GNSS Simulators Market Share, Size, Trends, Industry Analysis Report

By Component; By Type (Single Channel & Multi-Channel); By Receiver; By Application; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2741

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

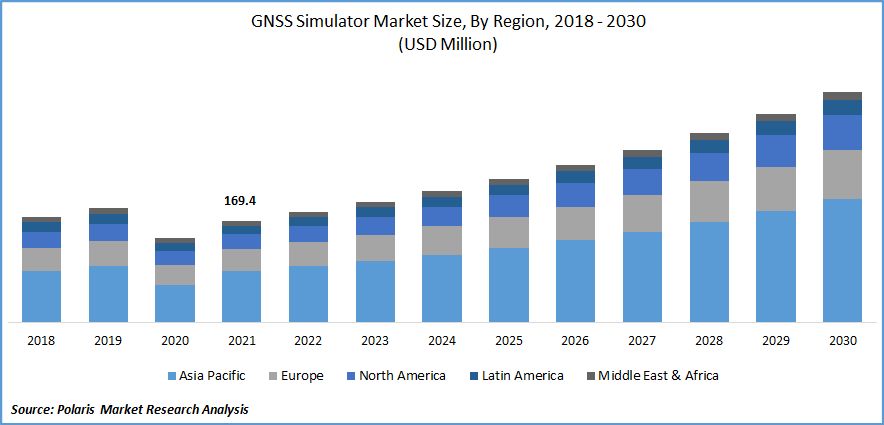

The global navigation satellite system (GNSS) simulators market was valued at USD 169.4 million in 2021 and is expected to grow at a CAGR of 9.6% during the forecast period. The growing demand for GNSS simulators is expected to be driven by rapid digitization, increased use of 5G connectivity, and rising demand from the military and defense sectors.

Know more about this report: Request for sample pages

GNSS simulators are replacing conventional simulators owing to their better accuracy, speed, and ease of handling. These simulators have huge applications in the aerospace, marine, and military& defense sector. In addition, the simulators are helpful in guiding weapons to a particular target in the military industry. Furthermore, GNSS is used in vehicles, aircraft, and naval ships for navigation and tracking the accurate position, which is expected to drive market growth.

The COVID-19 pandemic had a negative impact on the growth of the market. The lack of raw materials to produce GNSS chips resulted in the delay of production processes owing to the global lockdown. In addition, stringent government norms have setback the transportation units, disrupting the supply chain. Moreover, many marine and aerospace operations were standstill which hampered market growth.

The upgradation of conventional simulators to GNSS simulators requires a large space network station which is quite expensive that is one of the major restraining factors to hamper the market growth. Moreover, many low-income developing nations face a lack of digital infrastructure, halting market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The GNSS simulators market industry is likely to be driven by emerging innovative and advanced IoT devices. The growing adoption of IoT-based electronics like tablets, cameras, smartphones, and smartwatches is expected to drive market growth. Moreover, emerging technologies such as 5G, artificial intelligence, and smart automation require these simulators, which boosts market growth.

GNSS simulators are used in automotive, aviation, and military industries to test their devices in realistic conditions. So many key players are developing simulators according to the requirement of the end-use applications. For instance, Spirent’s GSS7000 GNSS simulator is integrated with MVGs over the air to deliver output that imitates real-world situations.

Report Segmentation

The market is primarily segmented based on component, type, receiver, application, vertical, and region.

|

By Component |

By Type |

By Receiver |

By Application |

By Vertical |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Services segment accounted for the largest share in 2021

The services segment accounted for the highest revenue share in 2021, owing to the rising adoption of GNSS simulators across end-use industries to monitor and fix simulation-related issues.

These simulators are also used in creating location-tracking systems such as drones, handsets, or smartwatches. They enable testing using all current and future signals and can incorporate the significant edge cases unpredictable in the real world. For example, several industries use CubeSats for communications and data services, many of which include GPS/GNSS receivers for orbit determination and timing.

In addition, the growing need to maintain and upgrade the conventional GNSS software and services with an updated version are some factors driving the segment growth.

Single channel is expected to grow at the highest CAGR

The demand for the single channel is rising due to its accuracy in tracking general locations within the confined area. In addition, this type of channel is used for pinpointing dots on a map and finding the location of the constellation between 2-4 meters or more.

It is also known as a signal generator. Such a kind of simulator can usually control a signal’s Doppler profile in a very handy way when tuning up receiver tracking loops. This type of simulator is widely used in R&D tests.

GPS is expected to witness faster growth over the forecast period

Global positioning system (GPS) is expected to significantly surge over the forecast period as it provides accurate positioning, navigation, and timing (PNT) services. In addition, GPS constellations are used with GNSS- compatible equipment to provide accurate location and time. These receivers are usually under the control of the US air force to maintain and operate its space and control segment. They are now used in many commercial devices, such as smartphones and navigators, and are expected to propel market growth.

Moreover, GPS offers a point of contact to ensure the telecommunication satellite orbits are stable, which is increasing its adoption in GNSS to track assets and work efficiently; such factors are supporting segment growth.

Vehicle assistance system is expected to lead the market

The growing adoption of GNSS in an autonomous vehicle to reduce traffic congestion, improve energy efficiency and encourage car sharing is expected to spur the vehicle assistance system segment over the forecast period. In addition, satellite-based positioning is essential for vehicle assistance and autonomous driving as it assists the location and distance from the vehicle to vehicle and vehicle to infrastructure (V2X), which are fulfilled by GPS and inertial measurement unit (IMU).

Moreover, GNSS offers a standard reference frame for the vehicles to connect with each other and the outside world using a consistent and reliable language to broadcast their locations which is an important factor in driving the segment growth.

Consumer electronics is expected to account for the largest share in 2030

The consumer electronics segment is expected to dominate the market over the forecast period owing to the rising consumer shift towards wireless and Bluetooth-equipped devices and applications such as wearables, smartphones, and growing IoT electronics. In addition, new-generation smartphones and wearables are equipped with high-performance GNSS chips to retrieve data and provide exact PNT information.

Consumer devices are increasingly expected to know their location. The growing sensor fusion technology in consumer applications brings a new challenge to everyone integrating a GNSS chipset.

Moreover, GNSS technology has created a lucrative opportunity for manufacturers to design thinner and lighter products to keep up with the competitive market, which is expected to drive segment growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

Asia Pacific is the largest region for GNSS simulators. It is expected to witness faster growth over the forecast period owing to rapid digitization and growing consumer interest in IoT devices and appliances. The automotive & consumer electronics sectors are expected to adopt GNSS simulators at the highest growth rate in the region. In addition, the vast use of beidou system in China fuels regional growth.

In addition, growing government investment in developing a digital solution and wide application of GNSS simulators in automotive, marine, aerospace, and military & defense is anticipated to bolster the market over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Accord Software & Systems Private Limited, Averna, CAST Navigation, Digilogic, Elkay, GMV NSL, Hexagon, Hyper Tech, IFEN GmbH, Ip-Solutions, Jackson Labs Technologies, Keysight Technologies, M3 Systems, Maxeye Technologies, NOFFZ Technologies, Orolia, Qascom, RACELOGIC, Rohde & Schwarz GmbH & Co.KG, Saluki Technologies, Spirent Communications, Syntony GNSS, Teleorbit, Tersus GNSS, u-blox, VIAVI Solutions, and Work Microwave.

Recent Developments

In July 2022, u-blox partnered with position partners to expand their global navigation satellite system (GNSS) augmentation in Australia and New Zealand and offer global coverage to their customers.

In January 2022, the Hexagon autonomy & positioning division partnered with Dayou to bring TerraStarX technology to provide fast, precise point positioning (PPP) correction. This GNSS correction generated from TerraStarX technology delivers correction in autonomous vehicles and mass-market.

GNSS Simulators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 184.2 million |

|

Revenue forecast in 2030 |

USD 383.6 million |

|

CAGR |

9.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Components, By Type, By Receiver, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Accord Software & Systems Private Limited, Averna, CAST Navigation, Digilogic, Eikay, GMV NSL, Hexagon, Hyper Tech, IFEN GmbH, Ip-Solutions, Jackson Labs Technologies, Keysight Technologies, M3 Systems, Maxeye Technologies, NOFFZ Technologies, Orolia, Qascom, RACELOGIC, Rohde & Schwarz GmbH & Co.KG, Saluki Technologies, Spirent Communications, Syntony GNSS, Teleorbit, Tersus GNSS, U-Blox, VIAVI Solutions, and Work Microwave. |