Grinding Machinery Market Size, Share, & Industry Analysis Report

: By Type, By Application (Automotive, Aerospace, Medical, Construction, Industrial Manufacturing, Electrical and Electronics, Marine, and Others), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5693

- Base Year: 2024

- Historical Data: 2020-2023

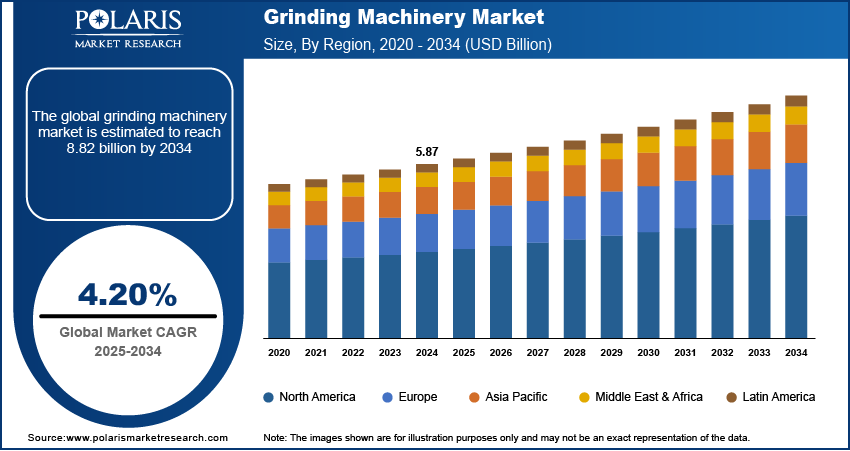

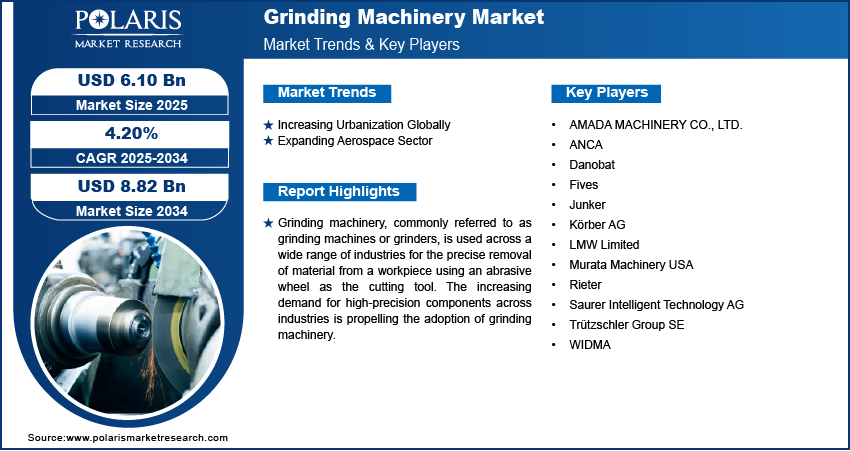

The global grinding machinery market size was valued at USD 5.87 billion in 2024. It is expected to register a CAGR of 4.20% during 2025–2034. The increasing demand for high-precision components across industries, driven by advancements in technology and stricter quality standards, is propelling the adoption of grinding machinery.

Market Overview

Grinding machinery, commonly referred to as grinding machines or grinders, is used across a wide range of industries for the precise removal of material from a workpiece using an abrasive wheel as the cutting tool. Each grain of abrasive on the wheel acts as a microscopic cutting edge, shearing away tiny chips from the surface of the workpiece through a process known as abrasive grinding. The core function of grinding machines is to achieve high surface quality, dimensional accuracy, and the desired shape or finish on metal, ceramics, wood, and even composite materials. These machines are powered primarily by electric motors.

There are several types of grinding machines, each designed for specific applications and levels of precision. Common types include surface grinders, which are used to produce flat surfaces; cylindrical grinders for external and internal cylindrical surfaces; centerless grinders for machining small cylindrical parts; tool and cutter grinders for sharpening and manufacturing cutting tools; and specialized machines such as gear and thread grinders for intricate finishing tasks.

The rising production of automobiles worldwide is propelling the grinding machinery market growth. Grinding machinery plays a critical role in manufacturing automotive engine parts, transmission systems, brake components, and electric drive units, all of which demand tight tolerances and smooth surface finishes to ensure performance and durability. The rising adoption of lightweight materials in automobile manufacturing, such as aluminum alloys and composites, is further necessitating the use of advanced grinding machinery capable of handling complex geometries. European Automobile Manufacturers Association, in its report, stated that 85.4 million motor vehicles were produced across the world in 2022, an increase of 5.7% compared to 2021. Therefore, the demand for grinding machinery is increasing with the rising production of automobiles worldwide.

The demand for grinding machinery is driven by the rising industrialization in emerging nations such as India, Brazil, and others. Rapid industrialization in these nations is driving manufacturing companies to invest in advanced grinding equipment to increase production capacity, improve product quality, and reduce operational costs. Industries such as metalworking, machinery, construction, and electronics rely on grinding tools to shape, finish, and refine components with high accuracy. The growth of small and medium-sized enterprises also fuels demand for grinding machines, as these businesses seek to modernize their operations and compete in global markets. Thus, with expanding industrialization in emerging nations, companies are prioritizing automation and process optimization, further increasing the adoption of high-performance grinding machinery that supports continuous, high-volume production. For instance, according to the Economic Survey 2023-24, presented by the Union Minister of Finance and Corporate Affairs of India, Smt. Nirmala Sitharaman, India witnessed 9.5 percent industrial growth in 2023-24.

Market Dynamics

Increasing Urbanization Globally

Urbanization is leading to an increase in construction projects, such as skyscrapers, roads, and bridges, that require grinding machines for concrete polishing, surface leveling, and stone processing to ensure durability and aesthetic finishes. The growing demand for residential and commercial spaces, owing to urbanization, is further fueling the use of grinding equipment in flooring, tile production, and façade finishing. Additionally, urban growth drives demand for grinding machines in sectors such as electrical equipment, appliances, and transportation, where high-quality, durable components are essential. The World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Hence, as urbanization increases globally, the demand for grinding machines also spurs.

Expanding Aerospace Sector

Aircraft manufacturers rely on grinding processes and machinery to produce critical parts such as turbine blades, landing gear, engine components, and structural assemblies with exacting tolerances and superior surface finishes. Aerospace suppliers are further investing in grinding equipment to maintain quality, reduce material waste, and streamline complex machining operations. Therefore, as the aerospace sector expands due to the growing production of aircraft to meet the growing population, the demand for grinding machinery increases.

Segment Insights

Market Assessment by Type

Based on type, the grinding machinery market is divided into non-precision grinder and precision grinder. The precision grinder segment accounted for a larger share in 2024 due to the rising demand for high-accuracy machining across key industries such as automotive, aerospace, and medical device manufacturing. Manufacturers increasingly adopted precision grinding equipment to meet sophisticated tolerance requirements and ensure superior surface finishes in components. The growing trend of automation and the integration of advanced CNC technologies further enhanced the appeal of precision systems, enabling greater process consistency, reduced cycle times, and lower operational errors. Additionally, the push toward lightweight, high-strength materials in manufacturing applications necessitated the use of a precision grinder capable of handling complex geometries with exceptional precision.

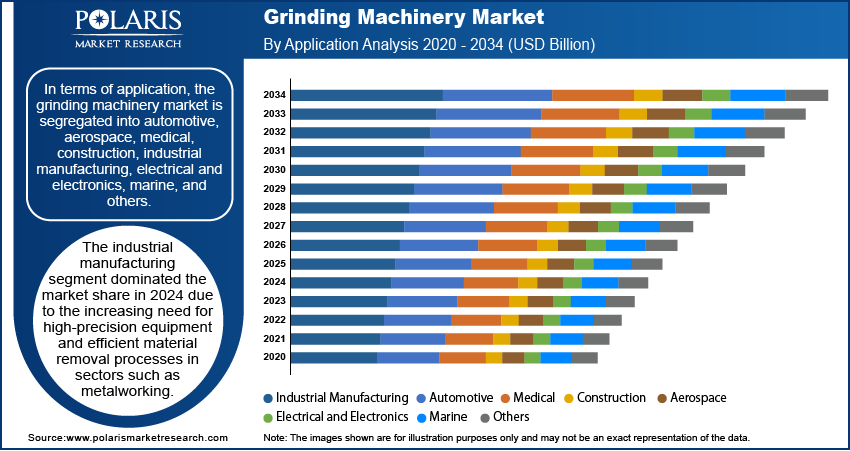

Market Evaluation by Application

In terms of application, the market is segregated into automotive, aerospace, medical, construction, industrial manufacturing, electrical and electronics, marine, and others. The industrial manufacturing segment dominated the grinding machinery market share in 2024 due to the increasing need for high-precision equipment and efficient material removal processes in sectors such as metalworking, tool and die making, and heavy machinery. Manufacturers across these industries prioritized advanced grinding solutions to enhance productivity, ensure dimensional accuracy, and reduce production downtime. The expansion of automated manufacturing facilities and the growing adoption of Industry 4.0 technologies played a crucial role in driving demand. Additionally, the rising consumption of fabricated metal products and the global push for improved manufacturing throughput supported sustained investments in grinding systems tailored for industrial operations.

The automotive segment is expected to grow at a robust pace in the coming years, owing to the rising complexity of vehicle components and the accelerating shift toward electric vehicles. OEMs and Tier 1 suppliers increasingly rely on advanced grinding solutions to achieve the efficiency required for EV motors, battery systems, and transmission assemblies. The need for efficient, repeatable processes to manufacture lightweight, high-strength parts is propelling demand for grinding machinery in automotive applications. In addition, regulatory pressures to improve fuel efficiency and reduce emissions have pushed automakers to adopt technologies and machinery that support precision finishing and material conservation, fueling demand for grinding machinery.

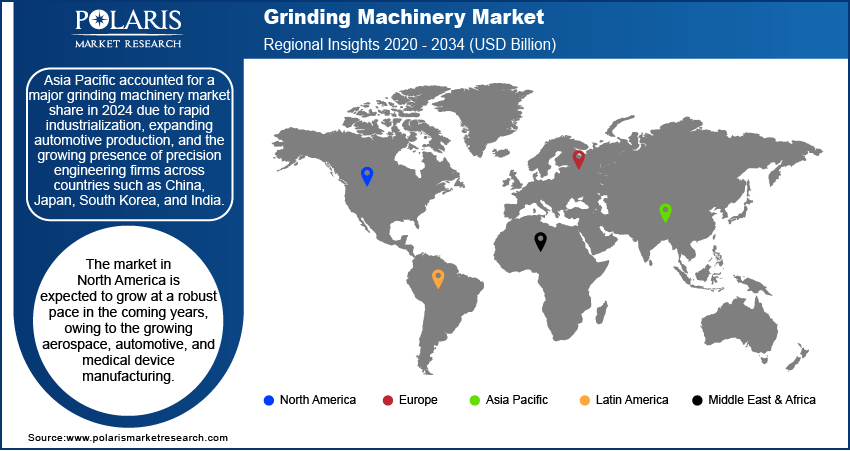

Regional Analysis

By region, the market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest share in 2024 due to rapid industrialization, expanding automotive production, and the growing presence of precision engineering firms across countries such as China, Japan, South Korea, and India. China dominated the Asia Pacific grinding machinery market, benefiting from its robust manufacturing base, extensive metalworking sector, and significant investments in smart factory initiatives. The country’s emphasis on enhancing domestic production capabilities and reducing dependence on imports led to increased adoption of grinding machinery. Additionally, government-backed infrastructure projects and supportive industrial policies in India accelerated demand for grinding machinery across various industries, including construction equipment, heavy machinery, and consumer electronics.

The North America grinding machinery market is expected to grow at a robust pace in the coming years, owing to the growing aerospace, automotive, and medical device manufacturing industries. Companies in the region are heavily investing in automation, digital manufacturing, and high-precision grinding machining tools to stay competitive in a global market. Moreover, reshoring initiatives and rising labor costs in the region are prompting manufacturers to modernize domestic production facilities, thereby driving grinding machinery sales. The growing focus on sustainable manufacturing practices and stricter quality control standards is contributing to the region’s rising adoption of next-generation grinding technologies and machinery.

The Europe grinding machinery market is rapidly growing due to the strong presence of the automotive and aerospace industries, particularly in countries such as Germany, the UK, France, and Italy. These sectors demand high-precision components, for which advanced grinding technologies are essential to achieve tight tolerances, smooth surface finishes, and complex geometries. Moreover, the rise in automation and Industry 4.0 initiatives across the German manufacturing environment is accelerating the adoption of CNC (computer numerical control) grinding machines.

Key Players and Competitive Analysis

The grinding machinery industry is highly competitive, characterized by strategic mergers and acquisitions, and collaborations as key players strive to strengthen their positions. Major companies are actively expanding their global footprint through partnerships and investments in advanced technologies to enhance efficiency and precision in grinding applications. Strategic mergers and acquisitions have become a common approach for firms to consolidate market share, diversify product portfolios, and gain access to new customer bases. Collaboration with technology providers and research institutions is also on the rise, enabling companies to innovate and develop high-performance, automated grinding systems. Expansion into emerging economies remains a priority, with manufacturers establishing production facilities and distribution networks to capitalize on growing industrial demand. The competitive landscape is further shaped by continuous advancements in grinding machinery, with companies focusing on sustainability, energy efficiency, and digitalization to meet evolving industry standards.

The grinding machinery industry is fragmented, with the presence of numerous global and regional players. A few major players are AMADA MACHINERY CO., LTD.; ANCA; Danobat; Fives; Junker; Körber AG; LMW Limited; Murata Machinery; Rieter; Saurer Intelligent Technology AG; and Trützschler Group SE.

AMADA MACHINERY CO., LTD. is a major Japanese manufacturer specializing in industrial cutting and grinding machines, recognized for its continuous innovation and commitment to quality. AMADA MACHINERY CO., LTD., under AMADA Group, operates in over 100 countries. The company plays a pivotal role in the metal cutting and grinding sectors, offering comprehensive solutions from development to sales and after-sales service. It provides a broad lineup of high-precision equipment designed for both surface and profile grinding applications. The product range of AMADA MACHINERY includes advanced CNC surface grinders, optical profile grinders, and flat rotary table grinding machines, each engineered to deliver exceptional accuracy and surface finish.

Körber AG is a prominent international technology group headquartered in Hamburg, Germany, employing over 12,000 people at more than 100 locations worldwide. The company operates as a strategic management holding, overseeing four key business areas: Digital, Pharma, Supply Chain, and Technologies. Körber is recognized for its entrepreneurial approach, focusing on technological leadership and innovation to deliver customer-centric solutions across diverse industrial sectors, including machinery manufacturing, logistics, and pharmaceuticals.

List of Key Companies in Grinding Machinery Market

- AMADA MACHINERY CO., LTD.

- ANCA

- Danobat

- Fives

- Junker

- Körber AG

- LMW Limited

- Murata Machinery

- Rieter

- Saurer Intelligent Technology AG

- Trützschler Group SE

- WIDMA

Grinding Machinery Industry Developments

October 2024: Nidec Machine Tool Corporation, a Nidec Group company, announced that it has added ZI25A, an internal gear grinding machine, to its product lineup.

May 2024: WIDMA showcased a range of advanced machining solutions at the Pune Machine Tool Expo (PMTX) 2024, including a newly introduced next-gen horizontal machining center, MacHX800, and blank profile grinding solution, BPG 15.

December 2022: Sabar, a next-generation manufacturer and exporter of spinning roll shop machinery, announced to launch fully automated cot grinding machine at India ITME 2022.

Grinding Machinery Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Non-precision Grinder

- Bench Grinder

- Portable Grinder

- Pedestal Grinder

- Flexible Grinder

- Precision Grinder

- Cylindrical Grinding Machines

- Surface Grinding Machines

- Centre-Less Grinding Machines

- Tool and Cutter Grinding Machines

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace

- Medical

- Construction

- Industrial Manufacturing

- Electrical and Electronics

- Marine

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Grinding Machinery Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.87 billion |

|

Market Size Value in 2025 |

USD 6.10 billion |

|

Revenue Forecast by 2034 |

USD 8.82 billion |

|

CAGR |

4.20% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.87 billion in 2024 and is projected to grow to USD 8.82 billion by 2034.

The global market is projected to register a CAGR of 4.20% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are AMADA MACHINERY CO., LTD.; ANCA; Danobat; Fives; Junker; Körber AG; LMW Limited; Murata Machinery USA; Rieter; Saurer Intelligent Technology AG; and Trützschler Group SE.

The precision grinder segment dominated market revenue in 2024.

The automotive segment is expected to grow at the fastest pace in the coming years.