Vertical Software Market Size, Share, Trends, Industry Analysis Report

By Organization (SMEs, Large Enterprises), By Application, By Deployment, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6359

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

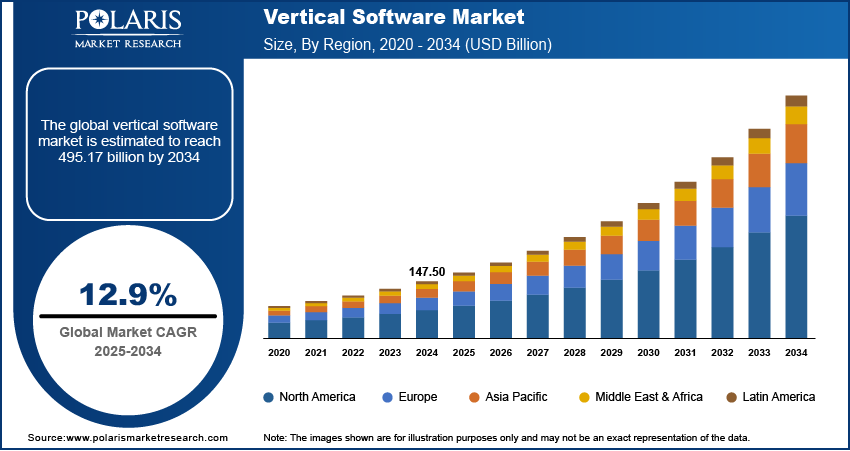

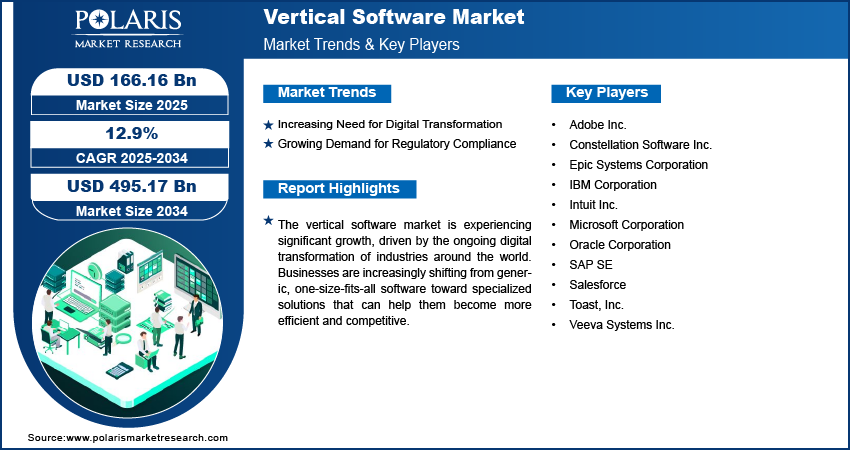

The global vertical software market size was valued at USD 147.50 billion in 2024 and is anticipated to register a CAGR of 12.9% from 2025 to 2034. The need for specific solutions is a major growth factor, as companies want software that directly addresses their unique business needs. The ongoing digital transformation across different industries is also driving the adoption of vertical software.

Key Insights

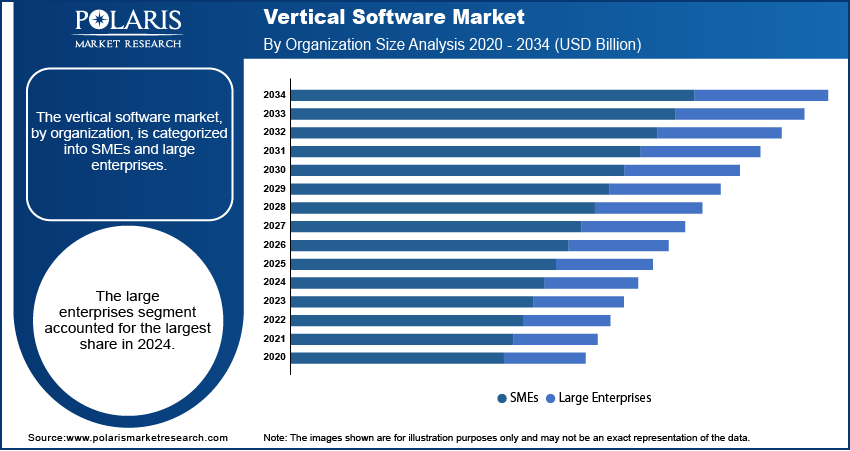

- By organization, the large enterprises segment held the largest share of the vertical software market in 2024. Increasing investments by large enterprises in advanced digital transformation solutions fueled the demand for vertical software.

- In terms of application, the enterprise resource planning (ERP) segment led revenue share in 2024. The rising need for seamless business process integration and real-time data management is driving the adoption of ERP solutions.

- Based on deployment, the cloud-based segment held the largest market share in 2024. Growing demand for scalable, cost-effective, and remotely accessible software solutions is accelerating the shift toward cloud-based deployments.

- By end use, the banking, financial services, and insurance (BFSI) segment dominated in 2024. Increasing regulatory compliance requirements and the growing need for advanced risk management tools are boosting vertical software adoption in the BFSI sector.

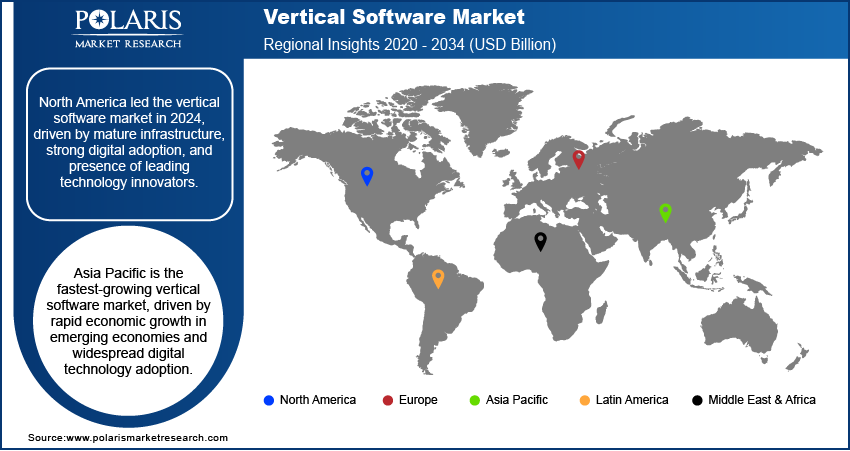

- By region, North America held the largest share of the global market in 2024. High levels of technological adoption, coupled with strong investments in AI, cloud computing, and automation, are driving market growth in the region.

Industry Dynamics:

- Businesses seek software that addresses their specific needs, workflows, and regulatory requirements. Unlike general-purpose software, vertical software offer enhanced efficiency and productivity by being tailor-made for particular sectors such as healthcare, finance, or retail. This need for customized, targeted tools is a key factor.

- The widespread adoption of digital technologies across all industries is a major driver. As companies move away from traditional methods and embrace digital operations, they require specialized software to manage complex processes, analyze data, and improve customer engagement. This shift is making these solutions an essential part of business modernization.

- The use of cloud-based models has made specialized software more accessible and scalable for businesses of all sizes.

Market Statistics

- 2024 Market Size: USD 147.50 billion

- 2034 Projected Market Size: USD 495.17 billion

- CAGR (2025–2034): 12.9%

- North America: Largest market in 2024

AI Impact on Vertical Software Market

- The integration of AI and machine learning (ML) into vertical software solutions provides powerful features, such as predictive analytics and automation.

- AI technology is used to automate repetitive tasks such as diagnostic support in healthcare, claims processing in insurance, or contract review in law.

- Vertical AI tools are replacing human labor with intelligent systems, as these systems can be used across complex and regulated environments.

- As AI models are trained on domain-specific data, they provide better automation, higher accuracy, and more relevant insights than generic AI tools.

Vertical software is designed to meet the specific needs of a particular market. Unlike general software used by many different businesses, vertical software is customized for a specific sector, such as healthcare, finance, or retail. This allows the software to offer specialized features and functions that are directly relevant to that sector’s unique workflows and regulations, helping companies operate more efficiently.

A few drivers in the vertical software landscape are the increasing focus on data-driven decision-making and the rise of specific regulatory compliance. Companies across all sectors now understand the value of data for making smart business choices. They need software that can collect data and analyze it to provide actionable insights. This demand is leading to the creation of vertical software with built-in analytics and reporting tools that are tailored to the data types and metrics of a specific industry.

The growing need for regulatory compliance is another factor. Many industries, such as healthcare and finance, have strict rules and standards they must follow. Vertical software is designed to help businesses comply with these complex requirements. For example, in the U.S. healthcare sector, companies must follow the Health Insurance Portability and Accountability Act (HIPAA), which protects sensitive patient information. Vertical software for healthcare is built with features to ensure data privacy and security, helping hospitals and clinics stay compliant with the law and avoid serious penalties.

Drivers and Trends

Increasing Need for Digital Transformation: The push for digital transformation is a primary driver in the vertical software market. As businesses in specific industries, such as healthcare and manufacturing, seek to modernize their operations, they are turning to specialized software solutions. These tools are designed to streamline workflows, improve efficiency, and enable new business models that would not be possible with older, generic systems. The adoption of these solutions helps companies stay competitive and meet the changing demands of their customers. This broad shift toward digital technology is making vertical software a crucial part of the strategy for many companies.

This driver is evident in the healthcare sector, where the World Health Organization (WHO) has actively promoted digital health solutions. In its “Global Strategy on Digital Health 2020–2025” report, WHO highlights the importance of digital tools in improving health outcomes and making health systems more sustainable and efficient. This focus on digital health at a global level underscores the widespread need for specialized software that can handle everything from patient data to remote care. The increasing demand for solutions that align with these modernization goals is a key factor driving the growth.

Growing Demand for Regulatory Compliance: Regulatory compliance is another significant driver. Industries such as finance and healthcare are heavily regulated, with strict rules governing data security, privacy, and reporting. General-purpose software often cannot meet these complex requirements, forcing companies to seek out specialized solutions. Vertical software is built with these regulations in mind, providing features that help businesses automatically comply with legal standards, reduce the risk of fines, and protect sensitive information. This focus on compliance makes vertical software a necessary investment for companies operating in these strict environments.

According to a 2025 report titled “Ten Key Regulatory Challenges of 2025,” from the Financial Stability Oversight Council (FSOC), regulators are increasingly focused on areas such as cybersecurity, data privacy, and fraud. The report notes that these challenges are becoming more complex due to advances in technology. This environment creates a strong demand for vertical software solutions that can help financial institutions manage these evolving risks and maintain compliance. This constant need to comply with new and changing regulations is driving the adoption of vertical software.

Segmental Insights

Organization Analysis

Based on organization, the segmentation includes SMEs and large enterprises. The large enterprises segment held the largest share in 2024. These large organizations often have complex operational needs that require specialized software to manage different departments, processes, and a large number of employees. They also have the financial resources and larger budgets to invest in highly customized and comprehensive vertical software solutions that can be scaled across their entire organization, often spanning multiple locations. This software helps them with important tasks such as ensuring regulatory compliance, improving efficiency, and integrating various business functions into a single system. The need for robust, scalable, and secure software to handle vast amounts of data and intricate workflows makes large enterprises the leading segment. Their continuous need to upgrade and maintain these systems also contributes significantly to their largest share.

The small and medium enterprises (SMEs) segment is anticipated to register the highest growth rate during the forecast period. These smaller businesses are increasingly recognizing the benefits of specialized software. Many of them are undergoing their own digital transformation and are seeking for affordable and easy-to-use solutions. The rise of cloud-based vertical software, which often comes with subscription-based pricing, has made these tools more accessible to SMEs by lowering the initial cost. This allows them to compete more effectively with larger companies by automating key processes and improving productivity without needing a huge capital investment. As more cloud-based, specialized solutions become available, SMEs are adopting them at a faster pace, making this segment a key area of growth.

Application Analysis

Based on application, the segmentation includes customer relationship management (CRM), enterprise resource planning (ERP), supply chain management (SCM), human resource management (HRM), and other. The enterprise resource planning (ERP) segment held the largest share in 2024. ERP software is essential for businesses as it integrates and manages core business processes, such as finance, manufacturing, and human resources, into a single system. In specific industries, a vertical ERP solution is even more powerful because it is designed to handle the unique workflows and regulatory requirements of that sector. For example, a vertical ERP system for a manufacturing company can manage everything from raw materials sourcing to production schedules and finished goods delivery, all while ensuring compliance with standards. Large companies, in particular, rely on these comprehensive systems to improve efficiency, reduce operational costs, and get a complete view of their business operations. This wide-ranging functionality makes ERP a dominant application.

The supply chain management (SCM) segment is anticipated to register the highest growth rate during the forecast period. As global supply chains have become more complex and prone to disruption, businesses in every sector are realizing the importance of having a robust and responsive supply chain. Vertical SCM software helps companies manage and optimize everything from inventory and logistics to supplier relationships and order fulfillment. These solutions provide real-time visibility into the entire supply chain, allowing businesses to anticipate issues, react quickly to changes, and make smarter decisions. The increasing need for greater supply chain resilience and efficiency, especially in a world where customer expectations for fast delivery are constantly rising, is fueling the rapid adoption of SCM solutions and driving its high growth rate.

Deployment Analysis

Based on deployment, the segmentation includes on-premises and cloud. The cloud segment held the largest share in 2024. The shift toward cloud computing has made it easier for businesses to access specialized software without needing to invest in expensive hardware and maintenance. Cloud deployment offers great flexibility and scalability, allowing companies to easily add or remove users and features as their needs change. This model is especially popular with new businesses and startups that need to get up and running quickly. Cloud-based solutions also provide regular automatic updates and strong data backup features, which helps companies stay secure and always have the latest technology. This combination of lower upfront costs, easy scalability, and constant updates has made the cloud the preferred choice for many businesses.

The cloud segment is anticipated to register the highest growth rate during the forecast period. This is largely driven by industries that have strict data and cloud security, privacy, and compliance rules, such as banking, government, and healthcare. These sectors often need complete control over their data. Also, an on-premises setup enables them to keep all information on their own servers behind their own firewalls. This gives them a sense of security and control that is not always possible with a third-party cloud provider.

End Use Analysis

Based on end use, the segmentation includes BFSI, media & entertainment, healthcare, IT & telecom, retail & e-commerce, government & public sectors, travel & hospitality, education, and others. The BFSI segment held the largest share in 2024 as the BFSI industry has unique and complex needs, particularly around data security and regulatory compliance. Financial institutions must adhere to strict government and regulations to protect sensitive customer information and prevent fraud. Vertical software provides tailored solutions that help these companies manage these complexities, from risk management to transaction processing. The sector's willingness to invest heavily in technology to gain a competitive edge and maintain security further contributes to its dominant position. As the financial world becomes more digitized, the reliance on specialized software to manage these intricate and regulated operations continues to grow in the coming years.

The healthcare sector is anticipated to register the highest growth rate during the forecast period. This is largely driven by a global push for digital health initiatives and the need for more efficient patient care. Hospitals, clinics, and other medical providers are adopting vertical software to manage electronic health records, streamline billing, and improve communication. These solutions are essential for handling complex medical workflows and ensuring patient data privacy under laws such as HIPAA. The rapid adoption of telehealth and remote patient monitoring, especially in recent years, has also fueled this growth. As the healthcare sector continues its digital transformation, the demand for specialized software that can improve outcomes and manage operational demands is rising at a fastest pace.

Regional Analysis

The North America vertical software market accounted for the largest share in 2024 due to its mature technological infrastructure and high adoption of digital solutions across various industries. The presence of major technology companies and a culture of innovation have made the region a leader in developing and using specialized software. Industries such as healthcare and finance are heavily invested in vertical software to manage complex operations and meet strict regulations. The widespread move toward cloud-based solutions and the focus on digital transformation by large corporations and smaller businesses contribute to North America's dominant position.

U.S. Vertical Software Market Insights

The U.S. is a key driver of the North American region. It has a high concentration of large enterprises and a strong focus on technology, which creates a large demand for vertical software. The country's dynamic business environment, with a constant push for efficiency and innovation, encourages companies to invest in tailored software solutions. Additionally, a strong venture capital and startup ecosystem fuels the development of new and specialized software for a variety of industries. This combination of a large consumer base and a continuous stream of new technology makes the U.S. a leading country in the vertical software industry across North America.

Europe Vertical Software Market Trends

The Europe market for vertical software is experiencing significant growth, driven by digital initiatives and a focus on specific solutions. Many European countries have strong manufacturing and industrial bases, which are increasingly adopting specialized software to improve efficiency through automation and data analytics. The region's focus on data protection and privacy, such as with GDPR regulations, also boosts the demand for vertical software that can help businesses comply with these strict rules. This need for compliance and operational modernization is making vertical software an important investment for European companies.

The Germany vertical software market is a major industrial powerhouse in Europe and is a significant contributor to the region's landscape. Its strong manufacturing and automotive sectors are driving the demand for vertical software to manage production, logistics, and supply chains. German companies are known for their focus on engineering and precision, which makes them ideal customers for highly specialized software that can help them maintain their competitive edge. The country's push toward "Industry 4.0," which involves the automation and data exchange in manufacturing technologies, is further accelerating the adoption of vertical software solutions.

Asia Pacific Vertical Software Market Overview

Asia Pacific is the fastest-growing market for vertical software. This growth is fueled by rapid economic development, especially in emerging economies, and a widespread embrace of digital technologies. As more businesses in the region undergo digital transformation, they are turning to specialized software to modernize their operations. The increasing number of startups and small businesses in countries across Asia Pacific is also contributing to this growth, as end users seek affordable, scalable, and easy-to-implement solutions.

China Vertical Software Market Overview

In Asia Pacific, China is a major player. The country's massive manufacturing sector and fast-growing e-commerce industry are creating a huge demand for vertical software. Chinese companies are using specialized software to improve everything from production efficiency to logistics and customer relationship management. The government's support for technological innovation and the country's huge consumer demand also provide lucrative opportunities for the vertical software industry in China. The rapid growth of the digital economy in China is making it a key hub for the development and adoption of vertical software.

Key Players and Competitive Insights

The vertical software features a competitive landscape with a mix of large, established technology companies and smaller, specialized providers. These major players often compete by offering a wide range of products for specific industries, focusing on features like automation, data analytics, and regulatory compliance. Many companies are also expanding their offerings through strategic acquisitions to quickly enter new vertical sector or strengthen their existing product lines. The competition is driven by the need to provide scalable and innovative solutions, particularly as more industries undergo digital transformation and seek to improve their operational efficiency. The landscape is also influenced by the growing popularity of cloud-based models, which have lowered the barrier to entry for many new competitors.

A few prominent companies in the industry include Microsoft, Oracle, SAP SE, Salesforce, Adobe Inc., IBM Corporation, Intuit Inc., Constellation Software Inc., Veeva Systems Inc., Epic Systems Corporation, and Toast, Inc.

Key Players

- Adobe Inc.

- Constellation Software Inc.

- Epic Systems Corporation

- IBM Corporation

- Intuit Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Salesforce

- Toast, Inc.

- Veeva Systems Inc.

Vertical Software Industry Developments

June 2024: SAP announced its intention to acquire WalkMe, a leader in digital adoption platforms.

September 2023: SAP announced its plan to acquire LeanIX, a company specializing in enterprise architecture management. The goal of this acquisition is to build a comprehensive suite of tools that help customers modernize their IT systems and drive continuous business transformation.

Vertical Software Market Segmentation

By Organization Outlook (Revenue – USD Billion, 2020–2034)

- SMEs

- Large Enterprises

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Supply Chain Management (SCM)

- Human Resource Management (HRM)

- Other

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-premises

- Cloud

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Media & Entertainment

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Government & Public Sectors

- Travel & Hospitality

- Education

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vertical Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 147.50 billion |

|

Market Size in 2025 |

USD 166.16 billion |

|

Revenue Forecast by 2034 |

USD 495.17 billion |

|

CAGR |

12.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 147.50 billion in 2024 and is projected to grow to USD 495.17 billion by 2034.

The global market is projected to register a CAGR of 12.9% during the forecast period.

North America dominated the share in 2024.

A few key players include Microsoft, Oracle, SAP SE, Salesforce, Adobe Inc., IBM Corporation, and Intuit Inc. Other notable companies that are active in this market are Constellation Software Inc., Veeva Systems Inc., Epic Systems Corporation, and Toast, Inc.

The large enterprises segment accounted for the largest share of the market in 2024.

The supply chain management (SCM) segment is expected to witness the fastest growth during the forecast period.