Pipeline Monitoring System Market Share, Size, Trends, Industry Analysis Report

By Technology (Ultrasonic Testing, PIGS, Smart Ball, Magnetic Flux leakage Technology and Others), Pipe Type, Application, By Region, And Segment Forecasts, 2025-2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM2959

- Base Year: 2024

- Historical Data: 2020-2023

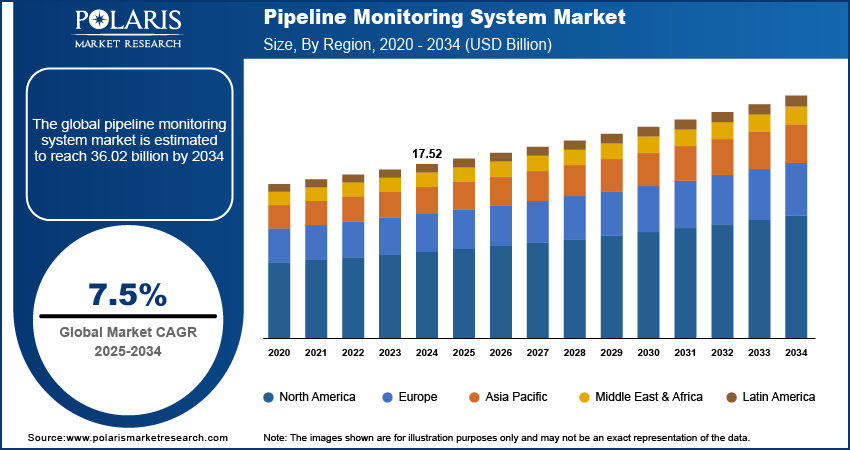

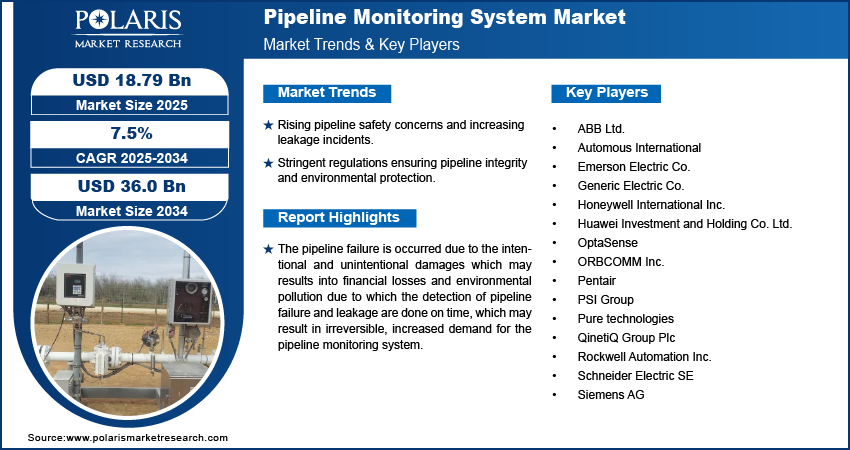

The global pipeline monitoring system market was valued at USD 17.52 billion in 2024 and is expected to grow at a CAGR of 7.5% during the forecast period. Rising need to contain wastage of crude oil, and leakage or theft happening during transportation are the key factors driving the market. Increasing geopolitical risks between the countries, real time monitoring of the cross-country pipeline has become a necessity. Russia has provide 170m cubic meters of gas per day but Recently Russia stop the supply of gas to Europe because many damage is found in underwater pipeline at the blastic sea near Island. Six gas distribution stations are disconnected due to Russia and Ukraine war.

Key Insights

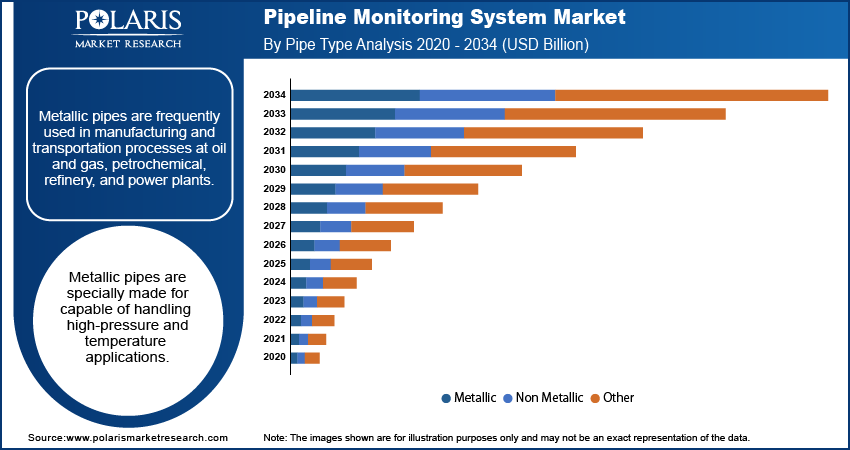

- By pipe type, the metallic pipe segment held the largest share in the market, primarily because of the extensive use of steel and iron pipes in crucial infrastructure like oil, gas, and water transportation.

- By application, the leak detection subsegment held the largest share the application landscape, as quickly finding and fixing pipeline leaks is critically important to prevent environmental damage.

- By technology, the ultrasonic technology subsegment held the largest share, favored for its reliability and accuracy in detecting flaws.

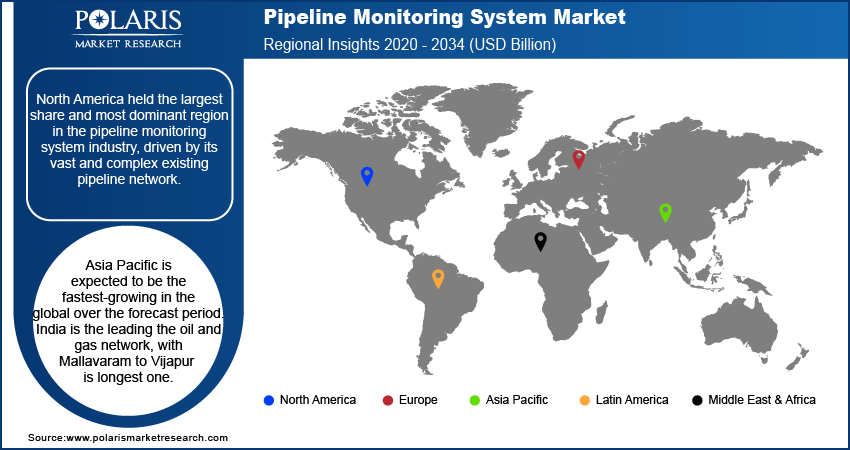

- By region, North America held the largest share and most dominant region in the pipeline monitoring system industry, driven by its vast and complex existing pipeline network.

Industry Dynamics

- The increasing demand for advanced solutions is driven by the growing concerns over pipeline safety and the rise in leakage incidents.

- Stringent government regulations for pipeline integrity and environmental protection are major growth factors.

- The aging pipeline infrastructure globally is also a key factor contributing to the demand. As older pipelines become more susceptible to failures, cracks, and corrosion, operators are compelled to invest in real-time monitoring and inspection technologies.

Market Statistics

- 2024 Market Size: USD 17.52 billion

- 2034 Projected Market Size: USD 36.02 billion

- CAGR (2025-2034): 7.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Market

- AI algorithms analyze real-time data from sensors (Internet of Things or IoT devices) along pipelines. This helps companies move away from routine or reactive maintenance toward a predictive maintenance approach.

- AI improves the accuracy and speed of early anomaly detection, which is crucial for safety.

- AI helps in optimizing various operational workflows. For example, it can analyze data to find the most efficient routing or flow rates within the pipeline system.

The pipeline failure is occurred due to the intentional and unintentional damages which may results into financial losses and environmental pollution due to which the detection of pipeline failure and leakage are done on time, which may result in irreversible, increased demand for the pipeline monitoring system. Pipeline monitoring system are helping in early detection of leakage which will help to stop oil discharge and propel the maintenance of pipeline. Pipeline monitoring system are used various method such as acoustic emission, fiber optic sensor, ground penetration radar to detect leakage in pipeline.

Leak detection key challenges are increasing in the liquid oil and gas sectors as a result of high pipe pressure, accidents, or natural disasters, leading to a variety of events such pipe leakage, pipe breaking, and pipe bursting. Leakage found in December 2022, at the Keystone pipeline at Kansas, U.S and such pipeline is operated by the TC Energy. The costs and supplies of oil manufacture and gas manufacture typically increase as a result of these incidents and these consequently poses a serious issue for the industry. As a result, it is anticipated to boost pipeline monitoring system market expansion for pipeline monitoring systems.

Advanced pipeline infrastructure has improved downstream process monitoring capabilities, user-friendly interface software, and detection algorithms. Due to advanced technology such as DAS technology to detects and analyses threats of overall pipeline and Distributed Temperature Sensing (DTS) is located drop in temperature of pipeline, are incorporated into monitoring systems are accelerating the market. Pipeline networks are increased day by day to transportation and distribution of oil and gas products in major countries, which may increase the demand for need for pipeline monitoring system. The increasing investment and increasing production of crude oil and gas are increasing the market growth during forecast period.

Industry Dynamics

Growth Drivers

Increased Used of IoT in Pipeline Monitoring

Internet of Things (IoT) are used real time data to detect any failure in the pipeline, IoT used smart sensors and placed with pipeline with proper planning to detect leakage and any failure. These IoT are minimize environmental footprint, minimize cost, also minimized downtime. IoT are detect early stage of damage by communicate with the help of smart sensor. These are also providing the proper location of damage and minimize the material loss released products IoT are eliminate regular inspection and improving worker productivity. With the help of data collected by Internet of Things sensor companies understand behaviors of pipeline under different external conditions

Report Segmentation

The market is primarily segmented based on Technology, pipe Type, Application and region.

|

By Technology |

By Pipe Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The ultrasonic segment is expected to witness the fastest growth

In 2024, ultrasonic segment exhibited highest growth rate over the study period. The ultrasonic monitoring technology are used to detect proper location of failure, faults and location, which uses sound wave with high frequency and noise pattern for overall pipeline. Ultrasonic technology cannot be detect small leakage during the pipeline but it will helps to detect other leakage with the help of Differentiate and characterize leak sound from normal liquid flow Such benefits of ultrasonic technology are propelling the market growth in the forecasted year.

LIDAR segment is likely to hold the second largest market share over the forecast period, followed by ultrasonic segment. It is optical technology which transmitted with the help of laser technology. LIDAR is used as a ranging tool to calculate the distance to a target by primarily detecting the objects' absorption, scatter, or re-emission of light. Such type of benefits and used of LIDAR to detect problem of pipeline which will propel the market growth of pipeline monitoring system during forecast period.

The metallic pipeline accounted for the second-largest market share in 2024

Metallic pipes are frequently used in manufacturing and transportation processes at oil and gas, petrochemical, refinery, and power plants. Metallic pipes are specially made for capable of handling high-pressure and temperature applications. The increasing demand for Metallic pipe is due to underground pipeline networks and under water pipeline networks to handle high pressures and do not need more maintained for these pipes.

The leak detection segment is expected to hold the significant revenue share

The leakage is the major problem during pipeline for these leak detection the pipeline monitoring system widely used to detect the problem. It provides real time analysis with the help of land based and air surveillance to monitor pipelines which transferring oil & gas products, including volume & mass balance meter out, automated change system, self-turn-around period, & computational monitoring systems. Smaller leaks are found using volume and mass balance solutions, whereas bigger leaks can be found using rate of change and computational monitoring systems.

North America accounted for the largest revenue share in 2024

In 2024, North America accounted for the largest revenue share and expected to maintain its dominance over the study period. This is primarily due to presence of huge pipeline network across the nation, need for real time monitoring, with the presence of innovative players employing cutting IoT based sensors to curtail any case leakage, theft, terrorist attack, or any kind of natural disaster. Drone technology is provided photos and videos in much more easily and flexible than traditional methods. Machine learning and AI are monitor and detect oil and gas pipeline Gas and oil pipeline are transfer product more than truck and train. According to PHMSA, US has more pipeline incident than other countries. Because of this natural gas was lost in billions of worth.

Asia Pacific is expected to be the fastest-growing in the global over the forecast period. India is the leading the oil and gas network, with Mallavaram to Vijapur is longest one. China is largest nature gas pipeline in Asia pacific region, also planned many LNG project in upcoming years. Tianjin - Inner Mongolia is one of the developing projects of nature gas in Asia pacific region. Austria is one of the important countries in Asia pacific region, it is planned to build formidable gas which used to supply to domestic market. Such type of Ongoing project is boosting the region.

Competitive Insight

Some of Major players operating in the global market of pipeline monitoring system which include ABB, Emerson, Honeywell International, Huawei Technologies, BAE Systems, Schneider Electric, Yokogawa Electric Corporation, Siemens, Badger Meter, AVEVA Group, IBM, Bentek Systems, General Electric, TransCanada PipeLines Limited, HollySys Group, and Inductive Automation.

Recent Developments

In May 2025, Process Vision, a provider of visual pipeline monitoring solutions, has entered into a new partnership with SICA Medición, designating the company as its official distributor across Mexico and Central America.

In December 2022, Williams announced the agreements with the Coterra Energy & Dominion Energy Virgini, a natural gas certification process for gathering & transmission deliveries, till the end, of 2023.

Pipeline Monitoring System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.52 billion |

| Market size value in 2025 | USD 18.79 billion |

|

Revenue forecast in 2034 |

USD 36.02 billion |

|

CAGR |

7.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Technology, By Pipe Type, By industrial vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB Ltd.; Emerson Electric Co.; Generic Electric Co.; Honeywell International Inc.; Huawei Investment and Holding Co. Ltd.; ORBCOMM Inc.; QinetiQ Group Plc; Rockwell Automation Inc.; Schneider Electric SE; Siemens AG; PSI Group; OptaSense; Pure technologies; Automous International; and Pentair |

FAQ's

The pipeline monitoring system market report covering key segments are Technology, pipe Type, Application and region.

Pipeline Monitoring System Market Size Worth $36.02 Billion By 2034.

The global pipeline monitoring system market expected to grow at a CAGR of 7.5% during the forecast period.

North America is leading the global market.

key driving factors in pipeline monitoring system market increasing number of gas and oil leakages accidents and Sustainable use of resources.