3D Imaging Market Size, Share, Trends, Industry Analysis Report

: By Technology, By Component, By Vertical, By Deployment (On-premise and Cloud), and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM4273

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

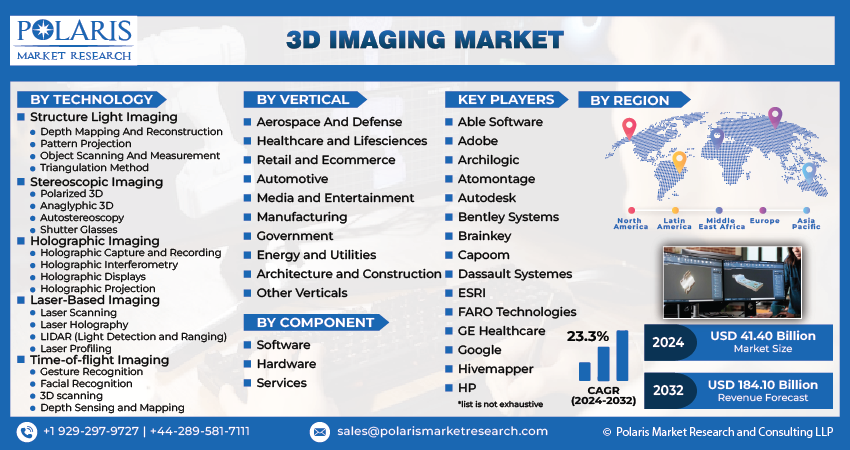

The global 3D imaging market size was valued at USD 42.44 billion in 2024, growing at a CAGR of 23.3% during 2025–2034. The market growth is primarily fueled by the growing demand for 3D displays for high-resolution visualization and increased usage of 3D imaging in 5G smartphones.

Key Insights

- The hardware segment accounted for the largest market share in 2024. The segment’s dominance is largely attributed to the crucial role of advanced imaging devices in capturing and rendering high-resolution three-dimensional visuals.

- The automotive and transportation segment is anticipated to register the highest CAGR, primarily due to 3D imaging becoming an integral part of precision vehicle design and autonomous driving.

- North America led the global market in 2024. The high adoption rate of advanced imaging solutions and the presence of major market participants drive the region’s leading market position.

- Asia Pacific is anticipated to witness the fastest growth. Rising industrialization and growing demand for automation are fueling market growth in the region.

Industry Dynamics

- The rising adoption of 3D imaging in the media & entertainment industry for content creation and consumption is fueling market growth.

- Growing demand for personalized medicine, which requires highly detailed anatomical visualization for guiding diagnosis and treatment planning, drives market growth.

- Advancements in sensor technologies are expected to create several market opportunities during the projection period.

- Limited field of view and depth perception may hinder market growth.

Market Statistics

2024 Market Size: USD 42.44 billion

2034 Projected Market Size: USD 344.37 billion

CAGR (2025-2034): 23.3%

North America: Largest Market in 2024

AI Impact on 3D Imaging Market

- AI enhances image reconstruction by processing complex datasets quickly, producing clearer and more accurate 3D visuals.

- Machine learning algorithms enable faster object recognition and segmentation, expanding applications in healthcare, security, and manufacturing.

- AI-driven automation streamlines workflows, reducing manual intervention and improving efficiency in 3D modeling and analysis.

- Intelligent analytics unlock deeper insights from 3D images, supporting precision diagnostics, quality control, and advanced design solutions.

To Understand More About this Research: Request a Free Sample Report

3D imaging involves generating a three-dimensional image to create the optical illusion of depth. This process typically utilizes two or more motion cameras to capture a three-dimensional object.

The combination of 3D image sensors, camera modules, and screens results in the creation of high-resolution images. Consequently, 3D imaging finds widespread applications in various industries, such as hospitals, entertainment, architecture and construction, and automotive. Furthermore, the rising demand for 3D displays and sensors for high-resolution visualization, increasing awareness of 3D imaging, and expanded usage in 5G smartphones and tablets are driving the industry.

The progressing advancements in the healthcare and life sciences sectors, coupled with the utilization of 3D technology for internal body structure visualization in treatment and diagnostics, are fueling the demand for 3D imaging technology in the medical field. Technical innovations are leading to a shift in consumer preferences toward high-resolution images, motion pictures, and animated films.

The market is further anticipated to grow during the forecast period due to increasing investments in artificial intelligence by the 3D medical imaging industry and growing demand for 3D imaging from retail and e-commerce. In February 2025, RadNet’s DeepHealth and ConcertAI’s TeraRecon collaborated to integrate AI and advanced visualization tools. The collaboration combines DeepHealth’s Diagnostic Suite with TeraRecon’s SaaS platform to enhance diagnostic workflows and expand access to AI-driven imaging solutions in healthcare. Additionally, the broader utilization of 3D imaging in the healthcare industry is foreseen as a response to the increasing demand for improved and more sophisticated healthcare facilities capable of delivering enhanced resolution and visualization for precise test diagnosis.

Market Dynamics

Increasing Utilization of 3D Imaging in Entertainment and Media Sector

The media & entertainment sector has experienced significant growth in the adoption of 3D imaging technologies, transforming the landscape of content creation, consumption, and experiences. Progress in 3D imaging has paved the way for immersive encounters in movies, gaming, virtual reality (VR), and augmented reality (AR), captivating audiences in novel ways. 3D imaging has facilitated the development of visually striking special effects and generative AI animation within the film industry, enriching the overall cinematic experience. For instance, in October 2024, Wonder Dynamics (Autodesk) launched Wonder Animation’s beta, an AI tool converting video into 3D-animated scenes. It streamlines film production while preserving artistic control, and the tech reconstructs multi-shot sequences in 3D, targeting animated film workflows. This technology has elevated storytelling and attracted audiences seeking more compelling and immersive entertainment. Likewise, 3D imaging has revolutionized the gaming industry, providing a more lifelike and immersive gaming experience. The capability to depict intricate, three-dimensional environments and characters has reshaped the gaming landscape, resulting in more interactive and visually impressive gameplay.

Increased Demand for Personalized Medicine

Increased demand for personalized medicine is boosting the 3D imaging market growth, as it necessitates highly detailed, patient-specific anatomical visualization to guide diagnosis and treatment planning. Personalized medicine aims to tailor medical interventions based on an individual’s unique biological profile, which requires precise imaging data to identify subtle physiological variations. 3D imaging technologies, such as MRI and CT scanners with volumetric reconstruction, provide clinicians with comprehensive, high-resolution views of organs and tissues, enabling more accurate disease characterization and targeted therapy. For instance, in December 2024, GE HealthCare launched Sonic DL for 3D, an AI-enhanced MRI acceleration tool. Expanding on its 2023 cardiac version, it now supports brain, spine, and body scans, maintaining 12x faster speeds while improving resolution, aiming to reduce clinician workload and scan times. This alignment of advanced imaging with patient-centric care enhances diagnostic confidence. It improves outcomes, thereby reinforcing the role of 3D imaging as an essential tool in the advancement of personalized healthcare.

Segment Insights

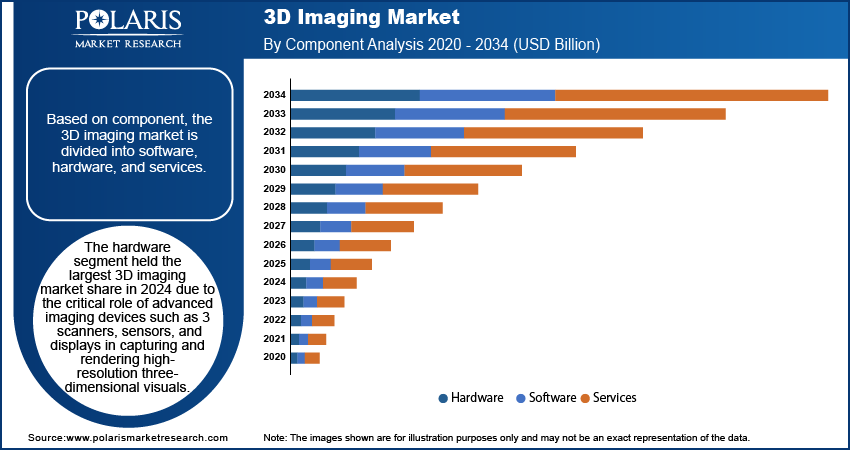

Market Assessment by Component

The global market segmentation, based on component, includes software, hardware, and services. The hardware segment held the largest 3D imaging market share in 2024 due to the critical role of advanced imaging devices such as 3D scanners, sensors, and displays in capturing and rendering high-resolution three-dimensional visuals. These hardware components form the foundational infrastructure necessary for accurate 3D data acquisition and visualization across multiple applications, such as healthcare diagnostics, automotive design, and industrial inspection. Continuous advancements in sensor technology, imaging resolution, and real-time processing capabilities have further fueled hardware adoption. Thus, as industries increasingly integrate 3D imaging into their core operations, the demand for high-performance and reliable hardware remains a major contributor to the industry development.

Market Evaluation by Vertical

The market segmentation, based on vertical, includes aerospace and defense, healthcare and life sciences, retail and e-commerce, automotive, media and entertainment, manufacturing, government, energy and utilities, architecture and construction, and other verticals. The automotive and transportation segment is expected to witness the highest CAGR during the forecast period as 3D imaging becomes integral to the development of advanced driver-assistance systems (ADAS), autonomous driving, and precision vehicle design. This technology is widely used for object detection, spatial analysis, and simulation during vehicle prototyping and manufacturing processes. Moreover, the increasing focus on safety and automation in transportation is accelerating the adoption of LiDAR, 3D sensors, and visualization tools that rely heavily on accurate 3D data. The industry's push toward innovation and efficiency, coupled with the rising demand for next-generation vehicles, is anticipated to drive sustained growth opportunities within this vertical.

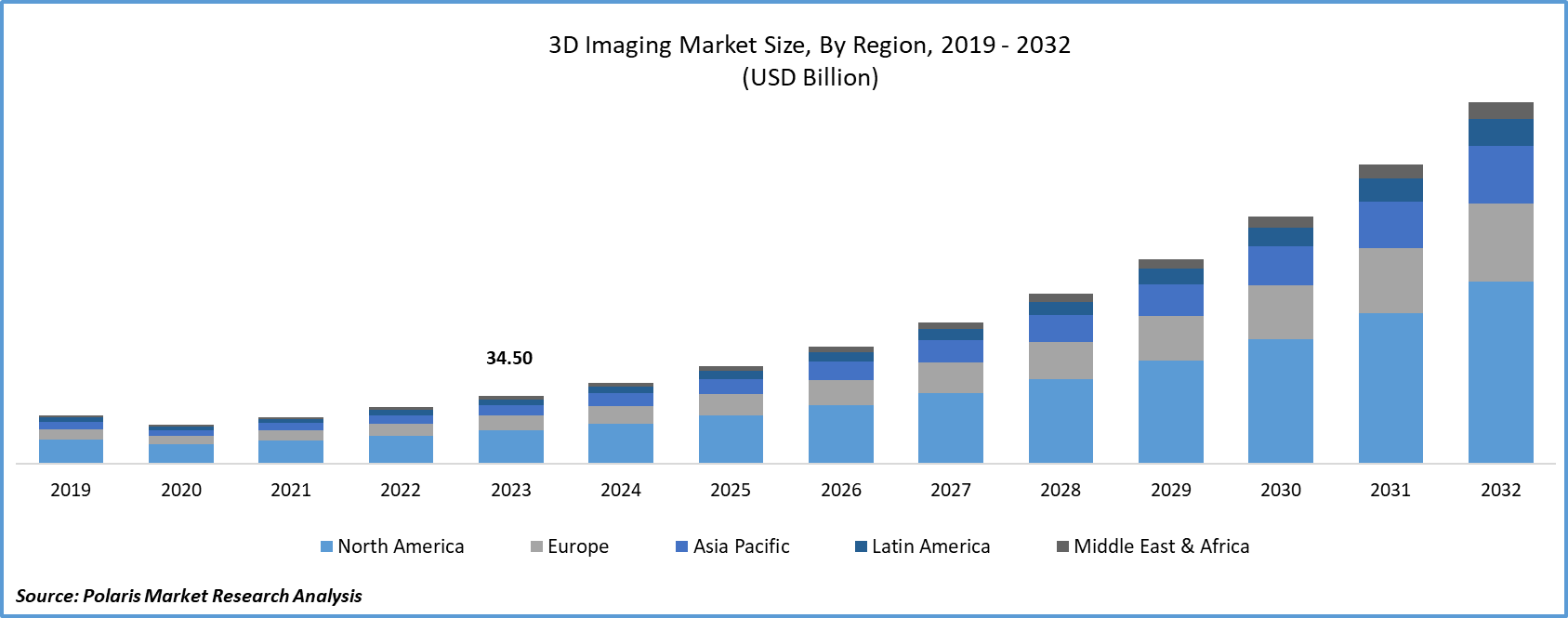

Regional Analysis

The report provides the 3D imaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the 3D imaging market revenue share in 2024, owing to its strong technological infrastructure, high adoption rate of advanced imaging solutions, and significant presence of major players. The region benefits from robust investments in sectors such as healthcare, automotive, aerospace, and media, where 3D imaging plays a pivotal role in enhancing accuracy and operational efficiency. For instance, in September 2024, Accent Imaging collaborated with Matterport to integrate advanced 3D spatial capture technology into its services. The collaboration enables industries such as real estate and construction to create digital twins for remote navigation, measurement, and facility management, enhancing operational efficiency. Furthermore, a mature research and development ecosystem supports continuous innovation in imaging technologies while favorable regulatory policies encourage early adoption. These factors collectively reinforce North America’s leadership in the global 3D imaging landscape.

The Asia Pacific 3D imaging market is projected to witness the fastest growth during the forecast period due to increasing industrialization, rising demand for automation, and rapid technological adoption across emerging economies. Countries such as China, India, South Korea, and Japan are investing heavily in various sectors, including manufacturing, healthcare, and consumer electronics. These sectors increasingly incorporate 3D imaging for improved performance and productivity. Additionally, growing government initiatives to support digital transformation and smart infrastructure development are creating favorable conditions for 3D imaging adoption. This dynamic market environment positions Asia Pacific as a key growth hub for the global 3D imaging industry.

Key Players and Competitive Analysis

The 3D imaging sector is experiencing robust expansion, primarily propelled by substantial advancements in sensor technology, software algorithms, and integration capabilities. The market analysis identifies Dassault Systèmes, Autodesk, and others as having established their positions through strategically diversified product portfolios and carefully cultivated partner and customer ecosystems. The competitive landscape is being progressively reshaped by emerging entrants who are successfully disrupting traditional market paradigms through AI-enhanced solutions. These innovations are particularly targeted toward small and medium-sized enterprises across three key verticals such as healthcare, manufacturing, and entertainment. Concurrently, there is an increasing prevalence of strategic alliances between hardware manufacturers and software developers, with cloud-based solutions demonstrating particularly strong market traction. Healthcare applications continue to represent the primary growth driver, with surgical planning and diagnostic implementations showing the most significant adoption rates. Substantial untapped opportunities exist within emerging economies where accelerating infrastructure development is creating favorable conditions for market penetration. The forward-looking assessment indicates that future strategic development will increasingly concentrate on mobile application capabilities and real-time processing technologies. Current R&D activities predominantly focus on automation enhancement, edge computing integration, and AR/VR synchronization technologies designed to deliver increasingly immersive user experiences. A few key major players are Able Software Co., Inc.; Adobe Inc.; Archilogic AG; Atomontage Inc.; Autodesk, Inc.; Bentley Systems, Incorporated; Brain Key Inc.; Capoom (Capoom, Inc.); Dassault Systèmes SE; ESRI (Environmental Systems Research Institute, Inc.); FARO Technologies, Inc.; GE Healthcare (General Electric Company); Google LLC; Hivemapper, Inc.; and HP Inc.

Bentley Systems, Incorporated specializes in infrastructure engineering software, serving professionals and organizations involved in the design, construction, and operation of critical assets such as roads, bridges, water systems, and industrial facilities. Founded in 1984 and headquartered in Exton, Pennsylvania, Bentley Systems has established itself as a pioneer in digital solutions for infrastructure, with a presence in over 186 countries. In 3D imaging, Bentley offers a comprehensive suite of products that enable precise modeling, visualization, and management of infrastructure projects. Its flagship applications, such as MicroStation, Bentley Descartes, and LumenRT, allow users to create, document, and visualize rich 2D and 3D designs, seamlessly integrating real-world digital context into their workflows. Bentley’s reality modeling technology, particularly through its acquisition of Acute3D, enables the transformation of digital photographs and LiDAR data into highly detailed 3D reality meshes, supporting everything from urban mapping to construction modeling. The company’s Orbit 3DM platform further enhances the ability to manage, analyze, and share vast volumes of reality data, such as image-based meshes and point clouds, ensuring that digital twins remain current and actionable for asset performance and predictive insights.

Dassault Systèmes SE specializes in 3D design, engineering, and digital innovation, headquartered in France and serving over 350,000 customers across diverse industries worldwide. Since its founding in 1981, the company has developed virtual worlds to drive sustainable innovation and meaningful impact in sectors ranging from manufacturing and infrastructure to life sciences and healthcare. Central to Dassault Système’s offering is its 3DEXPERIENCE platform. It is a comprehensive digital environment that integrates 3D design, simulation, product lifecycle management (PLM), and collaborative tools, enabling organizations to imagine, create, and test products in immersive virtual spaces. In 3D imaging, Dassault Systèmes continues to set industry standards with the recent launch of “3D UNIV+RSES,” a next-generation architecture that embeds generative AI technologies at the core of global IP lifecycle management. This platform empowers clients to fully exploit their extensive libraries of 3D design, virtual twins, and PLM data. It supports innovative applications such as generative experiences, virtual companions, and intelligent virtual twin experiences as a service (VTaaS). Companies in manufacturing, healthcare, and infrastructure use Dassault Systèmes sophisticated virtual twins and 3D imaging tools to ensure quality, safety, and regulatory compliance while also accelerating product development and enhancing sustainability.

List of Key Companies

- Able Software Co., Inc.

- Adobe Inc.

- Archilogic AG

- Atomontage Inc.

- Autodesk, Inc.

- Bentley Systems, Incorporated

- Brain Key Inc.

- Capoom (Capoom, Inc.)

- Dassault Systèmes SE

- ESRI (Environmental Systems Research Institute, Inc.)

- FARO Technologies, Inc.

- GE Healthcare (General Electric Company)

- Google LLC

- Hivemapper, Inc.

- HP Inc.

3D Imaging Industry Developments

February 2025, Stratasys and Siemens Healthineers collaborated to demonstrate how 3D-printed medical phantoms using RadioMatrix materials and Digital Anatomy technology can accurately replicate human anatomy. The collaboration aims to improve surgical planning and medical training by replacing simplistic models with patient-specific replicas.

March 2025, GE HealthCare and NVIDIA expanded their collaboration to develop autonomous X-ray and ultrasound technologies using AI. The partnership aims to address radiology staff shortages and improve efficiency in medical imaging by automating image capture and analysis processes.

December 2024, UC Irvine researchers launched XACT, a novel 3D CT imaging method using X-ray-induced acoustic waves. This technique captures volumetric data from a single X-ray projection, eliminating mechanical scanning and enabling real-time 3D imaging with ultrasound detectors.

3D Imaging Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Structure Light Imaging

- Stereoscopic Imaging

- Holographic Imaging

- Laser-Based Imaging

- Time-of-Flight Imaging

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Hardware

- Services

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Aerospace and Defense

- Healthcare and Lifesciences

- Retail and E-commerce

- Automotive

- Media and Entertainment

- Manufacturing

- Government

- Energy and Utilities

- Architecture and Construction

- Other Verticals

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-premise

- Cloud

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.44 billion |

|

Market Size Value in 2025 |

USD 52.20 billion |

|

Revenue Forecast in 2034 |

USD 344.37 billion |

|

CAGR |

23.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 42.44 billion in 2024 and is projected to grow to USD 344.37 billion by 2034.

The global market is projected to register a CAGR of 23.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Able Software Co., Inc.; Adobe Inc.; Archilogic AG; Atomontage Inc.; Autodesk, Inc.; Bentley Systems, Incorporated; Brain Key Inc.; Capoom (Capoom, Inc.); Dassault Systèmes SE; ESRI (Environmental Systems Research Institute, Inc.); FARO Technologies, Inc.; GE Healthcare (General Electric Company); Google LLC; Hivemapper, Inc.; and HP Inc.

The hardware segment held the largest market revenue share in 2024.

The automotive and transportation segment is expected to witness the highest CAGR during the forecast period.