Carbon Footprint Management Market Size, Share, Trends, Industry Analysis Report

By Type (Basic Tier, Mid-Tier, and Enterprise Tier), By Deployment, By End-Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM2851

- Base Year: 2024

- Historical Data: 2020-2023

Overview

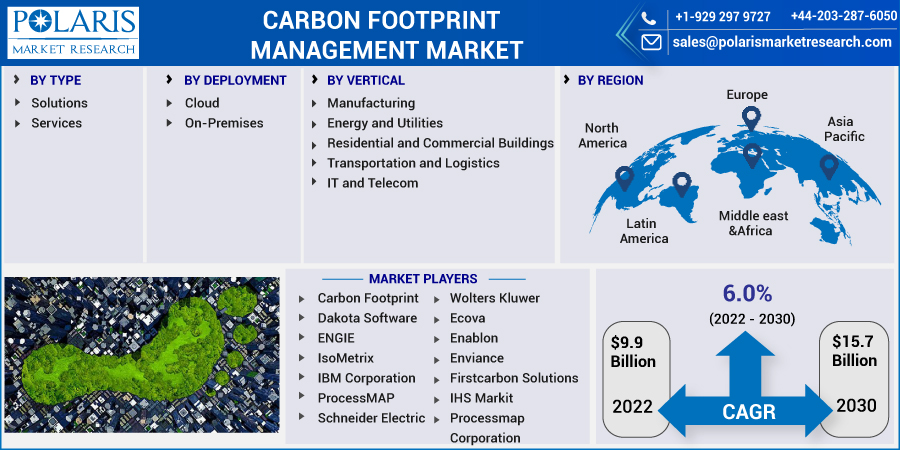

The global carbon footprint management market size was valued at USD 11.17 billion in 2024, growing at a CAGR of 8.9%from 2025 to 2034. Key factors driving demand for carbon footprint management include global climate change concerns coupled with international agreements and policies driving stricter emission targets.

Key Insights

- The enterprise tier segment dominated the market share in 2024.

- The transportation segment is projected to grow at a rapid pace in the coming years, propelled by global initiatives to decarbonize logistics, aviation, and automotive industries.

- The North America carbon footprint management market dominated the global market share in 2024.

- The U.S. carbon footprint management market is growing, due to the rising renewable energy deployment and the expansion of decarbonization initiatives across industries.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, propelled by national net-zero commitments from countries such as China, Japan, and South Korea.

- The market in India is growing rapidly, fueled by government-led initiatives, stricter carbon policies, and rising investor focus on ESG standards.

Industry Dynamics

- Global climate change concerns are accelerating emission reduction initiatives. Rising awareness of environmental risks and climate-related disasters is pushing organizations to adopt carbon footprint management solutions.

- International agreements and policies are enforcing stricter targets. Frameworks such as the Paris Agreement and carbon taxation laws are driving companies to monitor and reduce emissions, boosting demand for compliance solutions.

- AI-driven analytics platforms present strong opportunities. These tools enable real-time monitoring, predictive insights, and automated reporting, helping organizations meet ESG goals and optimize sustainability strategies.

- High implementation costs are restraining the market growth. Complex system integration, need for expertise, and significant upfront investments are limiting adoption among SMEs and in cost-sensitive markets.

Market Statistics

- 2024 Market Size: USD 11.17 Billion

- 2034 Projected Market Size: USD 26.23 Billion

- CAGR (2025–2034): 8.9%

- North America: Largest Market Share

AI Impact on Carbon Footprint Management Market

- AI enables precise carbon tracking by automatically analyzing complex operational data from sensors, IoT devices, and ERP systems to calculate emissions accurately.

- It identifies optimization opportunities, pinpointing inefficiencies in energy use, production, and logistics to recommend actionable, high-impact reduction strategies.

- AI powers predictive forecasting, modeling the impact of different reduction initiatives and future scenarios to guide strategic de-carbonization planning.

- It ensures automated compliance and reporting, streamlining the creation of auditable reports for evolving regulatory frameworks like carbon tax disclosures.

The carbon footprint management market comprises advanced software platforms, analytical tools, and consulting solutions designed to measure, monitor, and reduce greenhouse gas (GHG) emissions across diverse industries. Extensively deployed in manufacturing, energy, transportation, construction, and corporate enterprises, carbon footprint management solutions enable organizations to track emissions, optimize energy consumption, and implement sustainability strategies. Rising advancements in data analytics, AI integration, and cloud-based platforms are enhancing accuracy, scalability, and real-time reporting, supporting compliance with stringent environmental regulations and global climate initiatives. These solutions provide transparent reporting, streamlined carbon accounting, and actionable insights, contributing to operational efficiency, improved corporate sustainability performance, and accelerated progress toward net-zero goals.

Rising government regulations and the implementation of carbon taxation policies are driving the adoption of carbon footprint management solutions across industries. Regulatory authorities worldwide are enforcing stricter emission control frameworks, mandating transparent reporting, and introducing carbon pricing mechanisms to boost sustainable business practices. These policies are pushing organizations to invest in advanced carbon management platforms that help track, measure, and mitigate greenhouse gas (GHG) emissions. The growing focus on achieving national and international climate targets is accelerating the integration of such solutions in energy-intensive sectors including manufacturing, transportation, and utilities.

The increasing adoption of corporate ESG (Environmental, Social, and Governance) frameworks is further propelling the market growth. Companies across sectors are embedding ESG strategies into operations to enhance transparency, attract investors, and strengthen stakeholder confidence. According to a 2022 Harvard Business Review report, sustainability commitments are growing, with over 700 of the world’s 2,000 largest publicly traded companies pledging net-zero targets. Notably, 59 firms listed on the FTSE 100 committed to achieving net-zero emissions by 2050, highlighting a significant shift toward corporate climate accountability. Carbon footprint management solutions are crucial in enabling businesses to quantify and report sustainability performance, reduce environmental impact, and achieve long-term decarbonization goals. These initiatives highlight the growing need for corporate sustainability agendas with carbon management practices, fueling the market growth worldwide.

Drivers & Opportunities

Global Climate Change Concerns Accelerating Urgency for Emission Reduction Initiatives: Rising global climate change challenges are increasing the need for organizations and governments to adopt strict carbon footprint management solutions. Escalating levels of greenhouse gas (GHG) emissions fueled the urgency for emission monitoring and reduction strategies across industries. According to the International Monetary Fund (IMF), quarterly global GHG emissions increased by 2.5% in the first quarter of 2024, compared to a 0.6% increase in the fourth quarter of 2023, marking the largest quarterly increase since late 2022. This surge highlights the accelerating pressure on industries to implement carbon management systems that enable real-time tracking, accurate reporting, and effective mitigation strategies. The growing frequency of extreme weather events, rising public awareness, and investor scrutiny are further accelerating the adoption of emission management platforms worldwide.

International Agreements and Policies Driving Stricter Emission Targets: Rising global climate accords and policy frameworks are further accelerating the carbon footprint management market. International agreements such as the Paris Climate Accord and commitments under annual Conferences of the Parties (COP) are propelling countries to adopt stricter emission reduction targets and implement transparent reporting systems. According to The European Financial Review, a leading financial intelligence publication, Europe has emerged as the frontrunner in ESG adoption, with 93% of organizations identifying as active users. These policies are pushing enterprises across energy, transportation, and heavy industries to adopt digital carbon management platforms that ensure compliance with evolving regulatory requirements.

Segmental Insights

By Type

Based on type, the carbon footprint management market is segmented into basic tier, mid-tier, and enterprise tier solutions. The enterprise tier segment dominated the market in 2024, due to the large organizations adopting comprehensive platforms to track, report, and mitigate emissions across global operations. These advanced solutions integrate with ERP, supply chain, and energy management systems, enabling end-to-end visibility and compliance with stringent regulations.

The mid-tier segment is expected to grow at a steady pace, driven by increasing adoption among medium-sized enterprises seeking cost-effective yet scalable solutions that balance functionality with affordability. The basic tier segment continues to serve smaller businesses and startups that prioritize simplified reporting and monitoring capabilities, offering an entry point into carbon management practices as sustainability awareness expands.

By Deployment

Based on deployment, the carbon footprint management market is segmented into on-premise and cloud-based solutions. The on-premise segment held the largest share in 2024, fueled by strong adoption among large enterprises and highly regulated industries such as manufacturing, energy, and utilities. Organizations in these sectors prefer on-premise deployment due to greater control over sensitive environmental data, customized integration with existing enterprise systems, and compliance with stringent regulatory frameworks.

The cloud-based segment is projected to record the fastest growth during the forecast period, driven by its scalability, cost-effectiveness, and real-time monitoring capabilities. Cloud platforms enable enterprises of all sizes to track emissions, generate automated sustainability reports, and integrate advanced analytics for better decision-making without the need for heavy IT infrastructure investments. The growing shift toward digital sustainability platforms, coupled with rising adoption of ESG (Environmental, Social, and Governance) frameworks across industries, is fueling demand for cloud-based carbon footprint management.

By End-Use

Based on end-use, the carbon footprint management market is segmented into energy and utilities, manufacturing, transportation, IT and telecommunication, and residential and commercial buildings. Energy and utilities held the largest share in 2024, driven by the sector’s high emission intensity and growing focus on transitioning toward renewable energy sources. Regulatory mandates and carbon taxation policies are compelling utilities to adopt advanced monitoring systems to track Scope 1, 2, and 3 emissions more effectively.

The transportation sector is projected to record significant growth during the forecast period, propelled by global initiatives to decarbonize logistics, aviation, and automotive industries. Manufacturing remains a critical end-use, supported by the need to reduce industrial emissions and adopt low-carbon production practices. IT and telecommunication companies are increasingly investing in footprint management solutions to meet corporate ESG goals, reduce data center emissions, and meet investor-driven sustainability expectations.

Regional Analysis

North America accounted for a significant share of the carbon footprint management market in 2024, attributed to the strong regulatory frameworks and rapid corporate adoption of decarbonization strategies. The U.S. Environmental Protection Agency’s (EPA) Greenhouse Gas (GHG) Reporting Program is strengthening mandatory emission disclosures, compelling organizations to adopt advanced carbon accounting and reporting platforms. Growing emphasis on Environmental, Social, and Governance (ESG) performance metrics and accelerated net-zero commitments by Fortune 500 companies are driving investments in carbon management software and services. The region is witnessing increasing integration of AI- and cloud-based solutions to monitor and mitigate emissions across manufacturing, energy, and transport sectors.

U.S. Carbon Footprint Management Market Insights

The U.S. represents the largest market in North America, due to the rising renewable energy deployment and the expansion of decarbonization initiatives across industries. Large-scale projects in solar, wind, and hydrogen sectors are driving demand for precise carbon accounting solutions that ensure compliance with regulatory mandates and corporate climate goals. For instance, in August 2022, the U.S. federal government introduced the Inflation Reduction Act (IRA), allocating substantial tax credits and long-term financial incentives to accelerate renewable energy development over the next decade. This policy shift is propelling widespread adoption of carbon footprint management solutions among utilities, industrial manufacturers, and technology firms seeking to optimize reporting accuracy and meet stringent sustainability benchmarks.

Asia Pacific Carbon Footprint Management Market Outlook

Asia Pacific is projected to witness the fastest growth during the forecast period, propelled by national net-zero commitments from countries such as China, Japan, and South Korea. Rapid industrialization, urbanization, and surging energy consumption are driving the need for carbon management platforms to track, report, and mitigate emissions. Local enterprises and multinational corporations are actively investing in compliance-driven solutions to meet evolving sustainability regulations and global supply chain requirements. Increasing collaborations between governments, technology providers, and industry players are further shaping the carbon management landscape in the region.

India Carbon Footprint Management Market Trends

India is expected to emerge as a high-growth market within Asia Pacific, fueled by government-led initiatives, stricter carbon policies, and rising investor focus on ESG standards. In July 2024, the Indian government adopted detailed regulations for its compliance carbon market under the Carbon Credit Trading Scheme (CCTS). The new regulations outlined the design elements of the compliance mechanism, marking a crucial milestone in India’s carbon pricing framework. These developments are accelerating the adoption of carbon footprint management solutions by enterprises across energy, utilities, and industrial sectors, as companies prepare for mandatory carbon trading and reporting requirements.

Europe Carbon Footprint Management Market Dynamics

Europe held a significant market share in 2024, driven by ambitious climate policies and stringent compliance mandates. The European Green Deal and EU-wide carbon neutrality targets for 2050 are accelerating the integration of advanced carbon accounting platforms across industries. The expansion of the EU Emissions Trading System (EU ETS), along with sectoral emission caps, is compelling businesses to adopt comprehensive solutions for tracking, auditing, and reducing carbon footprints. Investments in smart city projects, green infrastructure, and electrification of transport across the region are further accelerating the demand for advanced carbon management tools. Vendors are increasingly collaborating with enterprises to provide customized solutions that ensure compliance with evolving EU sustainability regulations while supporting long-term decarbonization strategies.

Key Players & Competitive Analysis

The global carbon footprint management market is highly competitive, with leading players such as Accuvio Limited, Carbon Trust Advisory Limited, and Dakota Software Corporation driving innovation in sustainability reporting and emissions reduction technologies. Accuvio Limited specializes in cloud-based carbon and sustainability reporting platforms that enable enterprises to streamline compliance and ESG advisory disclosures. Carbon Trust Advisory Limited provides strategic consulting and verification services to help organizations meet decarbonization targets and improve climate resilience. Dakota Software Corporation leverages its expertise in EHS (environment, health, and safety) software to integrate carbon tracking and regulatory compliance tools into corporate sustainability workflows.

The market is expanding rapidly due to tightening global emission regulations, increasing investor scrutiny on ESG performance, and accelerating corporate net-zero commitments. Companies are developing advanced solutions that integrate real-time carbon accounting, predictive maintenance, and AI-driven sustainability insights. These platforms support compliance with regional frameworks such as the EU ETS, the US EPA’s GHG reporting, and India’s CCTS, helping enterprises optimize energy use, manage carbon offsets, and achieve transparency in supply chain emissions.

Prominent companies operating in the carbon footprint management market include Accuvio Limited, Carbon Trust Advisory Limited, Dakota Software Corporation, Ecova, Inc., Enablon S.A., ENGIE SA, Enviance, Inc., IBM Corporation, Intelex Technologies ULC, IsoMetrix South Africa (Pty) Ltd, Microsoft Corporation, ProcessMAP Corporation, SAP SE, Schneider Electric SE, and Wolters Kluwer N.V.

Key Players

- Accuvio Limited

- Carbon Trust Advisory Limited

- Dakota Software Corporation

- Ecova, Inc.

- Enablon S.A.

- ENGIE SA

- Enviance, Inc.

- IBM Corporation

- Intelex Technologies ULC

- IsoMetrix South Africa (Pty) Ltd

- Microsoft Corporation

- ProcessMAP Corporation

- SAP SE

- Schneider Electric SE

- Wolters Kluwer N.V.

Carbon Footprint Management Industry Developments

In June 2025, ePS Packaging partnered with Carbon Quota to embed its automated carbon calculator into ePS’s comprehensive software suite for the packaging and print industries, enabling data-driven sustainability and verifiable emission tracking in production processes.

In January 2025, the Stock Exchange of Thailand (SET), in collaboration with the Department of Climate Change and Environment (DCCE) and the Export-Import Bank (EXIM Bank), introduced “SET Carbon,” a carbon footprint management platform designed to strengthen Thailand’s carbon data management capabilities.

Carbon Footprint Management Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Basic Tier

- Mid-Tier

- Enterprise Tier

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On Premise

- Cloud

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Energy and Utilities

- Manufacturing

- Transportation

- IT and Telecommunication

- Residential and Commercial Buildings

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Footprint Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.17 Billion |

|

Market Size in 2025 |

USD 12.15 Billion |

|

Revenue Forecast by 2034 |

USD 26.23 Billion |

|

CAGR |

8.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.17 billion in 2024 and is projected to grow to USD 26.23 billion by 2034.

The global market is projected to register a CAGR of 8.9% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Accuvio Limited, Carbon Trust Advisory Limited, Dakota Software Corporation, Ecova, Inc., Enablon S.A., ENGIE SA, Enviance, Inc., IBM Corporation, Intelex Technologies ULC, IsoMetrix South Africa (Pty) Ltd, Microsoft Corporation, ProcessMAP Corporation, SAP SE, Schneider Electric SE, and Wolters Kluwer N.V.

The enterprise tier segment dominated the market revenue share in 2024, due to the large organizations adopting comprehensive platforms to track, report, and mitigate emissions across global operations.

The cloud segment is projected to witness the fastest growth during the forecast period, driven by its scalability, cost-effectiveness, and real-time monitoring capabilities.