U.S. Outdoor Power Equipment Market Size, Share, Trends, Industry Analysis Report

: By Equipment (Mowers Saws), By Power Source, By Application, By Functionality – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6351

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

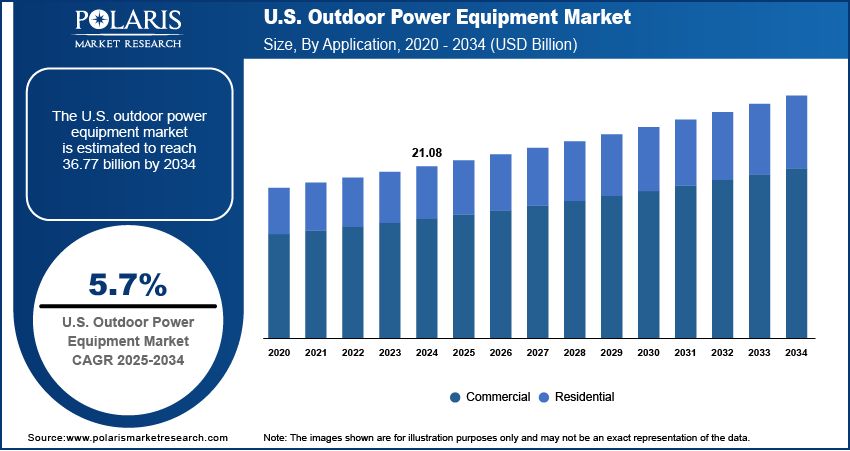

The U.S. outdoor power equipment market size was valued at USD 21.08 billion in 2024, and is anticipated to register a CAGR of 5.7% from 2025 to 2034. The growth is driven by strong retail and e-commerce presence, and high demand for residential landscaping and lawn care.

Key Insights

- In 2024, the mowers segment dominated the market, driven by widespread lawn ownership and a growing focus on residential landscaping across the U.S.

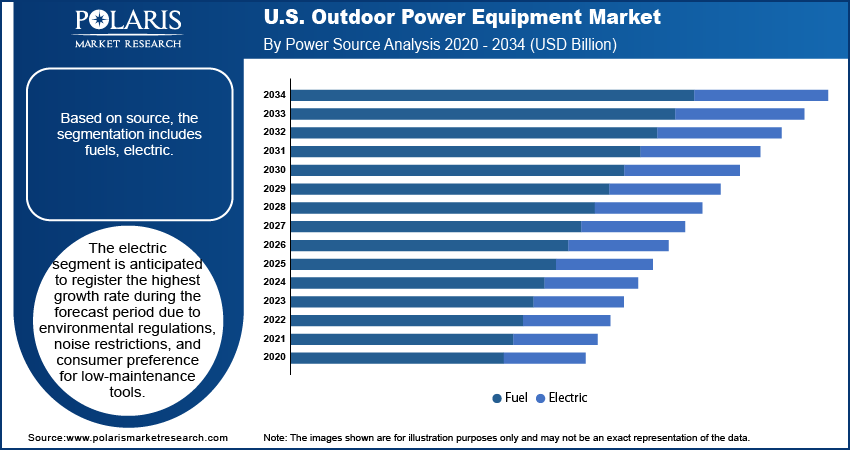

- The electric-powered equipment segment is expected to experience the fastest growth during the forecast period, supported by rising environmental concerns, stricter noise regulations, and a shift toward low-maintenance, eco-friendly tools.

- The residential application segment led the market in 2024, as homeowners increasingly invest in equipment like mowers, trimmers, blowers, and pressure washers to maintain and enhance their outdoor spaces.

- Connection and AI-enabled products are projected to witness the highest growth, fueled by rising demand for smart, automated, and user-friendly outdoor equipment solutions.

Industry Dynamics

- Strong retail and e-commerce presence is expected to accelerate the outdoor power equipment industry growth

- High demand for residential landscaping and lawn care is projected to drive the outdoor power equipment demand.

- The rising government initiatives for infrastructure development across the country to make cities greener is likely to pave the demand for the industry.

- High maintenance costs and environmental concerns related to emissions from fuel-powered equipment limits the growth.

Market Statistics

- 2024 Market Size: USD 21.08 Billion

- 2034 Projected Market Size: USD 36.77 Billion

- CAGR (2025-2034): 5.7%

AI Impact on the Industry

- AI enhances product development in the outdoor power equipment market by analyzing usage patterns, environmental conditions, and performance data to design more efficient, durable, and user-friendly equipment.

- AI-powered predictive maintenance systems monitor equipment health in real time, enabling early detection of wear and tear, reducing downtime, and extending the life of machines.

- AI-driven customer analytics help manufacturers better understand consumer preferences, seasonal demand patterns, and usage behavior, allowing for more targeted product designs and marketing strategies.

- Integration of AI in manufacturing operations streamlines production workflows, improves quality control, reduces material waste, and optimizes inventory management across outdoor power equipment facilities.

Outdoor power equipment refers to mechanical or motorized tools used for outdoor tasks such as lawn care, gardening, landscaping, and maintenance. Common types include lawn mowers, chainsaws, trimmers, blowers, and snow throwers, which can be powered by gas, electricity, or batteries. These tools are widely used by homeowners, commercial landscapers, and professionals to maintain outdoor spaces efficiently.

The expanding commercial landscaping sector in the U.S. significantly fuels the demand for outdoor power equipment. Businesses, municipalities, schools, and real estate developers increasingly rely on professional landscaping services to maintain green spaces, public parks, and campuses. This demand drives higher sales of commercial-grade equipment such as ride-on mowers, hedge trimmers, and chainsaws. Furthermore, the need for efficient, durable, and high-performing tools encourages landscaping companies to regularly upgrade their equipment. Moreover, strong growth in commercial real estate and institutional landscaping contracts further fuels the growth.

Government policies promoting environmentally friendly landscaping practices are influencing the outdoor power equipment industry in the U.S. Several states offer rebates and incentives for purchasing electric or low-emission tools, making them more affordable for both residential and commercial users. Additionally, some municipalities have imposed restrictions on noisy, gas-powered equipment, prompting users to upgrade to compliant models. These regulations are driving faster adoption of eco-friendly equipment. Federal funding for green infrastructure and urban beautification projects further creates opportunities for OPE manufacturers and landscaping service providers to meet regulatory and sustainability goals.

Drivers and Trends

Strong Retail and E-commerce Presence: The U.S. has a highly developed retail and e-commerce infrastructure that makes outdoor power equipment widely accessible to consumers. Major home improvement stores like Home Depot, Lowe’s, and Tractor Supply Co. offer an extensive range of products both in-store and online. Additionally, online marketplaces such as Amazon make it easy for consumers to compare brands, read reviews, and receive fast delivery. This ease of access, combined with seasonal promotions and financing options, encourages more frequent purchases and upgrades. The convenience of online shopping boosts U.S. sales of OPE, thereby fueling the growth.

High Demand for Residential Landscaping and Lawn Care: A large number of households in the U.S. have private lawns and gardens, driving consistent demand for outdoor power equipment. Suburban expansion and rising interest in home improvement encourage homeowners to invest in tools like lawn mowers, trimmers, and leaf blowers. Additionally, the increasing popularity of DIY landscaping, supported by online tutorials and home improvement shows, motivates consumers to purchase their own equipment. This trend is especially prominent in states with favorable climates for year-round yard maintenance. Consequently, residential usage fuels the demand for U.S. outdoor power equipment.

Segmental Insights

Equipment Analysis

Based on equipment, the segmentation includes mowers, saws, trimmers, edgers, blowers, tillers & cultivators, others. The mowers segment held the largest share in 2024 due to widespread lawn ownership and strong emphasis on home landscaping. The suburban lifestyle, with expansive lawns and outdoor spaces, fuels high demand for push, ride-on, and robotic mowers. Additionally, seasonal changes and HOA regulations in many neighborhoods encourage regular lawn maintenance. Manufacturers cater to diverse user needs by offering battery, gas, and zero-turn models. The growth of the landscaping services sector further supports the commercial mower segment. Moreover, increasing interest in DIY lawn care further fuels the segment growth.

Power Source Analysis

Based on source, the segmentation includes fuels, electric. The electric segment is anticipated to register the highest growth rate during the forecast period due to environmental regulations, noise restrictions, and consumer preference for low-maintenance tools. Cities such as Los Angeles and New York have implemented bans or limitations on gas-powered landscaping equipment, pushing both consumers and professionals toward battery-powered alternatives. Modern electric tools offer powerful performance, fast charging, and portability, making them ideal for residential use. Government incentives and manufacturer-led innovation in battery technology are further boosting adoption. This shift toward cleaner, quieter fuels the segment growth.

Application Analysis

Based on application, the segmentation includes commercial, and residential. The residential segment held the largest share in 2024 as homeowners across the country regularly invest in lawn mowers, trimmers, blowers, and pressure washers to maintain outdoor spaces. Rising homeownership rates and increasing interest in curb appeal and outdoor aesthetics further fuel product demand. The pandemic further sparked a strong DIY trend, with more people spending time at home and engaging in gardening or yard work. Consumers are further drawn to connected tools that simplify maintenance as smart home integration grows, driving the segment growth.

Functionality Analysis

Based on functionality, the segmentation includes conventional products, connection/ai enabled products. The connection/ai enabled products segment is anticipated to register the highest growth rate during the forecast period as consumers seek convenience, automation, and efficiency. Products such as robotic lawn mowers with app control, smart irrigation systems, and Bluetooth-enabled equipment offer real-time monitoring, automation, and remote operation. Tech-savvy U.S. homeowners appreciate features such as scheduling, battery health updates, and GPS tracking. Additionally, professional landscapers benefit from AI-driven tools that optimize task efficiency and equipment usage. This growing demand for smart, connected tools is supported by widespread internet access and smart home automation adoption, driving expansion in the segment.

Key Players and Competitive Insights

The U.S. outdoor power equipment market is highly competitive, driven by innovation, brand legacy, and expanding consumer demand. Key players like Deere & Company, The Toro Company, STIHL Group, Husqvarna, and Honda dominate the landscape with wide product portfolios and strong distribution networks. These brands continuously invest in advanced features such as battery-powered engines, smart connectivity, and ergonomic designs to meet evolving consumer preferences. Companies like Stanley Black & Decker, Makita Corp, and Techtronic Industries focus on cordless and electric tools, catering to the growing demand for eco-friendly and low-noise solutions. Briggs & Stratton, MTD Holdings Inc., and Ariens Company strengthen their presence through reliability and affordability in the residential and commercial segments. Additionally, brands such as Excel Industries, Robert Bosch, and Yamabiko Corp contribute to innovation in specialized segments. The competitive environment pushes continuous R&D, strategic partnerships, and new product launches across both residential and professional landscaping markets

Key Players

- KO KOBER GROUP

- Andreas Stihl AG & Company KG

- Ariens Company

- Briggs & Stratton

- CHEVRON (China) Trading Co., Ltd.

- Deere & Company

- Excel Industries, Inc.

- HONDA

- Husqvarna

- Makita Corp

- MTD Holdings Inc.

- Robert Bosch

- Stanley Black & Decker

- STIHL Group

- Techtronic Industries

- The Toro Company (US)

- Yamabiko Corp

Industry Developments

In May 2022, Toro unveiled a new robotic mower scheduled to be released in spring 2023. This autonomous mower, powered by alternative energy, is in its final year of research and development. It incorporates wireless navigation and vision-based localization systems, allowing for easy setup and eliminating the need for traditional boundary wire installation. The mower boasts theft-proof features, can handle slopes, and offers efficient cutting abilities, making it a highly functional and versatile option.

U.S. Outdoor Power Equipment Market Segmentation

By Equipment Outlook (Revenue – USD Billion, 2020–2034)

- Mowers

- Saws

- Trimmers

- Edgers

- Blowers

- Backpack Blowers

- Handheld Blowers

- Tillers & Cultivators

- Others

By Power Source Outlook (Revenue – USD Billion, 2020–2034)

- Fuel

- Electric

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Residential

By Functionality Outlook (Revenue – USD Billion, 2020–2034)

- Conventional Products

- Connection/AI Enabled Products

U.S. Outdoor Power Equipment Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.08 billion |

|

Market Size in 2025 |

USD 22.26 billion |

|

Revenue Forecast by 2034 |

USD 36.77 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to segmentation. |

FAQ's

The market size was valued at USD 21.08 billion in 2024 and is projected to grow to USD 36.77 billion by 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

A few key players in the market include AL-KO KOBER GROUP, Andreas Stihl AG & Company KG, Ariens Company, Briggs & Stratton, CHEVRON (China) Trading Co., Ltd., Deere & Company, Excel Industries, Inc., HONDA, Husqvarna, Makita Corp, MTD Holdings Inc., Robert Bosch, Stanley Black & Decker, STIHL Group, Techtronic Industries, The Toro Company (US), and Yamabiko Corp.

The Mower segment accounted for the largest share of the market in 2024.

The electric is expected to witness the fastest growth during the forecast period.