Heavy Construction Equipment Market Size, Share, Trends, Industry Analysis Report

: By Type, Application, End User (Mining, Infrastructure, Construction, Oil & Gas, Manufacturing, And Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM3875

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

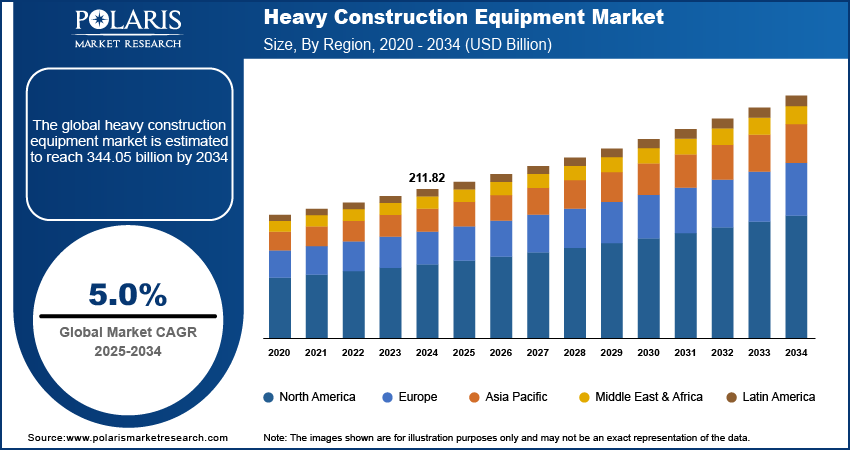

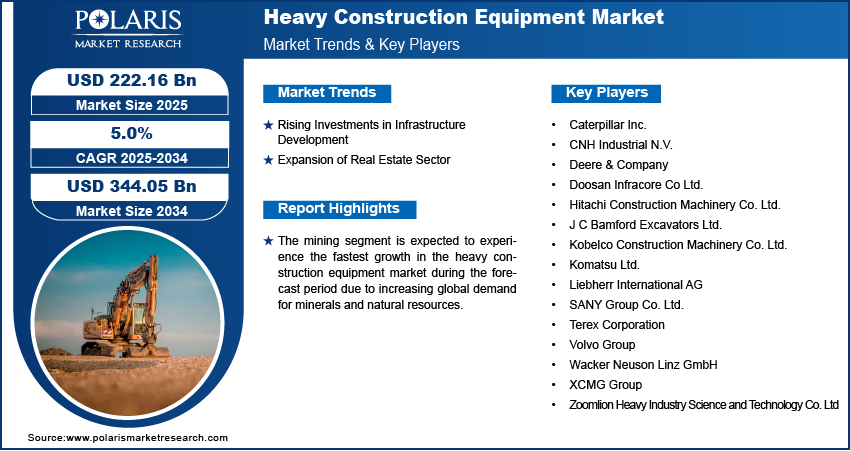

The global heavy construction equipment market size was valued at USD 211.82 billion in 2024, growing at a CAGR of 5.0% from 2025 to 2034. The increased demand for housing and infrastructure due to rapid urbanization and rising private investments, driven by the growing focus on PPPs, fuel the market development.

Key Insights

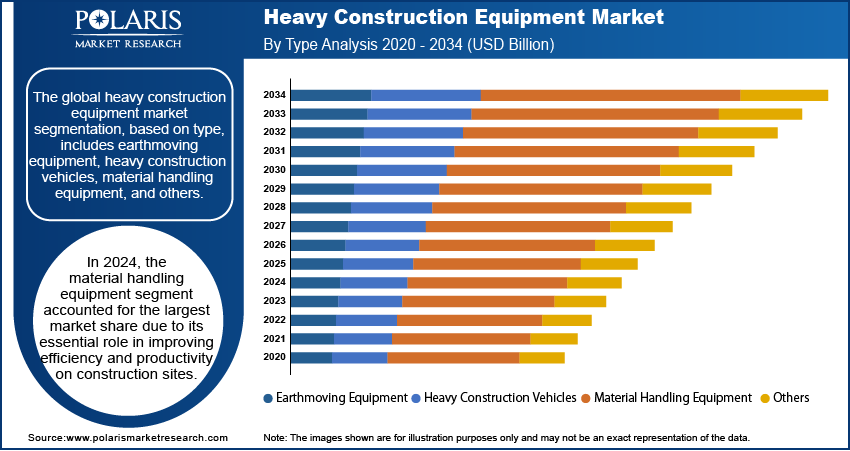

- The material handling equipment segment accounted for the largest market share in 2024, driven by its crucial role in enhancing productivity and efficiency on construction sites.

- The mining segment is expected to register the fastest growth during the projection period due to growing global demand for natural resources and minerals.

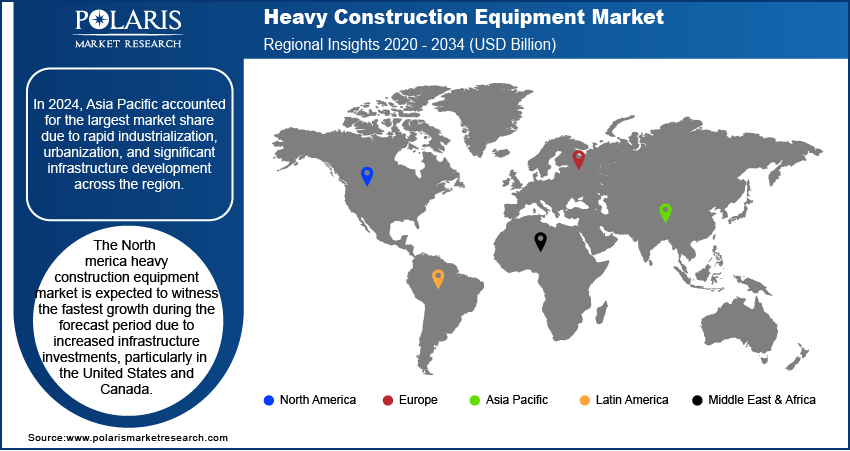

- Asia Pacific led the market in 2024, owing to rapid industrialization and significant infrastructure development in the region.

- North America is projected to witness the fastest growth during the projection period. The regional market growth is driven by increased infrastructure investments, especially in the US and Canada.

Industry Dynamics

- Significant investments by governments globally in infrastructure projects, including railways, roads, and bridges, is driving the demand for heavy construction equipment.

- The growing real estate sector, driven by improving living standards and rapid urbanization, is fueling the market revenue.

- The shift towards electric and hybrid construction equipment presents opportunities for market expansion.

- High initial and maintenance costs may present challenges to market growth.

Market Statistics

2024 Market Size: USD 211.82 billion

2034 Projected Market Size: USD 344.05 billion

CAGR (2025-2034): 5.0%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Heavy construction equipment refers to equipment and vehicles specifically designed for various construction tasks and operations such as grading, drilling, excavating, hauling, and paving. These machines are used across various end-user industries, including mining, oil and gas, construction, manufacturing, forestry, and infrastructure.

Heavy construction equipment such as loaders, excavators, and others are essential for mining exploration. Governments in Latin American countries are placing a strong emphasis on the expansion of the mining sector to meet the rising demand for metals and ores. The expansion of the mining sector in the region fosters heavy construction equipment market growth. Furthermore, there is an increase in the utilization of earthmoving equipment, such as loaders, which are used in various industries for transporting heavy waste material, dirt, sand, and other materials.

The continuous movement of people from rural to urban areas increases the demand for housing and infrastructure. This urban expansion necessitates substantial construction activities, thereby boosting the need for heavy construction equipment. Furthermore, the increasing focus on PPPs facilitates the execution of large-scale infrastructure projects. These collaborations attract private investments and expertise, further driving the heavy construction equipment market demand.

Heavy Construction Equipment Market Trend Analysis

Rising Investments in Infrastructure Development

Governments worldwide are making significant investments in infrastructure projects, including roads, bridges, railways, and airports. For instance, according to an October 2024 WatchBlog post by the U.S. Government Accountability Office, China invested about USD 679 billion in infrastructure through its Belt and Road Initiative across nearly 150 countries between 2013 to 2022. These investments aim to boost economic growth and address critical infrastructure gaps in developing nations by enhancing trade connectivity and supporting sustainable development. The construction of these projects requires extensive use of heavy machinery, which drives the heavy construction equipment market development.

Expansion of Real Estate Sector

The growing real estate sector, fueled by rapid urbanization and rising living standards, plays a pivotal role in driving heavy construction equipment market revenue. For instance, the India Brand Equity Foundation projects that the real estate sector in India will grow to a market size of ~USD 5.8 trillion by 2047. This growth is anticipated to increase its contribution to the country's GDP from the current 7.3% to about 15.5%. Heavy construction machinery such as excavators, loaders, and cranes is indispensable for efficiently meeting the construction demands of this thriving sector.

Segment Insights

Assessment Based on Type

The global heavy construction equipment market, based on type, is segmented into earthmoving equipment, heavy construction vehicles, material handling equipment, and others. In 2024, the material handling equipment segment accounted for the largest heavy construction equipment market share due to its essential role in improving efficiency and productivity on construction sites. These machines, which include forklifts, conveyors, and cranes, are critical for moving, loading, and unloading heavy materials, which are common tasks in large-scale construction projects. As the demand for faster project completion and reduced labor costs increases, the adoption of material handling equipment has become more prevalent. Additionally, advancements in automation and smart technologies, such as automatic telematics and robotics, have enhanced the functionality and efficiency of these machines, making them even more attractive to construction firms. The growing reliance on material handling equipment for seamless operations and cost-effective solutions has solidified its dominant share in the market.

Evaluation Based on End User

The global heavy construction equipment market, based on end user, is segmented into mining, infrastructure, construction, oil & gas, manufacturing, and others. The mining segment is expected to experience the fastest growth from 2025 to 2034. The segment’s growth is driven by the increasing global demand for minerals and natural resources, fueled by industrialization and infrastructure development, particularly in emerging markets. The increased need for raw materials such as coal, metals, and minerals is also fueling investments in mining activities. Advancements in mining technologies, including automation, autonomous vehicles, and energy-efficient machinery, are improving operational efficiency, reducing costs, and enhancing safety within the mining industry. Additionally, the rising emphasis on sustainable mining practices and the adoption of eco-friendly equipment are driving innovation in mining, contributing to the segment’s growth.

Regional Analysis

By region, the study provides heavy construction equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the heavy construction equipment market due to rapid industrialization, urbanization, and significant infrastructure development across the region. Countries like China, India, and Japan are leading the way in large-scale infrastructure projects, including the construction of roads, bridges, airports, and residential complexes, driving the demand for heavy construction equipment. For instance, in May 2024, the Asian Development Bank projected that the total value of potential infrastructure investments across Asia could reach approximately USD 26 trillion by 2030. This estimate highlights the significant demand for infrastructure development, further emphasizing the need for heavy construction equipment in the region. Additionally, increasing investments in mining and manufacturing sectors, coupled with the growing demand from residential and commercial real estate, further contribute to the region's dominance in the market. Government initiatives to enhance transportation networks, improve healthcare infrastructure, and boost industrial output are also driving the regional market growth.

The North America heavy construction equipment market is expected to witness the fastest growth during the forecast period due to increased infrastructure investments, particularly in the US and Canada. The region is experiencing a surge in public and private sector projects aimed at modernizing transportation networks, including highways, bridges, and airports, which require advanced construction machinery. Additionally, the growth of the real estate sector, especially in residential and commercial development, is contributing to the demand for heavy construction equipment. The ongoing emphasis on energy infrastructure, including renewable energy projects such as wind and solar farms, is further driving the need for specialized construction equipment. For instance, in October 2023, Governor Kathy Hochul declared an investment in renewable energy, the largest in US history. This initiative includes 22 land-based and three offshore wind projects, generating a total of 6.4 GW of clean energy sufficient to power 2.6 million homes and meet about 12 percent of New York's electricity needs upon completion.

Key Players and Competitive Insights

The competitive landscape of the heavy construction equipment market is marked by both global and regional players competing for market share through innovation, technological advancements, and strategic initiatives. Major companies such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, and Doosan Infracore dominate the market. These companies differentiate themselves by offering a broad range of heavy machinery and focusing on innovations such as automation, electric-powered equipment, and sustainability. Technological advancements, including smart equipment, telematics, and autonomous machinery, are reshaping the market, with companies emphasizing fuel efficiency and reduced environmental impact. Strategic initiatives, including mergers and acquisitions, geographical expansion into emerging markets, and the development of customer-centric solutions like after-sales services and maintenance packages, are key to gaining a competitive edge. Additionally, the growing demand for low-emission, energy-efficient machinery is prompting manufacturers to adopt sustainable practices. As a result, the market remains highly dynamic, driven by both technological advancements and strategic business decisions aimed at increasing market share and addressing evolving customer needs.

A few key major players are Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore Co Ltd., Hitachi Construction Machinery Co. Ltd., J C Bamford Excavators Ltd., Kobelco Construction Machinery Co. Ltd., Komatsu Ltd., Liebherr International AG, SANY Group Co. Ltd., Terex Corporation, Volvo Group, Wacker Neuson Linz GmbH, XCMG Group, Zoomlion Heavy Industry Science, and Technology Co. Ltd.

Caterpillar Inc. is a global manufacturer and distributor of industrial gas turbines, mining and construction equipment, diesel and natural gas engines, and diesel-electric locomotives. Their product portfolio includes compactors, asphalt pavers, road reclaimers, cold planers, material handlers, forestry machines, track-type tractors, telehandlers, motor graders, excavators, and pipelayers, as well as a variety of loaders and related parts and tools. In addition, they offer electric rope and hydraulic shovels, rotary drills, draglines, hard rock vehicles, mining trucks, tractors, wheel loaders, autonomous truck, wheel tractor scrapers, dozers, autonomous ready vehicles and solutions, machinery components, safety services, and mining performance solutions. The company’s Resource Industries segment focuses on providing machinery for heavy construction, mining, quarrying, and aggregates.

Volvo CE is one the largest manufacturers of articulated haulers and wheel loaders, and a leading global producer of excavation equipment, road development machines, and compact construction equipment. Volvo CE is a part of Volvo Group, which is known for its manufacturing of buses, trucks, construction equipment, and marine and industrial engines. The company also offers other solutions to its customers, such as servicing, financing, used equipment, rental, and other related services. It deals in various industry segments, including building, heavy infrastructure, road construction, quarries & aggregates, agriculture & landscaping, mining, recycling & waste, material handling, utilities, forestry, oil & gas, and demolition.

List of Key Companies

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Infracore Co Ltd.

- Hitachi Construction Machinery Co. Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr International AG

- SANY Group Co. Ltd.

- Terex Corporation

- Volvo Group

- Wacker Neuson Linz GmbH

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Heavy Construction Equipment Industry Developments

June 2024: Volvo CE showcased new electric machines at Volvo Days in Eskilstuna, Sweden, including the 23-tonne EC230 Electric excavator and corded EW240 Electric MH. The company expanded its battery-electric construction equipment lineup to lead in sustainable construction solutions.

In May 2024, Volvo Construction Equipment (Volvo CE) launched new products and modernized excavators, including the EC500, EC400, and EC230, featuring advanced technology for better performance and fuel efficiency. Volvo also introduced its first electric wheeled excavator, the EWR150 Electric, and expanded its electric machine lineup, including the L90 and L120 Electric wheel loaders.

In March 2024, SANY launched its new range of telehandlers in the UK, highlighting its commitment to expanding its presence in the UK and Ireland. These telehandlers are engineered for high performance, operator comfort, and safety, making them ideal for various material handling tasks. Designed to lift heavy loads and maneuver efficiently on construction sites, SANY telehandlers excel in diverse working environments.

In February 2024, Caterpillar announced two upgrades to its medium dozer line. Starting in early 2024, the Cat D7, D6 XE, D6, D5, and D4 models included the Cat Assist with Attachment Ready Option suite as a standard feature. Additionally, a unique Cat Grade with 3D Ready option provided greater flexibility for customers upgrading to Cat Grade with 3D on D6, D5, and D4 models.

Heavy Construction Equipment Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Earthmoving Equipment

- Heavy Construction Vehicles

- Material Handling Equipment

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Excavation & Demolition

- Tunneling

- Heavy Lifting

- Recycling & Waste Management

- Material Handling

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Mining

- Infrastructure

- Construction

- Oil & Gas

- Manufacturing

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heavy Construction Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 211.82 billion |

|

Market Size Value in 2025 |

USD 222.16 billion |

|

Revenue Forecast by 2034 |

USD 344.05 billion |

|

CAGR |

5.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global heavy construction equipment market size was valued at USD 211.82 billion in 2024 and is projected to grow to USD 344.05 billion by 2034.

• The global market is projected to register a CAGR of 5.0% from 2025 to 2034.

• In 2024, Asia Pacific accounted for the largest share of the heavy construction equipment market due to rapid industrialization, urbanization, and significant infrastructure development across the region.

• A few of the key players in the market are Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore Co Ltd., Hitachi Construction Machinery Co. Ltd., J C Bamford Excavators Ltd., Kobelco Construction Machinery Co. Ltd., Komatsu Ltd., Liebherr International AG, SANY Group Co. Ltd., Terex Corporation, Volvo Group, Wacker Neuson Linz GmbH, XCMG Group, Zoomlion Heavy Industry Science and Technology Co. Ltd.

• In 2024, the material handling equipment segment accounted for the largest market share due to its essential role in improving efficiency and productivity on construction sites.

• The mining segment is expected to witness the fastest growth during the forecast period due to increasing global demand for minerals and natural resources.