Medical Radiation Shielding Market Size, Share, Trends, Industry Analysis Report

: By Product, By Solution (Diagnostic Shielding and Radiation Therapy Shielding), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM4303

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

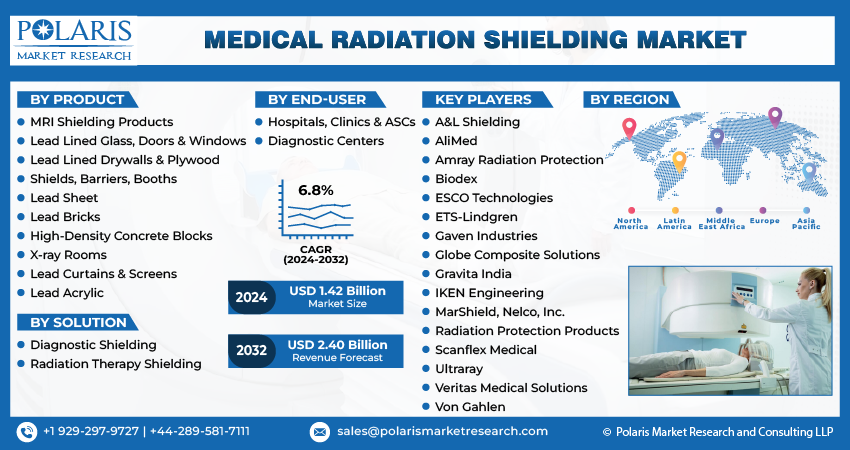

The global medical radiation shielding market size was valued at USD 1,414.75 million in 2024, growing at a CAGR of 6.7% during 2025–2034. The market expansion is primarily driven by increasing government regulations to improve workplace safety and ongoing R&D activities establishing new growth potential.

Key Insights

- The hospitals, clinics, & ASCs segment is anticipated to register significant growth, owing to the growing number of radiation therapies and diagnostic imaging procedures being done in these facilities.

- The diagnostic shielding segment led the market in 2024. The segment’s dominance is attributed to the rising use of imaging technologies such as CT scans and X-rays in diagnostic centers and hospitals.

- North America accounted for the largest market share in 2024, primarily driven by its advanced healthcare infrastructure and a high number of routine diagnostic procedures.

- Asia Pacific is anticipated to register the highest CAGR. Increasing healthcare investments and growing awareness about radiation safety are driving regional market growth.

Industry Dynamics

- Rising government investments in healthcare across both developed and developing economies are expanding the number of healthcare facilities and fueling the demand for medical radiation.

- The increasing prevalence of chronic diseases like cancer globally is driving the need for diagnostic services and radiation therapy, thereby driving market growth.

- Growing emphasis on customizing solutions for specific environments is expected to create several market opportunities.

- High initial cost of manufacturing may hinder market growth.

Market Statistics

2024 Market Size: USD 1,414.75 million

2034 Projected Market Size: USD 2,710.21 million

CAGR (2025-2034): 6.7%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Radiation shielding is a barrier that is positioned between a radiation source and the area or person that needs to be protected. It has the function of reducing, controlling, or altering the radiation exposure rate at a predetermined spot. Without shielding, radiation exposure to the general public, radiation workers (such as dentists and veterinarians), and even neighbouring office workers could exceed permitted exposure limits, which could have a harmful impact on their health.

Shielding is a crucial factor in every medical institution that considerably lowers unwanted exposure, even though it is difficult to avoid exposure to radiation totally. The ongoing research activities are establishing new growth potential with innovative product launches in the marketplace. Additionally, the stringent regulations by the government to improve workplace safety for healthcare providers and patient care is increasing the adoption of medical radiation shielding systems.

Radiation shielding has advanced beyond traditional heavy lead-based solutions. New materials and technologies offer lighter, more flexible, and eco-friendly alternatives that are currently being tested. For instance, in June 2022, a study published in PubMed Central focused on the development of a new robotic radiation shielding device for interventional cardiology procedures. They developed a radiation shielding system, which was tested for its performance in one week at the coronary catheterization laboratory. The result witnessed a significant reduction in radiation than without any shielding. Some innovations include non-toxic composite shielding, modular panels, and a mobile barriers system. These innovations are easier to install and use. These modern products are safer for the environment, easier to handle, and more cost-effective in the long run. More healthcare providers are upgrading their facilities with these advanced materials as technology improves, driving the medical radiation shielding market growth.

Market Dynamics

Rising Government Investments in Healthcare Sector

Government investments in the healthcare sector are rising in major developing and developed regions. According to the CMS, the US alone invested USD 4.9 trillion in the healthcare sector in 2023. This rising investments in the healthcare sector is expanding the number of healthcare facilities, due to which the demand for the medical radiation shield is rising to protect both patients and medical personnel from excessive exposure to ionizing radiation, particularly during procedures such as digital X-rays, CT scans, and interventional procedures. Additionally, rising healthcare investments are supporting existing healthcare facilities to modernize safety equipment, including radiation protection equipment, thereby driving the adoption of medical radiation shielding systems.

Rising Cases of Chronic Disease

The number of cancer cases is increasing around the world, due to which the demand for diagnostic services and radiation therapy is rising. These treatments involve exposure to ionizing radiation, which harms healthy tissue if not properly contained. According to the International Patients, Heidelberg University Hospital in Germany alone treats 4,500 patients per year through radiation therapy. Hospitals and clinics need to ensure safe environments for both patients and staff as more people require these procedures. The rising number of patients needing treatment makes it necessary to expand and upgrade radiation protection systems, driving the requirement for shielding solutions.

Segment Analysis

Market Assessment by End User

The medical radiation shielding market segmentation, based on end user, includes hospitals, clinics, & ASCs and diagnostic centers. The hospitals, clinics, & ASCs segment is expected to witness significant growth during the forecast period due to the increasing number of diagnostic imaging procedures and radiation therapies being performed in these facilities. More patients are visiting these centers for treatment as cancer rates and chronic diseases are rising, leading to a greater need for radiation protection. Additionally, investments in healthcare infrastructure, especially in developing countries, are supporting the expansion of hospitals and clinics, thereby driving the segmental growth.

Market Evaluation by Solution

The market segmentation, based on solution, includes diagnostic shielding and radiation therapy shielding. The diagnostic shielding segment dominated the medical radiation shielding market share in 2024 driven by the increasing use of imaging technologies such as X-rays, CT scans, and fluoroscopy in both hospitals and diagnostic centers. The need for effective shielding to protect healthcare workers and surrounding areas has become essential as more patients undergo these procedures for early disease detection and routine check-ups. Diagnostic shielding solutions, including lead-lined walls, doors, and glass, help reduce exposure to harmful radiation. The growing focus on patient and staff safety is further driving the segment growth.

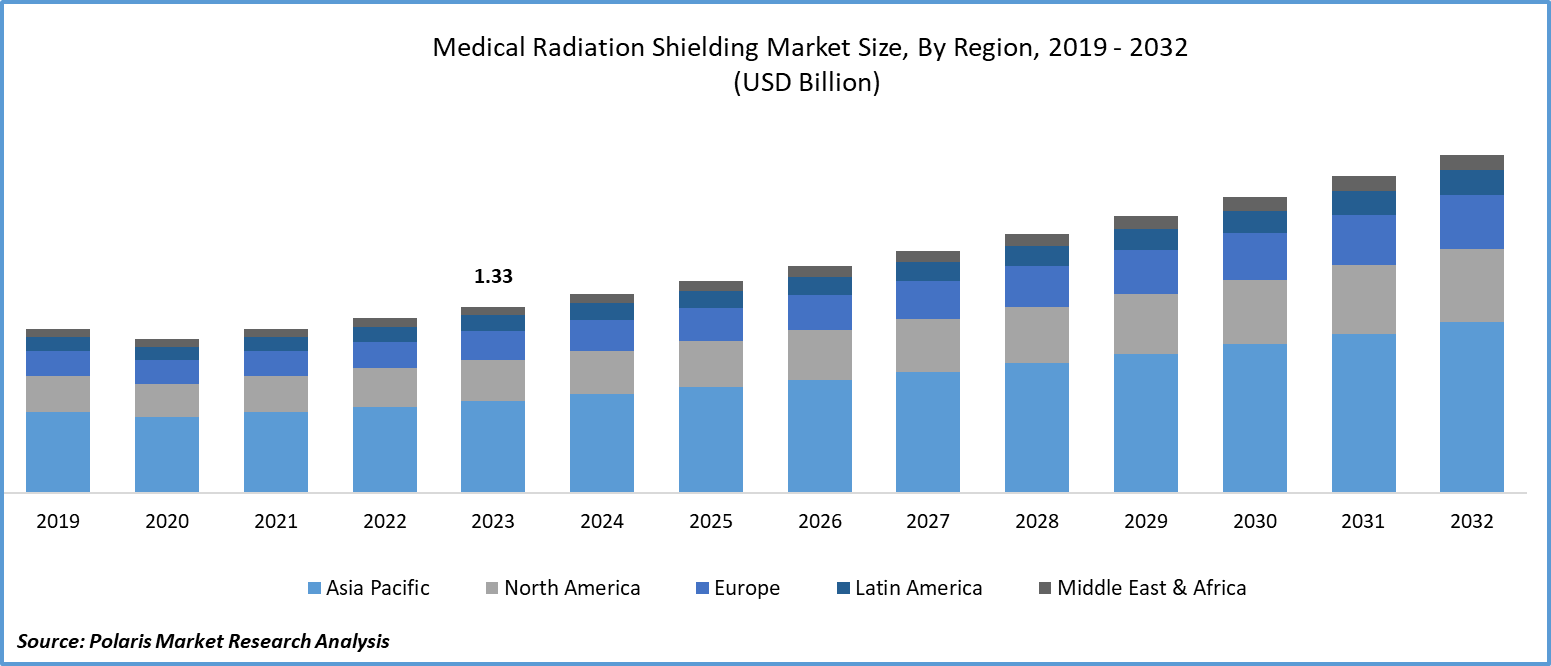

Regional Insights

The study provides the medical radiation shielding market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its advanced healthcare infrastructure and high adoption of diagnostic imaging and radiation therapy. The region has a well-established regulatory framework that enforces strict safety standards, encouraging hospitals and clinics to invest in effective shielding solutions. A high number of cancer cases and routine diagnostic procedures further increase the demand for shielding materials. According to the American Cancer Society, 1,958,310 people in the US were diagnosed with Cancer in 2023, showcasing the high prevalence of Cancer in the region, thereby driving the market growth in the region.

The Asia Pacific market is expected to record the highest CAGR during the forecast period due to rising healthcare investments, improving medical infrastructure, and growing awareness about radiation safety. Countries such as China, Japan, and South Korea are expanding diagnostic and cancer treatment centers to serve their large populations. The demand for radiation shielding is increasing as more hospitals are installing advanced imaging equipment and radiotherapy machines. Additionally, government initiatives to improve healthcare access and quality are further driving the demand for radiation protection equipment, thereby driving the industry expansion in Asia Pacific.

The market in India is growing rapidly, driven by rising cancer rates and an increasing number of imaging and treatment centers. The government’s focus on expanding healthcare access and infrastructure in both urban and rural areas has led to the installation of more diagnostic machines and radiotherapy units. Hospitals are adopting better shielding practices as awareness about radiation exposure and safety is growing among medical professionals. Additionally, the rise of private healthcare providers and medical tourism is boosting demand for modern facilities, further increasing the need for high-quality radiation protection materials across the country.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the industry by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market are A&L Shielding; AliMed; Amray Radiation Protection; Mirion Technologies, Inc.; ESCO Technologies; ETS-Lindgren; Gaven Industries; Globe Composite Solutions; Gravita India; IKEN Engineering; MarShield; Nelco, Inc.; Radiation Protection Products, Inc.; Scanflex Medical; Ultraray; Veritas Medical Solutions; and Von Gahlen.

Mirion Technologies, Inc. is a company specializing in radiation detection, measurement, and medical technologies. Headquartered in Atlanta, Georgia, it operates in multiple countries, including the US, Canada, the UK, France, Germany, Finland, China, Belgium, the Netherlands, Estonia, and Japan. The company employs around 2,800 people and serves industries such as nuclear energy, healthcare, defense, and scientific research. Mirion was formed in 2005 through the consolidation of several firms focused on radiation technology and has since expanded its product range and geographic presence. The company’s activities are divided into two main segments: Medical and Nuclear & Safety. The Medical segment provides products related to radiation therapy and diagnostic imaging. These include dosimetry equipment, patient safety systems, quality assurance tools for imaging and treatment, as well as shielding and handling equipment used in nuclear medicine. This segment primarily serves hospitals, cancer treatment centers, and diagnostic facilities. The Nuclear & Safety segment supplies radiation detection and measurement instruments for nuclear power plants, defense, industrial applications, and research laboratories. Its product range includes personal radiation detectors, area monitors, reactor instrumentation, waste management systems, and laboratory analysis tools such as process spectroscopy instruments. Mirion’s products are used to monitor radiation levels, ensure compliance with safety regulations, and support scientific analysis in environments where ionizing radiation is present. The company’s presence across multiple regions allows it to provide localized sales and service support to its customers.

Radiation Protection Products, Inc. (RPP) is a company that specializes in manufacturing radiation shielding materials and nuclear shielding products. Established in 1952, it operates from its headquarters in Wayzata, Minnesota, with a primary manufacturing facility in Chapel Hill, Tennessee, and a sales office in Mesa, Arizona. RPP provides products to the medical, nuclear, and industrial sectors, focusing on materials that help control radiation exposure. The company's product range includes lead-lined drywall and plywood, radiation-shielded doors, leaded X-ray safety glass, lead-lined door and window frames, lead bricks, and interlocking lead bricks. These products are used in various settings, such as medical imaging rooms, radiation therapy facilities, nuclear power plants, and industrial sites where radiation safety is crucial. RPP's products support applications such as X-ray, CT, PET, and fluoroscopy imaging, as well as linear accelerators and proton therapy in healthcare. They also cater to nuclear storage and research facilities and provide industrial lead products for specialized needs. RPP offers consultation, custom design, and installation services to support complex shielding projects. While primarily based in the US, the company serves clients across the country and provides services for international projects.

List of Key Companies

- A&L Shielding

- AliMed

- Amray Radiation Protection

- ESCO Technologies

- ETS-Lindgren

- Gaven Industries

- Globe Composite Solutions

- Gravita India

- IKEN Engineering

- MarShield

- Mirion Technologies, Inc.

- Nelco, Inc.

- Radiation Protection Products, Inc

- Scanflex Medical

- Ultraray

- Veritas Medical Solutions

- Von Gahlen

Medical Radiation Shielding Industry Developments

In September 2024, Burlington Medical launched BAT, an innovative radiation protection garment for the breast, axilla, and thyroid, to address critical gaps in protection and reduce cancer risks for healthcare workers.

In October 2020, NewSpring Mezzanine announced an investment in Veritas Medical Solutions, supporting the company’s mission to expand access to radiation-shielded treatment facilities for oncology centers and related industries.

Medical Radiation Shielding Market Segmentation

By Product Outlook (Revenue USD Million, 2020–2034)

- MRI Shielding Products

- Lead Lined Glass, Doors & Windows

- Lead Lined Drywalls & Plywood

- Shields, Barriers, Booths

- Lead Sheet

- Lead Bricks

- High-Density Concrete Blocks

- X-ray Rooms

- Lead Curtains & Screens

- Lead Acrylic

By Solution Outlook (Revenue USD Million, 2020–2034)

- Diagnostic Shielding

- Radiation Therapy Shielding

By End Users Outlook (Revenue USD Million, 2020–2034)

- Hospitals, Clinics, & ASCs

- Diagnostic Centers

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Radiation Shielding Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,414.75 million |

|

Market Size Value in 2025 |

USD 1,507.73 million |

|

Revenue Forecast in 2034 |

USD 2,710.21 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,414.75 million in 2024 and is projected to grow to USD 2,710.21 million by 2034.

The global market is projected to record a CAGR of 6.7% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are A&L Shielding; AliMed; Amray Radiation Protection; Mirion Technologies, Inc.; ESCO Technologies; ETS-Lindgren; Gaven Industries; Globe Composite Solutions; Gravita India; IKEN Engineering; MarShield; Nelco, Inc.; Radiation Protection Products, Inc.; Scanflex Medical; Ultraray; Veritas Medical Solutions; and Von Gahlen.

The diagnostic shielding segment dominated the market in 2024, driven by the increasing use of imaging technologies such as X-rays, CT scans, and fluoroscopy in both hospitals and diagnostic centers.

The hospitals, clinics, & ASCs segment is expected to witness significant growth during the forecast period due to the increasing number of diagnostic imaging procedures and radiation therapies being performed in these facilities.