CT Scanner Market Size, Share, & Industry Analysis Report

: By Type (Stationary CT Scanners and Portable CT Scanners), Device Architecture, Technology, Application, End-Use, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1685

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

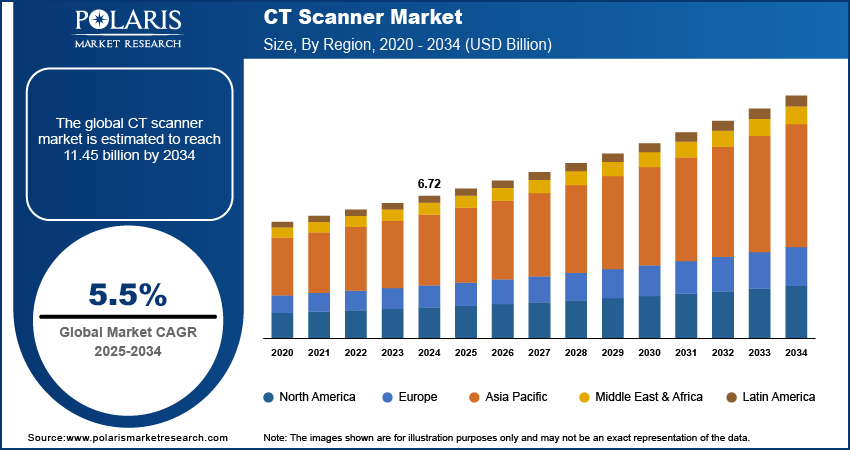

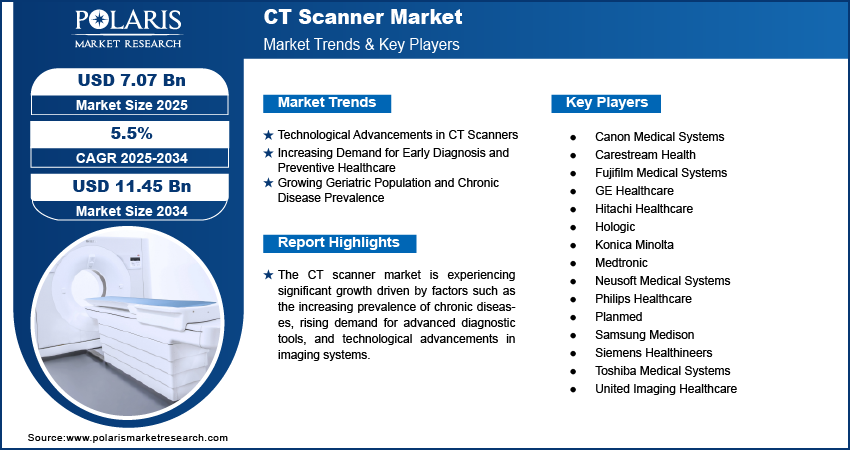

The global CT scanner market size was valued at USD 6.72 billion in 2024. The market is projected to grow from USD 7.07 billion in 2025 to USD 11.45 billion by 2034, exhibiting a CAGR of 5.5% during 2025–2034. The market is driven by rising prevalence of chronic diseases, growing demand for early and accurate diagnostics, advancements in imaging technology, and increased healthcare investments, particularly in emerging economies and aging populations requiring frequent diagnostic imaging.

Key Insights

- Stationary CT scanners lead the market due to their extensive adoption in hospitals and imaging centers, offering high performance, accuracy, and compatibility with comprehensive diagnostic applications.

- C-arm CT scanners dominate interventional imaging, driven by their critical role in real-time surgical guidance and minimally invasive procedures.

- High-slice CT scanners hold the largest share, supported by growing demand for rapid, high-resolution imaging in cardiology, oncology, and trauma care.

- Human applications lead the market, driven by rising cases of cancer, cardiovascular, and neurological diseases requiring advanced diagnostic imaging technologies.

- Hospitals and diagnostic centers dominate CT scanner demand, fueled by increased patient volume, need for precision diagnostics, and adoption of advanced imaging infrastructure.

- North America leads the market, driven by strong healthcare infrastructure, high diagnostic imaging demand, and early adoption of advanced medical technologies.

Industry Dynamics

- Rising demand for CT scanners is driven by increasing chronic disease prevalence, aging population, and growing need for accurate, non-invasive diagnostic imaging.

- Market expansion is supported by technological advancements, rising healthcare investments, and wider adoption in emergency care, oncology, and cardiovascular diagnostics.

- Challenges such as high equipment costs, radiation exposure concerns, and lack of skilled professionals in developing regions may limit broader market growth.

- Innovations in AI integration, low-dose imaging, portable CT systems, and faster scan technologies are enhancing diagnostic accuracy, patient safety, and operational efficiency in medical imaging.

Market Statistics

- 2024 Market Size: USD 6.72 billion

- 2034 Projected Market Size: USD 11.45 billion

- CAGR (2025-2034): 5.5%

- North America: Largest market in 2024

AI Impact on CT Scanner Market

- AI analyzes medical imaging data to enhance diagnostic accuracy, detect abnormalities early, and reduce human error in CT scan interpretation.

- Integration of AI enables real-time image reconstruction and optimization, improving scan quality while reducing radiation exposure and scan time.

- AI-powered tools assist in automating workflow, prioritizing critical cases, and supporting clinical decision-making in radiology departments.

- AI enhances CT scanner efficiency by predicting maintenance needs, optimizing scheduling, and streamlining imaging operations in healthcare facilities.

To Understand More About this Research: Request a Free Sample Report

The computed tomography (CT) scanner market involves the development, manufacturing, and sale of CT scanning devices used for medical imaging. These scanners use X-rays to create detailed images of the body’s internal structures, aiding in diagnosis and treatment planning.

Advancements in technology, including improved image resolution, faster scan times, and the integration of artificial intelligence (AI) for enhanced diagnostic accuracy, are driving the CT scanner market growth. Additionally, the increasing demand for early diagnosis of diseases, the growing aging population, and the rising prevalence of chronic conditions such as cancer and cardiovascular diseases contribute to the growth of the market. Trends anticipated to drive market expansion include the shift towards portable and compact CT scanners, as well as the increasing adoption of hybrid imaging systems that combine CT with other modalities like MRI and PET CT scanner for more comprehensive diagnostics.

Market Dynamics

Technological Advancements in CT Scanners

Innovations in hardware and software have significantly improved the performance of CT scanners. Modern scanners now offer higher image resolution, faster scan times, and lower radiation exposure. For example, multi-slice CT scanners, which can capture more detailed images by taking multiple slices at once, have gained popularity. Additionally, the incorporation of AI and machine learning in image interpretation and diagnosis has enhanced diagnostic accuracy. AI algorithms can identify patterns in scans that might be missed by human radiologists, leading to earlier detection of diseases. According to a study published in Radiology in 2020, AI-assisted CT imaging was found to improve diagnostic accuracy for conditions like lung cancer, underscoring the role of technology in driving the market expansion.

Increasing Demand for Early Diagnosis and Preventive Healthcare

Another key factor fueling the growth of the market is the increasing emphasis on early diagnosis and preventive healthcare. Early identification of conditions such as cancer, cardiovascular diseases, and neurological disorders is crucial for effective treatment. As healthcare systems worldwide focus on early disease detection to improve patient outcomes and reduce treatment costs, the demand for diagnostic tools such as CT scanners has surged. For instance, lung cancer screenings using low-dose CT scans are now recommended for high-risk populations, significantly boosting the demand for CT scanners. A study published in 2021 on NCBI suggests that early lung cancer detection using CT screening can reduce mortality rates by 20%, further driving the need for such technology in routine health checks. Thus, the rising demand for early diagnosis and preventive healthcare is driving the market revenue.

Growing Geriatric Population and Chronic Disease Prevalence

As people age, they become more susceptible to various health conditions, such as cardiovascular diseases, cancers, and neurological disorders, which often require advanced diagnostic imaging. For instance, according to the World Health Organization (WHO), the global population aged 60 years and older is expected to double by 2050 and reach 2.1 billion from 1.1 billion in 2023, leading to a higher demand for diagnostic services. Additionally, chronic diseases like diabetes and hypertension, which are prevalent among older adults, have increased the need for imaging tools to monitor complications. This demographic shift is driving the CT scanner market demand, as they are essential for diagnosing and managing conditions that commonly affect the elderly population.

Segment Insights

By Type-Based Insights

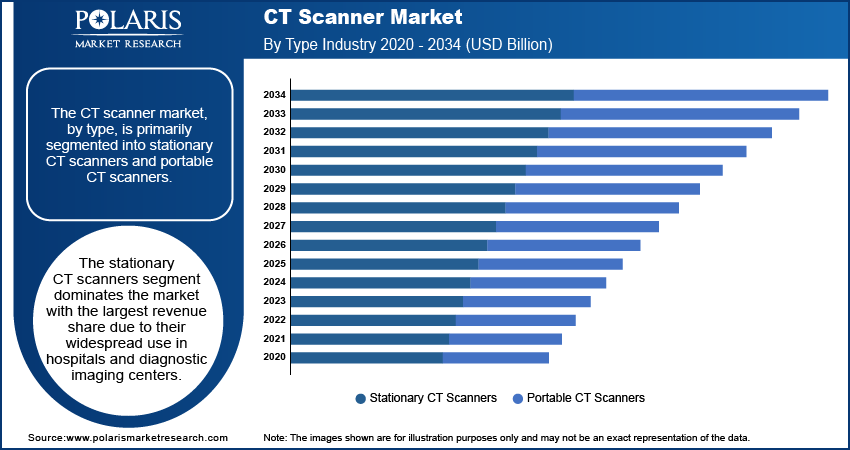

The CT scanner market, by type, is primarily segmented into stationary CT scanners and portable CT scanners, each catering to distinct healthcare needs. Stationary CT scanners dominate the market, holding the largest share due to their widespread use in hospitals and diagnostic imaging centers. These devices offer high-resolution imaging and are designed for more complex diagnostic procedures, making them essential in settings where advanced imaging is required. They are equipped with multiple advanced features, such as multi-slice capabilities and high-speed scanning, enabling more accurate and faster diagnoses for critical conditions. The demand for stationary CT scanners is expected to remain robust, driven by the growing need for detailed imaging in oncology, cardiology, and neurology.

Portable CT scanners are experiencing rapid growth during the forecast period. These compact, mobile devices are gaining popularity due to their flexibility and ability to provide imaging services in emergency settings, intensive care units, and remote or rural areas where traditional stationary scanners may not be available. Portable CT scanners also help in reducing patient transport risks and improving overall healthcare delivery. The increasing focus on point-of-care diagnostics and the rise in trauma cases are further contributing to the growth of the portable segment.

By Device Architecture-Based Insights

The CT scanner market is segmented by device architecture into C-arm CT scanners and O-arm CT scanners. The C-arm CT scanners segment holds the largest market share due to its established use in interventional procedures and surgeries. C-arm CT scanners are widely used in orthopedics, neurology, and trauma surgery due to their ability to provide real-time imaging during complex procedures. They are particularly valuable in guiding minimally invasive surgeries, allowing physicians to view detailed images without making large incisions. Their widespread adoption in hospitals and outpatient surgery centers has contributed to the dominance of this segment.

The O-arm CT scanners segment is witnessing the fastest growth, driven by its increasing application in spinal surgeries and other orthopedic procedures. O-arm systems provide 3D imaging, which offers enhanced visualization during surgery, thereby improving the precision of operations. This makes them highly popular in operating rooms, particularly for spine and joint surgeries. The segment’s growth is further supported by advancements in technology that have improved the functionality and affordability of O-arm systems, making them more accessible to smaller surgical centers and expanding their market presence. The increasing focus on improving surgical outcomes and reducing patient recovery times is also contributing to the rising demand for O-arm CT scanners.

By Technology-Based Insights

The CT scanner market is segmented by technology into high-slice CT, mid-slice CT, low-slice CT, and cone beam CT (CBCT). The high-slice CT segment holds the largest market share due to its ability to provide high-resolution images at faster scan speeds. These systems are critical in complex diagnostic procedures, including cardiovascular imaging, oncology, and neurology, where detailed imaging of the body’s internal structures is necessary. High-slice CT scanners are being increasingly adopted in major hospitals and diagnostic centers because they enable clinicians, driving their dominant position in the market.

The cone beam CT (CBCT) segment is registering the fastest growth, primarily due to its increasing use in dental and orthopedic applications. CBCT scanners offer a unique advantage by providing 3D imaging with reduced radiation exposure compared to traditional CT systems. This makes them particularly suitable for dental imaging, implant planning, and maxillofacial procedures, where high-quality imaging is required in a compact format. Advancements in CBCT technology, including improved image quality and the integration of artificial intelligence (AI) in medical diagnostics, are also contributing to its market growth.

By Application-Based Insights

The CT scanner market, by application, is segmented into human, veterinary, and research. The human application segment holds the largest market share, driven by the widespread use of CT scanners in diagnosing and monitoring a wide range of diseases and conditions, such as cancer, cardiovascular diseases, and neurological disorders. CT scanners play a vital role in hospitals, diagnostic imaging centers, and emergency departments, providing essential imaging services for both routine health checks and critical care situations. The increasing demand for advanced diagnostic tools, advancements in technology, and the rising prevalence of chronic conditions among the global population are other factors contributing to the segment’s dominance.

The veterinary application segment is registering the fastest growth, primarily driven by the increasing adoption of advanced imaging technologies in veterinary care. As animal health and welfare gain more focus, the use of CT scanners in veterinary clinics and animal hospitals is becoming more common. CT scanners are being used for diagnosing and treating injuries, tumors, and neurological disorders in pets, livestock, and other animals. The segment’s growth is supported by rising pet ownership, advancements in veterinary medicine, and the increasing need for non-invasive imaging tools in animal healthcare. Additionally, the growing interest in research and development of animal health products boosts demand for CT scanners in the veterinary field.

By End-Use-Based Insights

The CT scanner market, by end-use, is segmented into hospitals & diagnostic centers, research laboratories & academic institutes, ambulatory care centers, and others. The hospitals & diagnostic centers segment holds the largest market share, owing to the high demand for advanced diagnostic imaging in these settings. Hospitals and diagnostic centers are the primary locations where CT scanners are used for routine and emergency diagnostics, including oncology, cardiology, and trauma care. These centers benefit from high-resolution imaging, quick scanning capabilities, and the broad range of clinical applications offered by modern CT scanners, which contributes to the segment’s dominance in the market.

The ambulatory care centers segment is registering the fastest growth, driven by the increasing trend of outpatient care and the demand for cost-effective diagnostic solutions outside of traditional hospital settings. With advancements in mobile and compact CT scanners, ambulatory care centers are now able to offer high-quality imaging services to patients without the need for hospitalization. This growth is further supported by the rising preference for outpatient procedures, shorter recovery times, and reduced healthcare costs, which make ambulatory care centers an attractive option for both patients and healthcare providers. The segment is also benefiting from the increased adoption of technology and the ability to deliver imaging services in a more accessible and efficient manner.

Regional Analysis

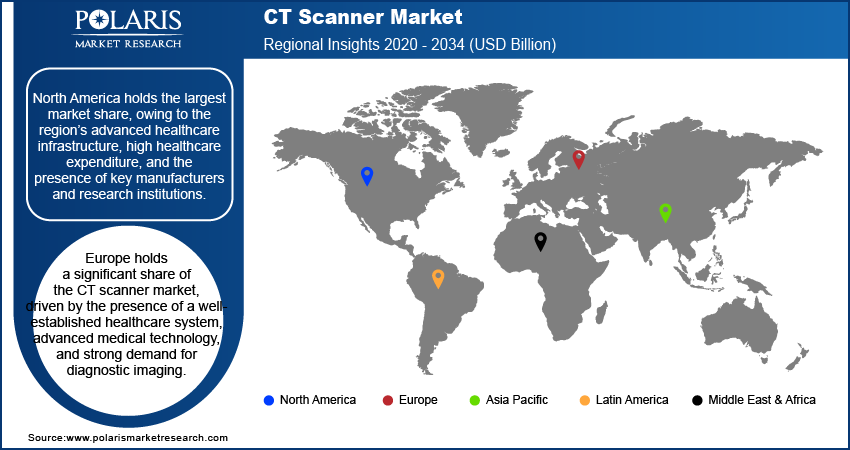

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The CT scanner market is widely distributed across various regions, with North America holding the largest market share. The dominance of this region can be attributed to the advanced healthcare infrastructure, high healthcare expenditure, and the presence of key manufacturers and research institutions. The US, in particular, is a major contributor, driven by the high demand for diagnostic imaging in hospitals, diagnostic centers, and outpatient care facilities. Additionally, the increasing prevalence of chronic diseases, the aging population, and technological advancements in CT scanner systems support market growth in North America.

Europe holds a significant share of the CT scanner market, driven by the presence of a well-established healthcare system, advanced medical technology, and strong demand for diagnostic imaging. The region is characterized by high healthcare expenditure, particularly in countries such as Germany, France, and the UK, which ensures wide access to advanced imaging devices. The growing focus on early diagnosis and personalized healthcare in Europe is further contributing to the demand for CT scanners. Additionally, the presence of major medical device manufacturers and research institutions in Europe supports market growth. The region is also witnessing an increasing preference for hybrid imaging systems, combining CT with other modalities for improved diagnostic accuracy.

The Asia Pacific CT scanner market is experiencing the fastest growth, driven by rapid advancements in healthcare infrastructure, particularly in countries such as China, India, Japan, and South Korea. The growing healthcare expenditure, coupled with the rising awareness of early disease detection and non-invasive diagnostic methods, is contributing to the adoption of CT scanners. The increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, has also amplified the need for advanced imaging technologies. Furthermore, governments in the region are investing in healthcare modernization, and the rising demand for affordable, portable, and compact CT scanners is fueling market expansion in emerging economies.

Key Players and Competitive Insights

Key players in the market include companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Hitachi Healthcare, Samsung Medison, Toshiba Medical Systems, Carestream Health, Neusoft Medical Systems, United Imaging Healthcare, Konica Minolta, Medtronic, Fujifilm Medical Systems, Hologic, and Planmed. These companies are actively involved in the development, manufacturing, and distribution of CT scanners across various regions. Some of these companies, such as Siemens Healthineers and GE Healthcare, offer a wide range of imaging solutions for multiple medical disciplines. Other players like Canon Medical Systems and Hitachi Healthcare focus on advanced imaging technologies for specific applications. Their product offerings are geared toward improving diagnostic accuracy, reducing radiation exposure, and enhancing imaging efficiency. These companies remain key players in the market and continue to innovate with new technologies, addressing the growing need for non-invasive diagnostic tools in healthcare. Additionally, companies like Canon Medical Systems and Hitachi Healthcare differentiate themselves through innovations in design and functionality, offering more compact and portable solutions suited for smaller healthcare facilities and mobile diagnostics.

In addition to technological innovation, pricing and after-sales service play a significant role in the competition within the market. Companies that provide comprehensive service packages, including installation, maintenance, and training, are more likely to establish long-term customer relationships. Players like Carestream Health and Neusoft Medical Systems are gaining traction by focusing on cost-effective solutions without compromising on imaging quality, making their products appealing to emerging healthcare markets. Furthermore, companies such as Konica Minolta and Medtronic are expanding their reach through strategic partnerships and acquisitions to strengthen their market position and deliver integrated healthcare solutions. The market remains dynamic as companies aim to meet the increasing demand for advanced, user-friendly, and affordable diagnostic imaging technologies.

Siemens Healthineers is a major player in the market, known for its wide range of medical imaging technologies. The company provides CT scanners designed to deliver high-quality imaging for various diagnostic needs, including routine exams and complex procedures. Siemens Healthineers focuses on integrating AI and software solutions into its products to improve diagnostic accuracy and efficiency.

GE Healthcare is another prominent player, offering a variety of imaging systems, including CT scanners. The company is known for providing reliable and cost-effective solutions used across different healthcare settings. GE Healthcare focuses on making its imaging devices more accessible, with an emphasis on improving diagnostic capabilities while ensuring ease of use.

List of Key Companies

- Canon Medical Systems

- Carestream Health

- Fujifilm Medical Systems

- GE Healthcare

- Hitachi Healthcare

- Hologic

- Konica Minolta

- Medtronic

- Neusoft Medical Systems

- Philips Healthcare

- Planmed

- Samsung Medison

- Siemens Healthineers

- Toshiba Medical Systems

- United Imaging Healthcare

CT Scanner Industry Developments

- In December 2024, Siemens Healthineers announced a significant upgrade to its SOMATOM CT scanner platform, which aims to enhance imaging capabilities and reduce scan times while lowering radiation exposure. This upgrade is part of the company’s ongoing efforts to innovate and meet the growing demand for advanced imaging technology.

- In November 2024, GE Healthcare introduced a new version of its Revolution CT scanner, which features improved image quality and faster scanning times. This new development is in line with the company’s strategy to support clinicians with more efficient tools for diagnosing complex conditions while also addressing patient safety and care.

Market Segmentation

By Type Outlook

- Stationary CT Scanners

- Portable CT Scanners

By Device Architecture Outlook

- C-Arm CT Scanners

- O-Arm CT Scanners

By Technology Outlook

- High-Slice CT

- Mid-Slice CT

- Low-Slice CT

- Cone Beam CT (CBCT)

By Application Outlook

- Human

- Veterinary

- Research

By End-Use Outlook

- Hospitals & Diagnostic Centers

- Research Laboratories & Academic Institutes

- Ambulatory Care Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.72 billion |

|

Market Size Value in 2025 |

USD 7.07 billion |

|

Revenue Forecast by 2034 |

USD 11.45 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The CT Scanner market has been segmented into detailed segments of type, device architecture, technology, application, and end-use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth strategy in the CT scanner market focuses on continuous innovation, expanding product portfolios, and improving customer accessibility. Key players are investing in advanced technologies like artificial intelligence, machine learning, and improved image resolution to enhance diagnostic capabilities and reduce scan times. Additionally, companies are focusing on increasing the affordability and portability of their devices to cater to emerging healthcare markets. Strategic partnerships, acquisitions, and geographic expansion into developing regions are also vital components of the marketing strategy. By offering tailored solutions for different healthcare settings, manufacturers aim to capture a broader customer base and address the growing demand for high-quality diagnostic imaging.

FAQ's

The CT Scanner market size was valued at USD 6.72 billion in 2024 and is projected to grow to USD 11.45 billion by 2034.

The market is projected to register a CAGR of 5.5% from 2025 to 2034.

North America had the largest share of the market in 2024.

Key players in the CT scanner market include companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Hitachi Healthcare, Samsung Medison, Toshiba Medical Systems, Carestream Health, Neusoft Medical Systems, United Imaging Healthcare, Konica Minolta, Medtronic, Fujifilm Medical Systems, Hologic, and Planmed.

The stationary CT scanners segment accounted for the larger share of the market in 2024.

The C-arm CT scanners segment accounted for the larger share of the market in 2024.

A computed tomography (CT) scanner is a medical imaging device that uses X-rays and computer processing to create detailed cross-sectional images (or slices) of the body. These images allow healthcare providers to view the inside of the body in a non-invasive manner, aiding in the diagnosis and treatment planning of various medical conditions, including cancers, heart diseases, injuries, and neurological disorders. CT scanners work by rotating an X-ray tube around the body, capturing multiple images from different angles, which are then combined by a computer to form a comprehensive 3D image. This technology is commonly used in hospitals, diagnostic centers, and emergency care settings for its speed and diagnostic accuracy.

A few key trends in the market are described below: Integration of Artificial Intelligence (AI): Increasing use of AI to improve diagnostic accuracy, automate image analysis, and reduce scan times. Portable and Compact CT Scanners: Rising demand for mobile and compact CT scanners, particularly for point-of-care settings, emergency care, and remote locations. Hybrid Imaging Systems: Growth in hybrid systems combining CT with other modalities like magnetic resonance imaging (MRI) or positron emission tomography (PET) for enhanced diagnostic capabilities. Low-Dose Radiation Technology: Advancements in technology aimed at reducing radiation exposure while maintaining image quality.

A new company entering the CT scanner market could focus on developing affordable, portable, and compact CT scanning solutions to address the growing demand for mobile and point-of-care diagnostics. Additionally, integrating advanced technologies such as AI for faster image processing and enhanced diagnostic accuracy would differentiate the company from competitors. Offering solutions with reduced radiation exposure, along with improved patient comfort and user-friendly interfaces, could also provide a competitive edge. Focusing on underserved markets in emerging regions, where healthcare infrastructure is expanding, presents another opportunity. Furthermore, providing cost-effective maintenance and support services would help build long-term customer relationships.

Companies manufacturing, distributing, or purchasing CT scanners and related products, and other consulting firms must buy the report.