Healthcare Navigation Platform Market Share, Size, Industry Analysis Report

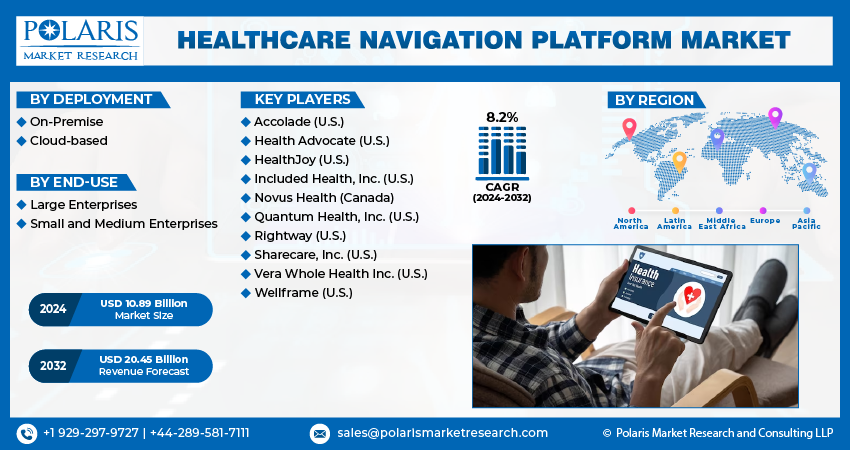

By Deployment (On-Premise, Cloud-based); By End-use; By Region; Segment Forecast, 2025- 2034

- Published Date:Jun-2025

- Pages: 119

- Format: PDF

- Report ID: PM4564

- Base Year: 2024

- Historical Data: 2020-2023

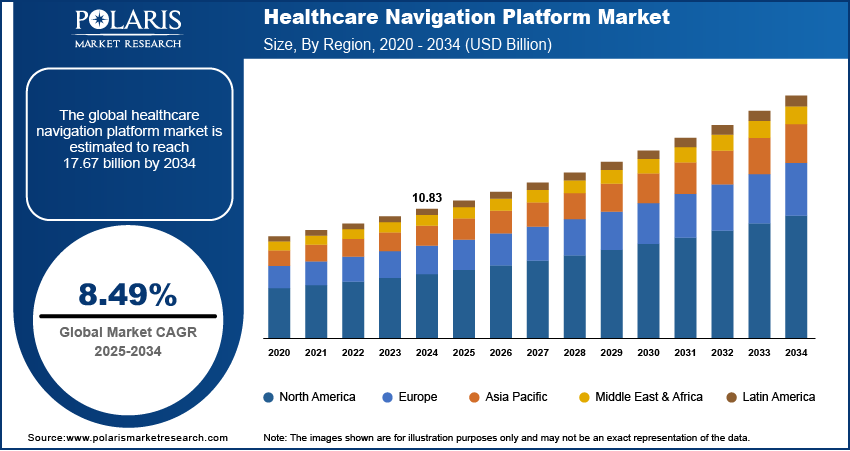

The Healthcare Navigation Platform Market was valued at 10.83 billion in 2024, growing at a CAGR of 8.49% from 2025. Employer health benefit optimization and user demand for coordinated care drive growth.

Market Overview

An increasing need for customized benefits coupled with the complexity in the employee benefits are major propelling the healthcare navigation platform market growth. Moreover, growing government initiatives to promote the use of healthcare IT and an increase in the use of data-driven technologies are anticipated to propel its adoption. Furthermore, rising demand for cloud-based platforms and high adoption of technology platforms with artificial intelligence (AI) will contribute to the market growth.

Increasing difficulties and struggle situations faced by the people owing to the ambiguous, complex, and fragmented nature of healthcare industry will increase the demand for healthcare navigation platforms in the coming years. Moreover, the advantages of healthcare navigation tools such as cost control, time savings, and personalized guidance are expected to boost the market growth in the projected years. Furthermore, the ability of the navigation tools to simplify the complexities of the U.S. healthcare system coupled with an increasing focus of companies towards strategic developments will drive the market growth.

For instance, in September 2023, Orion Health announced the introduction of new healthcare AI-enabled patient navigation services in Canada.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

Initiatives by the government to promote IT usage

The complex nature of the healthcare industry, the large number of options for insurance, and presence of numerous providers has increased the struggle and challenges faced by the people. An increase in the number of government initiatives related to healthcare IT to address problems and complexities in the healthcare system will boost the market growth.

For instance, in August 2023, the World Health Organization (WHO) & G20 India announced a new Global Initiative on Digital Health (GIDH) at the G20 Summit. Moreover, an increasing focus on research & development activities funded by government organizations will drive the demand for healthcare navigation platform market.

Increasing usage of artificial intelligence (AI) will prove beneficial for the growth

The use of artificial intelligence in healthcare industry has increased over the past decade. Artificial intelligence (AI)-powered apps that offer comprehensive and instant assistance are revolutionizing healthcare navigation. AI-powered care navigator helps in handling health-related queries for thousands of employees. Moreover, the benefits such as tailored healthcare advice, assistance in finding optimal insurance plan, and high priority to user privacy are attracting the employees as well as employers.

The growing attractiveness of this AI-based health benefit navigation tool in the corporate sector will significantly contribute to the market growth in the coming years. Moreover, the rising popularity of AI is encouraging market players to focus on this platform by undertaking various strategic initiatives such as new product launches, mergers, and acquisitions. For instance, in March 2023, Transcarent (a healthcare platform for self-insured employers) agreed to acquire leading AI-powered platform, named “98point6”. Such strategies adopted by the industry players will fuel the growth of healthcare navigation platform market during the forecast period.

Restraining Factors

Several problems associated with healthcare navigation platforms hampers the market growth

Despite the increasing popularity and proven effectiveness of healthcare navigation platforms, it is still not an advantage that everyone could benefit from. Significant financial expenses are required for the companies for certain traditional navigation systems that provide full-clinical navigation.

For instance, according to the blog published by Rightway in November 2021, the costing of more than USD 20 per employee per month is associated with the conventional navigation systems. Moreover, the failure of smooth integration of healthcare navigation solutions with an employer’s existing coverage can confuse the employees and cause conflict with the insurers. Such factors associated with the installation of these tools is expected to limit the healthcare navigation platform market growth.

Report Segmentation

The market is primarily segmented based on deployment, end-use, and region.

|

By Deployment |

By End-use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Insights

The cloud-based segment accounted for a dominant share of healthcare navigation platform market

Cloud-based segment held the largest share. This is due to benefits of cloud-based platform including reduction in IT staff’s responsibilities, elimination of capital expenses, and easier data backup. Moreover, factors such as growing adoption of digital health, increasing preference to cloud deployment in healthcare industry, and rapid growth of healthcare IT sector are also contributing to the segment’s growth.

Furthermore, market players concentrating towards the development and launch of cloud-based care navigation platform drives the segmental growth. For instance, in June 2023, apree health, a company with secure and scalable cloud architecture, introduced apree whole health, a navigation and clinical advocacy solution to help employers in lowering medical costs and enhancing patient outcomes.

By End-use Insights

Large enterprises emerged as the largest segment in global healthcare navigation platform market

The large enterprises segment accounted for the largest share in 2023. This is primarily due to increasing adoption of this platform by big employers, rising need to cut costs, and growing demand for AI-based navigators. Moreover, the complete configurability and scalability of this platform for a wide range of users is expected to contribute to the segmental growth. Furthermore, the availability of initial investments to implement care navigation platform and strong focus of large organizations towards the spending in technology solutions are contributing to the segmental growth.

Regional Insights

North America accounted for the largest healthcare navigation platform market share

North America dominated the global market. Patients in this region find it difficult to obtain healthcare services due to the complexity of the healthcare system. In order to address this problem, a large number of companies in the U.S. and Canada focuses on the launch of healthcare navigation platforms.

- For instance, in March 2023, CareCanada announced the introduction of an innovative platform to revolutionize healthcare navigation in Canada.

This platform helps patients to easily access information related to physicians and services. Moreover, the extensive range of services offered by the healthcare navigation platforms including access to digital health records, virtual consultations, health service navigation support, insurance coverage checker, and appointment booking & scheduling are anticipated to contribute to the healthcare navigation platform market expansion in the upcoming years.

Asia Pacific healthcare navigation market is projected to expand at the highest CAGR during the forecast timeframe. Factors such as presence of highly populous countries, increasing healthcare spending, and growing adoption of digital health solutions in this region will contribute to the market growth in the projected years.

For instance, according to the Ministry of Health and Family Welfare, in India, the National Health Authority (NHA) expanded its Digital Health Incentives Scheme (DHIS) until December, 2023, as a part of the Ayushman Bharat Digital Mission (ABDM). Hospitals, diagnostic labs, and companies that offer digital health solutions were given incentives under DHIS to adopt and enable revolutionary digitization.

Key Market Players & Competitive Insights

Fundings for healthcare navigation platform of companies will increase the competition in the coming years

The healthcare navigation platform market is consolidated in nature Moreover, the strategies such as receival of fundings, promotion of the existing products, and new products are helping the other small and medium-sized companies to strengthen their market shares. For instance, in January 2024, Care Continuity obtained funds totaling USD 10 million to support the expansion of its patient navigation platform. This funding will help the company to enhance its navigation platform.

Some of the major players operating in the global market include:

- Accolade (U.S.)

- Health Advocate (U.S.)

- HealthJoy (U.S.)

- Included Health, Inc. (U.S.)

- Novus Health (Canada)

- Quantum Health, Inc. (U.S.)

- Rightway (U.S.)

- Sharecare, Inc. (U.S.)

- Vera Whole Health Inc. (U.S.)

- Wellframe (U.S.)

Recent Developments in the Industry

- In May 2023, Health Management International Pte Ltd entered into an agreement to acquire MHC Asia Group Pte Ltd., a healthcare technology platform in Singapore.

- In February 2023, Quantum Health announced the addition of Cariloop, which is a new preferred partner within its Comprehensive Care Solutions platforms.

Report Coverage

The healthcare navigation platform market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, deployment, end-use, and their futuristic growth opportunities.

Healthcare Navigation Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 11.75 billion |

|

Revenue forecast in 2034 |

USD 17.67 billion |

|

CAGR |

8.49% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of healthcare navigation platform in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

key companies in the Healthcare Navigation Platform Market are Quantum Health, Novus Health, Accolade, HealthJoy

Healthcare navigation platform market exhibiting the CAGR of 8.49% during the forecast period.

The Healthcare Navigation Platform Market report covering key segments are deployment, end-use, and region.

key driving factors in Healthcare Navigation Platform Market are Increasing usage of artificial intelligence (AI)

Healthcare Navigation Platform Market Size Worth $17.67 Billion By 2034