PET-CT Scanner Device Market Share, Size, Trends, Industry Analysis Report

By Application (Cardiology, Oncology, Neurology); By Type; By Modality; By Slice Count; By Detector Type; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM1838

- Base Year: 2024

- Historical Data: 2020-2023

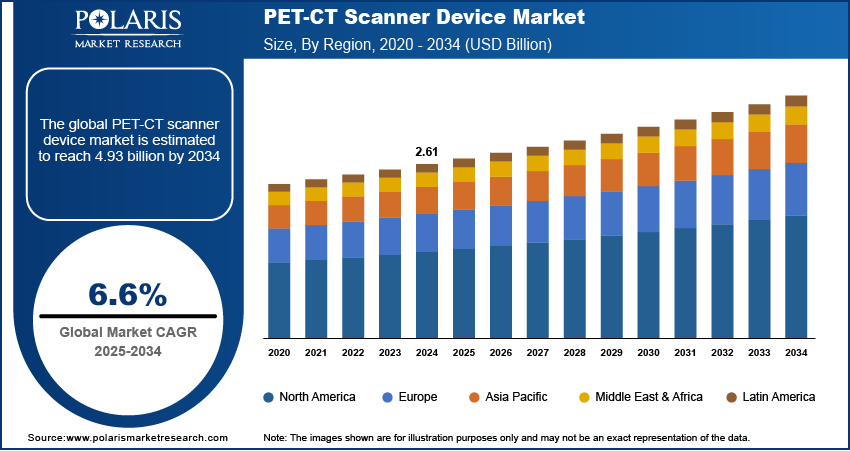

The global PET-CT scanner device market size was valued at USD 2.61 billion in 2024 and is anticipated to register a CAGR of 6.6% from 2025 to 2034.

Key Insights

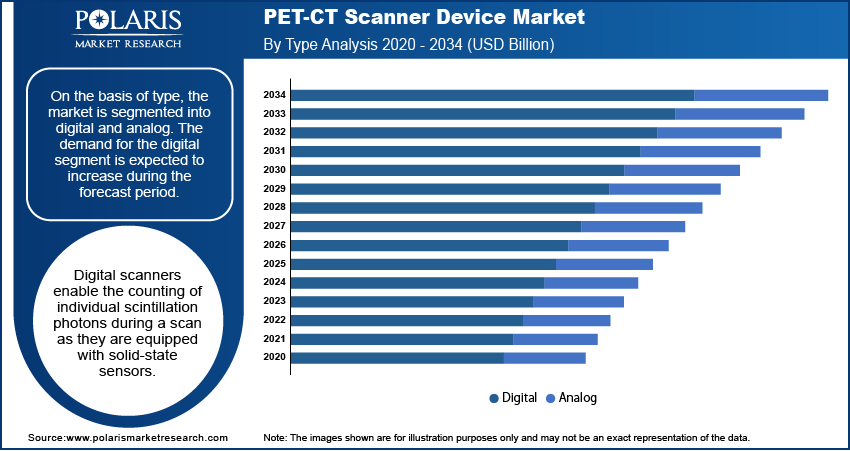

- Demand for the digital segment is expected to increase during the forecast period. This is due to solid-state sensors, which allow the counting of individual scintillation photons during a scan.

- The fixed PET-CT scanner device segment dominated the global market for PET-CT scanner devices in 2024. This is driven by greater reliability and improved efficiency.

- The oncology segment dominated the global market for PET-CT scanner device in 2024. This is due to the combination of a CT scan and a PET scan to provide more accurate results.

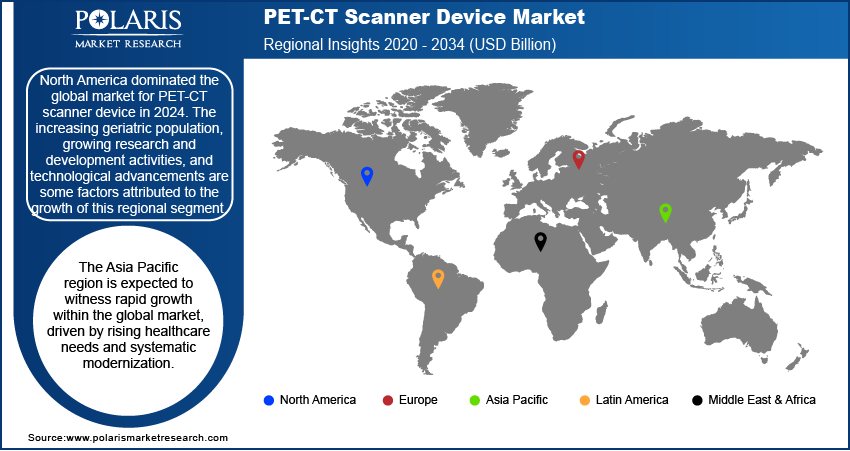

- North America dominated the global market for PET-CT scanner device in 2024. This is due to the aging population, expansion of R&D activities, and technological advancement.

Industry Dynamics

- Rise in development of higher-resolution detectors, improved reconstruction algorithms, and lower radiation dose protocols allows clinicians to obtain clearer, more precise images while minimizing patient exposure.

- Radiopharmaceuticals track a wider range of diseases with the development of new radiotracers, which provide a more refined approach to targeting neurological disorders, cardiovascular diseases, and rare cancers.

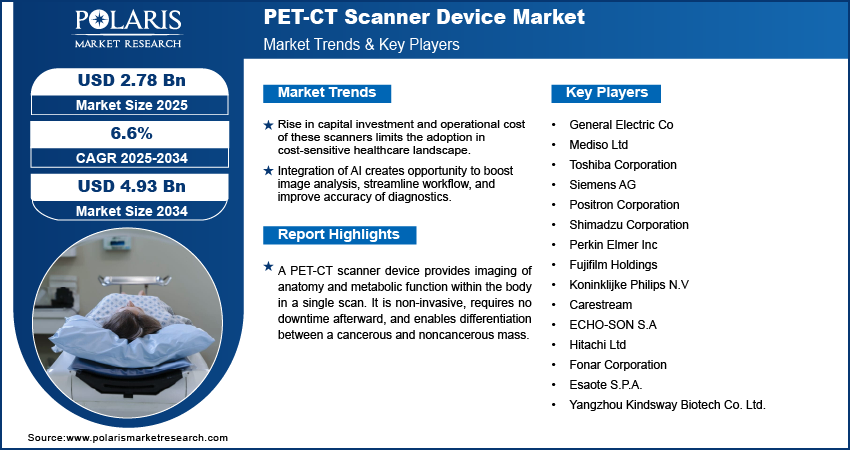

- Rise in capital investment and operational cost of these scanners limits the adoption in cost-sensitive healthcare landscape.

- Integration of AI creates opportunity to boost image analysis, streamline workflow, and improve accuracy of diagnostics.

Market Statistics

- 2024 Market Size: USD 2.61 billion

- 2034 Projected Market Size: USD 4.93 billion

- CAGR (2025-2034): 6.6%

- North America: Largest market in 2024

AI Impact on PET-CT Scanner Device Market

- The algorithms of AI analyze CT scans to detect abnormalities with accuracy in early disease detection, like cancer.

- AI automates time-consuming tasks like image reconstruction and organ segmentation, which helps in speeding up scan processing and analysis.

- It extracts crucial data from scans, which is beyond visual assessment, to offer measurable biomarkers for tailored treatment planning.

- High-quality images from lower-dose scans are provided with AI, improving patient safety by minimizing their radiation exposure during procedures.

A PET-CT scanner device provides imaging of anatomy and metabolic function within the body in a single scan. It is non-invasive, requires no downtime afterward, and enables differentiation between a cancerous and noncancerous mass. The growth in global prevalence of cancer has boosted the demand for these devices, as early detection and precise disease stage are essential for effective treatment planning. PET-CT scanners have become an essential tool in oncology based molecular diagnostics, monitoring therapy response, and guiding personalized treatment pathways by offering detailed visualization of tumor activity at a molecular level. The rise in cancer burden worldwide continues to reinforce the importance of PET-CT devices, positioning them as essential assets in modern healthcare infrastructure.

Government and private healthcare investments provide access to advanced imaging technology and boost diagnostic capabilities. Investments are being directed towards acquiring cutting-edge equipment such as PET-CT scanners, training medical professionals, and upgrading hospital facilities as healthcare systems seek to improve patient outcomes. For instance, in November 2024, the Australian Cancer Research Foundation granted USD 10 million to fund world-first total-body PET/CT scanning technology to speed up the development of new scans and targeted treatments to improve outcomes for people with cancer. These funding initiatives boost technology adoption and encourage research and innovation in imaging solutions. Moreover, public and private funds are allowing broader deployment of PET-CT scanners, thereby ensuring that a larger patient population benefits from accurate and timely diagnostic interventions.

To Understand More About this Research: Request a Free Sample Report

The product is increasingly being used for the detection of cancer, assessment of the effectiveness of treatment, evaluation of prognosis, identification of weak heart muscles, analysis of brain abnormalities, and assessment of tissue metabolism and viability. The increasing occurrence of chronic diseases, inclusion of scanning under Medicare, and growing investments in the development of advanced healthcare equipment by governments and private organizations are some factors expected to fuel the demand for the product during the forecast period.

PET-CT device is a combination of positron emission tomography (PET) detectors and computed tomography (CT). The PET-CT scanner devices combine the metabolic data from the scan with the detailed anatomic data from the CT scan device to deliver highly detailed images. The scanners use radioactive glucose, which is injected into a vein to detect tumor cells, which consume more glucose than normal cells.

Industry Dynamics

Growth Drivers

Innovation in scanner technology provides enhanced image quality, reduced scanning time, and improved diagnostic accuracy. Rising development, such as higher-resolution detectors, improved reconstruction algorithms, and lower radiation dose protocols, allows clinicians to obtain clearer, more precise images while minimizing patient exposure. For instance, in June 2023, Siemens Healthineers launched the Biograph Vision.X PET/CT Scanner. The scanner delivers a high 48-mm³ volumetric resolution and the best temporal resolution of 178 ps. These improvements enhance diagnostic capability and expand the scope of applications for PET-CT beyond oncology into cardiology, neurology, and other medical fields. Advances in scanner technologies are rising adoption and strengthening the clinical value of PET-CT systems.

Improvement in radiopharmaceuticals track a wider range of diseases. Conventional tracers, such as FDG, remain as a central part of oncogenic studies. However, the development of new radiotracers provides a more refined approach to targeting neurological disorders, cardiovascular diseases, and rare cancers. Advances in radiopharmaceuticals open imaging possibilities by providing sensitivity and specificity for earlier disease detection within PET-CT studies. As a result, advancements to radiopharmaceuticals expand clinical applications and improve patient outcomes, but also drives demand for PET-CT systems, and solidify their position as vital diagnostic modalities in contemporary medicine.

Know more about this report: Request for sample pages

What is the impact of regulatory standards on the PET-CT scanner device market?

Various government and private organizations are imposing stringent regulatory standards on diagnostic devices to ensure patient safety. Players operating in the PET-CT scanner device market are required to comply with these standards to ensure patient safety, radiation protection, and diagnostic efficacy. Regulatory requirements vary by region and comprise device approval, operational protocols, and radiation safety standards. The following table consists of key regulatory requirements in a few markets.

|

Region/Country |

Regulator |

Device Classification |

Approval Process |

Radiation Safety Oversight |

|

USA |

Food and Drug Administration (FDA) |

Class II |

510(k) Premarket Notification |

Radiation Control for Health and Safety Act |

|

European Union (EU) |

Notified Bodies |

Class IIa or IIb |

CE Marking |

European Basic Safety Standards Directive |

|

India |

CDSCO |

Class B or C |

Medical Device Rules, 2017 |

Atomic Energy Regulatory Board (AERB) |

|

Canada |

Health Canada |

Class III |

Medical Device License Application |

Canadian Nuclear Safety Commission (CNSC) |

It has become crucial for industry players to understand and comply to regulatory requirements. By adhering to these norms, PET-CT scanner manufacturers and healthcare providers can ensure the effective use of PET-CT scanners and the patient safety. It will also boost their position in the competitive landscape and offer opportunities for business expansion.

PET-CT Scanner Device Market Report Scope

The market is primarily segmented on the basis of type, modality, application, end-use, slice count, detector type, and region.

|

By Type |

By Modality |

By Application |

By End-User |

By Slice Count |

By Detector Type |

By Region |

|

|

|

|

|

|

|

Know more about this report: request for sample pages

Type Outlook

On the basis of type, the market is segmented into digital and analog. The demand for the digital segment is expected to increase during the forecast period. Digital scanners enable the counting of individual scintillation photons during a scan as they are equipped with solid-state sensors. These scanners enhance the quality of images by improving the detection of lesions while reducing the scan time. Unlike analog systems that rely on photomultiplier tubes and analog signal processing, digital scanners utilize solid-state silicon photomultipliers (SiPMs) to convert scintillation events directly into digital signals. Furthermore, the increased sensitivity of digital detectors means diagnostic-quality images can be acquired in a substantially reduced scan time or with a lower administered dose of radiopharmaceutical, enhancing patient comfort and safety while improving departmental throughput.

Modality Outlook

The market is segmented into fixed and mobile based on modality. The fixed PET-CT scanner device segment dominated the global PET-CT scanner device market in 2024. This is due to greater reliability and improved efficiency. Fixed PET-CT scanner devices improve the patient experience. Growth in the geriatric population, changing lifestyles, and increase in oncology and cardiovascular disorders have boosted the demand for fixed PET-CT scanner devices in hospitals. The stationary nature of these systems allows for their integration into robust, optimized infrastructure, such as advanced shielding, stable power supplies, and refined networking for seamless data transfer into Picture Archiving and Communication Systems (PACS). Therefore, this established setup provides a controlled environment that ensures consistent operational reliability and minimizes potential downtime.

Regional Outlook

North America dominated the global market for PET-CT scanner device in 2024. The increasing geriatric population, growing research and development activities, and technological advancements are some factors attributed to the growth of this regional segment. There have been increasing incidences of chronic diseases registered in the region, driving the growth of this region. Rising health concerns established healthcare infrastructure, and growing awareness regarding preventive healthcare and early diagnosis of diseases has increased the demand for PET-CT scanner devices in the region.

The Asia Pacific region is expected to witness rapid growth within the global market, driven by rising healthcare needs and systematic modernization. This is due to governmental and private investments aimed at upgrading healthcare infrastructure across both public and private hospital networks. Furthermore, rising healthcare expenditure, coupled with growing disposable incomes in emerging economies, is enhancing patient access to advanced diagnostic procedures. Increase in awareness of early disease detection, particularly for oncology and neurological disorders, is concurrently fueling clinical demand for advanced imaging modalities, positioning the region for exceptional market expansion. Countries such as China and India are witnessing growth boosted by their large patient populations, ambitious healthcare reforms, and rapidly expanding diagnostic imaging servces.

Competitive Landscape

The competitive landscape for the PET-CT scanner is witnessing expansion by strong competition from large medical imaging companies that use investment in R&D and technology as a way to help maintain their position in the space. Vendors have focused on developing advanced digital systems with Artificial Intelligence as a disruptive trend that is changing the course for the future of the industry. Demand and growth is increasingly being driven by emerging markets based on pent-up demand and opportunities created by the modernization of healthcare infrastructure. However, dealing with the economic and geopolitical challenges along with supply chain problems continue to create hurdles. Companies are pursuing aggressive market expansion strategies to capitalize on customizable solutions for various business segments, requiring a deep level of competitive intelligence and strategy for entry and optimal positioning for competition.

The leading players in the PET-CT scanner device market include General Electric Co., Mediso Ltd., Toshiba Corporation, Siemens AG, Positron Corporation, Shimadzu Corporation, Perkin Elmer Inc., Fujifilm Holdings, Koninklijke Philips N.V., Carestream, ECHO-SON S.A., Hitachi Ltd., Fonar Corporation, Esaote S.P.A., and Yangzhou Kindsway Biotech Co. Ltd.

Industry Development

June 2025: BC Cancer collaborated with the University of British Columbia (UBC) for the most advanced PET/CT scanner in the country. The machine provides fast imaging and whole body imaging in a single frame, providing patients with improved diagnostics with the development of novel imaging agents and targeted cancer treatments.

March 2025: The Kingdom of Jordan opened its first advanced nuclear medicine diagnostic centre in a public hospital with IAEA support to increase access to diagnostic services for cancer and other non-communicable diseases.

PET-CT Scanner Device Market

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.61 Billion |

|

Market Size in 2025 |

USD 2.78 Billion |

|

Revenue Forecast by 2034 |

USD 4.93 Billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.61 billion in 2024 and is projected to grow to USD 4.93 billion billion by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

The North America region dominated the market in 2024.

A few of the key players in the market are General Electric Co., Mediso Ltd., Toshiba Corporation, Siemens AG, Positron Corporation, Shimadzu Corporation, Perkin Elmer Inc., Fujifilm Holdings, Koninklijke Philips N.V., Carestream, ECHO-SON S.A., Hitachi Ltd., Fonar Corporation, Esaote S.P.A., and Yangzhou Kindsway Biotech Co. Ltd.

The fixed PET-CT scanner device segment dominated the global PET-CT scanner device market in 2024.

The demand for the digital segment is expected to witness the fastest growth during the forecast period.