therapies are creating new treatments for complex conditions, offering targeted and potentially curative options in areas like oncology and rare diseases.

- Aging population and rising chronic disease rates are driving sustained demand for long-term prescription treatments, particularly for age-related conditions like diabetes and heart disease.

- Rising political pressure and new regulations, such as Medicare price negotiations, threaten profitability and constrain pricing flexibility for innovative therapies.

- Breakthroughs in high-value areas such as gene therapy and obesity drugs create massive revenue potential and address vast unmet medical needs.

Market Statistics

- 2024 Market Size: USD 27.83 billion

- 2034 Projected Market Size: USD 67.51 billion

- CAGR (2025-2034): 9.3%

AI Impact on U.S. Prescription Drugs Market

- AI analyzes vast datasets to identify novel drug candidates faster, reducing early-stage development time and cost.

- AI improves patient recruitment, predicts outcomes, and enhances trial monitoring, increasing success rates and reducing delays.

- AI tailor’s treatments by analyzing genetic and health data, improving drug efficacy and patient outcomes through precision targeting.

- AI forecasts demand, streamlines manufacturing, and manages inventory, reducing costs and preventing shortages across the distribution network.

Prescription drugs are medications that require authorization from a licensed healthcare professional for safe and appropriate use, and form a critical segment of the U.S. healthcare system. The market is driven by the presence of accelerated FDA regulatory pathways, which have streamlined the approval process for innovative therapies. For instance, in 2024, the FDA's Center for Drug Evaluation and Research (CDER) approved 50 novel new drugs. Programs such as priority review and breakthrough therapy designation allow promising drugs, particularly those addressing unmet medical needs, to reach patients more quickly. This regulatory flexibility enhances patient access to life-saving treatments and also encourages pharmaceutical companies to invest in research and development with greater confidence. The accelerated pathways are instrumental in reducing the time and costs associated with traditional drug development, thereby supporting faster innovation cycles within the market.

The U.S. prescription drugs market is further driven by the growing focus on specialty and orphan drugs, which serve to complex, rare, and chronic conditions. Specialty drugs, often involving advanced formulations such as biologics or gene therapy, provide targeted solutions that are increasingly in demand in modern clinical practice. Orphan drugs, specifically designed for rare diseases, benefit from strong regulatory and commercial incentives that promote innovation in underserved therapeutic areas. The rise in demand for these highly specialized treatments highlights a shift toward personalized and precision medicine, reflecting the broader trend of tailoring healthcare to individual patient needs. Together, these dynamics highlight how prescription drugs in the U.S. are evolving beyond traditional therapies, shaping a market that emphasizes innovation, accessibility, and specialized care.

Drivers & Opportunities

Technological Innovation in Biologics, Gene/Cell Therapy: Technological innovation in biologics and gene/cell therapies is driving the expansion opportunities as it expands the scope of treatment options for complex and previously untreatable conditions. Advanced biologics, such as monoclonal antibodies and recombinant proteins, have redefined therapeutic approaches in oncology, immunology, and rare diseases by offering highly targeted and effective interventions. For instance, in December 2023, the FDA approved Vertex and CRISPR Therapeutics’ CASGEVY, a CRISPR/Cas9 gene-edited cell therapy, for the treatment of sickle cell disease. It is a one-time treatment intended to eliminate recurrent vaso-occlusive crises. Similarly, gene and cell therapies offer the potential for long-term or even curative solutions by addressing the underlying genetic causes of disease, rather than merely managing symptoms. These innovations reflect a paradigm shift toward precision medicine, encouraging greater investment in cutting-edge research and promoting a competitive market landscape that prioritizes novel, high-value therapies.

Aging Population and Chronic Disease Prevalence: The aging population and rising prevalence of chronic diseases further strengthen the growth trajectory of the U.S. prescription drugs market by fueling sustained demand for long-term treatment solutions. Age-related conditions such as cardiovascular diseases, diabetes, neurodegenerative disorders, and cancer are becoming more widespread, necessitating continuous pharmaceutical intervention as the elderly population continues to expand. A February 2024 HHS report states that nearly a quarter of the U.S. population will be 65 or older by 2060, with 42% of Americans having two or more chronic conditions, and 12% having five or more. Chronic disease management requires ongoing prescriptions and often the integration of advanced therapies to improve patient outcomes and quality of life. This demographic and health burden increases overall prescription volumes and also shifts demand toward specialized drugs that address multifaceted health needs. Together, these factors create a stable foundation for market expansion, driven by both innovation and the need to improve patient care.

Segmental Insights

Ailment Analysis

Based on product, the segmentation includes alzheimer’s, parkinson’s, migraine, chronic pain, sleep disorders, and major depressive disorder. The alzheimer’s segment accounted for USD 2.31 billion revenue share in 2024 due to the rising prevalence of age-related cognitive decline and the increasing need for long-term therapeutic management in the U.S. The growing aging population has boosted the demand for prescription drugs that slow disease progression, manage behavioral symptoms, and improve quality of life. Advances in research targeting amyloid and tau proteins, along with the development of combination therapies, have further strengthened the segment’s growth. Additionally, strong clinical focus and healthcare spending on neurodegenerative diseases continue to drive innovation, ensuring that Alzheimer’s treatments remain a central priority in the prescription drugs market.

The parkinson’s segment is expected to witness fastest growth at a CAGR of 9.5% during the forecast period driven by the rising number of diagnosed cases and the need for more effective symptom management therapies. Innovations in dopamine replacement strategies, extended-release formulations, and adjunctive therapies are enhancing treatment outcomes and patient adherence. The increasing research focus on disease-modifying approaches, such as neuroprotective and regenerative therapies, is also creating new growth avenues. This segment is poised to expand rapidly, reflecting the broader trend of advancing neurology-focused prescription drug development in the U.S, with the growing focus on improving motor and non-motor symptom control.

Key Players & Competitive Analysis Report

The U.S. prescription drugs sector is defined by intense competition among major players, with competitive intelligence and strategy centered on high-margin specialty drugs and biologics. Technological advancement in gene therapies and precision medicine represents the foremost revenue opportunity, though economic and geopolitical shifts, including regulatory and pricing pressures, present ongoing risks. Expert's insight emphasizes that future development strategies must prioritize demonstrating superior therapeutic value to secure favorable reimbursement. Key strategic developments include strategic investments in oncology and immunology, while pricing insights highlight the balance between innovation premiums and cost containment demands. Success depends on competitive positioning through R&D innovation and efficient commercial execution in a value-driven landscape.

Major companies operating in the prescription drugs industry include AbbVie, Inc.; Amgen, Inc.; Bristol Myers Squibb; Eli Lilly and Company; Gilead Sciences, Inc.; Johnson & Johnson; Merck & Co., Inc.; Moderna, Inc.; Pfizer, Inc.; and Regeneron Pharmaceuticals, Inc.

Key Players

- AbbVie, Inc.

- Amgen, Inc.

- Bristol Myers Squibb

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Merck & Co., Inc.

- Moderna, Inc.

- Pfizer, Inc.

- Regeneron Pharmaceuticals, Inc.

Industry Developments

- June 2025: Teva and Fosun Pharma announced a strategic partnership to co-develop TEV-56278, an investigational anti-PD1-IL2 therapy for oncology. The therapy utilizes a novel ATTENUKINE technology platform designed to improve efficacy and reduce toxicity.

- January 2023: Amgen announced the U.S. availability of AMJEVITA, a biosimilar to Humira. It is offered at two list prices, one 55% and another 5% below the current Humira list price.

U.S. Prescription Drugs Market Segmentation

By Ailment Outlook (Revenue, USD Billion, 2020–2034)

- Alzheimer’s

- Parkinson’s

- Migraine

- Chronic pain

- Arthritic Pain

- Neuropathic Pain

- Cancer Pain

- Chronic Back Pain

- Post-Operative Pain

- Fibromyalgia

- Bone Fracture

- Muscle Pain

- Acute Appendicitis

- Sleep disorders

- Insomnia

- Hypersomnia

- Sleep Apnea

- Sleep Breathing Disorder

- Circadian Rhythm Disorders

- Parasomnia

- Sleep Movement Disorders

- Major Depressive Disorder

U.S. Prescription Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 27.83 Billion |

|

Market Size in 2025 |

USD 30.36 Billion |

|

Revenue Forecast by 2034 |

USD 67.51 Billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 27.83 billion in 2024 and is projected to grow to USD 67.51 billion by 2034.

The market is projected to register a CAGR of 9.3% during the forecast period.

A few of the key players in the market are AbbVie, Inc.; Amgen, Inc.; Bristol Myers Squibb; Eli Lilly and Company; Gilead Sciences, Inc.; Johnson & Johnson; Merck & Co., Inc.; Moderna, Inc.; Pfizer, Inc.; and Regeneron Pharmaceuticals, Inc.

The alzheimer’s segment accounted for USD 2.31 billion revenue share in 2024.

The parkinson’s segment is expected to witness fastest growth at a CAGR of 9.5% during the forecast period.