Battery Materials Market Size, Share, Trends, & Industry Analysis Report

By Type (Cathode, Anode, Electrolyte, Separator, and Others), By Battery Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 127

- Format: PDF

- Report ID: PM6354

- Base Year: 2024

- Historical Data: 2020-2023

Overview

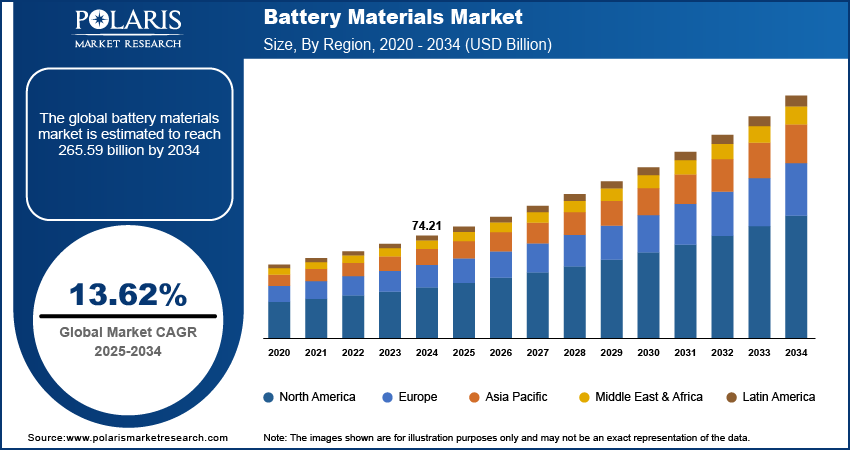

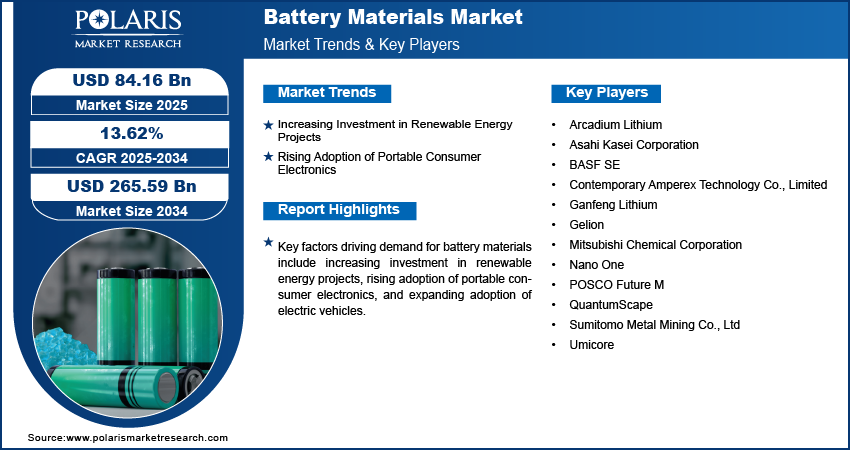

The global battery materials market size was valued at USD 74.21 billion in 2024, growing at a CAGR of 13.62% from 2025 to 2034. Key factors driving demand for battery materials include increasing investment in renewable energy projects, rising adoption of portable consumer electronics, and expanding adoption of electric vehicles.

Key Insights

- The cathode segment held the largest revenue share in 2024 due to the increasing adoption of EVs globally.

- The lithium-ion segment accounted for a major revenue share in 2024, due to its superior performance characteristics.

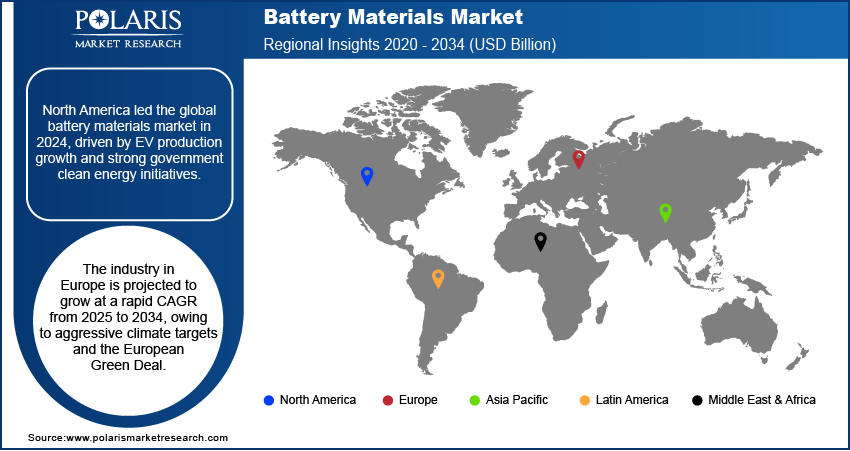

- North America battery materials market held the largest global battery materials share in 2024, owing to rapid expansion in electric vehicle (EV) production.

- U.S. held the largest revenue share in the North America battery materials landscape in 2024, due to rising focus on sustainable mobility.

- The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to aggressive climate targets and the European Green Deal, which mandates a transition to zero-emission vehicles by 2035.

Industry Dynamics

- Increasing investment in renewable energy projects is fueling the demand for battery materials as renewable energy sources, including solar and wind generate electricity intermittently, requiring large-scale batteries to store excess energy for use when production drops.

- The increasing adoption of portable consumer electronics is boosting demand for battery materials as these devices rely on rechargeable batteries for power.

- Growing demand for medical devices with reliable and long-lasting batteries is creating a lucrative market opportunity.

- The heavy dependence on foreign sources, especially China, for critical minerals and manufacturing expertise may hamper the market growth.

AI Impact on Battery Materials Market

- AI accelerates material discovery by predicting viable battery chemistries, reducing R&D time.

- Machine learning optimizes battery performance and lifespan by analyzing real-time data.

- Smart manufacturing powered by AI improves production yield and quality control in battery plants.

- AI-driven recycling solutions increase recovery rates of critical materials like lithium and cobalt.

Market Statistics

- 2024 Market Size: USD 74.21 Billion

- 2034 Projected Market Size: USD 265.59 Billion

- CAGR (2025-2034): 13.62 %

- North America: Largest Market Share

Battery materials are the key components used in the construction of batteries, enabling the storage and conversion of chemical energy into electrical energy. These include electrode materials such as lithium cobalt oxide or lithium iron phosphate (cathode) and graphite (anode), electrolytes (liquid, solid, or gel) that facilitate ion movement, and separators that prevent short circuits. These materials are crucial for battery performance, affecting capacity, voltage, lifespan, and safety.

They are widely used in consumer electronics, electric vehicles (EVs), renewable energy storage systems, and portable devices. Advances in battery materials, such as silicon anodes or solid-state electrolytes, aim to improve energy density, charging speed, and sustainability. Developing efficient, cost-effective, and environmentally friendly battery materials is essential for meeting the growing global demand for reliable energy storage solutions.

The global demand for battery materials is driven by the expanding adoption of electric vehicles. International Energy Agency, in its report, stated that electric car sales exceeded 17 million worldwide in 2024, rising by more than 25% from 2023. This is increasing the need for key battery components such as lithium, cobalt, nickel, and graphite. These materials form the core of lithium-ion batteries, which power most EVs. The surge in EV sales is also pushing battery manufacturers to scale up operations, further driving demand for raw materials. Additionally, advancements in battery technology and the push for longer-range, faster-charging EVs are encouraging the use of higher quantities and purer forms of these materials. Therefore, the increasing adoption of EVs is driving the demand for battery materials.

Drivers & Opportunities/Trends

Increasing Investment in Renewable Energy Projects: Renewable energy sources such as solar and wind generate electricity intermittently, requiring large-scale batteries to store excess energy for use when production drops. Hence, as governments and companies pour more money into expanding renewable capacity, they also invest in large scale batteries. These batteries need significant amounts of materials such as lithium, cobalt, nickel, and graphite, leading to market growth. For instance, by the end of 2023, the Infrastructure Investment and Jobs Act 2021, allocated nearly USD 75 billion to clean and renewable energy in the U.S., including projects related to grid improvement and expansion.

Rising Adoption of Portable Consumer Electronics: The increasing adoption of portable consumer electronics is boosting demand for battery materials as these devices rely on rechargeable batteries for power. Smartphones, laptops, tablets, wireless earbuds, and smartwatches have become essential in daily life, and each device requires lightweight, high-capacity batteries to function efficiently. Manufacturers are constantly focusing on improving battery life and performance, which is increasing the use of materials such as lithium, cobalt, nickel, and graphite. Additionally, the growing popularity of wearable technology and IoT devices are further amplifying battery material demand. Therefore, as more people worldwide purchase and upgrade their electronic gadgets, the production of these devices surges, directly raising the need for battery materials.

Segmental Insights

Type Analysis

Based on type, the segmentation includes cathode, anode, electrolyte, separator, and others. The cathode segment held the largest revenue share in 2024 as it plays a crucial role in determining the overall performance, capacity, and cost of a battery. Manufacturers focused heavily on cathode material innovation as it directly influences energy density and cycle life. The rising adoption of electric vehicles (EVs) has fueled demand for advanced cathodes made from materials such as nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP). Automakers favored cathode chemistries due to their ability to deliver longer driving ranges, higher stability, and enhanced safety. Additionally, government incentives for the adoption of clean energy and the expansion of renewable energy storage projects accelerated cathode consumption.

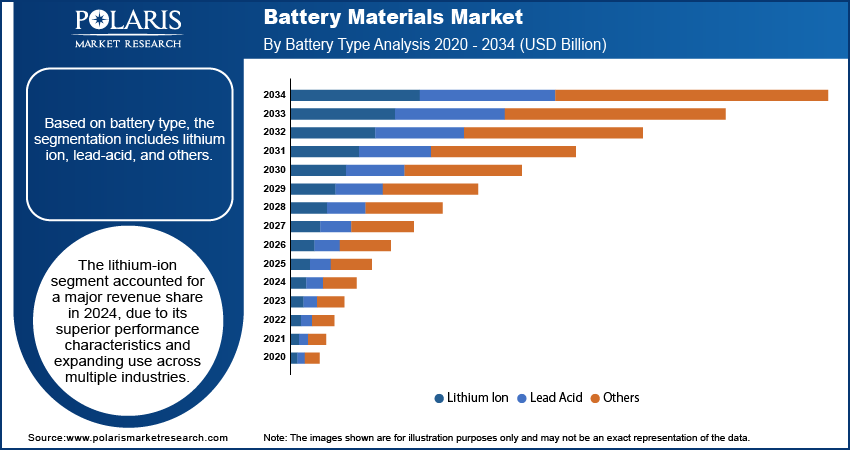

Battery Type Analysis

Based on battery type, the segmentation includes lithium-ion, lead-acid, and others. The lithium ion segment accounted for a major revenue share in 2024, due to its superior performance characteristics and expanding use across multiple industries. Automakers preferred lithium-ion batteries as they deliver higher energy density, longer cycle life, and lighter weight compared to lead-acid alternatives. The rapid electrification of transportation, supported by government incentives and stricter emission regulations, significantly boosted demand for lithium-ion technology. Consumer electronics manufacturers also relied heavily on these batteries to power smartphones, laptops, and wearable devices, further strengthening their dominance. Moreover, large-scale renewable energy storage projects integrated lithium-ion batteries as they provide reliable grid balancing and efficient energy management.

Application Analysis

In terms of application, the segmentation includes electric vehicles (EVs), consumer electronics, energy storage systems, and others. The electric vehicles (EVs) segment dominated the revenue share in 2024 due to the increasing shift toward cleaner mobility solutions. The surge in EV adoption was driven by government-backed incentives, stricter emission norms, and consumer demand for sustainable transportation. Manufacturers of EVs relied on high-performance batteries to extend driving range, reduce charging time, and ensure safety, which significantly increased the consumption of advanced materials. Major economies, including the United States, China, and several European nations, invested heavily in EV infrastructure and production facilities, further amplifying demand.

The energy storage systems segment is expected to grow at a robust pace in the coming years, owing to the rising deployment of solar and wind energy. Utilities and industrial users favor advanced battery systems for peak load management, backup power, and smooth integration of intermittent renewable sources. Growing investments in smart grids and microgrids, particularly in North America, Europe, and the Asia Pacific, are projected to fuel the adoption of high-capacity storage solutions. Additionally, the push for decarbonization and energy independence is compelling both developed and emerging economies to expand energy storage projects, leading to high consumption of battery materials.

Regional Analysis

North America battery materials market held the largest global battery materials share in 2024. This dominance is attributed to rapid expansion in electric vehicle (EV) production and government initiatives promoting clean energy. Automakers such as Ford, GM, and Tesla scaled up EV manufacturing, requiring large volumes of lithium, cobalt, nickel, and graphite. The Inflation Reduction Act (IRA) incentivizes domestic battery production and sourcing of raw materials from North America or free-trade partners, driving investment in local supply chains. Additionally, energy storage systems for renewable power projects boosted demand for advanced battery chemistries, strengthening the region’s push for material security and processing capabilities.

U.S. Battery Materials Market Insight

U.S. held the largest revenue share in the North America battery materials landscape in 2024, due to federal policies such as the Inflation Reduction Act, which mandated local content requirements for EV tax credits. U.S. companies are building gigafactories to produce lithium-ion batteries, increasing the need for critical minerals. Automakers and battery producers secured long-term supply agreements with mining firms to ensure stable access to lithium, nickel, and cobalt. The Department of Energy also funded projects to develop domestic processing and recycling infrastructure, reducing reliance on foreign sources. Growing consumer adoption of EVs and home energy storage systems further accelerated material demand.

Asia Pacific Battery Materials Market

The Asia Pacific market is projected to hold a substantial revenue share in 2034, driven by booming EV production in countries such as South Korea, India, and Japan. Governments in the region are implementing policies to reduce carbon emissions and promote electric mobility, stimulating investments in battery production and its associated materials. South Korean and Japanese firms are leading the development of next-generation batteries, which is increasing their demand for high-purity materials. India is expanding its EV infrastructure and local manufacturing under production-linked incentive schemes, creating new demand. The region’s extensive electronics industry is also driving the need for compact, high-performance batteries, leading to high adoption of battery material.

China Battery Materials Market Overview

The demand for battery materials in China is being driven by the world’s largest producer of EVs and lithium-ion batteries. Companies such as CATL and BYD are expanding their production capacity to meet the rising demand for domestic and international orders, which requires vast amounts of lithium, cobalt, and graphite. The Chinese government is also supporting the EV industry through subsidies, infrastructure development, and strict emissions standards, fueling mass adoption. Additionally, growth in e-bikes, energy storage, and consumer electronics is driving strong material consumption.

Europe Battery Materials Market

The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to aggressive climate targets and the European Green Deal, which mandates a transition to zero-emission vehicles by 2035. Automakers such as Volkswagen, BMW, and Stellantis are accelerating EV rollouts, necessitating large-scale battery production. Countries in the region are also investing in gigafactories and battery raw material processing facilities. Consumer demand for EVs, coupled with renewable energy integration, is further driving continuous growth in battery material requirements.

Key Players & Competitive Analysis Report

The battery materials market is highly competitive, featuring a diverse mix of global chemical giants, specialized material innovators, and vertically integrated battery manufacturers. Key players, including Umicore, BASF SE, and Mitsubishi Chemical Corporation, lead in cathode and precursor development, leveraging their scale and R&D investments. Chinese firms, such as Contemporary Amperex Technology Co., Limited (CATL) and Ganfeng Lithium, dominate the value chain, spanning from lithium refining to battery production. South Korea’s POSCO Future M and Japan’s Sumitomo Metal Mining Co., Ltd focus on advanced cathode and nickel materials. Emerging players like Nano One and QuantumScape are advancing next-generation technologies, including solid-state batteries. Companies such as Asahi Kasei and Gelion offer novel chemistries and sustainable solutions.

Major companies operating in the battery materials industry include Arcadium Lithium; Asahi Kasei Corporation; BASF SE; Contemporary Amperex Technology Co., Limited (CATL); Ganfeng Lithium; Gelion; Mitsubishi Chemical Corporation; Nano One; POSCO Future M; QuantumScape; Sumitomo Metal Mining Co., Ltd; and Umicore.

Key Companies

- Arcadium Lithium

- Asahi Kasei Corporation

- BASF SE

- Contemporary Amperex Technology Co., Limited (CATL)

- Ganfeng Lithium

- Gelion

- Mitsubishi Chemical Corporation

- Nano One

- POSCO Future M

- QuantumScape

- Sumitomo Metal Mining Co., Ltd

- Umicore

Industry Developments

July 2025, BASF and Contemporary Amperex Technology Co., Ltd. (CATL) signed a framework agreement for cathode active materials.

December 2024, Nano One, a green technology company, announced the allowance and/or issuance of 7 new patents for manufacturing batteries with active materials, bringing its 2024 total patents to 11.

August 2024, Arcadium Lithium acquires Li-Metal's lithium metal business to enhance production capabilities and meet demand for next-generation battery materials.

Battery Materials Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Cathode

- Anode

- Electrolyte

- Separator

- Others

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-Ion

- Lead-Acid

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Electric Vehicles (EVs)

- Consumer Electronics

- Energy Storage Systems

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Battery Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 74.21 Billion |

|

Market Size in 2025 |

USD 84.16 Billion |

|

Revenue Forecast by 2034 |

USD 265.59 Billion |

|

CAGR |

13.62% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 74.21 billion in 2024 and is projected to grow to USD 265.59 billion by 2034.

The global market is projected to register a CAGR of 13.62% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Arcadium Lithium; Asahi Kasei Corporation; BASF SE; Contemporary Amperex Technology Co., Limited (CATL); Ganfeng Lithium; Gelion; Mitsubishi Chemical Corporation; Nano One; POSCO Future M; QuantumScape; Sumitomo Metal Mining Co., Ltd; and Umicore.

The lithium ion segment dominated the market revenue share in 2024.

The energy storage systems segment is projected to witness the fastest growth during the forecast period.