Breathable Films Market Size, Share, & Industry Analysis Report

By Films Type (Microporous, Micro Voided, and Non-Porous), By Raw Material, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5751

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

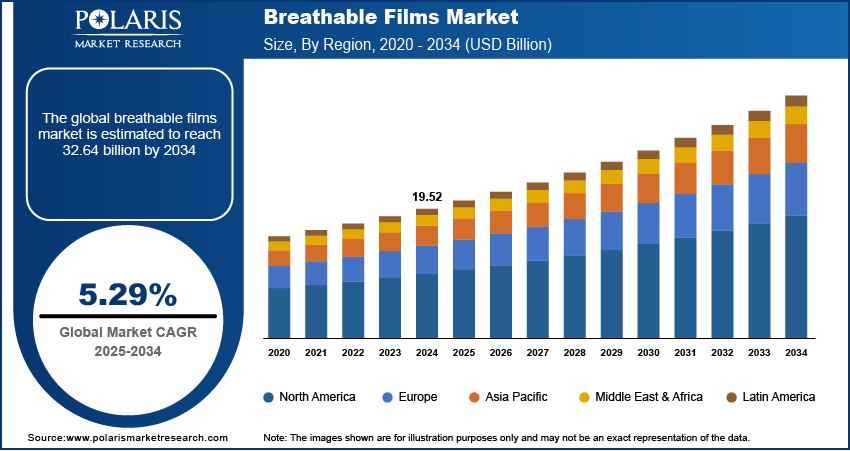

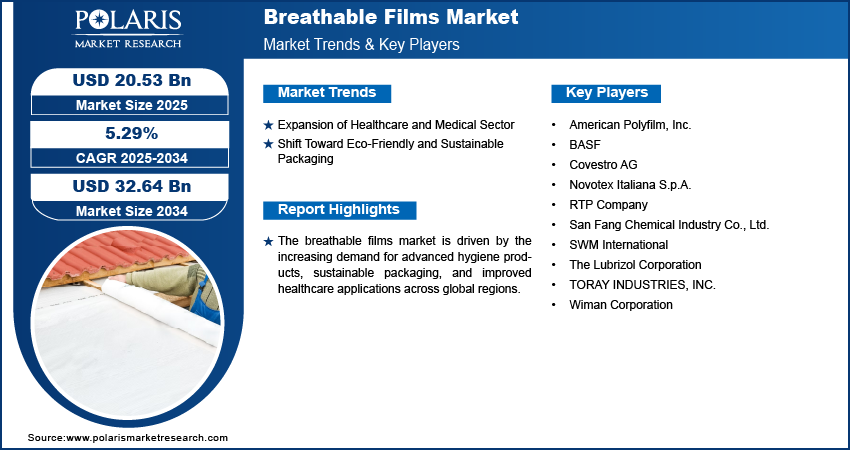

The global breathable films market size was valued at USD 19.52 billion in 2024, growing at a CAGR of 5.29% during 2025–2034. The growth is driven by the increasing focus on fire resistance and thermal management.

Breathable films are semi-absorbent membranes that allow the passage of water vapor while blocking liquids, making them ideal for applications requiring moisture control and comfort. The ongoing technological advancements in material science, which have greatly improved film properties such as permeability, tensile strength, and flexibility drive demand for these materials. In March 2021, Printpack launched Preserve, a fully polyethylene, recyclable, breathable film for fresh produce certified by How2Recycle. The micro-perforated material technology maintains product freshness and shelf life while supporting sustainability goals. These innovations have allowed manufacturers to develop highly functional films using polymers such as polyethylene, polypropylene, and polyurethane tailored to specific end-use applications. As a result, these films are extensively used in cleaning & hygiene products, medical supplies, food packaging, and construction materials, improving product performance and consumer satisfaction.

To Understand More About this Research: Request a Free Sample Report

The growth of the food and beverage industry is accelerating the demand for breathable films. According to an April 2025 US Bureau of Labor Statistics report, employment for food and beverage serving workers is projected to grow 5% from 2023 to 2033, reflecting expansion in the industry. These films offer an effective packaging solution that helps maintain the optimal atmosphere inside the packaging with increasing consumer preference for fresh, high-quality, and longer-lasting food products. These films prevent spoilage and extend shelf life, which is crucial for perishable goods such as fruits, vegetables, meat, and dairy products by allowing controlled gas exchange. Additionally, the rise of ready-to-eat and convenience foods, coupled with the expansion of cold chain logistics, fuels the adoption of breathable films in food packaging. This growing need for efficient, green packaging solutions in the food and beverage sector continues to drive innovation and market expansion.

Industry Dynamics

Expansion of Healthcare and Medical Sector

The rising demand for high-performance materials in the healthcare and medical sector is boosting new expansion opportunities. According to a January 2023 WEF report, global healthcare spending reached USD 12 trillion in 2022, reflecting growth opportunities. These films are widely used in surgical drapes, gowns, wound dressings, and protective covers due to their ability to provide barrier protection while allowing moisture vapor transmission. The growth of global healthcare infrastructure, increasing focus on infection control, and the rising need for disposable medical products have contributed to the adoption of these films. Furthermore, advancements in patient-centric care and hygiene standards are reinforcing their role in maintaining comfort and safety in clinical environments.

Shift Toward Eco-Friendly and Sustainable Packaging

The growing focus on sustainability and environmental responsibility is propelling the use of breathable films in eco-friendly packaging solutions. Manufacturers are increasingly developing recyclable and bio-based films to meet regulatory requirements and consumer demand for sustainable alternatives. For instance, in May 2023, Arkema introduced its bio-based Pebax and Rnew membranes derived from sustainably farmed castor beans. The material maintains high performance (moisture control, tear resistance, and viral barriers) while supporting 700,000 farming families in India and avoiding deforestation. These films reduce plastic waste and also improve product shelf life and freshness, particularly in food and personal care packaging. This shift toward green materials is encouraging innovation in breathable film production, making them a preferred choice for brands seeking both performance and environmental compliance.

Segmental Insights

By Raw Material Analysis

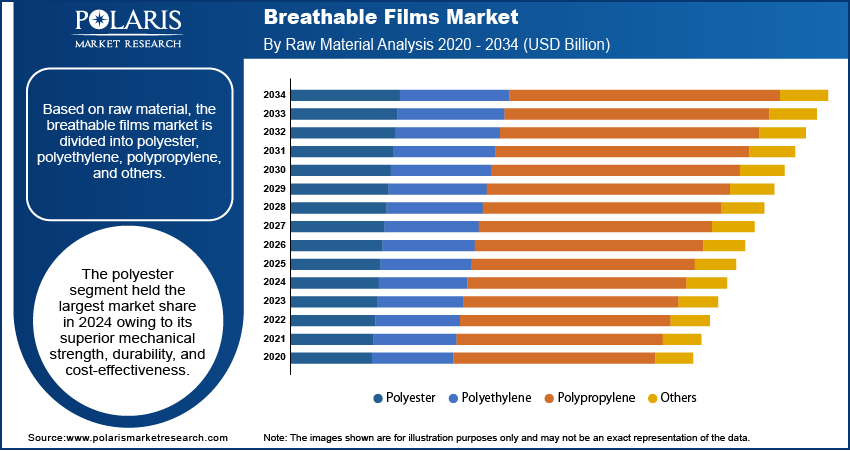

The segmentation, based on raw material, includes polyester, polyethylene, polypropylene, and others. The polyester segment held the largest market share in 2024 owing to its superior mechanical strength, durability, and cost-effectiveness. Polyester-based films offer excellent dimensional stability and resistance to moisture and chemicals, making them suitable for a broad range of applications, such as medical, packaging, and industrial sectors. Their compatibility with multilayer film structures and ability to maintain breathability without compromising barrier properties further strengthen their dominance. Additionally, polyester’s recyclability and availability in various grades contribute to its widespread adoption across end-use industries.

By Film Type Analysis

The segmentation, based on film type, includes microporous, micro voided, and non-porous. The microporous segment is expected to witness substantial growth during the forecast period due to its improved breathability and fluid barrier properties, which are crucial in hygiene, medical, and packaging applications. These films contain micro-sized pores that allow vapor transmission while preventing the penetration of liquids and contaminants. The rising use of microporous films in diapers, surgical garments, and food packaging is driven by consumer demand for comfort, safety, and freshness. Moreover, technological innovations have made microporous films thinner and more sustainable, positioning them as a preferred choice for high-performance applications.

By End Use Analysis

The segmentation, based on end use, includes personal care & hygiene, medical & healthcare, building & construction, industrial protective apparel, packaging, sports apparel, and others. The medical & healthcare segment is expected to witness significant growth during the forecast period as these films become essential components in infection control and patient care solutions. They are used extensively in wound care dressings, surgical masks, drapes, and protective garments due to their ability to balance barrier protection with breathability. The rise in surgical procedures, aging populations, and the focus on hospital-acquired infection (HAI) prevention are major factors driving the demand for breathable films. Additionally, regulatory standards promoting the use of breathable, skin-friendly materials further improve their adoption across medical environments.

Regional Analysis

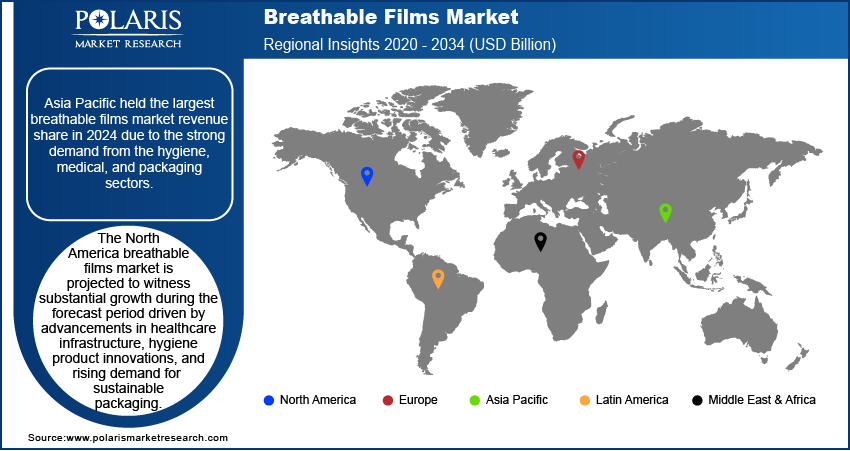

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market revenue share in 2024 due to the strong demand from the hygiene, medical, and packaging sectors. Rapid industrialization, population growth, and improved access to healthcare services are fueling consumption across emerging economies. Countries such as China, India, Japan, and South Korea are major contributors to the Asia Pacific breathable films market, driven by robust manufacturing capabilities, rising consumer awareness about hygiene, and increasing healthcare expenditure. According to a July 2024 report by the Ministry of Finance, India's health expenditure rose to USD 70 billion, with the health spending-to-GDP ratio increasing from 1.4% to 1.9% during the forecast period. Additionally, expanding food and personal care industries in the region drive the need for breathable packaging materials.

The China breathable films market is expanding rapidly, supported by the country’s massive population base and rising disposable incomes. The growth of the personal care and hygiene sector, particularly in rural and semi-urban areas, is further fueling demand. Additionally, the government's focus on improving healthcare infrastructure and sanitary standards is improving the usage of these films in medical and hygiene applications.

The North America breathable films market is projected to witness substantial growth during the forecast period, driven by advancements in healthcare infrastructure, hygiene product innovations, and rising demand for sustainable packaging. The region's focus on high-quality medical care and disposable protective equipment is accelerating the use of these films in clinical settings. The region is benefiting from strong R&D activities, regulatory compliance, and consumer preference for comfort-oriented, eco-friendly products in both healthcare and packaging domains.

The US breathable films market is witnessing growth due to increasing consumer demand for advanced hygiene products and protective healthcare materials. The presence of a robust medical sector, combined with strict quality standards for baby diapers, adult products, and surgical drapes, is accelerating product adoption. Moreover, a strong focus on sustainability and increasing investments in bio-based polymer development are further contributing to the market expansion.

The Europe breathable films market is projected to witness significant growth during the forecast period, fueled by strict environmental regulations and a developed healthcare system. The region's push toward sustainable and recyclable materials prompted manufacturers to adopt advanced breathable film technologies. Moreover, increasing hygiene awareness and the presence of major players with strong technological expertise support market expansion. Europe plays an important role in the field of breathable films due to its innovation-driven industries, well-established medical infrastructure, and growing demand for eco-conscious consumer goods.

The UK breathable films market is witnessing notable growth, owing to rising environmental awareness and a strong regulatory framework supporting sustainable packaging solutions. The healthcare sector’s demand for breathable, infection-control materials has increased, particularly in hospitals and care homes. Additionally, consumers are progressively shifting toward premium hygiene products that offer greater comfort and breathability.

Key Players & Competitive Analysis Report

The breathable films sector is witnessing investments and technological advancements driven by rising demand in hygiene, medical, and packaging applications. Competitive analysis reveals that major players are focusing on sustainable value chains, with bio-based materials. Developed markets lead in adoption due to strict regulations, while emerging markets show latent demand fueled by healthcare expansion. Disruptive technologies, such as monolithic films and microporous structures, are reshaping product offerings, with vendors such as RKW Group and Arkema improving competitive positioning. Industry trends highlight a shift toward fluorochemical-free solutions and recyclable materials, aligning with economic and geopolitical shifts toward circular economies. Small and medium-sized businesses are entering through innovations. Revenue growth is projected in the medical and apparel segments, supported by expert insights on moisture management and barrier performance. A few key players are Arkema; Asahi Kasei Corporation; BASF; Berry Global, Inc.; Exxon Mobil Company; CCL Industries Inc. (Innovia Films); Mitsui Chemicals, Inc.; Nitto Denko Corporation; RKW Group; The Dow Chemical Company; and Toray Industries, Inc.

Key Players

- Arkema

- Asahi Kasei Corporation

- BASF

- Berry Global, Inc.

- CCL Industries Inc. (Innovia Films)

- Exxon Mobil Company

- Mitsui Chemicals, Inc.

- Nitto Denko Corporation

- RKW Group

- The Dow Chemical Company

- Toray Industries, Inc.

Industry Developments

April 2024: RKW Group launched its nonwoven and specialty films, such as breathable Aptra film, Trikoron barrier film, and embossed films. These materials serve personal care, industrial, construction, and furniture applications.

December 2023: Arkema acquired South Korea’s PI Advanced Materials (PIAM) from Glenwood Private Equity, expanding its high-performance polymer offerings. The move strengthens Arkema’s portfolio for advanced electronics and electric mobility markets.

Breathable Films Market Segmentation

By Raw Material Outlook (Revenue, USD Billion, 2020–2034)

- Polyester

- Polyethylene

- Polypropylene

- Others

By Films Type Outlook (Revenue, USD Billion, 2020–2034)

- Microporous

- Micro Voided

- Non-Porous

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Personal Care & Hygiene

- Medical & Healthcare

- Building & Construction

- Industrial Protective Apparels

- Packaging

- Sports Apparels

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Breathable Films Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.52 billion |

|

Market Size in 2025 |

USD 20.53 billion |

|

Revenue Forecast by 2034 |

USD 32.64 billion |

|

CAGR |

5.29% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.52 billion in 2024 and is projected to grow to USD 32.64 billion by 2034.

The global market is projected to register a CAGR of 5.29% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Arkema; Asahi Kasei Corporation; BASF; Berry Global, Inc.; Exxon Mobil Company; CCL Industries Inc. (Innovia Films); Mitsui Chemicals, Inc.; Nitto Denko Corporation; RKW Group; The Dow Chemical Company; and Toray Industries, Inc.

The polyester segment dominated the market in 2024.

The microporous segment is expected to witness the fastest growth during the forecast period.