Sterilization Services Market Size, Share, Trends, & Industry Analysis Report

: By Type (Contract Sterilization and Validation Services), By Method, By Mode of Delivery, By End Users, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5747

- Base Year: 2024

- Historical Data: 2020-2023

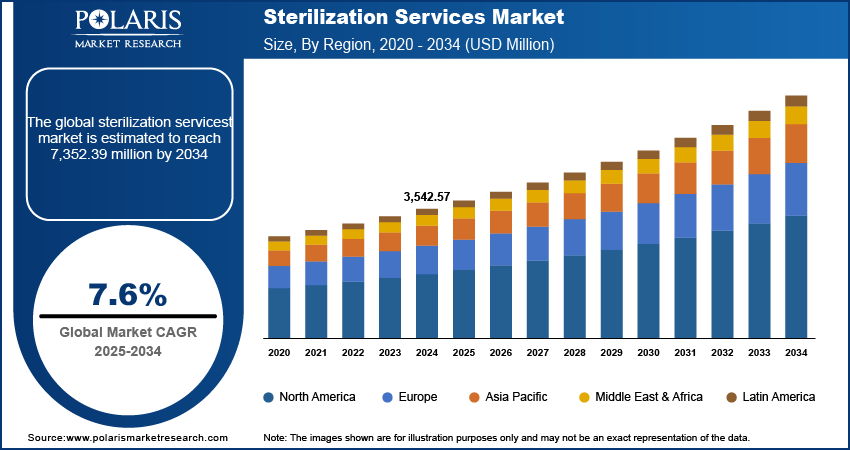

The sterilization services market size was valued at USD 3,542.57 million in 2024, exhibiting a CAGR of 7.6% during 2025–2034. The sterilization services market is driven by the rising incidence of hospital-acquired infections (HAIs), increasing surgical procedures, and heightened awareness of infection control, particularly post-COVID-19.

Market Overview:

The sterilization services market is defined by the provision of processes aimed at eliminating all forms of viable microorganisms from medical devices, pharmaceuticals, laboratory equipment, and other products requiring a sterile environment. These services are crucial in preventing infections and ensuring the safety and integrity of products across various industries, including healthcare, pharmaceuticals, and biotechnology. The services utilize a variety of methods, including ethylene oxide sterilization, gamma sterilization, electron-beam radiation sterilization, and steam sterilization, tailored to the specific requirements of the items being sterilized.

The increasing prevalence of hospital-acquired infections (HAIs) and other infectious diseases necessitates stringent sterilization practices in healthcare facilities. The rise in surgical procedures globally also contributes to the demand for effective sterilization services. Additionally, the increasing outsourcing of sterilization processes by pharmaceutical and medical device companies, seeking to reduce costs and focus on their core operations, fuels expansion. Stringent regulatory standards and growing awareness regarding environmental sanitization further propel the growth.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Increasing Prevalence of Hospital-Acquired Infections (HAIs)

Hospital-acquired infections (HAIs) are a significant driver for the sterilization services market. HAIs, infections contracted during healthcare delivery in a hospital or ambulatory setting, pose a serious risk to both healthcare workers and patients. According to the Centers for Disease Control and Prevention (CDC), on any given day, about 1 in 31 hospital patients has at least one healthcare-associated infection. The CDC's National and State Healthcare-Associated Infections Progress Report, updated on November 25, 2024, indicates that there were significant decreases observed for methicillin-resistant Staphylococcus aureus (MRSA) (16%), central line-associated bloodstream infections (CLABSI) (13%), C. difficile infection (CDI) (13%), CAUTI (11%), and ventilator-associated events (VAE) (5%) between 2022 and 2023. Also, the World Health Organization (WHO) indicates that in high-income countries, 7 out of every 100 patients acquire at least one healthcare-associated infection (HAI) during their hospital stay. This number is significantly higher in low- and middle-income countries, where 15 out of every 100 patients are affected. This persistent risk of HAIs and hospital-acquired infection therapeutics necessitates stringent sterilization practices in healthcare facilities, thereby driving the demand for effective sterilization services.

Rise in Surgical Procedures Globally

The increasing number of surgical procedures performed worldwide is another key driver. As surgical interventions often involve the use of instruments that come into direct contact with sterile tissues or mucous membranes, the risk of infection is considerable. The World Health Organization (WHO) notes that surgical care is an essential component of healthcare, with millions undergoing surgical treatment each year. WHO states that surgical interventions account for an estimated 13% of the world's total disability-adjusted life years (DALYs). The International Society of Aesthetic Plastic Surgery (ISAPS) reported that the total number of surgical and non-surgical aesthetic procedures increased by 3.4% in 2023, reaching 34.9 million, with surgical procedures showing a higher increase of 5.5%. This high volume of surgeries globally directly correlates with a greater demand for sterilization services to ensure patient safety and prevent post-operative infections, significantly impacting the growth.

Increasing Outsourcing of Sterilization Services

A notable trend in the sterilization services market is the increasing outsourcing of sterilization processes by medical device manufacturers and healthcare facilities to specialized service providers. This allows companies to focus on their core activities while benefiting from the expertise and cost efficiencies offered by these specialized providers. This is driven by the need for compliance with stringent regulatory requirements and the growing awareness of environmental sustainability, further propelling the growth forward.

Segmental Insights:

Market Assessment By Type

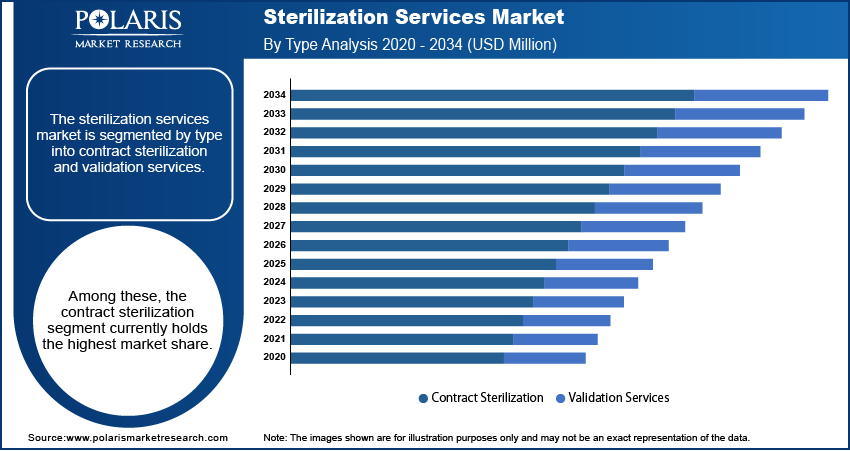

The market is segmented by type into contract sterilization and validation services. Among these, the contract sterilization segment currently holds the highest share. This dominance is primarily attributed to the increasing trend of outsourcing sterilization processes by medical device manufacturers, pharmaceutical companies, and healthcare facilities. By engaging specialized contract sterilization service providers, these entities can leverage the expertise, advanced technologies, and economies of scale offered, allowing them to focus on their core competencies while ensuring compliance with stringent regulatory standards. The convenience and cost-effectiveness associated with contract sterilization contribute significantly to its widespread adoption and substantial presence.

The validation services segment is anticipated to exhibit the highest growth rate. The escalating focus on quality control and regulatory compliance across the healthcare and life sciences industries fuels this growth. Validation services play a crucial role in verifying and documenting that sterilization processes consistently achieve the desired level of sterility. As regulatory bodies worldwide are increasingly emphasizing the need for robust validation procedures to ensure product safety and efficacy, the demand for these specialized services is expected to rise significantly. This heightened focus on compliance and the critical nature of validation in maintaining the integrity of sterile products are key factors driving the rapid expansion of this subsegment.

Market Evaluation By Method

The market is segmented by method into electron beam sterilization, ethylene oxide (EtO) sterilization, steam sterilization, gamma sterilization, x-ray sterilization, hydrogen peroxide sterilization, and others. Currently, the steam sterilization segment commands the largest share. This significant presence can be attributed to its widespread applicability, cost-effectiveness, and well-established history as a reliable sterilization method, particularly for heat- and moisture-stable medical devices and equipment. The versatility and efficiency of steam sterilization in processing large volumes of materials make it a preferred choice across various healthcare and research settings, solidifying its leading position.

The hydrogen peroxide sterilization segment is projected to experience the highest growth rate. The increasing adoption of low-temperature sterilization methods for heat-sensitive medical devices and the growing emphasis on faster turnaround times drive this rapid expansion. Hydrogen peroxide sterilization offers advantages such as shorter cycle times and lower residue compared to some other methods, making it increasingly attractive for sterilizing advanced medical instruments and electronics. The compatibility with a wide range of materials and the growing demand for efficient and gentle sterilization techniques are key factors fueling the high growth rate of the hydrogen peroxide sterilization segment.

Market Assessment By Mode of Delivery

The market is segmented by mode of delivery into off-site and on-site. Currently, the off-site sterilization segment accounts for the largest share. This dominance is primarily due to the benefits associated with outsourcing sterilization processes to specialized facilities. Off-site service providers offer economies of scale, advanced sterilization technologies, and expertise in regulatory compliance. This makes it a cost-effective and efficient solution for many medical device companies, pharmaceutical manufacturers, and healthcare institutions that prefer not to manage sterilization in-house. The convenience and comprehensive service offerings of off-site sterilization contribute significantly to its leading position.

The on-site sterilization segment is anticipated to exhibit the highest growth rate. This growth is being driven by the increasing need for immediate sterilization capabilities within healthcare facilities, particularly for critical and reusable medical devices. On-site sterilization allows for greater control over the sterilization process, reduces turnaround times, and minimizes the risk of contamination during transportation. The growing emphasis on infection control within hospitals and the need for efficient processing of surgical instruments are key factors contributing to the increasing adoption and high growth potential of the on-site sterilization segment.

Market Assessment By End Users

The market is segmented by end users into medical device companies, hospitals & clinics, pharmaceutical & biotechnology companies, and others. Currently, the hospitals & clinics segment represents the largest share. This significant presence is primarily driven by the high volume of surgical procedures, the increasing prevalence of hospital-acquired infections, and the stringent need to maintain sterile environments for patient safety. The continuous demand for disinfection and sterilization equipment for surgical instruments, medical equipment, and other supplies within healthcare facilities makes hospitals and clinics the dominant end-user segment.

The pharmaceutical & biotechnology companies segment is expected to demonstrate the highest growth rate. This rapid growth is fueled by the increasing production of pharmaceutical drugs and biopharmaceuticals, which require sterile manufacturing environments and sterile packaging to ensure product safety and efficacy. The stringent regulatory requirements governing the pharmaceutical and biotechnology industries, coupled with the growing complexity of biological products, are driving a greater demand for specialized sterilization services. This heightened focus on sterility testing and assurance in the life sciences sector is a key factor propelling the strong growth of this end-user segment.

Regional Analysis

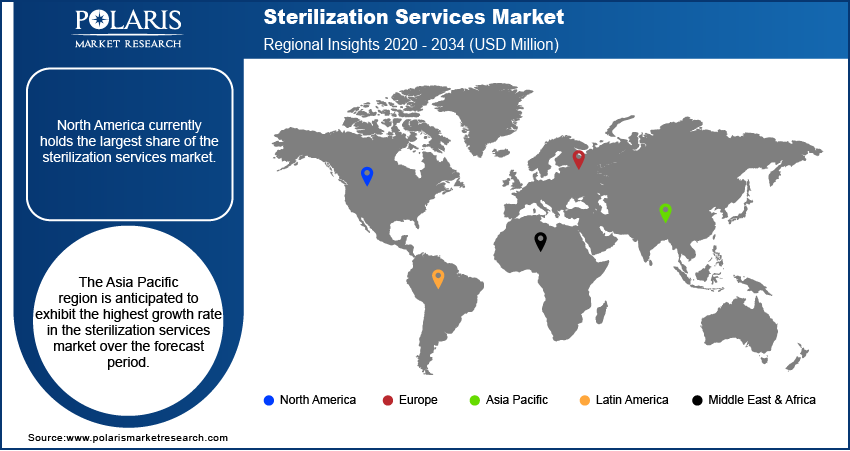

The North America sterilization services market currently holds the largest share. This dominance is primarily attributed to the region's sophisticated healthcare system, the presence of major medical device manufacturers and pharmaceutical companies, and stringent regulations regarding sterilization practices. The high volume of surgical procedures performed annually, coupled with a strong emphasis on preventing hospital-acquired infections, contributes significantly to the large demand in this region. Furthermore, the well-established practice of outsourcing sterilization services to specialized providers further bolsters the share of North America.

The Asia Pacific sterilization services market is anticipated to exhibit the highest growth rate over the forecast period. This rapid development is driven by a confluence of factors, including increasing healthcare expenditure, a growing and aging population, and a rising number of hospitals and clinics, particularly in developing economies within the region. Furthermore, increasing awareness regarding infection control and the adoption of advanced medical technologies are fueling the demand for sterilization services. The growing medical tourism industry and the increasing focus on local manufacturing of medical devices are also contributing to the significant potential and high growth trajectory of the Asia Pacific region.

Key Players and Competitive Insights

The major players in the sterilization services market include STERIS plc, Sotera Health Company (which includes Sterigenics U.S., LLC), E-BEAM Services, Inc., BGS Beta-Gamma-Service GmbH & Co. KG, Medistri SA, MMM Group, Noxilizer, Inc., B. Braun Medical Ltd., Cantel Medical Corporation (part of STERIS), and Fortive Corporation. These companies offer a range of sterilization methods and services to various end-user segments within the healthcare and life sciences industries.

The competitive landscape is characterized by a mix of global and regional players, all striving to enhance their penetration and service offerings. Competition is driven by factors such as service quality, technological innovation, geographical reach, and the ability to meet stringent regulatory requirements. Companies are increasingly focusing on expanding their service portfolios to include a variety of sterilization methods and value-added services like validation and testing. Strategic collaborations, partnerships, and expansions of facilities are common approaches adopted by these players to strengthen their position and cater to the growing demand trends.

List of Key Companies in Sterilization Services Industry:

- B. Braun Medical Ltd.

- BGS Beta-Gamma-Service GmbH & Co. KG

- Cantel Medical Corporation (part of STERIS)

- E-BEAM Services, Inc.

- Fortive Corporation (Advanced Sterilization Products - ASP)

- Medistri SA

- MMM Group

- Noxilizer, Inc.

- Sotera Health Company (Sterigenics U.S., LLC)

- STERIS plc

Sterilization Services Industry Developments

- July 2024: STERIS plc (Ireland) inaugurated a new ethylene oxide facility in Singapore to bolster medical device production.

- June 2024: Servizi Italia S.p.A (Italy) merged with Ekolav S.r.l (Italy) to improve production synergies and reduce overall structural costs.

Sterilization Services Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Contract Sterilization

- Validation Services

By Method Outlook (Revenue – USD Million, 2020–2034)

- Electron beam Sterilization

- Ethylene Oxide (EtO) Sterilization

- Steam Sterilization

- Gamma Sterilization

- X-Ray Sterilization

- Hydrogen Peroxide Sterilization

- Others

By Mode of Delivery Outlook (Revenue – USD Million, 2020–2034)

- Off-Site

- On-Site

By End Users Outlook (Revenue – USD Million, 2020–2034)

- Medical Device Companies

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Sterilization Services Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,542.57 million |

|

Market Size Value in 2025 |

USD 3,802.95 million |

|

Revenue Forecast by 2034 |

USD 7,352.39 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The sterilization services market has been segmented into detailed segments of type, method, mode of delivery, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Companies are increasingly focusing on strategic initiatives to drive growth and expand their penetration. A key marketing strategy involves highlighting the critical role of sterilization in preventing healthcare-associated infections and ensuring product safety across various industries. Emphasizing compliance with stringent regulatory standards and offering customized sterilization solutions tailored to specific client needs are also crucial. Furthermore, many players are investing in technological advancements and expanding their geographical reach to cater to a wider customer base. Building strong relationships with medical device manufacturers, pharmaceutical companies, and healthcare providers through effective communication and demonstrating reliability are essential for sustained growth. Additionally, showcasing environmental sustainability practices in their sterilization processes is becoming a significant differentiator in their marketing efforts.

FAQ's

The global market size was valued at USD 3,542.57 million in 2024 and is projected to grow to USD 7,352.39 million by 2034.

The market is projected to register a CAGR of 7.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

The major players include STERIS plc, Sotera Health Company (which includes Sterigenics U.S., LLC), E-BEAM Services, Inc., BGS Beta-Gamma-Service GmbH & Co. KG, Medistri SA, MMM Group, Noxilizer, Inc., B. Braun Medical Ltd., Cantel Medical Corporation (part of STERIS), and Fortive Corporation.

The contract sterilization segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Increasing Outsourcing: A significant trend is the growing preference for outsourcing sterilization processes to specialized contract sterilization service providers by hospitals, clinics, medical device companies, and pharmaceutical & biotechnology companies to achieve cost efficiency and focus on core operations. ? Stringent Regulatory Focus: Heightened emphasis on adherence to stringent regulatory standards and quality control in sterilization processes is driving the demand for validation services and advanced sterilization methods.

Sterilization services encompass a range of procedures aimed at eliminating all forms of viable microorganisms, including bacteria, viruses, fungi, and spores, from medical devices, pharmaceuticals, laboratory equipment, and other products. These services are essential for preventing infections and ensuring the safety and integrity of products across various industries such as healthcare, pharmaceuticals, and biotechnology. Sterilization can be achieved through various methods, including physical means like heat (steam sterilization, dry heat), radiation (gamma, electron beam), and filtration, as well as chemical methods using gases (ethylene oxide, hydrogen peroxide vapor) and liquids. The choice of sterilization method depends on the nature of the item being sterilized and the required level of sterility assurance.