Orphan Drugs Market Share, Size, Trends, Industry Analysis Report

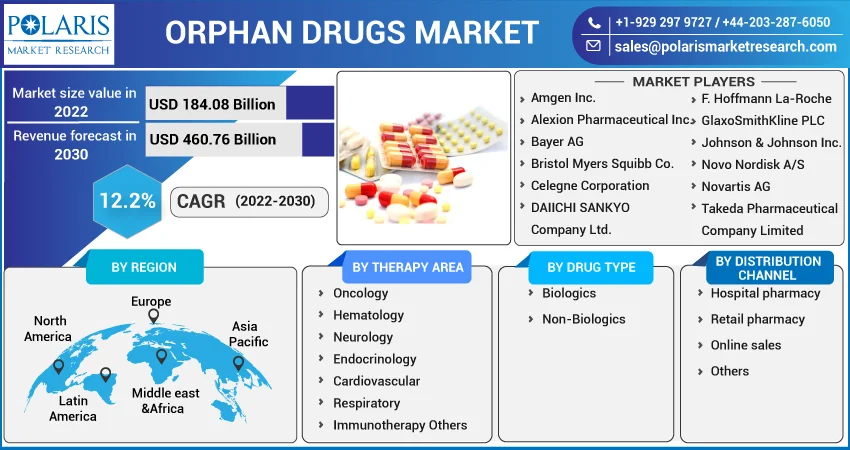

By Therapy Area (Oncology, Hematology, Neurology, Endocrinology, Cardiovascular, Respiratory, Immunotherapy, and Others); By Drug Type; By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 114

- Format: PDF

- Report ID: PM1393

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

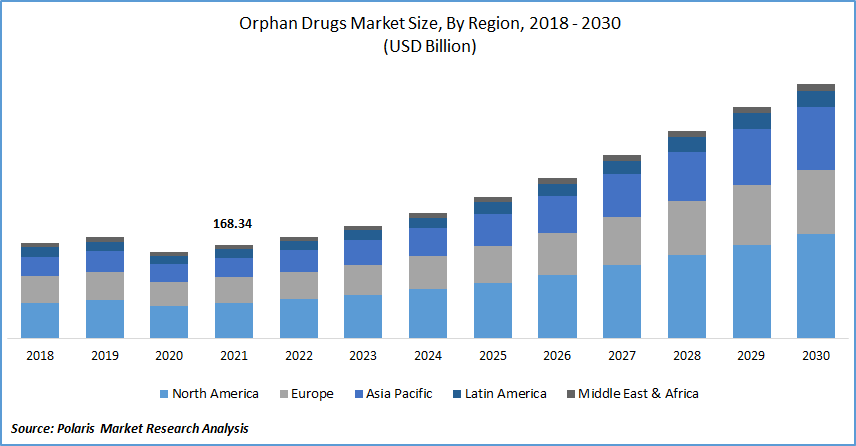

The global orphan drugs market was valued at USD 168.34 billion in 2021 and is expected to grow at a CAGR of 12.2% during the forecast period. The rise in the prevalence of rare diseases, as well as the rise in healthcare expenditure, are also expected to boost the growth of the market. Additionally, advantageous reimbursement rules and favorable government regulations are expected to drive orphan drugs market expansion.

Know more about this report: Request for sample pages

Orphan pharmaceuticals are pharmaceuticals that are used to diagnose and treat rare medical illnesses. These medications are developed to address a specific public health need and typically have a limited market because they are designed for a small patient population.

They are effective against a wide range of oncological, metabolic, hematologic, chronic, progressive, viral, and neurological illnesses. Lymphoma, glioma, leukemia, cystic fibrosis, ovarian cancer, immunologic, multiple myeloma, and renal cell carcinoma are all life-threatening, degenerative, and disabling medical conditions that require specific treatment options that are effective for their specific symptoms.

Patients suffering from uncommon diseases around the world are looking for effective and efficient treatments. Increasing R&D investments and patient advocacy for better treatment are driving the launch of newer and more effective product solutions.

For instance, the number of clinical biopharmaceuticals has a strong pipeline for orphan drugs clinical trials. These developments have resulted in the creation and commercialization of multiple blockbuster medications for the treatment of various malignancies, immunological illnesses, and other uncommon diseases.

Moreover, the increasing number of disease therapeutics being researched and developed is expected to positively impact industry growth. The growing target patient population for rare diseases is expected to drive industry growth for orphan drugs. According to the European Organization for Rare Diseases, over 300.0 million people worldwide will suffer from one or more rare diseases in 2020. However, the high costs associated with this may limit the orphan drugs market growth.

Furthermore, Emmes, a global clinical research company (CRO), launched an Orphan Reach as a one-of-a-kind 'rare CRO' in November 2021. Emmes' experience will be combined with that of Orphan Reach, a UK-based specialty CRO that Emmes acquired in May 2021. Emmes' world-class biostatistics, data management, and clinical trial execution skills will enable the center to function as a full-service, end-to-end services organization.

As a result, the introduction of such advanced therapies by existing and emerging businesses have been critical in increasing drugs uptake, which is expected to benefit global orphan drugs market expansion throughout the forecast period.

However, the industry is expected to shrink due to factors such as a reduction in screening services, decreased connectivity to specialists, treatment disruptions, limited operational processes in most industries, insufficient funding to research and academic institutions, temporary closure of large academic institutions, and interrupted supply chain and difficulties.

Nonetheless, the industry is expected to recover and grow steadily in the coming years. Although the industry for orphan medicines is growing at a reasonable rate, certain factors can inhibit its growth. The high cost of medicines, insufficient data on rare diseases, and a lack of competent health experts are all factors limiting growth in the industry for orphan medicines.

The impact of the COVID-19 pandemic on specific pharmaceutical markets is projected to be greater due to the deferral of non-life-threatening diagnosis and treatment. This is especially true for people suffering from uncommon diseases, as more financial and healthcare resources have been focused on the pandemic by different nations. This is predicted to have a significant impact on patients suffering from rare diseases, as a shortage of diagnostic and consultation services by healthcare experts will influence the timely prescription of orphan medications. Then several industries pushed their doors due to the lack of drugs.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising interest in rare disorder therapeutics is due to the fact that important pharmacological discoveries resulting in bestselling drugs innovations are more likely in uncommon disorders than in typical pharmaceutical portfolios. The Orphan Drugs Act was implemented in 1983 to inspire pharmaceutical firms to create rare disease therapies.

The Food and drug administration (FDA) Office for the Development of Orphan Products decides whether a drugs qualifies as an orphan. The extremely high costs of bringing a medicinal product to market in pharmaceutical companies would not be covered by anticipated product revenues. This also results in small market potential for new drug use and economic damage to the pharmaceutical industry.

Another important factor is that pharmaceutical companies are required to do larger outcome studies for standard therapies such as diabetes and coronary artery disease (CAD) regulatory clearances compared to rare disorders. Despite increased global attention on the development and marketing of rare illness treatments, some obstacles are impeding global industry growth. The high cost of these medications is one of the most significant impediments.

Report Segmentation

The market is primarily segmented based on therapy area, drug type, distribution channel, and region.

|

By Therapy area |

By Drug Type |

By Distribution channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The online pharmacy segment is expected to witness fastest growth

Online orphan medicine distribution would complement the evolving market dynamics in the next years. This growth can be ascribed to the platform's simplicity of use for consumers while purchasing medications. Furthermore, due to a rising number of consumers turning to online pharmacies for the purchase of these pharmaceuticals during COVID-19 periods, online pharmacy has experienced substantial development.

Oncology is expected to hold the significant revenue share

Increasing relaxation activities are expected to increase interest in the industry. Every year, the oncology division of drugs treats an increasing number of cancer patients with various types of disease. To combat the situation, there is a growing need and interest in powerful drugs in the drugs development field. As a result, the global orphan drugs market is expected to see development opportunities in the coming years.

The growing geriatric rate of the elderly population with chronic conditions necessitates the development of viable drugs to treat the condition or keep them in control. As a result of significant development in the global orphan drugs market during the forecast time frame, interest in the industry has grown.

Oncology treatments are in significant companies' design and development pipelines, as are a significant number of orphan medicines dedicated to the treatment for cancer. The hematology sector is expected to be among the most predominant segments due to a variety of new products being introduced and increasing positive regulatory approvals. Neurology is predicted to expand at a relatively fast rate as product offerings for critical disorders such as multiple sclerosis improve overall.

The demand in North America is expected to witness significant growth

Among regions, North America is expected to grow rapidly in the global market. Several factors contribute to the industry's growth, including the promotion of laws that allow for the rapid approval of such drugs, drugs status exclusivity for such drugs, and a strong health system. The presence of a well-established healthcare network, key players, and a growing patient population is accelerating regional growth.

Furthermore, favorable government policies and funding are boosting regional growth. One reason for market expansion is that in the United States, orphan drugs receive seven years of marketing exclusivity after FDA approval for a specific use, as well as tax breaks and a user fee waiver.

Because of the region's large patient population and widespread acceptance of advanced rare disease therapies, the European market is expected to grow rapidly. This, combined with the presence of favorable reimbursement policies in the United States, accounts for North America's market dominance.

Asia Pacific market is expected to grow the fastest, owing to rising healthcare costs and increased awareness of uncommon diseases. Asia Pacific orphan pharmaceuticals market is expected to rise due to rising rates of rare diseases and increased awareness of these in various developing economies.

Furthermore, the expansion of clinical trials in Asia-Pacific is expected to be faster than in Europe and the United States, driving growth in the region. Government initiatives to increase the number of community health and oncology centers should increase orphan drugs availability in developing regions.

Competitive Insight

Some of the major players operating in the global market include Amgen Inc., Alexion Pharmaceutical Inc., Bayer AG, Bristol Myers Squibb Co., Celegne Corporation, DAIICHI SANKYO Company Ltd., F. Hoffmann La-Roche, GlaxoSmithKline PLC, Johnson & Johnson Inc., Novo Nordisk A/S, Novartis AG, Takeda Pharmaceutical Company Limited, and others.

Recent Developments

In March 2022, CER-001, developed by ABIONYX Pharma, received FDA Orphan Drugs Designation (ODD) for the diagnosis of LCAT deficiency manifesting as kidney dysfunction and/or ophthalmologic illness.

The term refers to both partial LCAT insufficiency, which manifests as Fisheye Disease, and comprehensive LCAT deficiency, which manifests as renal symptomatology and corneal opacities. Advancement of LCAT deficiency, in which there is no available drug, can eventually lead to kidney disease requiring dialysis or kidney transfusion, and/or complete corneal opacification mandating transplant.

Orphan Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 184.08 billion |

|

Revenue forecast in 2030 |

USD 460.76 billion |

|

CAGR |

12.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Therapy area, By Drug Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Amgen Inc., Alexion Pharmaceutical Inc., Bayer AG, Bristol Myers Squibb Co., Celegne Corporation, DAIICHI SANKYO Company Ltd., F. Hoffmann La-Roche, GlaxoSmithKline PLC, Johnson & Johnson Inc., Novo Nordisk A/S, Novartis AG, Takeda Pharmaceutical Company Limited |