Graphic Film Market Share, Size, Trends, Industry Analysis Report

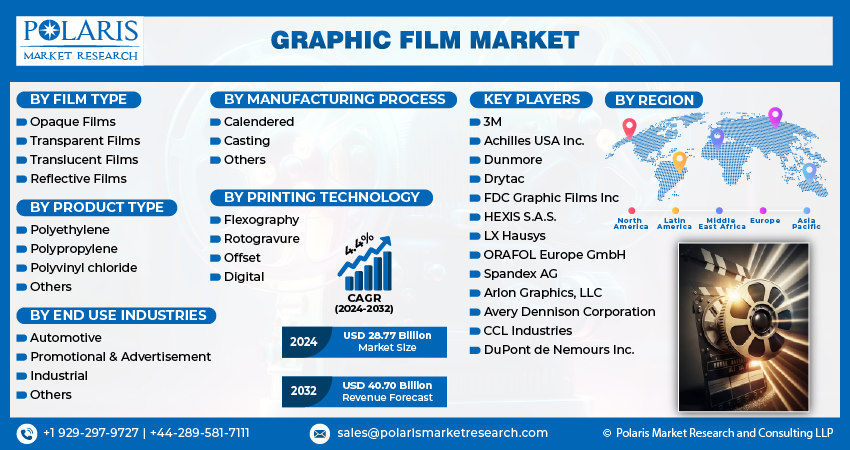

By Film Type (Opaque Films, Transparent Films, Translucent Films, Reflective Films); By Product Type; By End Use Industries; By Manufacturing Process; By Printing Technology; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4457

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

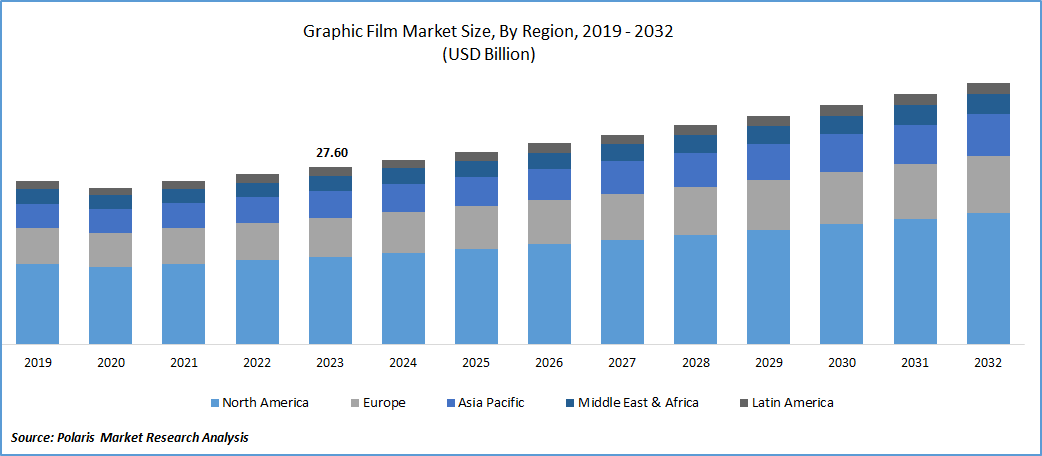

The global graphic film market was valued at USD 27.60 billion in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period.

The rising automotive industry is expected to contribute to the growth of the graphic film market. In the vehicle manufacturing process, graphic film is utilized to protect the vehicle from exterior components by adopting it as paint protection film, which can assist in lowering maintenance costs. The increasing number of innovations is propelling the growth of the market. For instance, in 2023, Turner signs used Drytac Polar Grip white gloss vinyl and matching Drytac Weathershield Matte UV laminate to provide appealing, vibrant walls for school students. The ongoing expansion activities by companies to cater to consumer demand with product innovations are expected to foster the growth of the graphic film market.

To Understand More About this Research: Request a Free Sample Report

For instance, in September 2023, Avery Dennison launched its new collection of three colors for the Supreme Wrapping Film ColorFlow film series as a part of the fall 2023 Celestial Satins color collection.

Moreover, the brand enhancement activities of retail stores, primarily in the apparel segment, with a view to retain their customers from the rapid advancements in e-commerce.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Graphic Film Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

However, the lower recycling potential of graphic films and volatility in prices due to the existence of fluctuations in supply costs are expected to hinder the demand for graphic films. The evolution of prominent substitutes like digital signage in the market is expected to limit the opportunities for graphic film in the future.

Growth Drivers

Increasing Brand Coverage Initiatives by Companies

Graphic films are widely used in the advertising of products and decorations at parties like birthdays, weddings, and more. The durability and weather resistance of graphic films are driving their adoption in the automobile and construction industries. The higher return on investment on fleet graphics compared to other advertising options, such as online advertising, is that it can approximately cost $21 per thousand impressions, while fleet graphics cost $0.15. This factor is highly influencing the adoption of graphic film by business players as part of cost-minimization strategies. Furthermore, growing demand for interior design and workplace modeling among the companies is expected to further enhance their growth potential in the coming years.

Report Segmentation

The market is primarily segmented based on film type, product type, end use industries, manufacturing process, printing technology, and region.

|

By Film Type |

By Product Type |

By End Use Industries |

By Manufacturing Process |

By Printing Technology |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By End Use Industries Analysis

Promotional & Advertisement Segment is Expected to Witness the Highest Growth During the Forecast Period

The promotional and advertisement segment will grow rapidly, mainly driven by the increasing number of competitors in the market, leading to increased investments in marketing. Attracting the target audience is the main factor for the marketing agents because it is vital in obtaining new customers along with retaining existing customers, contributing to the adoption of banners and appealing product coverings, and driving demand for graphic film in the marketplace.

The automotive segment led the industry market with a substantial revenue share in 2022, largely attributable to consumers' willingness to pay an additional price for quality and safety vehicles.

By Product Type Analysis

Polyvinyl Chloride Segment Accounted for the Fastest Growth in 2023

The polyvinyl chloride segment accounted held the largest share. This is attributable to durability, versatility, and printability. Its resistance to extreme weather conditions is driving its adoption as signage, banners, and vehicle wraps.

By Film Type Analysis

Transparent Films Segment Held the Significant Market Revenue Share in 2023

The transparent films segment held a significant market share in revenue in 2023, which was highly related to the appealing visuals and design availability. The increasing demand for decorating equipment on the market is driving the need for suitable film types for creative designs in the form of transparent films. The growing application of transparent films is gaining importance in window graphics among numerous industries.

By Manufacturing Process Analysis

Calendered Segment Held the Significant Growth in 2023

The calendered segment held a significant growth share in 2023, which was highly accelerated due to its ease of handling because of the stiffness and thinness of the film. This is considered versatile in nature, attributable to its significant performance in moderate, simple, and flat curves. Moreover, the higher abrasion resistance power of calendared film is driving significant demand for this manufacturing process in the market.

By Printing Technology Analysis

Flexography Segment Held Substantial Revenue in 2023

The flexography segment held a significant revenue share, which was highly attributable to the continuous rise in advanced automation technologies and the adoption of environmentally friendly production processes by companies using recyclable materials. It is considered an effective medium for applying simple and economical designs with numerous materials, including paper and plastic containers. Moreover, it utilizes lower-cost materials in the printing process, leading to a cheaper production process and allowing higher printing speeds.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region dominated the market. According to the Skin Cancer Foundation, around 5 million cases are registered in the United States annually. In overall cancer cases in the US, skin cancer constitutes a higher share, and it is one of the most curable forms of cancer. This trend is driving vehicle manufacturers to equip automobiles with solar-protected window films and wraps. This trend is likely to stimulate the demand for graphic films in the coming years.

The durable graphic films are easy to remove and can quickly transform the vehicle's aesthetics. Apart from this, graphic films are widely used in the automotive and advertising sectors to create advertising banners and vehicle wraps. For example, Honda wrapped one of its vehicles to commemorate its participation in the Rebelle Rally, which is an all-women off-road navigation competition in the United States.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing living standards in the population. Increasing purchasing power among the people in the region is facilitating the demand for residential decoration and protective equipment, driving automobile companies and other product manufacturers to use qualitative designs with safety as a major concern.

Key Market Players & Competitive Insights

The graphic film market is fragmented and is anticipated to witness competition due to the presence of several market players. The increasing collaborative strategies by companies, with the acquisitions and rising innovations in flexography, paint-protected films, and high-quality graphics, are expected to propel the growth of the market. AP Corp. acquired Carolina Solar Security, a window tinting service provider, to expand its footprint in coastal North Carolina.

Some of the major players operating in the global market include:

- 3M

- Achilles USA Inc.

- Arlon Graphics, LLC

- Avery Dennison Corporation

- CCL Industries

- DuPont de Nemours Inc.

- Dunmore

- Drytac

- FDC Graphic Films Inc

- HEXIS S.A.S.

- LX Hausys

- ORAFOL Europe GmbH

- Spandex AG

Recent Developments

- In October 2023, Drytac introduced Polar Blockout UV, a white PET film with a matte finish and opaque layered printable film to the North American market portfolio.

- In October 2023, Avery Dennison and Partner Siser unveiled the retail launch of EasyPSV Starling Vinyl Film at the nationwide Michaels Stores.

- In October 2023, UPM Raflatac, a supplier of self-adhesive paper and paper products, introduced a new line of graphic solutions in North and South America.

Graphic Film Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 28.77 billion |

|

Revenue forecast in 2032 |

USD 40.70 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Film Type, By Product Type, By End Use Industries, By Manufacturing Process, By Printing Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Graphic Film Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Graphic Film Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Metal Stamping Market Size, Share 2024 Research Report

3D Imaging Market Size, Share 2024 Research Report

Managed SIEM Services Market Size, Share 2024 Research Report

Personal Cloud Market Size, Share 2024 Research Report

High-speed Data Converter Market Size, Share 2024 Research Report

FAQ's

film type, product type, end use industries, manufacturing process, printing technology and region are the key segments in the Graphic Film Market

The global graphic film market size is expected to reach USD 40.70 billion by 2032

The global graphic film market is expected to grow at a CAGR of 4.4% during the forecast period.

North America regions is leading the global market

Increasing brand coverage initiatives by companies are the key driving factors in Graphic Film Market