Camera Modules Market Share, Size, Trends, Industry Analysis Report

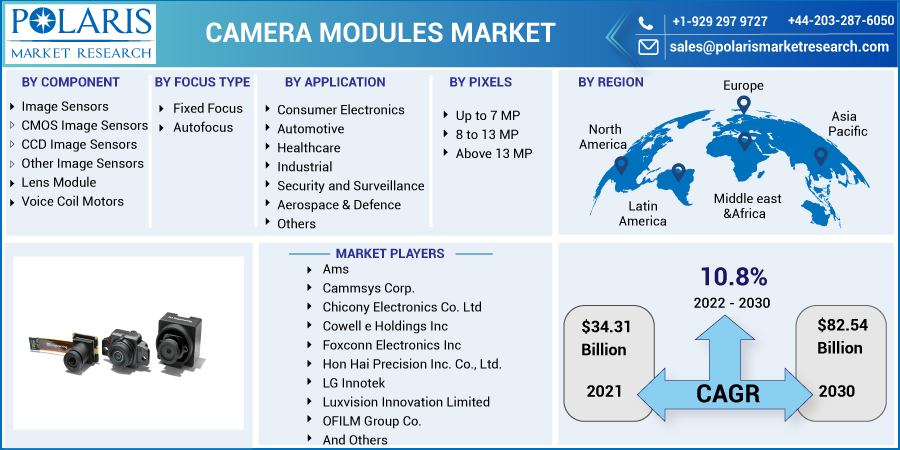

By Component; By Focus Type (Fixed Focus, Autofocus); By Application; By Pixels (Up to 7 MP, 8 to 13 MP, Above 13 MP); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2303

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

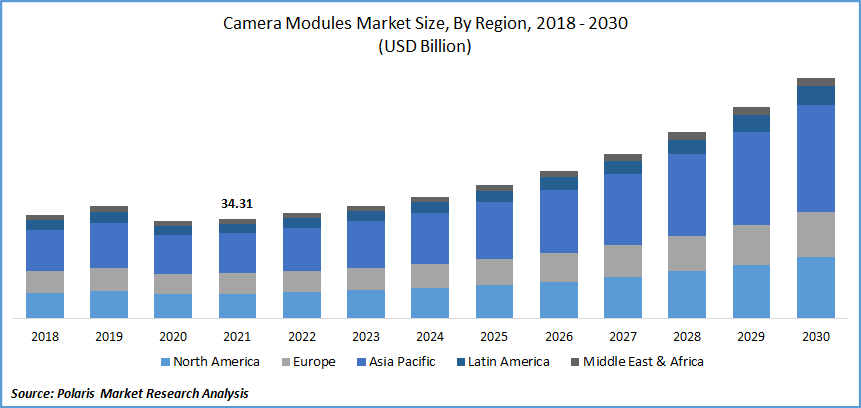

The global camera modules market was valued at USD 34.31 billion in 2021 and is expected to grow at a CAGR of 10.8% during the forecast period. Factors such as the widespread use of camera modules across various verticals, launches of government measures, and advancements in technologies are boosting the market growth. These devices are widely used in the medical and healthcare sectors, mobile and tablet PC devices, the automotive industry, defense and aerospace, industrial and security applications, and consumer electronics.

Know more about this report: Request for sample pages

It is also anticipated that the market for camera modules would increase due to the rising need for imaging systems in the military and space. The automobile sector is one of the industries for such smart technology that is growing the quickest. In addition to automotive and military, an aging population and increased health awareness have increased the need for imaging equipment in these technologies. The demand for these medical and health sciences items has grown as a result of this characteristic.

Furthermore, the introduction of government limitations in many locations is the main factor behind this expansion. Driver safety is a top issue for the government. Governments and manufacturers are implementing several initiatives in several countries to increase driver safety and lower the frequency of traffic accidents. Additionally, it is anticipated that laws mandating the installation of imagers in autos would improve the driver's eyesight. The increased application of these regulations in areas like North America and Europe is expected to accelerate industrial growth.

However, factor such as the miniaturization of devices leading to design complexities is restraining the market growth during the forecast period. Due to downsizing, a few frequent difficulties that may arise during the production of camera modules result in poor quality and other architectural concerns. Precise focus, loose lens or incorrect glue distributing, lens abnormality, poor contact between many components, defects out from SMT procedure, defects from FPC (flexible printed circuit,) faulty sensor, unsurpassed sensor and lens, incompatible FOV (field of view), and the handset, defects from SMT or FPC, malfunction in the lens arrangement, and others are among the issues.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Among the forces influencing image sensor implementation is the increased inclusion of elevated cameras modules equipped with sensor technology in mobile devices, the growth in the adoptive parents of image cameras modules for automotive applications, and the upsurge in the use of image sensors in medical advancements imaging solutions. In addition, new picture technological solutions such as organic photodetectors, image sensors, hyper-spectral imaging, x-ray detectors, and wavefront imaging significantly improved image sensors.

Further, in September 2021, LG Innotek declared it developed the most potent 'eco magnet' in partnership with the magnet business SGI. When used in conjunction with a high-pixel smartphone camera, the ECO Magnet improves photo and video clarity by boosting the overall primary cause of the actuators.

Also, in July 2021, ams OSRAM, a global pioneer in optical technologies, announced the NanEyeM camera modules for specific medical endoscopy to its NanEye range. It has a better definition that meets existing industry standards, while the smallest digital endoscopic camera modules are accessible. The trend from reused to disposable bronchoscopes in surgical techniques such as bronchoscopy has lately quickened. Thus, these factors boost the camera modules market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on component, focus type, application, pixels, and region.

|

By Component |

By Focus Type |

By Application |

By Pixels |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Component

Based on the component segment, the image sensors segment was the largest revenue share in 2021. The primary factors driving the expansion of the image sensor market are the augmented demand for consolidated HD camcorders and smartphones, improvements in digital technology, and growing consumer concerns regarding security and surveillance. Key companies are also implementing organic growth tactics in the camera modules market to strengthen their product portfolio.

Geographic Overview

In terms of geography, North America dominated with the highest camera modules market share in 2021. The improvement of technology in the Information and Communication Technology (ICT) sector, as well as the introduction of Artificial Intelligence (AI) and the Internet of Things (IoT), is projected to boost the market of the North American camera modules market during the forecast period. The advent of 5g technology and its applications in many industries like healthcare, retail, and others is expected to fuel modules industry growth throughout the forecast period.

Additionally, the market for camera modules worldwide in 2021 had a significant CAGR in the Asia Pacific region. The Japanese government's plans to expand the connected vehicles division in time for the 2020 Olympics would undoubtedly enhance demand for linked cars in Japan during the projected period. In order to improve consumer perception of automated driving systems, Japanese automakers have started showcasing AD technology. The development of smart cities is also playing a significant role in propelling the market for security cameras in China. To increase efficiency, cutting-edge video surveillance systems have connected the city administration.

Competitive Insight

Some of the major players operating in the global market include Ams, Cammsys Corp., Chicony Electronics Co. Ltd, Cowell e Holdings Inc, Foxconn Electronics Inc, Hon Hai Precision Inc. Co., Ltd., LG Innotek, Luxvision Innovation Limited, OFILM Group Co., Omni vision Technologies, Partron Co., Ltd, Primax Electronics, Samsung Electro-Mechanics Co, Ltd, and Sharp Corporation.

Camera Modules Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 34.31 billion |

|

Revenue forecast in 2030 |

USD 82.54 billion |

|

CAGR |

10.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Focus Type, By Application, By Pixels, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Ams, Cammsys Corp., Chicony Electronics Co. Ltd, Cowell e Holdings Inc, Foxconn Electronics Inc, Hon Hai Precision Inc. Co., Ltd., LG Innotek, Luxvision Innovation Limited, OFILM Group Co., Omni vision Technologies, Partron Co., Ltd, Primax Electronics, Samsung Electro-Mechanics Co, Ltd, and Sharp Corporation. |