Construction Equipment Market Share, Size, Trends, & Industry Analysis Report

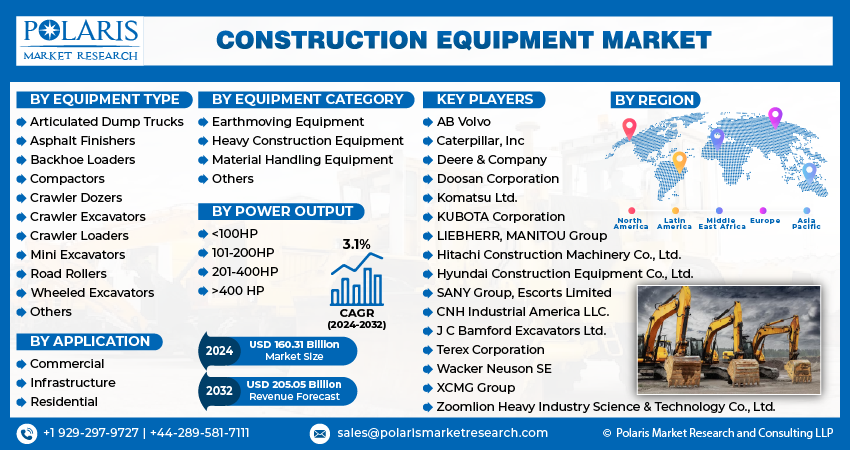

By Power Output (<100HP, 101-200HP, 201-400HP, >400 HP); By Equipment Type; By Equipment Category; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jul-2025

- Pages: 127

- Format: PDF

- Report ID: PM4538

- Base Year: 2024

- Historical Data: 2020-2023

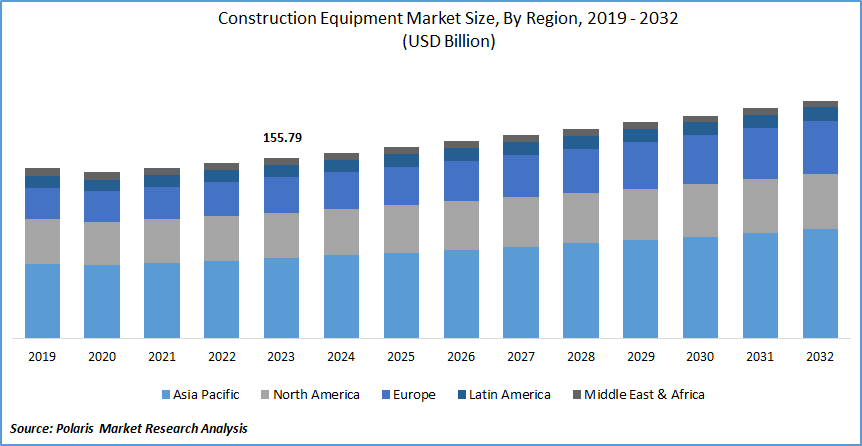

The global construction equipment market size was valued at USD 224.56 billion in 2024, exhibiting a CAGR of 8.50% during 2025–2034. The market is driven by increasing infrastructure investments, urbanization across emerging economies, and technological advancements in machinery and automation.

Industry Trends

Construction equipment refers to the machinery, tools, and vehicles used in the construction industry for various purposes, such as excavation, lifting, loading, hauling, paving, drilling, and compacting. These equipment are designed to perform specific tasks efficiently and safely and are essential for completing construction projects on time and within budget.

The global construction equipment market is expected to experience significant growth in the forecast period, driven by increasing infrastructure development projects, rising demand for advanced machinery, and growing investments in renewable energy projects. The market is also expected to be fueled by the increasing market trends of automation and technological advancements in construction equipment, which will improve efficiency and productivity in construction activities. The surge in government expenditure on infrastructure development has led to a significant increase in construction activities across developing countries. In particular, India is prioritizing the improvement of its road infrastructure to facilitate seamless transportation of resources.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces the construction equipment market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

To Understand More About this Research: Request a Free Sample Report

- For instance, the Indian Minister of Road Transport and Highways announced in June 2022 the inauguration of 15 new national highway projects in Patna Hajipur and Bihar. The total cost of these projects is around USD 1.7 billion.

The rising demand for material handling and road construction equipment, such as pavers, forklifts, dozers, etc., is a result of this increased road construction activity. Moreover, the integration of technology with construction equipment is likely to boost market growth in the coming years. Original equipment manufacturers (OEMs) are leveraging this opportunity to introduce new products and expand their customer base in the market.

Key Takeaways

- Asia Pacific dominated the market and contributed over 43.3% of the industry share in 2024

- By equipment category, the material handling equipment segment held the largest construction equipment market share in 2024

- By power output category, the <100HP segment dominated the global market for construction equipment in terms of construction equipment market size

- By application category, the infrastructure segment is expected to grow with a significant CAGR over the market forecast period

What are the market drivers driving the demand for the Construction Equipment market?

The rise in demand of equipment for developmental projects drives construction equipment market growth.

As governments and private organizations invest in various development projects, such as infrastructure development, transportation networks, and real estate projects, there is a growing need for heavy-duty construction equipment to facilitate these projects, which subsequently drives market growth. This includes equipment such as excavators, cranes, bulldozers, and concrete mixers, among others. The increasing demand for this equipment is driven by the need for efficiency, speed, and quality in project execution, as well as the desire to minimize construction timelines and costs.

Also, the growing market trends of smart city initiatives and greenfield development create a heightened demand for advanced construction equipment that can deliver precision and efficiency in project execution. Thus, the surge in demand for construction equipment is expected to continue in the forthcoming years, driven by the increasing number of developmental projects and the need for modernization and expansion of existing infrastructure.

Which factor is restraining the demand for Construction Equipment?

The high maintenance cost hampers the construction equipment market growth.

Construction equipment requires frequent maintenance and repairs to ensure proper functioning, which results in substantial costs for equipment owners and operators. This includes not only the cost of replacement parts but also labor expenses for skilled technicians who are needed to perform maintenance tasks. In addition, hold-on time while equipment is being serviced or repaired leads to a loss of productivity and revenue for contractors, further increasing overall costs. Also, many firms may opt to continue using older machines to reduce operation costs, even if they are less efficient or reliable than newer models. This decision limits the adoption of advanced technology and innovative solutions that could otherwise improve efficiency and profitability across the industry.

Report Segmentation

The market is primarily segmented based on equipment type, equipment category, power output, application, and region.

|

By Equipment Type |

By Equipment Category |

By Power Output |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Equipment Category Insights

Based on equipment category analysis, the market has been segmented based on earthmoving equipment, heavy construction equipment, material handling equipment, and others. The material handling equipment segment dominated the global construction equipment market due to its versatility and wide range of applications on job sites. Material handling equipment includes cranes, excavators, telehandlers, and forklifts, which are essential for lifting, moving, and placing heavy materials such as steel beams, concrete slabs, and heavy machinery. These machines enable contractors to work efficiently and safely, reducing manual labor and increasing productivity.

In addition, advancements in technology have made material handling equipment more efficient, reliable, and cost-effective, further driving demand for these machines. The growth in infrastructure development, residential and non-residential construction projects, and industrial activities also contribute to the high demand for material handling equipment, making it the largest segment in the market.

By Power Output Insights

Based on power output category analysis, the market has been segmented based on <100HP, 101-200HP, 201-400HP, and >400 HP. The market for small construction equipment with <100HP, such as mini-excavators, compact wheel loaders, skid steer loaders, and compact track loaders, dominated the industry in terms of market size in 2023 due to its versatility and maneuverability. The demand for these machines is expected to increase even further in emerging economies like Asia Pacific, Latin America, and Africa due to infrastructure development, urbanization, and small-scale construction projects. Technological advancements, including improved operator comfort, powertrain efficiency, and automation, also drive the segment's growth. As a result, cost-effective, compact, and versatile machinery is becoming increasingly popular in the construction industry.

By Application Insights

Based on application analysis, the market has been segmented based on commercial, infrastructure, and residential. The infrastructure application segment, which includes construction equipment, is expected to experience significant market growth in the forecast period due to increasing investments in infrastructure development projects such as roads, highways, bridges, and buildings. Governments around the world are recognizing the importance of investing in infrastructure to stimulate economic growth, improve transportation efficiency, and enhance public safety. This has led to an increase in demand for construction equipment such as excavators, cranes, and bulldozers, which are essential for these projects.

In parallel, advancements in technology have made construction equipment more efficient and reliable, further driving their adoption in the industry. Overall, the growing demand for infrastructure development and technological advancements in construction equipment is expected to drive the growth of the infrastructure segment in the assessment period.

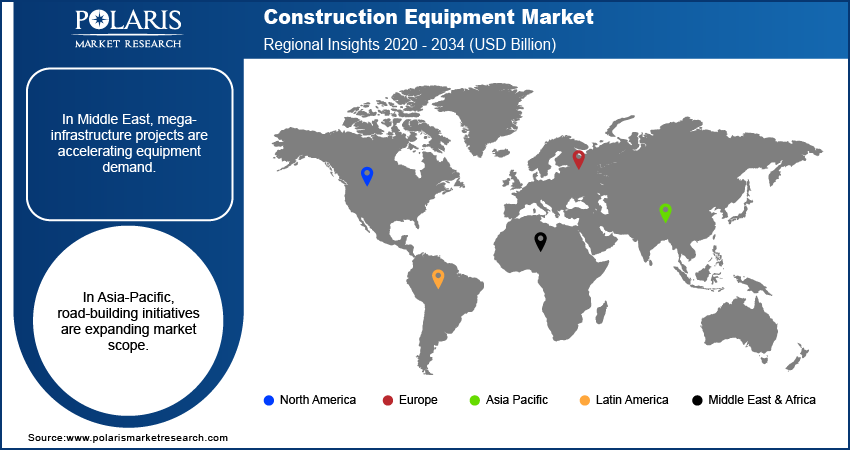

Regional Insights

The global market—encompassing excavators, loaders, cranes, bulldozers, backhoes, and compact machinery—is currently led by Asia construction equipment market, which holds the largest market share globally, estimated to be around 45 to 50%. This dominance stems primarily from China, the largest single-country market by both volume and value. China's position is built upon sustained investments in public infrastructure, urban development, and high-speed rail systems, all of which require intensive deployment of heavy equipment. Additionally, the Chinese government’s multi-trillion yuan Belt and Road Initiative has propelled demand for construction machinery, both domestically and abroad. The country is also a major manufacturer of equipment, exporting large volumes to developing nations in Africa, Southeast Asia, and South America. Government support through subsidies for electric construction machinery and the domestic emphasis on transitioning to low-emission engines have reinforced China’s dominance. However, the fastest-growing region for construction equipment is North America, with particular emphasis on the United States, where the sector has experienced a significant revival post-pandemic. Fueled by the Infrastructure Investment and Jobs Act passed by the U.S. government, a $1.2 trillion federal commitment is now actively funding thousands of road, bridge, and utility upgrade projects across the nation. As a result, U.S. demand for both heavy-duty and compact equipment has grown steadily, with annual sales of certain segments—such as compact track loaders and wheeled excavators—increasing by 10 to 12% over the last two years. Additionally, a growing shift toward electric-powered and autonomous construction machinery is being encouraged by environmental policies under the U.S. Department of Energy and Environmental Protection Agency, which have both launched grant programs supporting clean construction technologies.

Real-world indicators illustrate the scale and momentum in each of these regions. In China, government figures show over 100,000 kilometers of new roads constructed since 2020, and sales of domestic excavators reached more than 320,000 units annually as of 2023. In addition to internal use, China exports construction machinery to over 100 countries, supported by financing through state-run banks and international trade arms. Meanwhile, the United States has seen over 30,000 infrastructure projects launched or re-activated in the last two years alone, with nearly $500 billion in federal and state funds already allocated as of 2024. In states like Texas, California, and Florida, demand for highway grading equipment, tunneling systems, and concrete boom pumps has surged. Technological upgrades are further shaping these markets. China’s Ministry of Industry and Information Technology has encouraged manufacturers to integrate GPS-based guidance systems, remote diagnostics, and hybrid powertrains into new equipment lines. In North America, U.S. government labs and academic institutions are supporting testing of hydrogen-powered machinery and fully electric jobsite equipment under Department of Energy pilot programs. Importantly, the U.S. government’s Buy American provisions have also provided a boost to domestic manufacturers, encouraging them to expand production and innovate to meet both public sector and private contractor needs.

Asia, led by China, maintains the top position in the global construction equipment market due to a combination of massive infrastructure rollouts and export-oriented manufacturing. However, North America, led by the United States, is the fastest-growing market, driven by strategic public investments and an accelerating transition to advanced, eco-efficient equipment. These two forces—Asia’s scale and North America’s momentum—are shaping the future trajectory of the construction equipment industry worldwide.

Competitive Landscape

The global market for construction equipment is highly competitive and dominated by several well-established players, including Caterpillar, Volvo CE, Hitachi Construction Machinery, Komatsu, and John Deere. These companies have a strong presence worldwide and offer a wide range of products, such as excavators, bulldozers, wheel loaders, cranes, and compactors. They have extensive distribution networks, robust product portfolios, and strong brand recognition, which enables them to maintain their market share. In addition, these companies invest heavily in research and development to introduce innovative technologies and improve existing products, further solidifying their position in the market.

Some of the major players operating in the global market include:

- AB Volvo

- Caterpillar, Inc

- CNH Industrial America LLC.

- Deere & Company

- Doosan Corporation

- Escorts Limited

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

- LIEBHERR

- MANITOU Group

- SANY Group

- Terex Corporation

- Wacker Neuson SE

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Recent Developments

-

In January 2025, United Rentals announced the acquisition of H&E Equipment Services in a USD 4.8 billion deal—adding nearly 64,000 rental units to its fleet, aiming to strengthen its service capabilities and capitalize on rising infrastructure investments in the U.S.

-

In October 2023, CASE Construction Equipment launched an all-new lineup of mini track loaders TL100 and small articulated loaders to offer a powerful attachment platform in a compact, easy-to-maneuver, and easy-to-transport machine.

-

In November 2023, Volvo Construction Equipment launched two models of electric equipment, including the ECR25 Electric compact excavator and the L25 Compact wheeled loader, in the markets of Asia, such as China, South Korea, Japan, and Singapore.

-

In September 2023, Komatsu launched an electric micro excavator (PC05E-1) in Japan, which has a hydraulic outlet that serves as a pressure source for hydraulic hand tools.

-

In May 2023, Hitachi Construction Machinery Americas launched the ZAXIS-7 compact excavators to complete tasks on urban job sites efficiently. These compact excavators are commonly used as tool carriers with a wide range of attachments that increase job-site versatility.

Report Coverage

The Construction Equipment market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, equipment type, equipment category, power output, application, and futuristic growth opportunities.

Construction Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 243.42 billion |

|

Revenue Forecast in 2034 |

USD 508.32 billion |

|

CAGR |

8.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Equipment Type, By Equipment Category, By Power Output, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of construction equipment in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2034 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Finish Foils Market Size, Share 2024 Research Report

Mustard Seeds Market Size, Share 2024 Research Report

Dry Van Container Market Size, Share 2024 Research Report

FAQ's

AB Volvo, Caterpillar, Inc., CNH Industrial America LLC., Deere & Company, Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction are the key companies in Construction Equipment Market.

Construction Equipment Market is exhibiting the CAGR of 8.50% during the forecast period

The Construction Equipment Market report covering key segments are equipment type, equipment category, power output, application, and region.

The rise in demand for equipment for developmental projects drives construction equipment market growth are the key driving factors in Construction Equipment Market.

The global Construction Equipment market size is expected to reach USD 508.32 Billion by 2034