India Orthobiologics Market Size, Share, Trends, & Industry Analysis Report

: By Application (Spinal Surgery, Trauma Repair, and Reconstructive Surgery), By Product, and By End Use– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5745

- Base Year: 2024

- Historical Data: 2020-2023

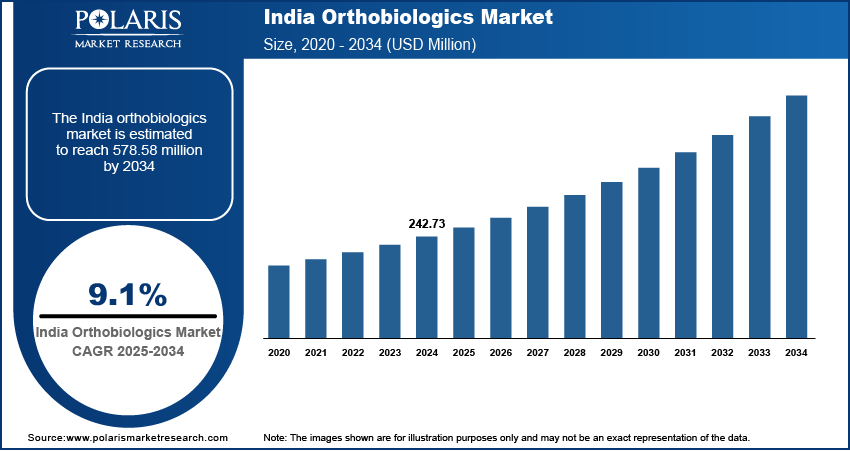

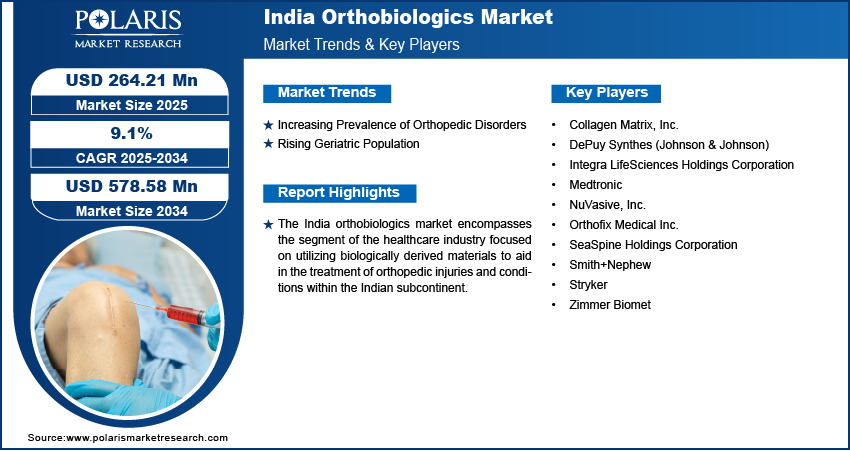

The India orthobiologics market size was valued at USD 242.73 million in 2024, exhibiting a CAGR of 9.1% during 2025–2034.

The India orthobiologics market is primarily driven by the increasing prevalence of musculoskeletal disorders, a rapidly aging population, and the growing adoption of regenerative treatments like stem cell therapy and platelet-rich plasma (PRP).

Market Overview

The India orthobiologics market involves the use of biological substances to aid in the healing of musculoskeletal injuries. These substances, derived from materials naturally found in the body, are used to improve the recovery of fractured bones and injured muscles, tendons, and ligaments. Orthobiologics includes products like bone grafts, bone growth stimulators, cartilage repair solutions, soft tissue biologics, and viscosupplementation. The total number of orthobiologic procedures performed in India was 580,964 in 2022. This field represents a growing segment within the broader orthopedic market, offering less invasive and more natural treatment options compared to traditional methods.

To Understand More About this Research: Request a Free Sample Report

The increasing prevalence of orthopedic disorders, sports injuries, and road accidents contribute to a higher demand for ortho-biologic solutions. The rising geriatric population and the growing awareness of these treatments further fuel expansion. Additionally, the preference for minimally invasive surgeries, which orthobiologics often facilitate, is a significant driver. The continuous advancements in regenerative medicine and stem cell therapies also present lucrative opportunities for growth.

Industry Dynamics

Increasing Prevalence of Orthopedic Disorders

The rising occurrence of orthopedic disorders in India is significantly increasing during the forecast period. Musculoskeletal disorders are a major contributor to disability, and their prevalence is substantial across various occupational groups in India. A systematic review and meta-analysis published in the Journal of Occupational Health in 2024 estimated the pooled prevalence of work-related musculoskeletal disorders at 76%. This high prevalence indicates a large population suffering from conditions that could benefit from orthobiologic treatments aimed at tissue repair and regeneration. As the burden of these disorders continues to grow due to factors like sedentary lifestyles and occupational hazards, the demand for effective and minimally invasive solutions like orthobiologics is expected to increase significantly, thereby driving the growth.

Growing Number of Road Accidents and Sports-Related Injuries

The increasing incidence of road accidents and sports-related injuries across India is another key factor propelling the growth. According to the Ministry of Road Transport and Highways, a total of 461,312 road accidents occurred in India in 2022, resulting in 443,366 injuries. These accidents often lead to fractures, ligament tears, and other musculoskeletal traumas that require advanced healing solutions. Similarly, sports injuries are also on the rise, particularly among children, due to increased participation without adequate training and safety measures, as reported by the Times of India in January 2025. Common sports injuries include joint sprains, muscle strains, and ligament tears. The need for effective treatments to facilitate quicker and better recovery from these injuries is driving the demand for orthobiologics, which offer regenerative properties.

Rising Geriatric Population

The expanding geriatric population in India is a substantial driver for the orthobiologics market. The "Elderly in India 2021" report by the National Statistical Office highlights that the elderly population (aged 60 years and above) is steadily increasing due to improved healthcare and economic well-being. It was estimated that there would be nearly 138 million elderly persons in India in 2021. This demographic shift leads to a higher prevalence of age-related orthopedic conditions such as osteoarthritis and degenerative joint diseases. Orthobiologic treatments like viscosupplementation and cartilage repair solutions are increasingly being adopted to manage these conditions, offering pain relief and improved joint function. As the geriatric population continues to grow, the demand for orthobiologics to address their specific needs will also rise, thereby acting as a significant growth factor.

Segmental Insights

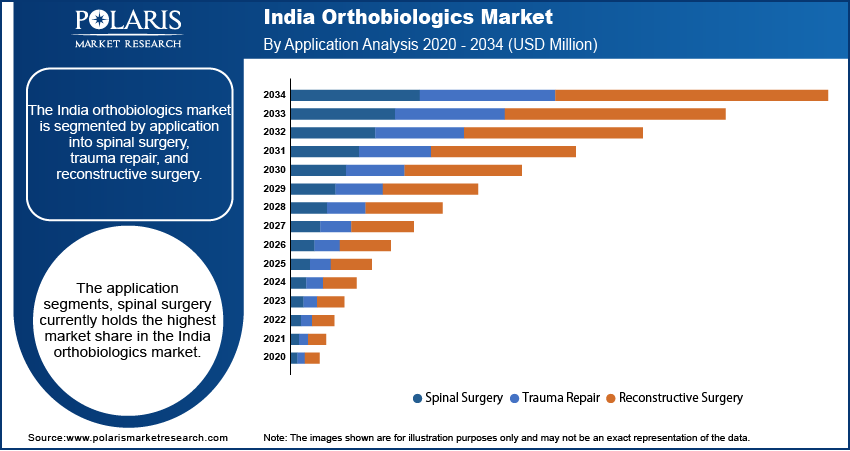

Market Assessment By Application

The market is segmented by application into spinal surgery, trauma repair, and reconstructive surgery. The application segments, spinal surgery currently holds the highest share. The increasing number of spinal procedures performed to address degenerative conditions, trauma, and deformities contributes significantly to the substantial demand within this subsegment. Factors such as the aging population and the rising adoption of advanced surgical techniques for spinal ailments are likely to maintain the dominant position of the spinal surgery segment in terms of share.

The trauma repair segment is anticipated to exhibit the highest growth rate. The rising incidence of road accidents and sports-related injuries across the country is leading to a greater need for effective solutions in trauma cases. Orthobiologics play a crucial role in accelerating the healing process and improving outcomes in fracture management and soft tissue injuries resulting from trauma. As the awareness and adoption of orthobiologic products in trauma care increase, this segment is poised for the fastest expansion.

Market Evaluation By Product

The market is segmented by product into demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation, synthetic bone substitutes, and stem cell therapy. Among the product segments, the allograft segment currently commands the largest share. Allografts, which are bone tissues sourced from human donors, are widely utilized in various orthopedic procedures due to their osteoconductive and osteoinductive properties, making them a preferred choice for bone grafting applications. The established use and availability of allografts contribute to their significant presence.

The stem cell therapy segment is expected to demonstrate the highest growth rate. The increasing focus on regenerative sports medicine and the promising clinical outcomes associated with stem cell-based therapies for musculoskeletal conditions are driving rapid adoption in India. Continuous advancements in research and development, along with a growing interest in innovative treatment modalities, position stem cell therapy as a high-potential segment for future expansion.

Market Evaluation By End Use

The market is segmented by end-use into hospitals and clinics. The hospital segment accounts for the largest share. This is attributable to the high volume of orthopedic surgeries and procedures performed in hospital settings across the country. Hospitals possess the necessary infrastructure, advanced medical equipment, and skilled healthcare professionals required for administering a wide range of orthobiologic treatments. Consequently, the significant patient footfall for orthopedic care in hospitals solidifies their dominant position in terms of share.

The clinics segment is anticipated to experience the highest growth rate. The increasing preference for specialized orthopedic clinics offering focused care and the rising number of these facilities, particularly in urban and semi-urban areas, are contributing to this growth. Clinics often provide more accessible and potentially cost-effective treatment options for certain orthopedic conditions, including the application of various orthobiologic products. This growing accessibility and patient preference are expected to drive the fastest expansion in the clinic's segment.

Key Players and Competitive Insights

The major players active in the India orthobiologics market include DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Medtronic, Smith+Nephew, Orthofix Medical Inc., NuVasive, Inc., SeaSpine Holdings Corporation, Integra LifeSciences Holdings Corporation, and Collagen Matrix, Inc. These companies offer a range of orthobiologic products, including bone grafts, bone substitutes, growth factors, cell-based therapies, and viscosupplements, catering to the diverse needs of the market.

The competitive landscape is characterized by the presence of both multinational corporations and domestic players. Competition is driven by product innovation, the breadth of product portfolios, pricing strategies, and the strength of distribution networks. Key competitive factors include the development of advanced biomaterials, the introduction of minimally invasive treatment options, and strategic collaborations with healthcare providers. Market penetration strategies often involve focusing on key metropolitan areas and gradually expanding into tier-II and tier-III cities to capture the growing demand trends across different regions in India. Market entry assessments for new players would need to consider these established dynamics and the increasing potential.

List of Key Companies in India Orthobiologics Industry

- Collagen Matrix, Inc. (Regenity)

- DePuy Synthes (Johnson & Johnson)

- Integra LifeSciences Holdings Corporation

- Medtronic

- NuVasive, Inc.

- Orthofix Medical Inc.

- SeaSpine Holdings Corporation

- Smith+Nephew

- Stryker

- Zimmer Biomet

India Orthobiologics Industry Developments

- April 2025: Zimmer Biomet announced the completion of its acquisition of Paragon 28, Inc., a company specializing in foot and ankle orthopedic solutions.

- March 2025: Johnson & Johnson MedTech, which includes DePuy Synthes, highlighted its latest advancements in digital orthopaedics at the American Academy of Orthopaedic Surgeons (AAOS) 2025 Annual Meeting. This showcase included cutting-edge implants, advanced techniques, and data-driven technologies across various orthopedic specialties, such as joint reconstruction, trauma, and spine.

India Orthobiologics Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Spinal Surgery

- Trauma Repair

- Reconstructive Surgery

By Product Outlook (Revenue – USD Million, 2020–2034)

- Demineralized Bone Matrix(DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation

- Synthetic Bone Substitutes

- Stem Cell Therapy

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Clinics

India Orthobiologics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 242.73 million |

|

Market Size Value in 2025 |

USD 264.21 million |

|

Revenue Forecast by 2034 |

USD 578.58 million |

|

CAGR |

9.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The India orthobiologics market has been segmented into detailed segments of application, product, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A successful growth strategy would involve a multi-pronged approach. Increasing market penetration in tier-II and tier-III cities, beyond the major metropolitan areas, can tap into a significant underserved patient base. Collaborations with local hospitals and clinics to enhance product accessibility and build trust are crucial. Raising awareness among healthcare professionals through continuous medical education programs about the benefits and applications of orthobiologics will drive adoption. Furthermore, tailoring product offerings to meet the specific needs and economic considerations of the Indian market, along with strategic partnerships for distribution, will be essential for sustainable market development and capturing the growing demand trends. Exploring opportunities in medical tourism could also provide an additional avenue for market growth.

FAQ's

The market size was valued at USD 242.73 million in 2024 and is projected to grow to USD 578.58 million by 2034.

The market is projected to register a CAGR of 9.1% during the forecast period, 2024-2034.

The major players include DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Medtronic, Smith+Nephew, Orthofix Medical Inc., NuVasive, Inc., SeaSpine Holdings Corporation, Integra LifeSciences Holdings Corporation, and Collagen Matrix, Inc.

The spinal surgery segment accounted for the largest share of the market in 2024.

Following are some of the trends: ? Increasing Adoption of Minimally Invasive Procedures: There is a growing preference among both patients and healthcare professionals for minimally invasive surgical techniques. ? Rising Geriatric Population and Prevalence of Orthopedic Disorders: With an aging population in India, the incidence of age-related orthopedic conditions like osteoarthritis and osteoporosis is increasing.

Orthobiologics refers to the use of biologically derived materials to treat orthopedic conditions and injuries. These treatments aim to enhance the body's natural healing processes for musculoskeletal issues, including bone fractures, soft tissue damage (tendons, ligaments, muscles), and degenerative conditions like osteoarthritis. Orthobiologics includes a range of products such as bone and vascular grafts, growth factors, cell-based therapies like stem cells and platelet-rich plasma (PRP), and viscosupplementation products.