Antimicrobial Coatings Market Share, Size, Trends, & Industry Analysis Report

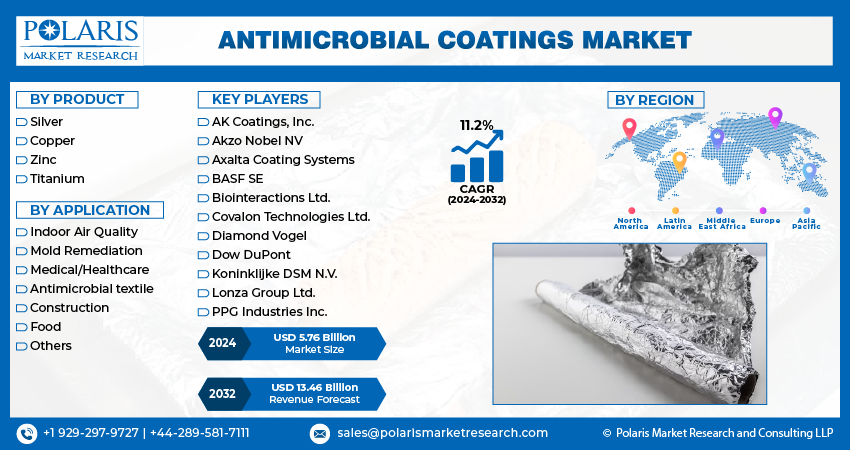

By Products (Silver, Copper, Zinc, Titanium); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1435

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global antimicrobial coatings market was valued at USD 12.3 billion in 2024 and is expected to grow at a CAGR of 13.80% from 2025 to 2034. Growth is driven by heightened awareness of hygiene in medical facilities and increasing use in consumer products.

Key Insights

- In 2024, the silver segment accounted for the largest revenue share and was the most sought-after material for antimicrobial coatings due to its superior antimicrobial properties.

- In 2024, the medical/healthcare segment captured the largest revenue share in the antimicrobial coatings market,t owing to its extensive use in preventing pathogens in both the medical and food sectors.

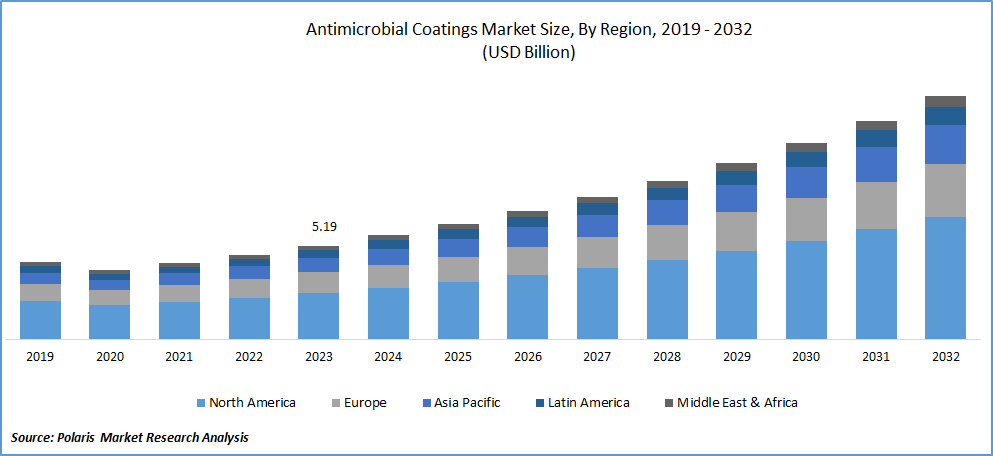

- In 2024, North America held the highest market share for antimicrobial coatings, driven by high demand for these products.

- Asia Pacific is forecast to be the fastest-growing market for antimicrobial coatings, driven by its large population and high economic growth, particularly in emerging nations.

Industry Dynamics

- The need for antimicrobial coatings is also increasing rapidly in the medical sector due to growing disease threats and increasing healthcare requirements.

- A primary opportunity in the antimicrobial coating market is the growing demand for hygiene and infection control across the healthcare, food, and public infrastructure industries.

- The market is expanding at a rapid pace due to technological developments such as antimicrobial polymers, photocatalytic coatings, and water treatment reactors coated with next-generation antimicrobial ceramics, which increase efficiency and provide broader areas of application.

- One major hindrance in the market is that advanced materials are very costly, and regulatory issues pose hurdles to their large-scale adoption.

Market Statistics

2024 Market Size: USD 12.3 billion

2034 Projected Market Size: USD 45.2 billion

CAGR (2025-2034): 13.80%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Antimicrobial coatings are designed to resist microbes and prevent the growth of microbial impurities. They find widespread application in the construction, food, and healthcare industries. These coatings are applied to various surfaces such as doors, glass panels, walls, HVAC vents, counters, etc.

The purpose of antimicrobial coatings is to apply a chemical agent on a surface that inhibits the growth of disease-causing microorganisms. In addition to their antimicrobial properties, these coatings offer benefits such as increased surface durability, improved appearance, corrosion resistance, and more. They are commonly used on medical devices to destroy or hinder the growth of microorganisms, protecting individuals from infectious diseases.

Antimicrobial coatings serve as a powerful defense against healthcare-associated infections. They feature highly effective antimicrobial properties and precise dosing and delivery mechanisms from the surface of medical devices. The focus of antimicrobial coatings is to reduce the accumulation of microbes on biomedical devices by altering interfacial features.

Antimicrobial coatings are vital in preventing surface contamination by germs and bacteria. These coatings have rapidly gained popularity and have become a billion-dollar industry. Antimicrobial coatings utilize alloys such as copper, zinc oxide, silver, zinc omadine, and titanium oxide to stop bacterial and fungal infections effectively. This germ-killing technology finds applications in various industries, including medical, industrial, automotive, and food processing.

These coatings, known as Antimicrobial Coatings (AMCs), are composed of chemical compounds that completely inhibit the growth of microorganisms on the treated surface. They are particularly valuable in healthcare settings and industries where maintaining a sanitized working environment is crucial.

The demand for Antimicrobial Coatings (AMCs) is experiencing significant growth, particularly in the medical industry. With the emergence of numerous diseases causing high mortality and morbidity rates worldwide, healthcare facilities and hospitals face significant challenges. As a result, the medical industry is expected to witness substantial growth.

AMCs have proven to be highly effective in inhibiting bacterial growth in the medical sector, due to the adoption of various technologies and chemical strategies. These coatings are applied to equipment surfaces, textile products in hospital rooms, and other devices requiring strict hygiene standards in clinical settings. Considering the phenomenal growth of hospitals and medical centers, the prospects for AMCs remain promising. As the industry expands, the demand for antimicrobial coatings will increase accordingly.

Industry Dynamics

- Growth Drivers

- Technological Advancements

Antimicrobial resistance has become a global challenge, making treating infectious diseases increasingly difficult. In this context, Antimicrobial Coatings (AMCs) that effectively prevent the transfer of pathogens have the potential to replace traditional medical equipment and other products.

The global AMCs market has witnessed rapid growth, driven by technological advancements. These technologies include antimicrobial coated polymers, antimicrobial photocatalytic coatings, water treatment on coated reactors, and new generation antimicrobial coated ceramics.

However, one significant factor limiting market growth is the challenge of smearing these coatings with various cleaning procedures in healthcare facilities. It can result in the emission of toxic gases into the environment, due to significant implications and concerns.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Silver segment accounted for the largest revenue share in 2024

In 2024, the silver segment accounted for the largest revenue share and the preferred material for antimicrobial coatings due to its exceptional antimicrobial properties. Silver oxide, in particular, is highly effective in combating bacterial strains such as Escherichia coli, which is responsible for causing respiratory diseases, food poisoning, and skin infections. These factors have significantly contributed to the growth of the coatings market and are expected to continue driving its expansion throughout the forecast period.

By Application Analysis

- Medical/Healthcare segment held the highest revenue share in 2024

In 2024, the medical/healthcare segment held the highest revenue share in the antimicrobial coatings market. These products are extensively used in the medical field and the food industry for pathogen prevention. The increasing population and rapid urbanization have led to convenience-driven production processes in the food industry, including producing ready-to-eat packaged food and beverages. Additionally, high-voltage air conditioners utilize antimicrobial coatings in mechanical components, vents, and related surfaces.

Regional Analysis

- North America dominated the largest market in 2024

In 2024, North America dominated the largest market share for antimicrobial coatings, experiencing significant demand for these products. The increased focus on antimicrobial coatings in medical and healthcare settings, driven by government initiatives, has contributed to the growth in the market.

The United States, in particular, has a high healthcare expenditure, with an annual spending of over USD 3 trillion on in-hospital care. Government regulations and initiatives aimed at reducing hospital-acquired infections have played a crucial role in driving the market in the United States. Additionally, the food and beverage industry, as well as the textile industry, in both the United States and Canada, are also witnessing growth in the antimicrobial coatings market.

After North America, the Asia Pacific region is expected to dominate the fastest markets for antimicrobial coatings, due to its large population and ongoing economic development, particularly in developing countries. The term "Asia Pacific region" refers to the geographical area that includes countries in East Asia, Southeast Asia, South Asia, and Oceania. Diverse economies, cultures, and industries characterize this region. Also factors such as increased awareness of hygiene, the importance of infection control, and advancements in technology led to a significant market share for antimicrobial coatings in Asia.

Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include;

- AK Coatings, Inc.

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Biointeractions Ltd.

- Covalon Technologies Ltd.

- Diamond Vogel

- Dow DuPont

- Koninklijke DSM N.V.

- Lonza Group Ltd.

- PPG Industries Inc.

Recent Developments

- In June 2024, NEI Corporation launched NANOMYTE® AM-100EC, a micron-thick coating that delivered antimicrobial and easy-to-clean properties. It adhered to diverse surfaces, showed superior abrasion resistance, and achieved a 99.99% E. coli reduction under ISO 22196 testing.

- In April 2022, Specialty Coating Systems, Inc. expanded its presence by adding Specialty Coating Systems (Vietnam) Co. Ltd., an ISO 9001:2015-certified facility. The new facility will offer conformal coating services to customers in various industries, such as consumer electronics, industrial electronics, transportation, aerospace, and medical devices. This expansion will enhance the company's business opportunities and reputation in Vietnam.

- In October 2022, Microban International launched LapisShield, a revolutionary non-heavy-metal technology meticulously crafted to incorporate antimicrobial functionality into water-based coatings seamlessly.

- In November 2020, Zonitise launches an antimicrobial surface coating designed to provide ongoing elimination of harmful pathogens, creating a safer and cleaner environment. Scientifically proven to eradicate bacteria and viruses, including TGEV coronavirus, the model virus for SARS-CoV-2, for up to twelve months after just one application.

Antimicrobial Coatings Market Report Scope

|

FAQ's

The global key market players include Covalon Technologies Ltd., BASF SE, PPG Industries Inc., AK Coatings

The global antimicrobial coatings market is expected to grow at a CAGR of 11.2% during the forecast period.

Human Machine Interface Market report covering key segments are product, application, and region.

The key driving factors in Antimicrobial Coatings Market is Technological Advancements

The global antimicrobial coatings market size is expected to reach USD 45.2 billion by 2034.