Green Packaging Market Share, Size, Trends, Industry Analysis Report

By Packaging Type (Recycled, Reusable, Degradable); By Application (Food & Beverages, Personal Care, Healthcare, Others); By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3595

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

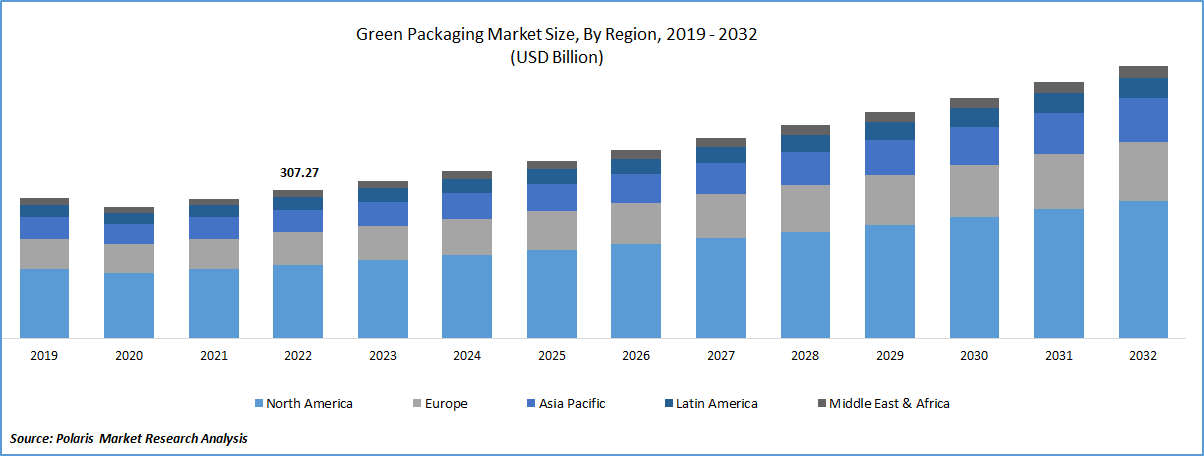

The global green packaging market was valued at USD 326.14 billion in 2023 and is expected to grow at a CAGR of 6.30% during the forecast period. Consumer awareness of sustainability issues and the implementation of strict government regulations are major factors driving the adoption of green packaging solutions. It refers to packaging materials that are environment friendly & promote sustainability. These solutions are designed to minimize the impact on the environment throughout their entire lifecycle. Some commonly used sustainable materials in green packaging include paper, plant-based materials, recycled materials, and other biodegradable or compostable materials.

Know more about this report: Request a Free Sample Report

The benefits of green packaging extend beyond reducing the carbon footprint. They also help conserve natural resources, reduce waste generation, and promote the circular economy. By using renewable materials and optimizing packaging designs, companies can minimize the use of non-renewable resources and reduce energy consumption during production.

Increased consumer awareness in the United States about the detrimental environmental effects of single-use plastic products has indeed played a significant role in driving the adoption of green packaging solutions. As a result, many manufacturers and suppliers have started prioritizing sustainable packaging options to meet consumer demand and address environmental concerns. Returnity Innovations, is a U.S.-based packaging company that is actively working towards reducing plastic packaging waste in landfills. They offer a range of sustainable packaging solutions, including poly-mailer bags, garment bags, and other reusable packaging products. These alternatives help replace single-use plastics with more environmentally friendly options, thereby reducing the overall environmental impact.

Poly-mailer bags are a popular choice in the e-commerce industry for shipping products. By providing sustainable alternatives to traditional plastic mailer bags, Returnity Innovations Inc. helps reduce the amount of plastic waste generated in the shipping process. Garment bags are another example of reusable packaging solutions offered by the company, which can replace single-use plastic garment covers commonly used in the retail industry. By offering reusable packaging products, Returnity Innovations. promotes a circular economy where materials are utilized for longer periods, reducing the need for constant production of new packaging materials. This approach not only reduces waste but also minimizes the consumption of resources required for manufacturing new packaging.

Industry Dynamics

Growth Drivers

The U.S. government has implemented stringent regulations and policies to address plastic packaging waste and promote the adoption of green packaging solutions. These measures have had a positive impact on the country's green packaging market, encouraging manufacturers and suppliers to prioritize sustainable packaging practices. One notable initiative in the United States is the Sustainable Packaging Coalition (SPC). The SPC is an environmental organization that focuses on promoting sustainable packaging practices and providing resources and guidance to companies seeking to implement environmentally friendly packaging solutions. The coalition collaborates with businesses, government agencies, and other stakeholders to drive innovation and advocate for sustainable packaging.

Various programs and initiatives in the United States are actively promoting the adoption of green packaging solutions. One such example is the sustainable packaging solutions program initiated by Green Seal. This program aims to encourage manufacturers & producers in both commercial markets to adopt with the recycled content packaging. By promoting the use of recycled materials in packaging, the program seeks to reduce burden of plastic waste in the land-fills and promote a more circular economy.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Speak to Analyst

Recycled Segment Accounted for the Largest Market Share in 2022

Recycled content packaging encompasses various materials, including paper, plastic, glass, metal, and others, all of which contribute to sustainable packaging solutions. Recycled plastics, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), are widely used in a range of packaging products such as pouches, bottles, and containers. These recycled plastics offer several advantages, including cost-effectiveness compared to other recycled materials.

While recycled plastics like PET and HDPE are cost-effective options for packaging, it's important to note that the overall cost and availability of recycled materials can vary depending on market conditions and regional factors. However, advancements in recycling technologies and increasing demand for sustainable packaging solutions are likely to drive further innovation and investment in recycled content packaging across various industries.

Food & Beverages Segment Expected to Hold Significant Market Share

Food & Beverages segment is projected to hold significant market share in terms of revenue over the study period. Segment's dominance can be attributed to the increasing popularity of sustainable packaging solutions across various food and beverage categories. In the food & beverages sector, there is a growing demand for sustainable packaging alternatives, driven by consumer preferences for environmentally friendly products. Sustainable packaging options like compostable packaging and molded pulp have gained traction in fast food outlets, restaurants, frozen foods, dairy products, beverages, and even pet food products. Burger King and Starbucks Coffee Company are prime examples of food and beverage companies that have embraced sustainable packaging solutions as part of their sustainability initiatives.

Healthcare segment led the industry market with substantial market share in 2022. The adoption of green packaging solutions in the healthcare industry is influenced by the need for sustainable practices, convenience, and consumer concerns about hygiene, particularly in the context of the COVID-19 pandemic. In the pharmaceutical sector, aluminum foil packaging is commonly used for oral drugs like pills and capsules. Aluminum foil is a recyclable material, and its use in pharmaceutical packaging aligns with sustainability goals. By utilizing recyclable materials like aluminum foil, the healthcare industry can contribute to reducing waste and promoting circular economy principles.

North America Region Dominated the Global Market in 2022

This is primarily due to growing consumer awareness of the environmental impact of plastic packaging materials. Consumers are increasingly concerned about the negative effects of single-use plastics on ecosystems and are actively seeking sustainable alternatives. This awareness has led to a higher demand for green packaging solutions across various industries, including healthcare and food & beverage.

In Europe, there is a strong emphasis on sustainability and environmental responsibility, which has spurred the adoption of green packaging practices. Bioplastics, derived from renewable sources such as sugarcane or corn starch, have gained significant traction in the region. These bioplastics offer improved biodegradability and reduced carbon emissions compared to traditional plastics. They find applications in food packaging, shopping bags, and other areas where the use of plastic materials is common.

The Asia Pacific region is anticipated to be the fastest growing region with a healthy CAGR throughout the projected period. The Chinese government has implemented regulations and policies, such as the Prevention and Control of Environmental Pollution by Solid Wastes, to address the challenges posed by solid waste disposal and dumping. These regulations restrict the improper disposal of solid wastes and encourage the adoption of sustainable waste management practices, including green packaging solutions. The government's focus on environmental protection has created a favorable environment for the growth of the green packaging market in China.

In addition to government initiatives, retailers in China are actively adopting green packaging solutions to meet the growing consumer demand for sustainable products and adhere to government policies. Alibaba, uses sustainable packaging materials to promote the adoption of green packaging practices. By incentivizing sustainable packaging, Alibaba contributes to the market growth of green packaging in China and encourages sellers to embrace more environmentally friendly packaging options.

Competitive Insight

Some of the major players operating in the global market include DS Smith, Amcor, Be Green Packaging, DuPont, Mondi, Nampak, Ball Corporation, Evergreen Packaging, Sealed Air, and Tetra Laval.

Recent Developments

- In February 2023, Sealed Air completed the acquisition of the Liquibox. With this company is expected to expand its portfolio of offerings in food & beverage industry, to meet growing demand of green packaging.

Green Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 346.26 billion |

|

Revenue forecast in 2032 |

USD 564.72 billion |

|

CAGR |

6.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Packaging Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

DS Smith, Amcor, Be Green Packaging, DuPont, Mondi, Nampak, Ball Corporation, Evergreen Packaging, Sealed Air, and Tetra Laval. |

FAQ's

The global green packaging market size is expected to reach USD 564.72 billion by 2032.

Top market players in the Green Packaging Market are DS Smith, Amcor, Be Green Packaging, DuPont, Mondi, Nampak, Ball Corporation, Evergreen Packaging.

North America contribute notably towards the global Green Packaging Market.

The global green packaging market expected to grow at a CAGR of 6.3% during the forecast period.

The Green Packaging Market report covering key are type, application, and region.