Finish Foils Market Share, Size, Trends, Industry Analysis Report

By Material Type (PVC, PET); By Technology (Impregnation, Coating, Drying); By Format Type (Furniture Films, Floor Films); By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3947

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

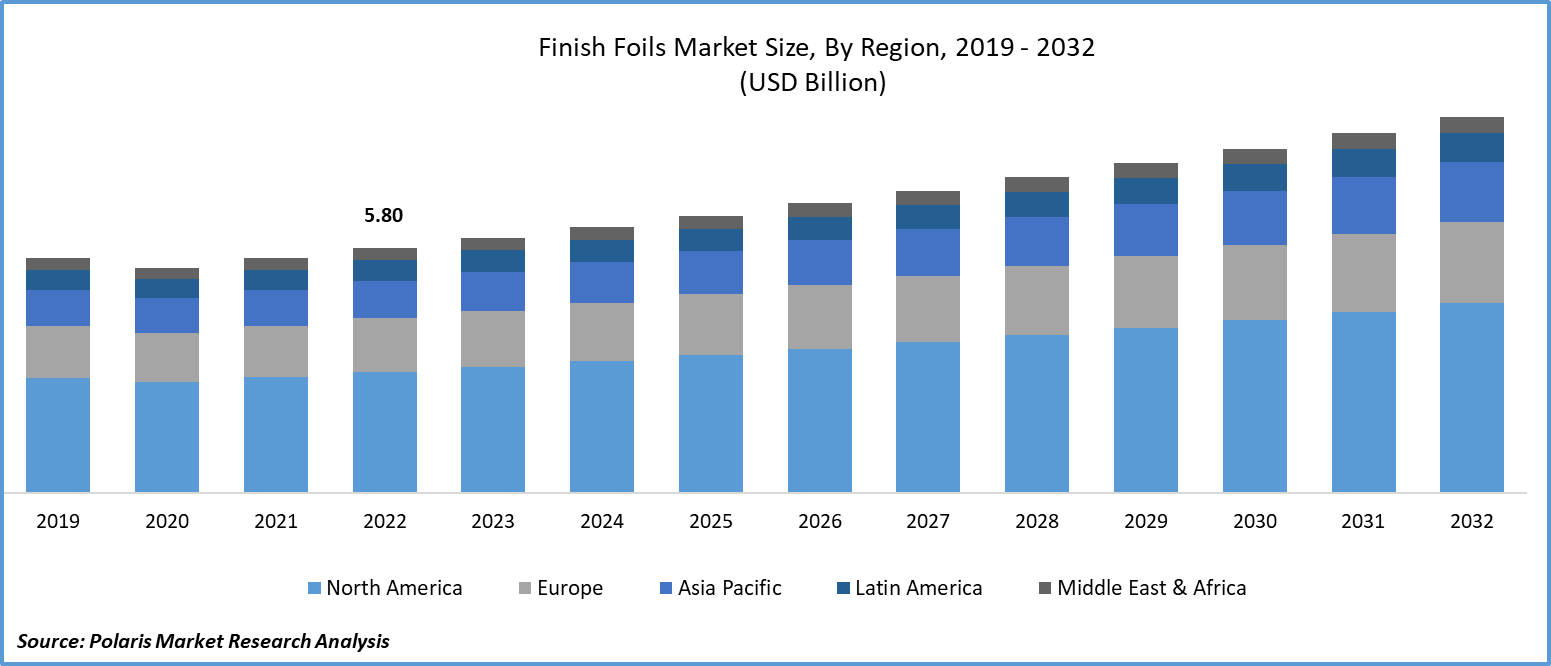

The global finish foils market was valued at USD 5.80 billion in 2022 and is expected to grow at a CAGR of 4.4% during the forecast period.

Finish foils are the lacquer-coated paper layers with the printed surfaces. They are primarily used for coating wood panels as a decor finish foil. They are created with premium lacquers, base papers, & light-resistant printing inks. Utilizing finish foil has several benefits, including eco-friendliness and a bright and transparent texture to the finished product.

To Understand More About this Research: Request a Free Sample Report

These foils are printed specialty papers that act as a protective coating on top of the substrate and offer both design flexibility and long-lasting performance. Both classic and contemporary rooms can benefit from the outstanding qualities of finish foil. It can be simply applied to a plain or even damaged surface to change the interior decor. Companies are investing huge amounts in product innovations to gain a higher number of consumers and capture a larger share of the global finish foils market.

- For instance, in July 2023, Lamidecor, a decorative paper manufacturing company, introduced the new CPL Finish Corteza. It is a kind of finish applied to door surfaces, furniture surfaces, and other decorative components. Melamine layers, ornamental papers, and thermosetting resins are used to create the CPL finish.

Moreover, the renovation of an existing home and the purchase of a new home are the two main events that have a direct impact on the home improvement or renovation sector. The growing demand for remodeling houses is driving demand for decorating products like finish foils due to their effectiveness in renovating households with appealing looks. Furthermore, the signaling effect is also creating awareness among the people. One of the primary drivers of this effect is social media. Netizens are getting informed about the decoration ideas in the form of reels by social media influencers, driving a wider audience to the product in the coming years.

However, the prices of these cost-effective decorative products are highly influenced by the supply levels of manufacturers. Uncertain housing market price fluctuations are affecting the demand for finish foils.

Growth Drivers

- Finish Foils is projected to witness higher demand owing to its ability to renovate visually appealing rooms

Finish foil is frequently used on a variety of surfaces that resemble wood, including floors, picture frames, kitchen, bathroom, and living room furnishings. A heat press machine is used to press the final foil onto the surface of wall panels, baseboards, inner doors, MDF (Medium Density Fibre-board), chipboard, plywood, and other products. When building tiny, custom pieces of furniture like chairs and wardrobes, the carpenter will occasionally apply finish foil to MDF panels. This foil will serve as the completed piece's ornamental and protective covering.

Furthermore, along with serving a decorative purpose, finish foil offers resistance and protection against stains and scratches, preserving the furniture's original appearance for a long time. Moreover, these foils are single-layer ornamental sheets that have been coated with a mixture of urea and melamine resins as well as thermosetting lacquers. They are extensively used in the furniture and interior design industries. House remodeling and decorating dwelling rooms are further driving the demand for finish foils in the coming years.

Report Segmentation

The market is primarily segmented based on material type, technology, format type and region.

|

By Material |

By Technology |

By Format Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type Analysis

- Polyvinyl chloride (PVC) segment is expected to witness the highest growth during the forecast period

The pvc segment is projected to grow at a CAGR during the projected period, primarily driven by its ability to make various effective finish foils. One of the essential factors driving the demand for this material is its resistance to water and weather conditions. The finish foils made up of PVC material are a cost-effective option for consumers compared to other materials. Affordability is driving the demand from people who are trying to remodel or renovate their house for the first time.

The PET segment led the industry market with a substantial revenue share in 2022, largely attributable to its transparency. The demand for decorative glasses with transparent and clarity features is creating a need for finish foils with pet material where underlying material visibility is essential. These foils are gaining traction due to their environmentally friendly characteristics, as this type of material is recyclable.

By Technology Analysis

- Coating segment registered the largest market share in 2022

The coating segment accounted for the largest market share. Coatings can provide customized designs for users, making them an attractive option for consumers as everyone has unique interests. They work effectively by creating visually appealing and attractive foils. Furthermore, coatings are efficient in providing additional layer protection to the finish foils, increasing their durability for years. Additionally, it is easier to maintain and clean compared to wood, which is appealing to more consumers where time plays a crucial role in line with their professional lifestyle.

The impregnation segment is expected to grow at the fastest growth rate in the next few years on account of its capability to provide moisture resistance to the finish foils. Impregnation enables finish foil usage in various applications in interior design. This process makes finish foils suitable for various interior design applications, fuelling their demand throughout the study period.

By Format Type Analysis

- Furniture Films segment held a significant market revenue share in 2022

The furniture films segment held a significant market share in revenue in 2022, which is highly influenced by rising demand for attractive decorative products at the global level. Furniture films are designed for industrial applications like furniture manufacturing and house remodeling. This is used to enhance the durability and visual appeal of furniture surfaces.

Regional Insights

- Asia Pacific region registered the largest growth in the global market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is projected to continue its dominance over the study period. The growth of the segment can be largely attributed to the rising demand for place-saving furniture due to the growing urbanization, driven by the housing shortage in the region. The growing packaging industry in the region is fueling demand for finish foils.

The Packaging Industry Association of India (PIAI) estimates that the industry is expanding at a CAGR of 22% to 25%. The packaging industry has played a significant role in the development of technology and innovation in the nation over the past several years and has added value to a variety of manufacturing sectors, including the agricultural and FMCG segments. This demonstrates the growing demand for aesthetic and visually appealing packaging in this region, driving demand for finish foils in the coming years.

The Europe region is projected to witness faster growth with a healthy CAGR during the study period, owing to the growing consumption of furniture. People in the region are showing profound interest in home renovation and interior design, driving demand for furniture and, in turn, finish foils, as they are used for decoration purposes and are affordable to consumers.

Key Market Players & Competitive Insights

The finished foil market is expanding at the global level due to ongoing research and development activities by companies to present new, appealing products to consumers. The continuous evolution of major companies in this market with their latest product launches and collaborations to expand their company's product portfolio in this domain is driving market growth. Mergers and acquisitions activities are growing among key market players to enlarge their global market share.

Some of the major players operating in the global market include:

- Ahlstrom-Munksjo

- Brushfoil

- Chiyoda

- Impress

- Imawell

- Interprint

- Kronospan

- Lamidecor

- Likora Dekorfolien GmbH

- Möbelfolien GmbH

- Schattdecor

- SURTECO

- Tocchio

- Turkuaz Decor

Recent Developments

- In March 2022, Winter & Company has partnered with the Foilco to form 3D Chaos by providing digital artists and creatives with around 300,000 foil & cover material options.

Finish Foils Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.04 billion |

|

Revenue forecast in 2032 |

USD 8.91 billion |

|

CAGR |

4.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material Type, By Technology, By Format Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |