Microfiltration Membranes Market Share, Size, Trends, Industry Analysis Report

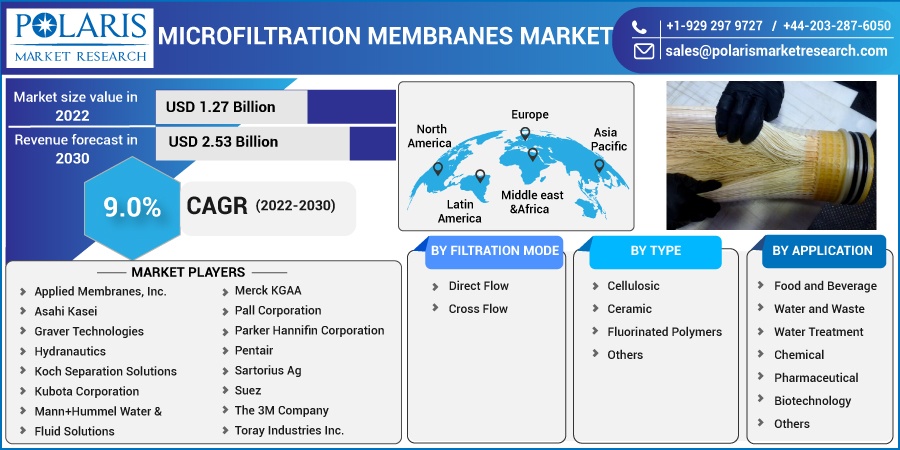

By Filtration Mode (Direct Flow, Cross Flow); By Type (Cellulosic, Ceramic, Fluorinated Polymers, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2650

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

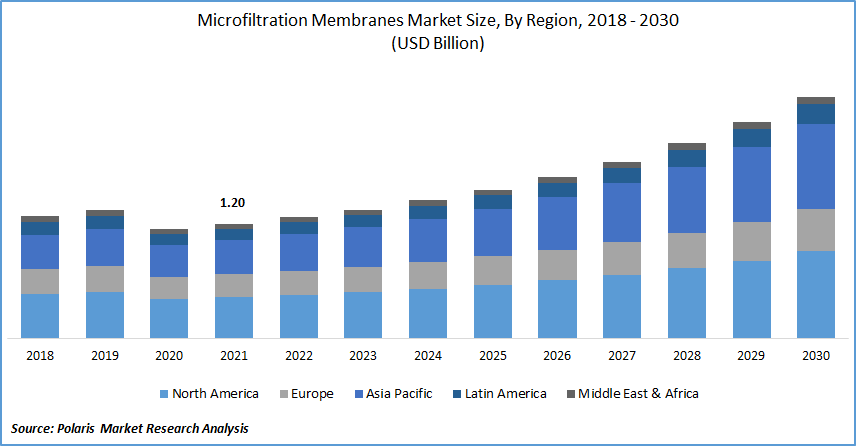

The global microfiltration membranes market is valued at USD 1.20 billion in 2021 and is expected to grow at a CAGR of 9.0% in the forecast period. The process of microfiltration involves low-pressure separation through microfiltration membranes to remove unwanted particles and microorganisms. These membranes are equipped with open pore structures.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

These membranes are made using organic materials like polymer-based membranes or inorganic materials like stainless steel or ceramic. Microfiltration membranes are developed to have a pore size of 0.1 to 10 µm. They are used across various applications to eliminate unwanted particles and act as an initial step in high-purity filtration systems.

These membranes remove large contaminants to obtain streams for further treatment. They are used in boiler refeeds, cooling towers, wastewater treatments, and potable water treatment. These are utilized in the pharmaceutical and food & beverage sectors for clarification and sterilization of water.

These membranes also find application in desalination pretreatments in multi-stage processes. Municipal and industrial organizations make use of microfiltration membranes to maximize the efficiency of re-use filtration systems.

They eliminate contaminants such as fats, solids, and microbes from process fluids, increasing their application in the manufacturing of dairy and food products. These are often combined with other technologies, such as ultrafiltration, reverse osmosis, and nanofiltration to obtain high-quality products.

In the dairy sector, these membranes are utilized for clarifying fermentation broths, whey fractionation, and microbial removal. Some applications of microfiltration membranes in the food and beverages sector include wine clarification, wet corn milling, plant extract clarification, and gelatin clarification, among others.

The outbreak of the COVID-19 pandemic affected the global microfiltration membranes market on account of disruptions in the supply chain, restricted manufacturing activities, and a lack of workforce. The market also suffered from reduced demand for the industry from industrial sectors due to the shutting of manufacturing plants and factories during the pandemic. Lockdown restrictions across the world caused restricted movement of goods and acquisition of raw materials.

However, due to the implementation of lockdowns across the world, the majority of people stayed indoors, leading to rising in waste generation, which further resulted in an increase in demand from the municipal sector. The global microfiltration membranes market is expected to experience growth post-pandemic owing to a rise in environmental concerns and greater initiatives to address concerns regarding water scarcity and water pollution.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growth in population across the world, rising urbanization in developing countries, and rise in industrialization have supported the growth of the industry. Microfiltration membranes are increasingly being used for the treatment of water and wastewater owing to greater concerns regarding water scarcity and initiatives to recycle water.

Microfiltration membranes are used across various applications such as food and beverage, water and wastewater treatment, chemical, pharmaceutical, biotechnology, and others. These membranes are utilized in the food and beverage sector for the processing of milk and filtration of beer and wine. They are also used for the separation of oil and water in the metalworking sector. The biotechnology sector uses these membranes for retaining biomass from fermentation broths.

Economic growth in emerging countries and reduction in water reserves have resulted in greater demand for microfiltration membranes. The rise in water pollution, increasing use in industrial applications, and introduction of environmental regulations across the world boosts the growth of the global microfiltration membranes market. Governments worldwide are implementing stringent regulations associated with wastewater, driving the demand for microfiltration membranes.

Report Segmentation

The market is primarily segmented based on filtration mode, type, application, and region.

|

By Filtration Mode |

By Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Crossflow Segment Dominated the Global Market in 2021

The crossflow segment dominated the global market in 2021. Crossflow offers higher efficiency and performance as compared to direct flow. The liquids to be filtered flow continuously across the membrane, eliminating uneven flow and fouling.

These modes provide a longer life span as compared to others. It offers an automated and continuous filtration process leading to greater consistency and quality. Greater demand from industrial applications and higher performance boost the growth of this segment.

Fluorinated Polymers Segment Accounted for a Major Share

The fluorinated polymers segment accounted for a major share in 2021. The demand for these membranes has increased in commercial applications owing to their high strength, durability, and chemical resistance. These membranes offer resistance to fluctuating temperatures, pH, and fouling tendencies.

Market players offer these membranes in different configurations, such as flat sheet and spiral-wound, among others, to offer greater flexibility and customization for different applications. Ceramic membranes are used across various applications such as food and beverages and wastewater treatment on account of their high porosity, durability, and greater resistance to pressure, temperature, and chemicals.

Water and Waste Water Treatment Segment to Hold a Major Share

The water and wastewater treatment segment accounted for a major share in 2021. Waste water is treated through microfiltration membranes to enable the flow of water while limiting undesirable materials. These membranes are used to enhance the quality of water, especially in industrial applications.

These membranes are capable of separating a wide range of contaminants, increasing their application across the world. A rise in awareness regarding water scarcity, environmental concerns, and a greater need to recycle water has increased the demand for microfiltration membranes.

Asia Pacific Dominated the Global Market in 2021

Asia Pacific accounted for a major share of the global microfiltration membrane market in 2021. An increase in environmental concerns and the introduction of supportive environmental policies support the market growth in the region. Growth in urbanization rise in concerns regarding water scarcity and water pollution accelerates the market growth.

The increase in industrial growth in countries such as India, Japan, and China, coupled with rising awareness associated with the reuse and recycling of water, has increased the demand for microfiltration membranes. The rise in investment in research and development, technological innovation, and the presence of prominent market players further contribute to the market growth in the region.

Competitive Insight

The prominent players operating in the global microfiltration membranes market include Applied Membranes, Inc., Asahi Kasei, Graver Technologies, Hydranautics, Koch Separation Solutions, Kubota Corporation, Mann+Hummel Water & Fluid Solutions, Merck KGAA, Pall Corporation, Parker Hannifin Corporation, Pentair, Sartorius Ag, Suez, The 3M Company, and Toray Industries Inc.

These major companies are introducing a wide variety of products with advanced features to offer improved efficiency to consumers. They are also entering partnerships and collaborations to enter new geographies and strengthen market presence.

Recent Developments

- In April 2021, Koch Separation Solutions introduced INDU-COR HD, which is developed for treatment of industrial waste streams with higher efficiency. This launch expands the company’s portfolio of tubular membrane products. This new product offers superior packing density, enabling cost effective crossflow filtration with greater operational efficiency and sustainability.

- In September 2019, De.mem introduced new microfiltration membrane to be used in the food and beverages sector. This hollow fibre membrane provides a large pore size along with a greater flux, and improved throughput of liquids. The development is aimed at strengthening the company’s offerings of nanofiltration and ultrafiltration technologies.

Microfiltration Membranes Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2022 |

USD 1.27 billion |

|

Revenue forecast in 2030 |

USD 2.53 billion |

|

CAGR |

9.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Filtration Mode, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Applied Membranes, Inc., Asahi Kasei, Graver Technologies, Hydranautics, Koch Separation Solutions, Kubota Corporation, Mann+Hummel Water & Fluid Solutions, Merck KGAA, Pall Corporation, Parker Hannifin Corporation, Pentair, Sartorius Ag, Suez, The 3M Company, and Toray Industries Inc. |