Building Thermal Insulation Market Share, Size, Trends, Industry Analysis Report

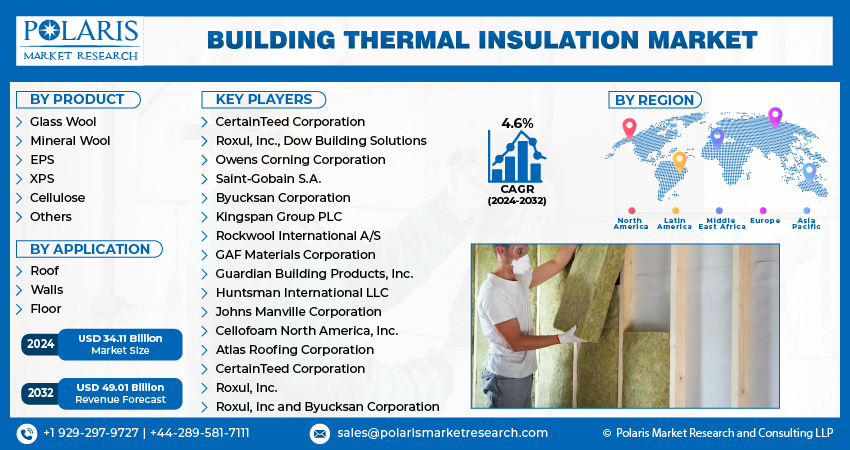

By Product (Glass Wool, Mineral Wool, EPS, XPS, Cellulose); By Application (Roof, Walls, Floor); By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM3219

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

The global building thermal insulation market was estimated at USD 53.8 billion in 2034 and is projected to grow at a 4.6% during the forecast period. Key elements anticipated to fuel the expansion include increasing household and commercial deployment of the product to lower total energy costs and increased awareness of energy saving.

Key Insights

- Roof application held the largest market share in 2024. This is due to the growing need to prevent direct sunlight from penetrating the roofs of buildings.

- Expanded Polystyrene (EPS) is expected to witness the highest CAGR. This is due to the good thermal insulation properties and a long lifespan.

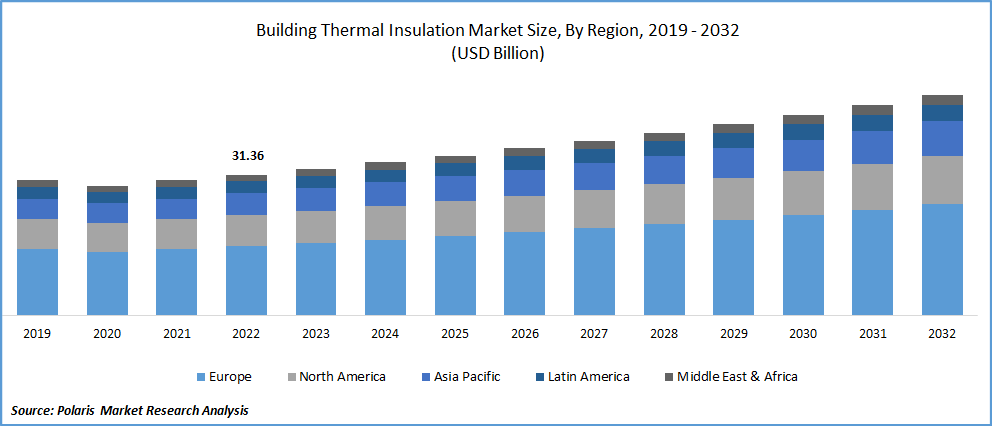

- In 2024, Europe held the largest market share due to the initiatives from the European Commission and REACH to endorse thermal insulation as an energy conservation methodology.

- The Asia Pacific region is expected to witness the fastest growth of the building thermal insulation market, driven by ongoing urbanization and major infrastructure development.

Industry Dynamics

- The demand for thermal insulation in buildings is growing due to the expansion of the building and construction industries.

- The demand for building thermal insulation products in residential and commercial applications is driving the rising energy costs.

- Constant changes in raw material prices create price volatility, which challenges market stability.

- The increased demand for high-performance insulation materials is due to the rise in energy codes, which create growth opportunities.

Market Statistics

- 2024 Market Size: USD 34.2 billion

- 2034 Projected Market Size: USD 53.8 billion

- CAGR (2025-2034): 4.6%

- Europe: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

What Does the Current Market Landscape Look for Building Thermal Insulation?

The building thermal insulation market is projected to be driven by favorable regulations as a result of the focus on reducing overall energy usage. Thermal building insulation aids in lessening a building's reliance on heating, ventilation, and air conditioning (HVAC) systems. This decreases total energy consumption, which is anticipated to improve the expansion.

The largest proportion in North America is anticipated to belong to the United States. Growth is anticipated to be fueled by a number of initiatives, including the Weatherization Assistance Program (WAP), which focuses on widespread product uptake in low-income families.

Building thermal insulation demand is anticipated to increase as a result of favorable building codes in the United States and Canada, as well as the establishment of energy certification organizations like the Leadership in Energy and Environmental Design (LEED) and the U.S. Green Building Council (USGBC). Due to its low biodegradability and carcinogenicity, the United States Environmental Protection Agency (EPA) has put strict limitations on the use of foamed plastics that could harm market growth.

Due to the global COVID-19 breakdown, there has been a decline in the market for thermal insulation. Most the world's nations are on lockdown, which has halted new construction operations and prevented the consumption of insulation materials. Also, due to a lack of both the necessary materials and manpower to complete the installation, the old buildings that are required to get insulated under the new norms and regulations adopted by the local government are also on hold.

Over the forecast period, the industry's attention is projected to turn to the development of environmentally friendly goods due to the influence that building insulation materials have on the environment. In addition, it is anticipated that rising plastic foam prices will hinder expansion, spurring the creation of substitute goods.

The strict restrictions governing traditional goods like plastic foams are making recyclable insulation more and more attractive. Over the projection period, the threat of alternatives is anticipated to grow as consumers, architects, and businesses show an increased preference for green, biodegradable, and recyclable items as a result of growing environmental awareness.

The building and construction business uses between 50% and 60% of the insulation material, followed by the consumer goods and transportation industries. The whole insulation business is experiencing margin issues as a result of the tremendous blow that the coronavirus outbreak has dealt to these industries. There is additional pressure on regions with strict thermal insulation laws, like Europe and North America. They are waiting until there is an extreme necessity before building any new structures or buying any technology. Also, a region like Asia-Pacific, which had the fastest growth rate in the consumption of thermal insulation as a residential building area is still undeveloped and has a lot of room for expansion, is also having trouble.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Market Expansion?

As the building and construction industries have expanded, so has the demand for thermal insulation for buildings. Building thermal insulation techniques reduce heat transfer between surrounding environments to maintain stable indoor temperatures. Also, they reduce carbon emissions by requiring less energy to maintain temperature and limiting heat transmission to the outer environment. It offers outstanding structural qualities, like as impact and fire resistance.

For instance, 1,295,000 housing projects were finished, according to the U.S. Census Bureau and U.S. Department of Housing and Urban Development. Moreover, 1,724,700 dwelling developments were scheduled to be allowed by construction permits in 2021. As comparison to the 2020 figure of 1,471,100, this is 17.2% (0.6%) greater. The market for building thermal insulation is projected to expand as a result of the rising number of development projects.

The increased demand for building thermal insulation products in residential and commercial applications is the main factor contributing to rising energy costs. Energy consumption that is inefficient has two costs. Significant energy use could result in high consumer costs due to recent price hikes. Natural resources are also depleted as a result of it. Consumers make it a point to insulate their spaces as a result, especially those who live in residential regions. There is a sizable industry for creating low-energy insulating materials like foamed plastics. Some of these solutions can pay for their insulating costs back in as little as a year through energy savings.

Report Segmentation

The market is primarily segmented based on application, product, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Segment Insights

Application Analysis

Which Segment by Application Held the Largest Share of the Market?

Roof application had a largest market share in 2024 and is anticipated to experience a substantial CAGR during the forecast period as a result of the growing need to prevent heat from buildings' roofs from being penetrated by direct sunlight. During the projection period, an increase in the number of single-family homes is anticipated to accelerate the segment's growth.

Product Analysis

Why EPS Segment is Expected to Witness Highest CAGR?

Expanded Polystyrene (EPS), which has good thermal insulation properties and a long lifespan, is anticipated to have the highest CAGR in terms of revenue over the projection period. Moreover, rising consumer demand for the product as a result of its non-toxic, rot-proof, and recyclable qualities is anticipated to fuel expansion.

Why Europe Held the Largest Share of the Market?

In 2024, the Europe held the largest market share. This is attributed to regional growth. This is due to the initiatives from the European Commission and REACH to endorse thermal insulation as an energy conservation methodology. These regulations leveraged the ambitions of regional initiatives, which like the European Green Deal, demand robust energy efficiency improvements in buildings. The European region benefits from a mature building construction sector with an established willingness to adopt and preference for advanced insulation materials with a high performance. Furthermore, existing sustainability benchmarks and occupant comfort must continue to drive retrofit and renovation activities in the residential and commercial segments, producing a consolidated regional position.

Why Asia Pacific is Expected to Witness the Fastest Growth?

The Asia Pacific region is expected to witness the fastest growth of the building thermal insulation market. This growth is largely driven by ongoing urbanization and major infrastructure development. Key economies' governments are developing and enforcing strinct building energy codes to enhance sustainability and reduce the operational carbon footprint of new buildings. Furthermore, the regulatory push is further driven by the rising energy costs and growing environmental awareness. This is combine to raise the attractiveness of insulation solutions. The significant number of ongoing residential and commercial projects in emerging countries provide a meaningful and sustained addressable market. The combination of these regulatory, economic, and developmental factors presents a uniquely favorable opportunity for accelerated market growth.

Competitive Insight

Some of the major players operating in the global building thermal insulation market include CertainTeed Corporation, Roxul, Inc., Dow Building Solutions, Owens Corning Corporation, Saint-Gobain S.A., Byucksan Corporation, Kingspan Group PLC, Rockwool International A/S, GAF Materials Corporation, Guardian Building Products, Inc., Huntsman International LLC, Johns Manville Corporation, Cellofoam North America, Inc., Atlas Roofing Corporation, CertainTeed Corporation, Roxul, Inc., Roxul, Inc and Byucksan Corporation.

Industry Developments

May 2025: AkzoNobel launched a thermal insulation coating system, which can cool down buildings and make them more energy efficient.

June 2024: Nuvoco Vistas Corp. Ltd. launched its ground-breaking product, Ecodure Thermal Insulated Concrete. This material provides an eco-friendly solution to the challenges of global warming and rising indoor temperatures.

Building Thermal Insulation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.2 billion |

| Market size value in 2025 | USD 35.7 billion |

|

Revenue forecast in 2034 |

USD 53.8 billion |

|

CAGR |

4.6% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

NICE Actimize, Tata Consultancy Services Limited, Trulioo, BAE Systems, Nice Systems, Fiserv, Cognizant Technology Solutions Corporation, ACI Worldwide, SAS Institute, Fiserv, Oracle Corporation, BAE Systems, LexisNexis Risk Solutions, CaseWare RCM and Accenture |

FAQ's

The building thermal insulation market report covering key segments are application, product and region.

Building Thermal Insulation Market Size Worth USD 53.8 Billion By 2034.

The global building thermal insulation market projected to grow at a 4.6% during the forecast period.

Europe held the largest global market in 2024.

key driving factors in building thermal insulation market are increase efforts in conserving energy and reducing greenhouse gas emission.