HVAC Systems Market Size, Share, Trends, Industry Analysis Report

By Equipment (Heating, Ventilation, Cooling), By Application, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6390

- Base Year: 2024

- Historical Data: 2020-2023

Overview

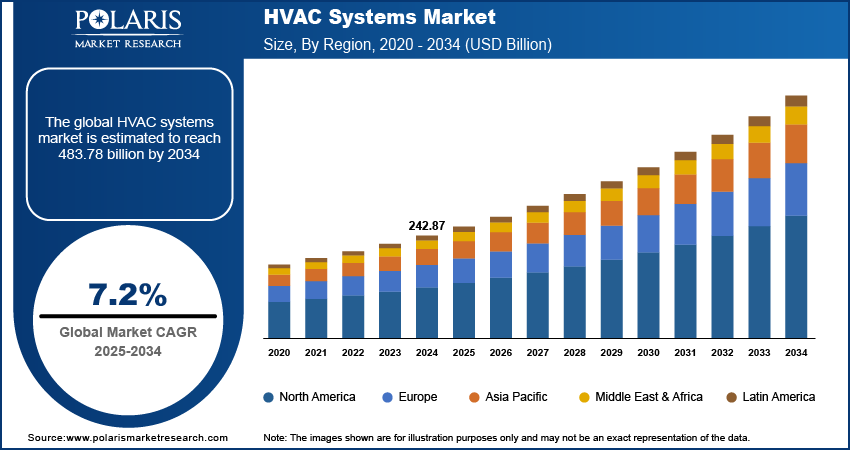

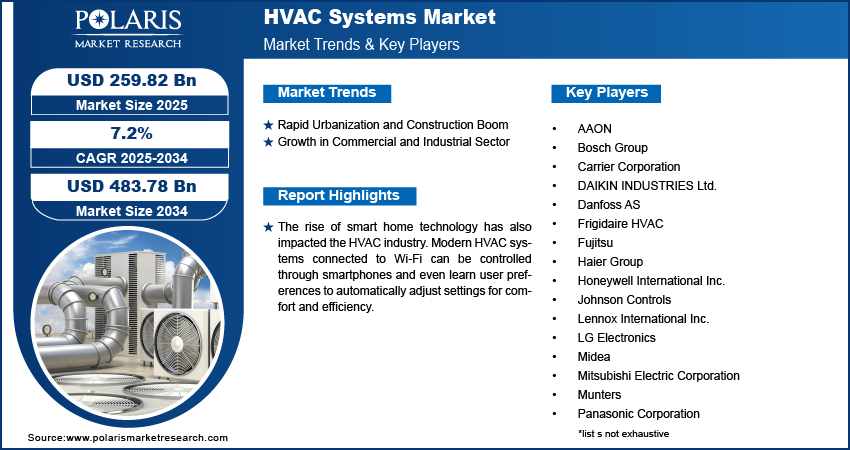

The global HVAC systems market size was valued at USD 242.87 billion in 2024, growing at a CAGR of 7.2% from 2025 to 2034. The market growth is driven by rapid urbanization and construction boom and growth in commercial and industrial sector.

Key Insights

- In 2024, the heating segment held the largest market share, driven by strong demand for heating solutions in colder regions of North America and Europe.

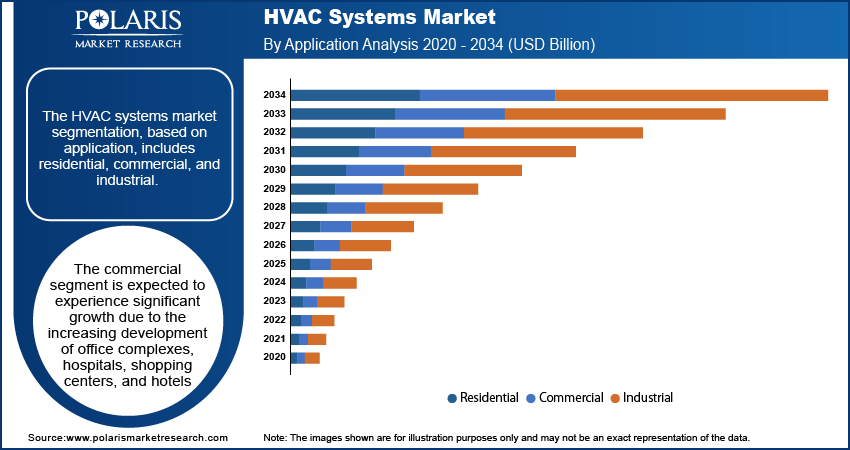

- The commercial segment is anticipated to witness significant growth during the forecast period, fueled by the expansion of office buildings, hospitals, shopping malls, and hotels.

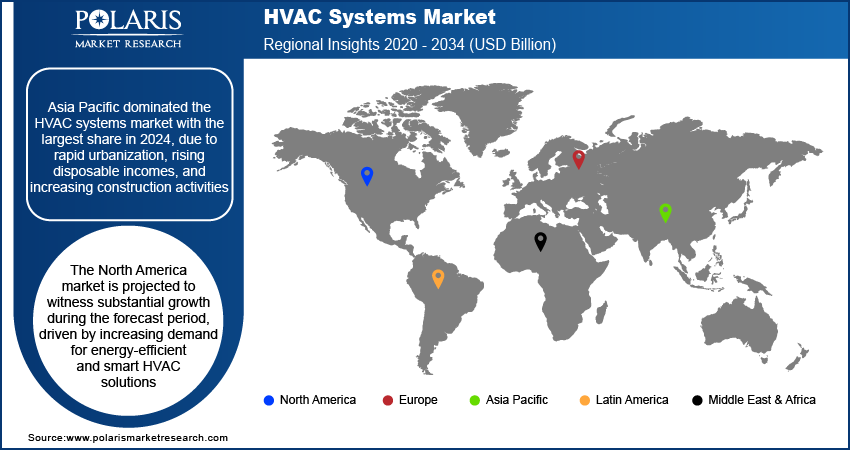

- The Asia Pacific market led in 2024, supported by rapid urbanization, increasing disposable incomes, and a surge in construction activities.

- The North American market is expected to grow considerably during the forecast period, due to rising demand for energy-efficient and smart HVAC systems.

- The U.S. market is projected to experience strong growth as smart HVAC technologies gain adoption, enhancing comfort while reducing energy use.

Industry Dynamics

- Rapid urbanization and construction boom drives the demand for HVAC systems.

- Growth in the commercial and industrial sector is fueling the industry growth.

- The rise of smart home technology has also impacted the HVAC industry by improving the HAVC system’s appeal.

- High initial installation costs and maintenance expenses restrain the growth.

Market Statistics

- 2024 Market Size: USD 242.87 billion

- 2034 Projected Market Size: USD 483.78 billion

- CAGR (2025–2034): 7.2%

- Asia Pacific: Largest market in 2024

AI Impact on HVAC Systems Market

- AI improves HVAC system efficiency by analyzing real-time data to optimize energy consumption and reduce operational costs.

- AI-enabled predictive maintenance detects potential HVAC system failures early, minimizing downtime and extending equipment lifespan.

- Integration of AI allows smart HVAC systems to adapt to user preferences and environmental changes, enhancing comfort and indoor air quality.

- AI-driven analytics help manufacturers forecast demand and optimize production schedules, improving supply chain management and reducing inventory costs.

HVAC systems refer to Heating, Ventilation, and Air Conditioning systems that regulate indoor temperature, air quality, and comfort in residential, commercial, and industrial spaces. The systems include components such as air conditioners, heat pumps, furnaces, ductwork, and ventilation units. They help maintain a healthy and energy-efficient indoor environment by controlling temperature, humidity, and airflow.

Global climate change is causing more frequent and severe weather events, including extreme heatwaves and cold spells. Consequently, people rely more on heating and cooling systems to stay comfortable and safe. In regions where HVAC was once a luxury, it is now becoming a necessity, especially in countries experiencing rising temperatures. At the same time, unpredictable weather patterns increase demand for flexible, high-performance HVAC systems that quickly adapt to changing conditions. This growing need for reliable climate control is pushing HVAC sales forward across residential, commercial, and industrial sectors, thereby driving the growth.

The rise of smart home appliance technology has impacted the HVAC industry. Modern HVAC systems connected to Wi-Fi can be controlled through smartphones, and even learn user preferences to automatically adjust settings for comfort and efficiency. Features such as remote access, energy usage monitoring, and predictive maintenance are making HVAC systems more appealing and convenient. These innovations improve user experience and help save energy and reduce breakdowns. Smart HVAC systems adoption is rising as technology continues to evolve, thereby fueling the growth.

Drivers & Opportunities

Rapid Urbanization and Construction Boom: The demand for new buildings for homes, offices, and commercial spaces is increasing as cities grow quickly and more people move into urban areas. According to the World Bank Group, as of 2024, 58% of the world population lives in urban areas. Every new building needs an HVAC system to ensure comfortable indoor conditions. This construction boom, especially in developing countries such as India, China, and parts of Africa and the Middle East, is driving HVAC system sales. Alongside new buildings, renovations of older structures to include modern HVAC accessories and units further fuel this demand, thereby driving the growth of the industry.

Growth in Commercial and Industrial Sector: Expanding industries, shopping malls, data centers, healthcare facilities, and office complexes all require efficient climate control solutions. According to Statistics Canada, in 2024, the investment in commercial building construction in Ontario Canada grew by 1.3% compared to 2023. HVAC systems are critical in keeping equipment safe, maintaining air quality, and ensuring comfort for employees and customers. Additionally, data centers need precise temperature control to keep servers running smoothly, while hospitals need clean, temperature-regulated air for patient safety. Continuous investments in advanced HVAC technologies fuels demand as these sectors continue to grow and demand higher performance systems, further boosting expansion.

Segmental Insights

Equipment Analysis

The segmentation, based on equipment, includes heating, ventilation, and cooling. In 2024, the heating segment dominated with the largest share due to the high demand for heating solutions in colder regions across North America and Europe. The growing construction of residential buildings and public infrastructure in these regions drove the installation of central heating systems. Additionally, rising energy prices encouraged the adoption of energy-efficient heating technologies such as heat pumps and smart thermostats. Governments further supported this shift by offering subsidies and incentives for sustainable heating systems, further fueling the demand. The need for reliable heating grows as global temperatures fluctuate, thereby driving the segment growth.

The cooling segment accounted for significant growth driven by increasing global temperatures, urbanization, and rising incomes in developing nations. More consumers in countries such as India, China, and Brazil can afford air conditioners, and rising heatwaves have made cooling a necessity rather than a luxury. Additionally, commercial spaces such as malls, data centers, and office buildings need large-scale cooling systems to ensure comfort and equipment safety. Advancements in inverter-based air conditioners and energy-efficient cooling technologies further attracted consumers. The demand for cooling systems is expected to keep rising with a focus on thermal comfort and energy savings.

Application Analysis

The segmentation, based on application, includes residential, commercial, and industrial. The commercial segment is expected to experience significant growth due to the increasing development of office complexes, hospitals, shopping centers, and hotels. These buildings require advanced HVAC systems to maintain comfortable indoor environments, comply with health and safety regulations, and improve energy efficiency. Post-pandemic awareness of indoor air quality has led businesses to invest in ventilation and filtration systems, further boosting the segment. Additionally, smart HVAC solutions with remote monitoring and energy tracking features are gaining popularity among commercial facility managers. The need for commercial HVAC systems rises as the global economy expands and more businesses modernize their infrastructure, thereby driving the segment growth.

Distribution Channel Analysis

The segmentation, based on end user, includes online, retail stores, wholesale stores, and others. The retail stores segment dominated with the largest share driven by the strong presence of HVAC product displays, instant purchase availability, and customer trust in physical retail outlets. Many customers prefer in-person consultation and hands-on experience before investing in HVAC systems, especially in the residential segment. Retailers offer bundled services such as delivery, installation, and after-sales support, which further attract buyers. In emerging economies, rising urbanization and increased footfall in electronics and appliance stores further support this trend, thereby driving the growth.

Regional Analysis

Asia Pacific HVAC Systems Market Trends

The market in Asia Pacific dominated with the largest share in 2024, due to rapid urbanization, rising disposable incomes, and increasing construction activities. Countries such as India and Southeast Asian nations are investing heavily in residential, commercial, and industrial infrastructure, driving demand for HVAC systems. The region's hot and humid climate further increases the need for efficient cooling solutions. Government initiatives promoting energy efficiency and sustainable building codes further boost growth. Additionally, the expanding middle class is upgrading homes and offices with modern HVAC technologies, driving the growth of the industry in the Asia Pacific.

China HVAC Systems Market Insights

The industry in China is expected to witness significant growth during the forecast period, due to its large population and fast-growing economy. The government’s focus on smart city projects and green building standards supports the adoption of energy-efficient HVAC systems. China’s booming real estate sector, including residential complexes, commercial buildings, and industrial parks, fuels demand. Moreover, rising awareness about indoor air quality and stringent environmental regulations fuels the use of advanced HVAC technologies. Moreover, China’s strong manufacturing base further enables easy availability of affordable HVAC products, which boosts the industry growth in China.

North America HVAC Systems Market Analysis

The North America industry is projected to witness substantial growth during the forecast period, driven by increasing demand for energy-efficient and smart HVAC solutions. Aging infrastructure in both residential and commercial buildings is being replaced with modern, eco-friendly systems that reduce energy consumption and carbon footprint. Government regulations and incentives promoting sustainability accelerate the adoption of advanced HVAC technologies, such as variable refrigerant flow (VRF) and geothermal heat pumps. Additionally, the region’s extreme weather conditions, from hot summers to cold winters, create demand for both cooling and heating systems, thereby fueling the growth.

U.S. HVAC Systems Market Outlook

The U.S. industry is projected to witness substantial growth during the forecast period due to the adoption of smart HVAC technologies that improve comfort and reduce energy consumption. Homeowners and businesses increasingly prefer connected HVAC systems controlled via smartphones and AI-driven automation. Federal and state-level incentives for energy-efficient appliances encourage upgrading old systems. The country’s vast commercial real estate and healthcare infrastructure drives HVAC demand. Rising awareness about indoor air quality pushes consumers toward advanced filtration and ventilation solutions, thereby fueling the U.S. market growth.

Europe HVAC Systems Market Insights

The industry in Europe is expected to experience significant growth in the future, due to increasing regulations focused on energy efficiency and reducing carbon emissions. The European Union’s strict building codes and incentives encourage the installation of eco-friendly HVAC systems that use renewable energy sources such as heat pumps and solar-powered units. Growing awareness about climate change and indoor air quality further fuels demand for advanced ventilation and air purification technologies. The rise in new construction and renovation of old buildings to meet sustainability standards further drives the growth. Moreover, Europe's focus on smart buildings and integration of HVAC with IoT systems fuels its appeal, thereby driving adoption in the region.

Germany HVAC Systems Market Outlook

The market in Germany is expected to experience significant growth due to its commitment to energy efficiency and green building initiatives. Strict government policies promote the use of sustainable HVAC solutions such as heat pumps, solar thermal systems, and energy recovery ventilators. The country’s strong industrial base, modern residential developments, and commercial infrastructure require advanced heating and cooling technologies. German consumers and businesses prioritize reducing energy costs and environmental impact, driving demand for smart and highly efficient HVAC systems. Additionally, ongoing investments in retrofit projects to upgrade older buildings further fuels the growth in the country.

Key Players and Competitive Analysis

The industry is highly competitive, with key players vying for market share through innovation, energy efficiency, and smart technologies. Leading companies such as Carrier, Trane, Daikin, and Johnson Controls dominate with broad global reach and diverse product portfolios. Asian giants such as Mitsubishi Electric, LG, Samsung, Haier, and Midea are rapidly expanding, leveraging cost-effective manufacturing and smart home integrations. American firms such as Lennox, Rheem, and AAON focus on energy-efficient solutions tailored to North American standards. Bosch, Fujitsu, and Panasonic bring strong engineering capabilities and environmentally friendly technologies. Companies such as Danfoss and Honeywell contribute with advanced components and automation. Niche players such as STULZ and Munters specialize in precision and industrial HVAC applications. The market is driven by sustainability, regulatory compliance, and demand for smart, IoT-enabled systems. Strategic partnerships, R&D investment, and regional expansions are key tactics shaping the competitive landscape.

Key Players

- AAON

- Bosch Group

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Danfoss AS

- Frigidaire HVAC

- Fujitsu

- Haier Group

- Honeywell International Inc.

- Johnson Controls

- Lennox International Inc.

- LG Electronics

- Midea

- Mitsubishi Electric Corporation

- Munters

- Panasonic Corporation

- Rheem Manufacturing Company

- SAMSUNG

- STULZ Air Technology Systems, Inc.

- Trane

HVAC Systems Industry Developments

In March 2025, Danfoss India unveiled seven innovative HVACR products at ACREX India 2025, reinforcing its commitment to sustainable building solutions by enhancing energy efficiency, real-time monitoring, and system performance across temperature, fluid, and gas management applications.

In January 2025, Panasonic launched the OASYS Residential Central Air Conditioning System in the U.S., introducing a first-of-its-kind energy-efficient solution that integrates Mini Split AC, ERV, and transfer fans to enhance indoor comfort and sustainability.

In April 2025, Foster International launched its own HVAC brand, FOSTER, offering energy-efficient systems and smart technologies designed for residential, commercial, and industrial applications, reinforcing its commitment to innovation, sustainability, and regional leadership in the HVAC industry.

HVAC Systems Market Segmentation

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Heating

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Electric Baseboards

- Heating Cables

- Others

- Ventilation

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Others

- Cooling

- Air Conditioning

- Chillers

- Cooling Towers

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Retail Stores

- Wholesale Stores

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

HVAC Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 242.87 Billion |

|

Market Size in 2025 |

USD 259.82 Billion |

|

Revenue Forecast by 2034 |

USD 483.78 Billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 242.87 billion in 2024 and is projected to grow to USD 483.78 billion by 2034.

The global market is projected to register a CAGR of 7.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are AAON, Bosch Group, Carrier Corporation, DAIKIN INDUSTRIES Ltd., Danfoss AS, Frigidaire HVAC, Fujitsu, Haier Group, Honeywell International Inc., Johnson Controls, Lennox International Inc., LG Electronics, Midea, Mitsubishi Electric Corporation, Munters, Panasonic Corporation, Rheem Manufacturing Company, SAMSUNG, STULZ Air Technology Systems, Inc., and Trane.

The heating segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.