Generative AI in Animation Market Size, Share, Trends, & Industry Analysis Report

By Component (Services, Solutions), By Type, By End-Use, and By Region, Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 135

- Format: PDF

- Report ID: PM5018

- Base Year: 2024

- Historical Data: 2020-2024

Market Overview

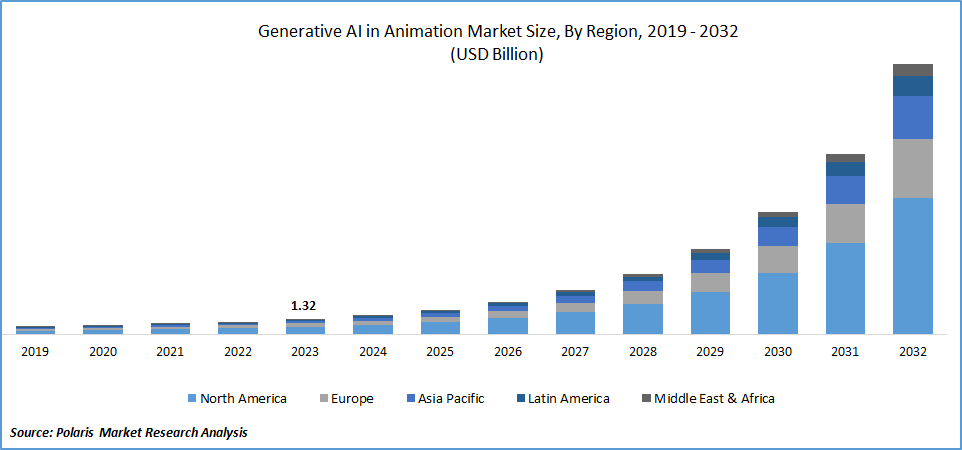

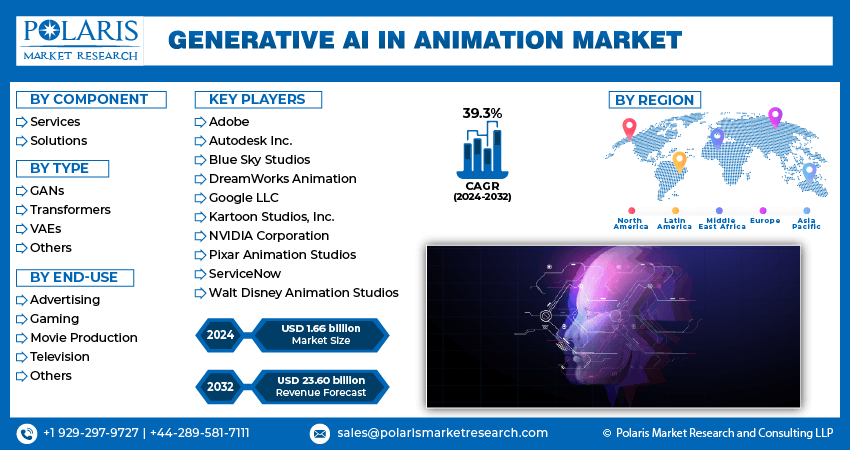

The global generative AI in animation market size was valued at USD 1.8 billion in 2024, exhibiting a CAGR of 39.50% during 2025–2034. The market is driven by rapid advancements in AI-generated content creation, rising demand for cost-efficient animation tools, and expansion of digital media platforms.

Key Insights

- The solutions category led the market due to its seamless integration with AI and animation software, enabling streamlined workflows, reduced production time, and enhanced creative output.

- The gaming segment has dominated market share as developers increasingly leverage generative AI to produce visually engaging, dynamic content at scale, thereby enhancing immersive gaming experiences.

- North America, accounting for approximately 33% of the global market, leads due to the early adoption of AI by major entertainment studios, tech firms, and game developers, who utilize AI for character creation, lip-syncing, and scene automation.

- While North America leads, the Asia Pacific region is the fastest-growing market, driven by rapid expansion in gaming and entertainment sectors across China, India, Japan, and South Korea, supported by the rising use of locally developed AI animation tools.

Industry Dynamics

- The growing demand for faster content creation and cost-effective animation workflows is driving the adoption of generative AI in animation.

- The integration of AI with real-time rendering and its growing use in gaming and advertising further drive market growth.

- Creative limitations and ethical concerns around originality hinder widespread acceptance.

- Advancements in personalized content generation open new creative and commercial possibilities.

Market Statistics

- 2024 Market Size: USD 1.8 billion

- 2034 Projected Market Size: USD 20.38 billion

- CAGR (2025-2034): 39.50%

- North America: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Generative AI in animation uses algorithms to create new, dynamic content by learning from existing data, automating processes like character design, movement, and scene generation to enhance creativity and efficiency. The market is experiencing robust growth driven by the increased demand for realistic animation from the entertainment industry. Generative AI enables animators to achieve lifelike character movements, realistic physics simulations, and detailed environments that enhance audience engagement.

Moreover, this technology reduces production time and also expands creative possibilities by automating complex tasks requiring extensive manual effort, thus boosting generative AI in animation market growth.

The expansion of AI-powered tools and software in the market leverages advanced algorithms to enhance creativity, efficiency, and productivity in animation production. These tools, such as Animator, automate and streamline various aspects of the animation workflow, such as character animation, scene generation, and special effects. This leads to innovation by enabling animators to focus more on creative decision-making, ultimately driving the evolution of animation techniques and capabilities.

Market Trends

Rising Content Creation is Driving the Market Growth

The market CAGR for generative AI in animation is increasing due to the growing demand for content creation, particularly on digital and online platforms. This technology enables content creators to produce engaging content in efficient and scalable ways. It includes features for character movement and scene creation, allowing for creativity and personalization.

For instance, in May 2023, Stability AI, a synthetic media startup, launched a tool that utilizes open-source Stable Diffusion generative AI models to generate animations, driving the surge of content creation. The Stable Animation SDK is capable of transforming text prompts into animated videos. It can also incorporate an image or pre-existing video clip to ensure efficient and swift usage by content creators to enhance their creativity.

Rising Advancements in Generative AI in Animation

The generative AI in animation market is experiencing significant growth. The market growth is driven by the rising advancements in the animation processes, enabling the creation of realistic movements and expressions based on input data from existing animation databases. These advancements not only streamline production timelines but also enable animators to explore more imaginative storytelling through AI-generated characters and environments, representing a significant advancement in the field of digital animation and driving the market revenue.

For instance, in November 2023, Pika Labs introduced Pika 1.0, a generative AI in animation model focused on transforming ideas into videos. This model offers the capability to generate content in various styles and enables users to edit pre-existing video clips by painting over objects, individuals, or entire scenes.

Segment Insights

By Component Insights

The global generative AI in animation market segmentation, based on component, includes services and solutions. The solutions category dominated the market owing to its ability to integrate with AI technology and animation software to create smooth workflows and streamline production processes. Additionally, providers of these solutions frequently offer customizable options, including character design, scene generation, and rendering tailored to individual requirements.

For instance, in May 2024, ServiceNow demonstrated the use of generative AI service agents with the help of NVIDIA AI Enterprise software. These service avatars are designed for customers and employees to interact with animated generative AI technology, improving employee and customer experiences by making them more engaging and personalized.

By End-Use Insights

The global generative AI in animation market segmentation, based on end-use, includes advertising, gaming, movie production, television, and others. The gaming segment dominated the market due to the increased demand for creative and visually appealing gaming content. This led to the integration of generative AI in gaming and drove the utilization of generative AI in animation.

For instance, according to Invest India, the Indian gaming industry is witnessing rapid growth, with the rise of three gaming unicorns: Game 24X7, Dream11, and Mobile Premier League, along with the number of online gamers reaching 500 million by 2025.

Regional Insights

The Generative AI in Animation market is transforming the animation industry by enabling faster content creation, enhancing creativity, and reducing production costs. North America dominates this market due to its strong technology infrastructure, presence of major AI and animation companies, and high investment in research and development. The region’s established entertainment industry, including Hollywood and leading gaming studios, actively adopts generative AI to streamline workflows and innovate storytelling techniques. Additionally, North America benefits from supportive government policies and a robust startup ecosystem that fosters AI-driven animation technologies, making it a hub for cutting-edge solutions.

In contrast, the Asia Pacific region is the fastest-growing market for generative AI in animation, driven by rapid digital transformation, rising demand for animated content in gaming, media, and advertising, as well as the increasing adoption of AI tools by emerging studios. Countries like China, Japan, South Korea, and India are investing heavily in AI research and animation production capabilities. The expanding mobile user base and growth of OTT platforms fuel demand for diverse, localized animated content, which generative AI helps to produce efficiently. Moreover, cost advantages and growing talent pools contribute to the region’s accelerating market growth.

Europe’s generative AI animation market is characterized by a strong focus on creative innovation and quality, supported by government initiatives that promote digital arts and AI adoption. European studios emphasize blending traditional animation techniques with AI-generated content to maintain artistic integrity. The region also benefits from collaboration between academic institutions and industry players, encouraging experimentation with AI tools in animation.

Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the generative AI in animation market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the generative AI in animation industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global generative AI in animation industry to benefit clients and increase the market sector. In recent years, the generative AI in animation industry has witnessed some technological advancements. Major players in the market include Adobe, Autodesk Inc., Blue Sky Studios, DreamWorks Animation, Google LLC, Kartoon Studios, Inc., NVIDIA Corporation, Pixar Animation Studios, ServiceNow, and Walt Disney Animation Studios.

Google LLC, a subsidiary of Alphabet Inc., provides search and advertising services on the Internet. The company, Google LLC, operates in two major reportable segments – Google Services and Google Cloud. The Google Services segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google Photos, Google Maps, Google Play, YouTube, and Search. In May 2024, Google LLC unveiled AI-driven functionalities aimed at enhancing search and advertising capabilities for advertisers to produce animated ads from static images. This allows advertisers to integrate brand-specific fonts and colors into their ads, thereby expanding the customization possibilities offered by Google's Performance Max platform.

NVIDIA Corporation is a computer hardware manufacturing company that provides GPU-accelerated computing solutions for AI and deep learning, gaming, self-driving cars, supercomputing, robotics, parallel computing, automotive technology, and professional graphics. In May 2023, NVIDIA Corporation launched a significant Omniverse update featuring the OpenUSD framework and generative AI, which will improve 3D pipelines and speed up industrial digitalization through new applications and services. The platform provides the ability to create modular apps, optimize rendering with NVIDIA RTX GPUs, and access extended-reality developer tools. This empowers developers and businesses to create more extensive simulations and tailor 3D projects.

Key companies in the market include

- Adobe

- Autodesk Inc.

- Blue Sky Studios

- DreamWorks Animation

- Google LLC

- Kartoon Studios, Inc.

- NVIDIA Corporation

- Pixar Animation Studios

- ServiceNow

- Walt Disney Animation Studios

Industry Developments

- May 2025: Primordial Soup, a new creative studio founded by filmmaker Darren Aronofsky, launched in partnership with Google DeepMind to develop AI-driven storytelling and create its first short film project, ANCESTRA, which debuts at Tribeca—marking a major innovation in studio-level generative AI animation

- May 2024: Autodesk acquired Wonder Dynamics in order to incorporate its VFX solution and cloud-based 3D animation with AI into existing tools to streamline processes and boost creativity. This acquisition further reinforces Autodesk's strategic objective of leveraging AI to unite teams, data, and processes within the media and entertainment industry.

- April 2024: Kartoon Studios, Inc. introduced an AI toolkit aimed at enhancing the quality of animation and streamlining workflow processes to enhance the overall quality of animated content.

- December 2023: Autodesk Inc.'s animation and 3D modeling software Maya incorporated generative AI tools to revolutionize the creation of textures, HDR images, and materials directly within the platform to enhance the efficiency of scene lighting and look development processes for artists utilizing Maya.

Market Segmentation

Generative AI in Animation Component Outlook

- Services

- Solutions

Generative AI in Animation Type Outlook

- GANs

- Transformers

- VAEs

- Others

Generative AI in Animation End-Use Outlook

- Advertising

- Gaming

- Movie Production

- Television

- Others

Generative AI in Animation Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.8 Billion |

|

Market Size Value in 2025 |

USD 2.5 Billion |

|

Revenue Forecast in 2034 |

USD 47.8 Billion |

|

CAGR |

39.50% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global generative AI in animation market size was valued at USD 1.8 billion in 2024 and is projected to be valued at USD 47.8 billion in 2034

The global market is projected to grow at a CAGR of 39.50% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are Adobe, Autodesk Inc., Blue Sky Studios, DreamWorks Animation, Google LLC, Kartoon Studios, Inc., NVIDIA Corporation, Pixar Animation Studios, ServiceNow, and Walt Disney Animation Studios.

The solutions category dominated the market in 2024

The gaming segment held the largest share of the global market