Disinfection and Sterilization Equipment Market Size, Share, Trends, & Industry Analysis Report

By Methods (Physical Method, Chemical Method, Mechanical Method), By Products & Services, By End Use, By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM1313

- Base Year: 2024

- Historical Data: 2020-2023

Overview

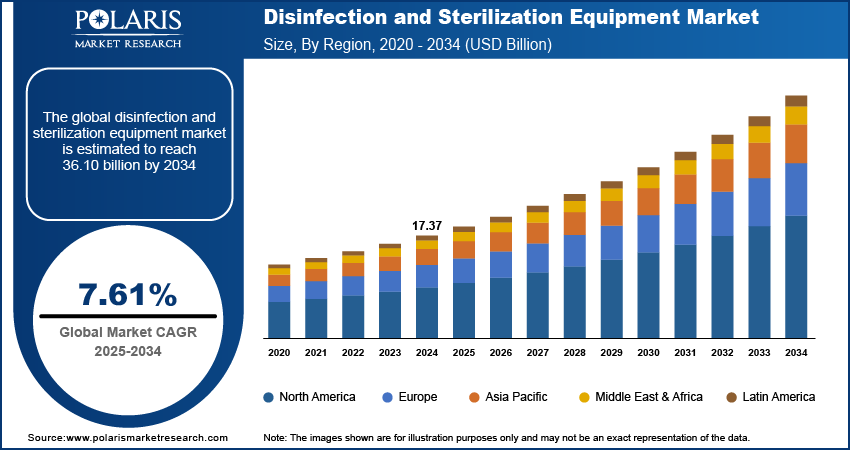

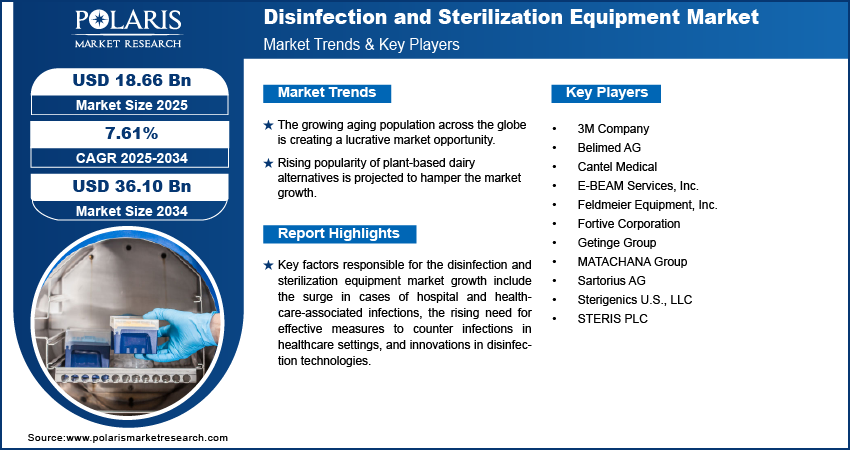

The global disinfection and sterilization equipment market size was valued at USD 17.37 billion in 2024. The market is projected to grow at a CAGR of 7.61% during 2025 to 2034. Key factors driving demand for disinfection and sterilization equipment include a growing elderly population, rising incidence of healthcare-associated infections (HAIs), and increased surgical procedures globally.

Key Insights

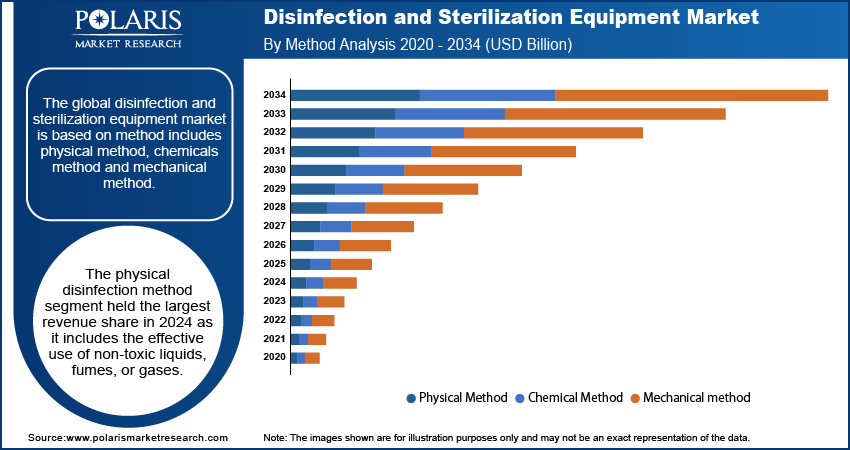

- The physical disinfection method segment held the largest revenue share in 2024 as it includes the effective use of non-toxic liquids, fumes, or gases.

- The hospitals and clinics segment accounted for a major revenue share in 2024. This is attributed to the rising rate of HAIs.

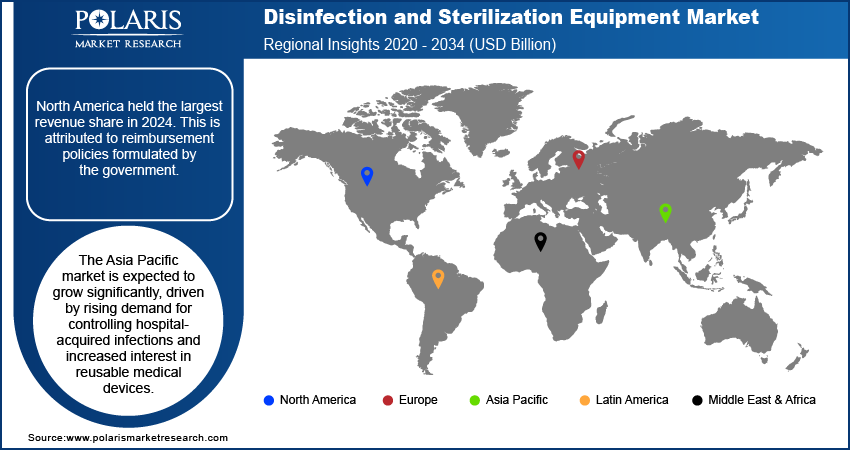

- North America held the largest revenue share in the global market, due to reimbursement policies formulated by the government.

- The market in the Asia Pacific region is projected to grow at a rapid pace, owing to the rising requirement for controlling medical clinic-acquired contaminations.

Industry Dynamics

- The rising numbers of HAIs (Hospital-acquired Infections) and HCAIs (healthcare-acquired infections) are leading to market growth.

- The rise in the number of surgeries in medical facilities is further increasing the demand for disinfection and sterilization equipment.

- The growing aging population across the globe is creating a lucrative market opportunity.

- Rising popularity of plant-based dairy alternatives is projected to hamper the market growth.

- Disinfection and sterilization equipment may damage heat-sensitive materials, which may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 17.37 Billion

- 2034 Projected Market Size: USD 36.10 Billion

- CAGR (2025-2034): 7.61%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Disinfection and Sterilization Equipment Market

- AI helps in tracking sterilization processes.

- AI predicts equipment failures and minimizes downtime.

- AI adjusts sterilization parameters for different materials.

Key factors responsible for the disinfection and sterilization equipment market growth include the surge in cases of hospital and healthcare-associated infections, the rising need for effective measures to counter infections in healthcare settings, and innovations in disinfection technologies. Moreover, the rise in the number of surgeries in medical facilities is one of the main considerations adding to showcase the disinfection and sterilization equipment market development. As per the CDC, each year, up to 1.7 Mn hospitalized in-patients in the U.S acquire healthcare-associated infections, and more than 98,000 of such people (1 out of 17) die by acquiring HCAIs. Furthermore, 32% of all hospital-acquired infections (HAIs) in the nation are urinary tract contaminations, 22% are surgical-site infections, 15% are lung (pneumonia) diseases, and 14% are circulation system contaminations; these are some of the factors responsible for the adoption of effective disinfection equipment for the reduction of worldwide infection cases.

The COVID-19 outbreak took the disinfection equipment market to another level. There was an immense and steady demand for effectively sterilized cutting-edge medical care systems and infrastructure for treating the covid-19 infected patients in the hospitals and clinics. To satisfy this rising need all around the world, many organizations have approached to fulfil the demand and produce manageable products like masks and PPE kits to decrease the spread of COVID-19.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising numbers of HAIs (Hospital-acquired Infections) and HCAIs (healthcare-acquired infections) because of the unavailability of proper disinfection measures are one of the key components expected to impel disinfection and sterilization equipment market development during the forecast period. Proper disinfection is expected for the various equipment utilized in the hospitals and clinics as they help in reducing the chances of contamination spread. The rising pervasiveness of chronic conditions has fundamentally expanded the hospital admission rate. This is propelled the hospitals to purchase disinfection and sterilization equipment.

Report Segmentation

The market is primarily segmented based on method, products and services, end-use, and region.

|

By Method |

By Products and Services |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Physical Disinfection Method Held the Largest Market Share in 2024

The physical disinfection method hedl the largest revenue share in 2024. This method includes the effective use of non-toxic liquids, fumes, or gases, and it is considered one of the modest, fast, and compelling sterilization methods for killing and eliminating possibly all types of microorganisms and spores. Hospitals and clinics majorly utilized this method to sterile the clinical equipment and instruments, like surgical blades and scissors. Dental specialists additionally regularly utilized this disinfection method to clean their dental surgical equipment.

Hospitals & Clinics Sector Accounted for a Major Revenue Share in 2024

Based on the end use, the hospitals and clinics segment accounted for the major revenue share in 2024, due to the rising rate of HAIs, the increasing number of hospitals and clinics in Asian nations, the rising number of surgeries performed every year, and the rising government initiatives to diagnose HAIs.

The municipal segment in the market and is supposed to maintain steady growth during the forecast period, owing to the introduction of various advanced technologies for the treatment of drinking water and sewage water in developed economies. Metropolitan treatment plants have expanded their inclination towards advanced water treatment technology over traditional technologies since they are more productive and safe for the ecosystem.

North America Dominated the Revenue Share in 2024

North America held the largest revenue share in 2024. This is attributed to reimbursement policies formulated by the government. Several administrative strategies in regards to the delivery of safe and quality medical care services, for example, the presence of the Patient Protection and Affordable Care Act, additionally commanded the utilization of sterilization equipment in clinics and facilities. The high incidence of chronic diseases, along with growing aging population in the region contributed to the regional dominance.

The market in the Asia Pacific region is supposed to observe an impressive development rate due to the factors like the rising requirement for controlling medical clinic-acquired contaminations and developing interest in non-dispensable clinical gadgets. The government is in the region making continuous efforts to increase awareness about cleanliness in hospitals and clinics, which is leading to market gorwth. The growing government healthcare spending and development of new hospital facilities is further projected to propel the market growth.

Competitive Insight

The key market players continually participate in different formative systems like association, coordinated efforts, new item dispatches, and acquisitions to reinforce their market position and gain market share. Players operating in the market are expanding their presence to capture market share and win people trust. The growing healthcare spending by people and governments across the globe is fuether leading to enhanced competition. Some of the major players operating the disinfection and sterilization equipment market include STERIS PLC; Sterigenics; Cantel Medical; E-BEAM Services; Fortive, Getinge, MATACHANA, Feldmeier Equipment, 3M Company, Sartorius, Belimed, Fortive Corp, Boekel Scientific, others.

Key Developments

- In June 2021, STERIS gained Cantel, through a US subsidiary to enhance its vast portfolio of cleansing instruments and services.

- In October 2020, Getinge introduced “Solsus 66 steam sanitizer” for the medical clinics with expanded limit and the operational reliability.

- In August 2021, Aurabeat introduced anti- of COVID class 2 device for SARS-COV-2 disinfection, in India.

- In February 2021, Xech introduced stethoscope sanitizer, “Xech Sterostet”, in India.

- In April 2020, FDA endorsed the utilization of Steris V-PRO 1 Plus, and maX low-temperature cleansing frameworks for purification of around 750,000 N95 respirators and comparative covers every day in clinics utilized for treating COVID-19 patients. This might expand the altruism of the organization.

Disinfection And Sterilization Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.37 billion |

| Market size value in 2025 | USD 18.66 billion |

|

Revenue forecast in 2034 |

USD 36.10 billion |

|

CAGR |

7.61% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

STERIS PLC; Sterigenics., LLC; Cantel Medical; E-BEAM Services, Inc., Getinge Group, MATACHANA Group, Feldmeier Equipment, Inc., 3M Company Group, Sartorius AG, Belimed AG, Fortive Corporation, others. |

FAQ's

• The global market size was valued at USD 17.37 billion in 2024 and is projected to grow to USD 36.10 billion by 2034.

• The global market is projected to register a CAGR of 7.61% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are STERIS PLC; Sterigenics., LLC; Cantel Medical; E-BEAM Services, Inc., Getinge Group, MATACHANA Group, Feldmeier Equipment, Inc., 3M Company Group, Sartorius AG, Belimed AG, Fortive Corporation, and Others.

• The physical method segment dominated the market revenue share in 2024.