Medical Packaging Films Market Share, Size, Trends, Industry Analysis Report

By Type (Metallized Films, Thermoformable Films, High Barrier Films, Others); By Material; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4370

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

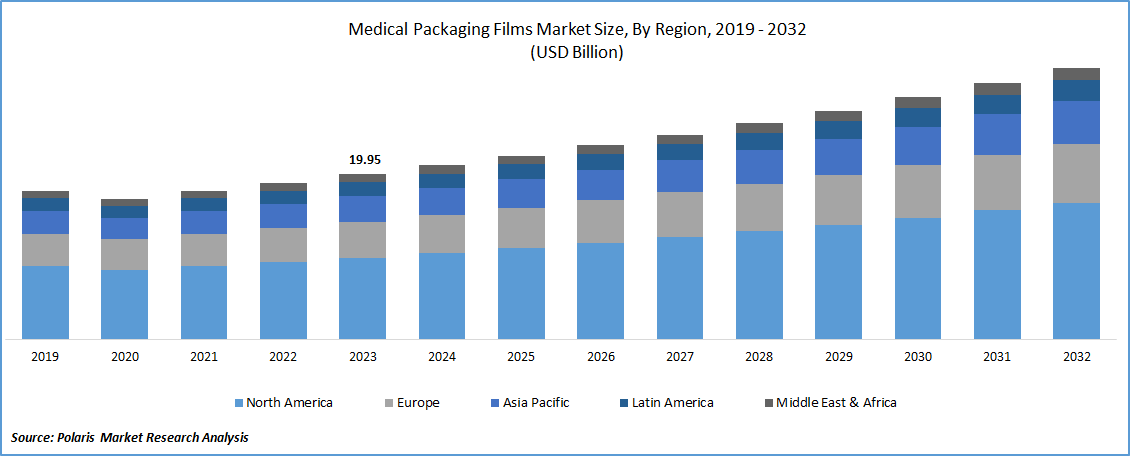

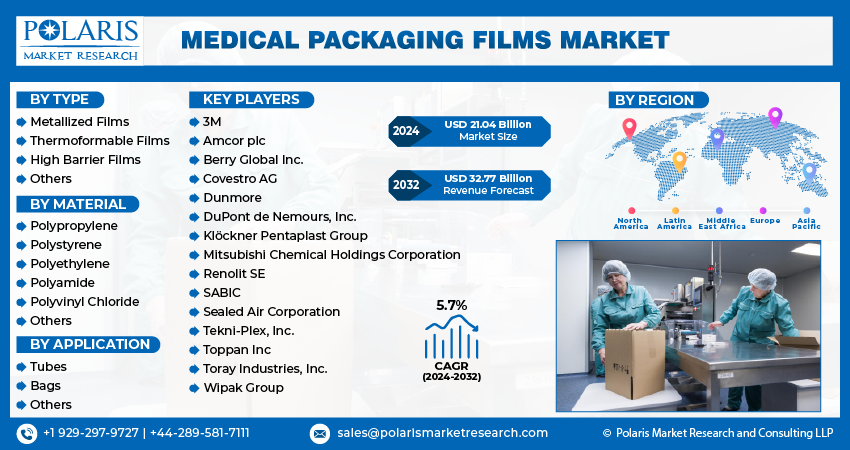

The global medical packaging films market was valued at USD 19.95 billion in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period.

Revolutionizing healthcare packaging, technological innovations in medical packaging films are reshaping industry standards. Smart packaging technologies, anti-counterfeiting features like holographic labels, and nanotechnology applications for enhanced barrier properties stand out. Biodegradable materials align with sustainability goals, while active packaging solutions offer functions like oxygen scavenging. Printed electronics enable real-time information on temperature and expiration status. Advanced coating technologies and modified atmosphere packaging enhance film properties, ensuring product integrity. Innovative sterilization packaging, user-friendly designs, and augmented reality integration further elevate the field. These advancements collectively address evolving challenges, ensuring safer, more efficient packaging for medical products.

In addition, companies operating in the market are adopting acquisition as a strategy to strengthen market presence.

To Understand More About this Research: Request a Free Sample Report

- For instance, in July 2023, Oliver Healthcare Packaging completed the acquisition of EK-Pack Folien, a German-based manufacturer specializing in film and foil technology. This strategic move is geared towards enhancing control over the supply chain and fostering innovation in the development of new products, aligning with the dynamic requirements of customers.

Advanced material innovations stand out, creating prospects for materials that elevate the performance and sustainability of medical packaging films. The demand for customized packaging solutions tailored to specific medical products presents a significant avenue for innovation and market expansion. The burgeoning biopharmaceuticals sector offers opportunities to develop packaging films catering to the unique requirements of biologics and specialized medications. The surge in e-commerce within the healthcare sector opens doors for packaging films, ensuring safe and efficient product delivery directly to consumers. Sustainability trends provide an opportunity to develop eco-friendly and recyclable medical packaging films. Smart packaging technologies, global market expansion, and the rise of telemedicine create additional openings for innovative solutions. Companies offering regulatory compliance expertise and those addressing infection control challenges have distinct opportunities.

Industry Dynamics

Growth Drivers

Growing healthcare industry and technological innovations in packaging materials

The expanding healthcare industry, propelled by factors like population growth, an aging demographic, and rising healthcare needs, is a key driver for the growth of the medical packaging film market. There is greater demand for advanced medical packaging films crucial for ensuring the safety, sterility, and efficacy of a diverse range of medical products. As the global healthcare sector continues to burgeon, the market for medical packaging films experiences a significant surge. This underscores the vital role these films play in meeting the evolving demands of an expanding healthcare landscape, becoming integral components in ensuring the integrity of medical products.

Technological strides in medical packaging films are transforming healthcare. From smart packaging and anti-counterfeiting measures to biodegradable materials and printed electronics, these innovations enhance safety and sustainability. Advanced coatings, sterilization solutions, and user-friendly designs further optimize packaging efficiency, ensuring secure and user-centric medical product delivery.

Report Segmentation

The market is primarily segmented based on type, material, application, and region.

|

By Type |

By Material |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The thermoformable films segment accounted for a significant market share in 2023.

In 2023, the thermoformable films segment accounted for a significant market share. Thermoformable medical packaging films are designed for shaping through heat, creating custom-fitted packaging for healthcare products. These films easily mold to complex shapes, ensuring a snug fit around medical device. Offering versatility in design, they allow for the creation of trays and blisters tailored to specific product needs. The thermoforming process enhances protection, which is crucial for delicate medical devices during handling and transportation. These films can possess barrier properties, resisting moisture and contaminants while also being compatible with sterilization methods. Thermoformable films are often made from various materials, meeting regulatory standards for safety and quality in medical packaging.

By Material Analysis

The polyethylene segment accounted a significant market share in 2023.

In 2023, the polyethylene segment accounted for a significant market share. Polyethylene medical packaging films serve as sterile barriers for medical instruments, devices, and pharmaceuticals. These films play an essential role in packaging hospital supplies, surgical drapes, wound care products, and diagnostic kits. They contribute to maintaining sterility in biomedical research samples and laboratory equipment. Additionally, polyethylene films are crucial in packaging veterinary medicines, disposable medical products, and pharmaceutical samples, protecting contents from contamination.

By Application Analysis

The bags segment accounted for the largest market share in 2023.

The bags segment accounted for the largest market share in 2023. These bags offer crucial roles in preserving sterility, shielding against contaminants, and upholding the integrity of medical supplies. These films act as formidable barriers, protecting contents from microorganisms, moisture, light, and gases. Bags derived from these films offer transparency, facilitating visual inspections while maintaining sterility. Engineered to endure various sterilization methods such as steam, ethylene oxide, and gamma radiation, these films ensure compatibility with stringent processes. They boast robust sealing properties, preventing the infiltration of contaminants and establishing a secure environment for medical items.

Furthermore, their chemical resistance, adherence to regulatory standards, and versatility in packaging options make them well-suited for diverse medical applications. Printable variations allow for direct conveyance of essential information on the bags, simplifying identification and adherence to usage guidelines. In essence, medical packaging films play a pivotal role in ensuring safety, sterility, and regulatory compliance in healthcare packaging.

Regional Analysis

Asia-Pacific is expected to experience significant growth during the forecast period

The medical packaging films market in Asia-Pacific, notably in China and India, is expected to witness dynamic growth driven by increasing healthcare awareness and infrastructure development. The robust expansion of the healthcare industry, fueled by rising expenditures and pharmaceutical production, has heightened demand for these films. Ongoing technological advancements, a focus on sustainability, and the engagement of global packaging players further characterize the industry. The COVID-19 pandemic has increased the need for secure packaging, leading to higher demand.

In 2023, North America accounted for a significant revenue share. The North American medical packaging film market has experienced growth driven by healthcare needs, technological advancements, and an aging population. Stringent FDA regulations shape the industry, fostering a focus on innovative films with advanced features. Biocompatible and sustainable materials are increasingly favored, reflecting environmental awareness. Customization is prominent to meet specific product requirements and comply with regulations. Key players, both multinational and regional, compete on innovation and quality.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- 3M

- Amcor plc

- Berry Global Inc.

- Covestro AG

- Dunmore

- DuPont de Nemours, Inc.

- Klöckner Pentaplast Group

- Mitsubishi Chemical Holdings Corporation

- Renolit SE

- SABIC

- Sealed Air Corporation

- Tekni-Plex, Inc.

- Toppan Inc

- Toray Industries, Inc.

- Wipak Group

Recent Developments

- In November 2023, Coveris unveiled a recyclable thermoforming film designed for use in medical device applications. The company has introduced Formpeel P as a new addition to its range of sustainable materials. This innovative product offers equivalent functionality and safety compared to conventional materials, while reducing both packaging and product waste.

- In November 2023, Amcor introduced the latest iteration of its Medical Laminates solutions, facilitating the creation of recyclable all-film packaging within the polyethylene stream. This novel packaging solution features a mono-material polyethylene (PE) laminate suitable for various packaging formats. By adopting this new solution, the carbon footprint of the end package is significantly reduced while meeting the performance standards required for device applications.

Medical Packaging Films Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.04 billion |

|

Revenue forecast in 2032 |

USD 32.77 billion |

|

CAGR |

5.7% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Medical Packaging Films Market report covering key segments are type, material, application, and region.

The global medical packaging films market size is expected to reach USD 32.77 billion by 2032

The global medical packaging films market is expected to grow at a CAGR of 5.7% during the forecast period.

Asia-Pacific regions is leading the global market.

Growing healthcare industry are the key driving factors in Medical Packaging Films Market.