Machine Control System Market Size, Share, Trends, Industry Analysis Report

By Type [Global Navigation Satellite System (GNSS), Sensors, Total Stations, Laser Scanners], By Equipment, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6394

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

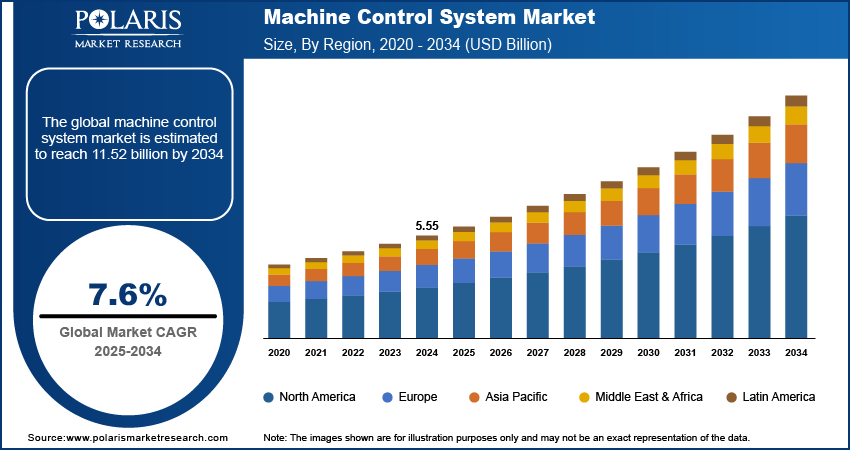

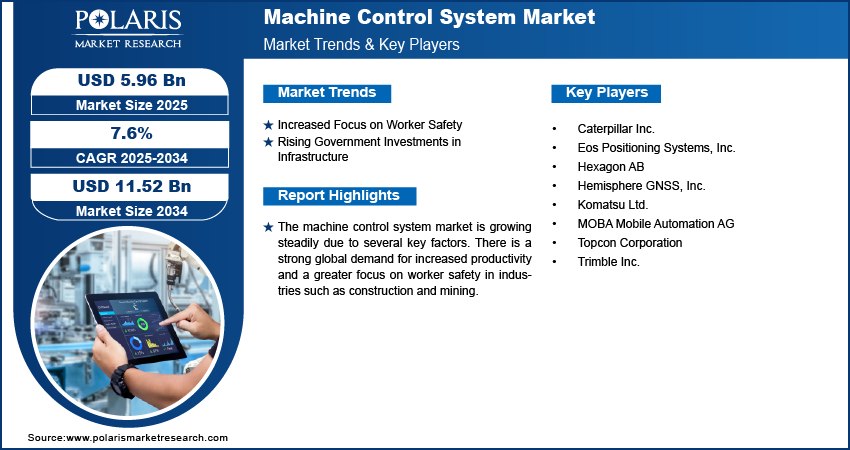

The global machine control system market size was valued at USD 5.55 billion in 2024 and is anticipated to register a CAGR of 7.6% from 2025 to 2034. The growing demand for automation and precision in heavy machinery is a major growth driver. The need to improve work efficiency and reduce project timelines also drives the market demand. Additionally, a greater focus on worker safety and minimizing accidents on job sites is boosting the adoption of these systems.

Key Insights

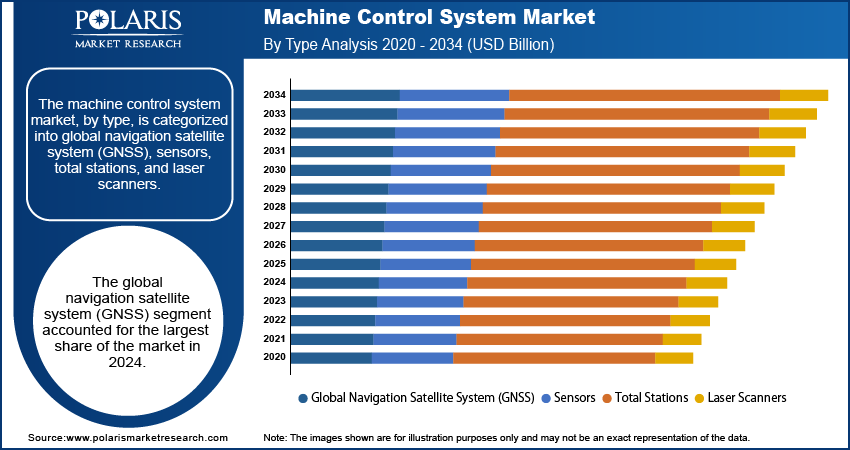

- By type, the global navigation satellite system (GNSS) segment held the largest share in 2024, driven by the increasing adoption of high-precision positioning technologies to enhance construction efficiency and accuracy.

- Based on equipment, the excavators segment held the largest share in 2024, propelled by the rising integration of advanced machine control systems to improve digging accuracy and reduce operational costs.

- In terms of end use, the infrastructure segment dominated the market in 2024, supported by the growing number of large-scale infrastructure development projects and government investments in smart construction technologies.

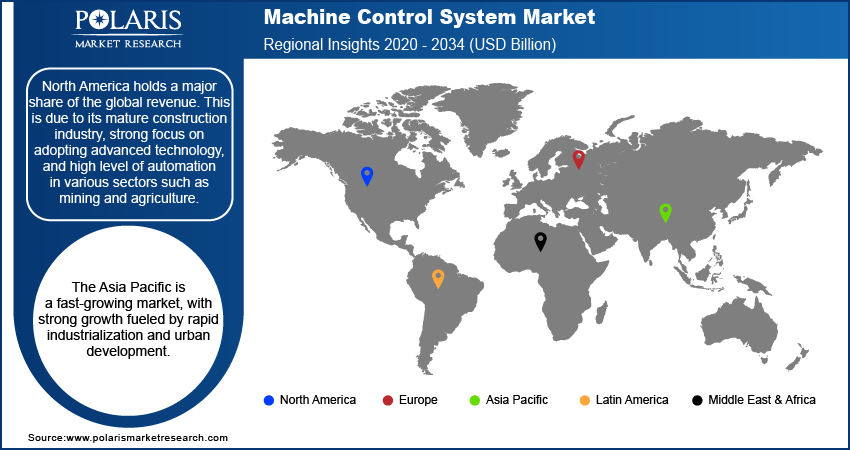

- By region, North America dominated the global revenue share in 2024, fueled by rapid technological advancements, high adoption of automation in construction, and supportive government initiatives.

Industry Dynamics

- The increasing push for higher productivity and faster project completion is a key driver. Companies are using these systems to reduce project timelines and labor costs while ensuring accurate results and less material waste on large-scale projects such as infrastructure development.

- A growing focus on worker safety and preventing accidents is also a major growth factor. These technologies help to automate hazardous tasks, reducing the need for human presence in risky areas on construction and mining sites. This directly leads to fewer injuries and a safer work environment.

- The rising adoption of automation and modern technology in heavy industries is fueling demand. The use of advanced systems such as GNSS and 3D guidance allows for better precision in tasks such as grading, digging, and paving, which is crucial for modern construction and mining projects.

Market Statistics

- 2024 Market Size: USD 5.55 billion

- 2034 Projected Market Size: USD 11.52 billion

- CAGR (2025–2034): 7.6%

- North America: Largest market in 2024

AI Impact on Machine Control System Market

- Artificial intelligence (AI) technology enables terrain analysis, semi-autonomous equipment, and predictive grading, which are standard features in modern control systems.

- AI enables machines to learn from operational data. Using the data, machines can adjust control parameters autonomously. Such use of technology improves efficiency and reduces human intervention.

- AI tools adjust machine operations autonomously using live data, improving energy efficiency, throughput, and product consistency.

- AI systems analyze sensor data to predict equipment failures before they happen. This helps in reducing downtime and maintenance costs.

Machine control systems use technology such as GNSS, lasers, and sensors to automate and guide heavy equipment. These systems allow machinery to operate with a high degree of precision based on a digital design plan, reducing the need for traditional surveying methods and manual guesswork. This leads to more efficient and accurate work on job sites.

One factor influencing the market is the increasing demand for data analytics and real-time site management. These systems collect large amounts of data on machine performance and site progress. This information helps project managers make better decisions about resource allocation, monitor productivity from a distance, and manage complex projects more effectively. The data also provides valuable insights for preventative maintenance.

Another important driver is the growing need to address the shortage of skilled labor. In many regions, there is a lack of experienced operators for heavy machinery. These control systems make it easier for less-experienced workers to operate complex equipment with high accuracy. This can shorten the training time needed and helps companies maintain a high level of work quality even with a smaller pool of skilled workers. The use of this technology also reduces the pressure on experienced workers by handling repetitive tasks, allowing them to focus on more complex operations. For instance, the US Bureau of Labor Statistics has noted a trend of increasing demand for construction managers and a need for new technologies to enhance labor productivity and safety.

Drivers and Trends

Increased Focus on Worker Safety: The growing concern for worker safety and the reduction of on-site accidents is a major driver for the market. Traditional methods of operating heavy machinery such as grinding machinery can be risky due to poor visibility, human error, and the dangerous nature of the work itself. Machine control systems help reduce these risks by providing automated controls and real-time data, which can reduce the number of human-related incidents. This focus on safety is pushing construction and mining companies to invest in new technologies that can better protect their workers.

According to the U.S. Bureau of Labor Statistics' Census of Fatal Occupational Injuries in 2023, the construction sector had the highest number of fatalities among all industries, with 1,075 deaths. The report noted that falls, slips, and trips were the largest cause of these deaths, accounting for nearly 40% of all construction fatalities. This highlights the need for technologies that can reduce the risks of working at heights and in dangerous environments. This strong need for safer workplaces drives the adoption of machine control systems in high-risk industries.

Rising Government Investments in Infrastructure: Major government spending on infrastructure projects worldwide is another key driver for the market. Governments are investing heavily in building new roads, bridges, and other public works. To complete these large-scale projects on time and within budget, contractors need to use the most efficient and precise tools available. Machine control systems play a big part in meeting these demands by making large construction jobs faster and more accurate.

A Congressional Budget Office presentation on Public Spending on Transportation and Water Infrastructure showed that in 2023, federal, state, and local governments spent $626 billion on transportation and water infrastructure. This huge investment requires modern, efficient methods to be successful. As governments continue to fund these large projects, the demand for technology that can improve project speed and accuracy will continue to increase. This push for efficiency and precision on major public projects is driving the growth of the market.

Segmental Insights

Type Analysis

Based on type, the segmentation includes global navigation satellite system (GNSS), sensors, total stations, and laser scanners. The global navigation satellite system (GNSS) segment held the largest share in 2024. GNSS uses satellite signals to provide real-time location data, which is essential for guiding machinery with great accuracy. This technology is used for a wide range of tasks, including grading, digging, and paving on large projects like highways and dams. Its ability to work over wide areas without needing a lot of on-the-ground equipment makes it the preferred choice for many large-scale construction and mining projects. The dominance of GNSS is also a result of its seamless integration with other advanced technologies, which helps improve overall efficiency and reduce waste on job sites.

The laser scanners segment is anticipated to register the highest growth rate during the forecast period. Laser scanners are known for their ability to create detailed 3D maps and models of a work area with high accuracy. This is especially useful for jobs that require detailed measurements and complex designs, such as building renovations or specialized surveys. The rapid growth of this segment is attributed to ongoing technological improvements, which have made these systems more precise and easier to use. As a result, they are being used in more fields beyond their traditional uses. Their ability to quickly gather a lot of data makes them valuable for quality checks and monitoring progress, which is helping them grow in popularity.

Equipment Analysis

Based on equipment, the segmentation includes excavators, loaders, graders, dozers, scrapers, and paving systems. The excavators segment held the largest share in 2024. These machines are essential for digging, trenching, demolition, and material handling across many different projects, from residential buildings to large-scale infrastructure. Machine control systems for excavators help automate and guide the bucket's movement with a high degree of accuracy. This allows operators to dig to precise depths and angles, reducing the need for manual checks and survey crews. The ability of these systems to improve efficiency, lessen rework, and lower costs on a machine that is so central to most projects has made it the leading choice for companies. The versatility and constant use of excavators across the modular construction, mining, and utility sectors ensure that this segment remains a significant part of the market.

The graders segment is anticipated to register the highest growth rate during the forecast period. Graders are vital for the final stages of a project, where they create smooth, level surfaces for roads, airfields, and building foundations. The increasing demand for perfectly graded surfaces and the rising complexity of design plans are driving the fast adoption of machine control systems for these machines. These systems, often using a combination of lasers and GNSS, allow graders to achieve a perfect grade in fewer passes, which saves a lot of time, fuel, and money. As infrastructure development continues to be a global focus, the need for precise grading technology becomes more important, directly fueling the rapid growth in this segment.

End Use Analysis

Based on end use, the segmentation includes infrastructure, commercial, residential, and industrial. The infrastructure segment held the largest share in 2024. This includes building new roads, highways, bridges, dams, airports, and public utilities. These large-scale projects have a strong need for the precision and efficiency that machine control systems provide. By using these systems, contractors can handle complex earthmoving and grading tasks with high accuracy, which helps them meet tight deadlines and control costs. The extensive government funding and long-term nature of infrastructure development worldwide ensure a consistent demand for these technologies. This strong, ongoing need for efficient project execution on a massive scale makes infrastructure the most dominant end-use sector.

The residential segment is anticipated to register the highest growth rate during the forecast period. As populations grow, especially in urban areas, there is a constant need for new housing developments, which drives a lot of residential construction activity. While these projects are often smaller than infrastructure or commercial ones, the increasing use of machine control systems in this sector is a major reason for its rapid growth. These systems help home builders improve productivity and reduce manual labor on tasks such as site preparation, foundation work, and landscaping. The growing awareness among smaller contractors about the benefits of using this technology to save time and lower costs propels its adoption, making residential construction a fast-growing area.

Regional Analysis

The North America machine control system market accounted for the largest share in 2024, driven by a strong focus on advanced technology and a mature construction industry. The region has been quick to adopt machine control systems to improve work quality and safety on various projects. The high level of automation in the construction equipment, mining, and agriculture sectors also supports the ongoing demand for these technologies. Additionally, the region benefits from a large number of key companies that are constantly innovating and releasing new products.

U.S. Machine Control System Market Insights

In North America, the U.S. holds a major share. The country has a very active and well-established construction industry that relies heavily on advanced solutions for tasks such as grading, digging, and paving. Government initiatives and large investments in infrastructure projects are also a big part of the country's growth. The need for precise and efficient work on highways, bridges, and other public projects makes the use of these systems very important for meeting strict timelines and safety standards.

Europe Machine Control System Market Trends

The industry in Europe is well-developed, with a strong emphasis on modernizing its construction and industrial sectors. The region has a high standard for quality and safety, which encourages the use of technology that can reduce errors and improve worker protection. A number of large-scale infrastructure and residential projects are also driving the growth. Countries across the region are focusing on digital transformation, and the adoption of these systems is a key part of that effort to make operations more efficient.

The Germany machine control system market led revenue share in Europe in 2024. This dominance is attributed to its strong economy and large manufacturing sector, creating a high demand for these systems. Its focus on using new technology and its well-established construction sector make it a significant contributor to the region. The country's ongoing efforts to build new housing and update its public works are also providing a boost to the adoption of these systems.

Asia Pacific Machine Control System Market Overview

Asia Pacific is the fastest-growing regional market, with strong growth fueled by rapid industrialization and urban development. Countries in this region are investing heavily in new infrastructure and smart city projects, which are creating a huge demand for advanced construction equipment. The push for automation to increase productivity and meet the needs of a growing population is also a major factor. As technology becomes more affordable and available, more companies are starting to use these systems to improve their operations.

China Machine Control System Market Outlook

China holds a major share in the industry in Asia Pacific as it has a huge and active construction sector. The country's government has been making massive investments in infrastructure development, including high-speed rail, new airports, and smart cities. These large projects require the highest levels of precision and efficiency. As a result, the use of machine control systems is becoming more and more common across the country's construction and mining industries.

Key Players and Competitive Insights

The competitive landscape is made up of both large, well-known companies and smaller, specialized firms. Major players such as Trimble, Hexagon (Leica Geosystems AG), Topcon Corporation, MOBA Mobile Automation AG, and Caterpillar Inc. hold a significant share due to their strong global presence, broad product offerings, and brand recognition. These companies often offer a full range of products, from hardware such as GNSS receivers and sensors to the software that manages project data. The competition is mainly based on product innovation, partnerships with equipment manufacturers, and providing strong customer support and service.

A few prominent companies in the industry include Trimble Inc., Hexagon AB, Topcon Corporation, MOBA Mobile Automation AG, and Hemisphere GNSS, Inc. Other important players include Caterpillar Inc., Komatsu Ltd., and Eos Positioning Systems, Inc.

Key Players

- Caterpillar Inc.

- Eos Positioning Systems, Inc.

- Hexagon AB

- Hemisphere GNSS, Inc.

- Komatsu Ltd.

- MOBA Mobile Automation AG

- Topcon Corporation

- Trimble Inc.

Machine Control System Industry Developments

April 2025: Hexagon completed its acquisition of the Geomagic software business from 3D Systems Corporation. This move adds new reverse engineering and inspection software to Hexagon's portfolio, which can be used with a wide range of 3D scanning devices.

April 2025: Trimble launched new API capabilities for its Accubid Anywhere estimating application. This addition helps streamline design collaboration and improve efficiency for contractors by allowing them to work more smoothly across different software platforms.

Machine Control System Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Global Navigation Satellite System (GNSS)

- Sensors

- Total Stations

- Laser Scanners

By Equipment Outlook (Revenue – USD Billion, 2020–2034)

- Excavators

- Loaders

- Graders

- Dozers

- Scrapers

- Paving Systems

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Infrastructure

- Commercial

- Residential

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Machine Control System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.55 billion |

|

Market Size in 2025 |

USD 5.96 billion |

|

Revenue Forecast by 2034 |

USD 11.52 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.55 billion in 2024 and is projected to grow to USD 11.52 billion by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

North America dominated the share in 2024.

A few key players include Trimble Inc., Hexagon AB, Topcon Corporation, MOBA Mobile Automation AG, and Hemisphere GNSS, Inc. Other important players include Caterpillar Inc., Komatsu Ltd., and Eos Positioning Systems, Inc.

The global navigation satellite system (GNSS) segment accounted for the largest share of the market in 2024.

The graders segment is expected to witness the fastest growth during the forecast period.