Distributed Antenna System (DAS) Market Size, Share, Trends, Industry Analysis Report

: By Offering (Hardware, Services), By DAS Type, By Coverage, By Ownership, By Technology, By User Facility, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2382

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

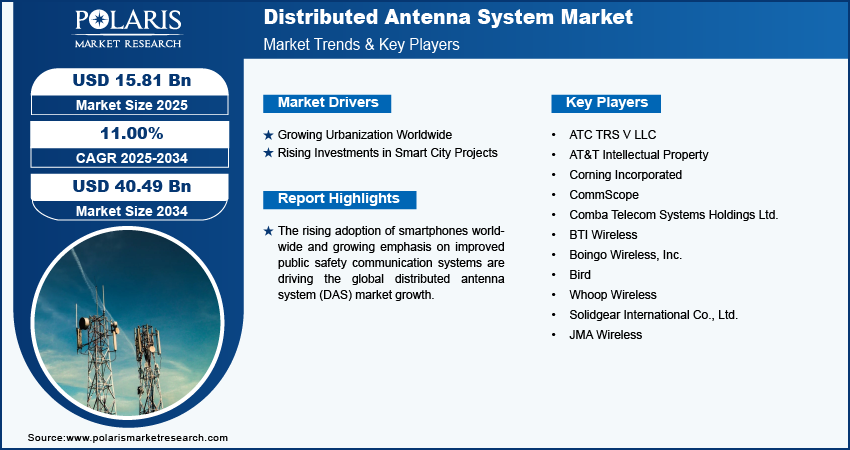

Distributed antenna system (DAS) market size was valued at USD 14.28 billion in 2024. It is projected to grow at a CAGR of 11.00% during the forecast period. The growing expansion of telecommunication networks, investment in 5G infrastructure, and rising adoption of smartphones is propelling the market growth.

Key Insights

- The neutral host segment held a considerable market share in 2024 due to its ability to provide adaptable solutions applicable to multiple service providers simultaneously.

- The passive segment captured the market in 2024 due to its simplicity, cost-effectiveness, and dependability.

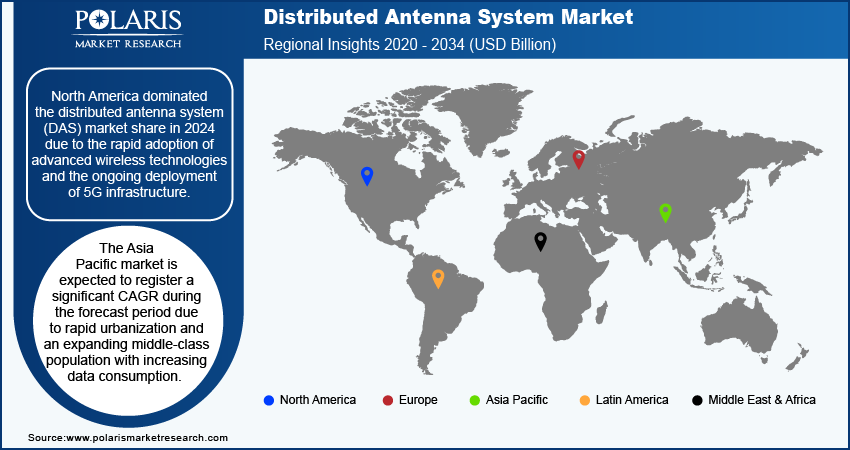

- North America dominated the market in 2024, driven by the rapid adoption of advanced wireless technologies and the ongoing deployment of 5G network infrastructure.

- Asia Pacific is expected to grow at a robust CAGR over the forecast period, led by urbanization and increasing data usage among the burgeoning middle class.

Industry Dynamics

- Distributed antenna systems (DAS) are growing in response to the increasing emphasis on improved public safety communication.

- Increased global urbanization is likely to propel the market, driven by rising demand for DAS to provide reliable signal coverage in congested buildings and public transportation systems.

- Increased investment in smart city initiatives, such as India's Smart City Mission, will propel the market, as these cities require DAS to enable quick and reliable connectivity to accommodate new technologies and 5G networks.

- Competition from low-cost, carrier-class solutions with simpler maintenance and lower installation costs can hinder market growth.

Market Statistics

2024 Market Size: USD 14.28 billion

2034 Projected Market Size: USD 15.81 Billion

CAGR (2025-2034): 11.00%

North America: Largest Market Share

-market.webp)

To Understand More About this Research:Request a Free Sample Report

Distributed antenna system (DAS) is a sophisticated network designed to improve wireless communication coverage and capacity, particularly in environments where traditional cellular networks struggle to provide adequate service. This technology addresses the limitations of conventional cell towers by deploying multiple smaller antennas throughout a designated area, such as large buildings, stadiums, airports, and other high-density locations. The core objective of DAS is to enhance signal strength and quality by strategically distributing the coverage area, thereby ensuring seamless connectivity for users.

The rising adoption of smartphones worldwide is driving the global distributed antenna system (DAS) adoption. According to the GSMA’s annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population, which is some 4.3 billion people, owns a smartphone, including 5G smartphones. Smartphones drive a massive increase in data consumption due to activities like streaming, gaming, and social media. DAS helps manage this higher data traffic by improving network capacity and coverage, thereby increasing demand.

The demand for the distributed antenna system (DAS) is driven by the growing emphasis on improved public safety communication systems. Strong and consistent signal strength is vital in critical or emergency situations. DAS provides the necessary amplification of signals, especially in areas with challenging architecture or materials that block signals, such as concrete or metal, which increases their adoption and integration into existing communication systems to enhance public safety. Therefore, as the emphasis on improved public safety communication systems increases, the demand for distributed antenna systems (DAS) also spurs.

Driver Analysis

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the growth of the market. According to data published by the United Nations, more than half of the global population lives in urban areas. Urban areas generally have skyscrapers and multi-story buildings that obstruct signals from traditional cell towers. This spurs the demand for DAS as it distributes signals effectively throughout these structures, ensuring consistent coverage for occupants. Furthermore, urbanization leads to expanded public transportation networks, which increases the adoption of DAS as it improves connectivity in subway systems, trains, and buses, ensuring that passengers have access to reliable service while on the move.

Rising Investment in Smart City Projects

The rising investment in smart city projects is estimated to fuel the global market. The government of India released ₹48,000 crores to develop 100 smart cities across the country under the Smart City Mission (SCM). Smart cities rely on a wide range of interconnected devices and systems, including IoT sensors, traffic management systems, and public safety communications, which necessitates the use of DAS to provide the fast connectivity required for these technologies to function effectively. Furthermore, many smart city projects are aligned with the rollout of 5G technology, which offers high speeds and low latency. DAS is essential for the deployment of 5G networks, facilitating better connectivity in smart cities.

Segment Insights

Distributed Antenna System (DAS) Breakdown by Ownership Insights

Based on ownership, the market is categorized into neutral host, carrier, and enterprise. The neutral host segment accounted for a major market share in 2024 due to its ability to provide versatile solutions that cater to multiple service providers simultaneously. This model allows various carriers to share infrastructure, significantly reducing deployment costs and enhancing network efficiency. The rise of smart city initiatives and the ongoing deployment of 5G technology further accelerate this segment's growth as municipalities and enterprises seek to ensure seamless connectivity for residents and businesses alike. The collaboration between various telecom operators through neutral host models facilitates better coverage and reliability, making it an attractive option for businesses.

The carrier segment is projected to grow at a rapid pace during the forecast period owing to the rising need for individual operators to maintain control over their networks while meeting the increasing demand for mobile data. Carriers invest in dedicated systems to enhance their service quality and ensure robust connectivity, especially in densely populated areas and high-traffic venues. The expansion of 5G networks also propels this segment forward as carriers provide superior speed and reliability to compete in crowded areas. Furthermore, the growing prevalence of IoT devices is propelling the growth of the carrier segment.

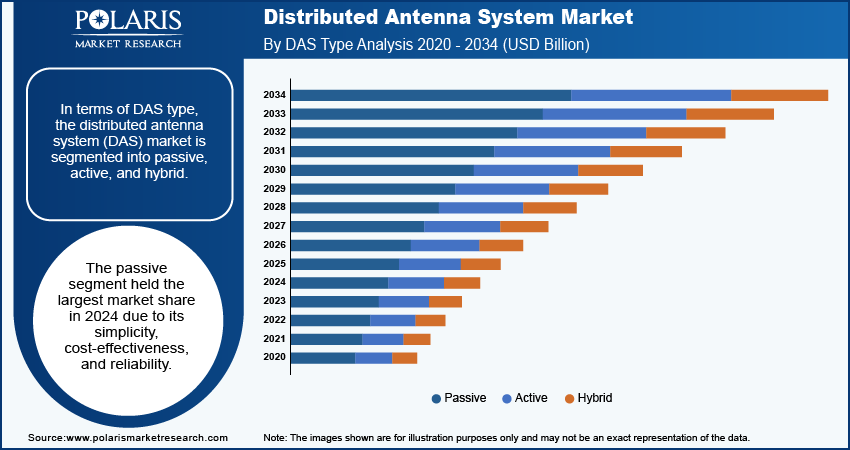

Distributed Antenna System (DAS) Breakdown by DAS Type Insights

In terms of DAS type, the market is divided into passive, active, and hybrid. The passive segment held the largest share in 2024 due to its simplicity, cost-effectiveness, and reliability. Passive systems use coaxial cables and antennas without the need for additional electronic equipment, making them easier to install and maintain. Many organizations, particularly in commercial buildings and venues, prefer passive systems as they require less infrastructure investment while providing adequate coverage in various environments. The demand for enhanced wireless connectivity in densely populated areas, combined with the need for efficient signal distribution, drives the adoption of passive systems.

The hybrid segment is estimated to grow at a robust pace in the coming years owing to its ability to offer advantages of both passive and active systems. Hybrid solutions incorporate both passive components, such as antennas and coaxial cables, and active elements, like remote radio units, providing flexibility and scalability. This configuration enables organizations to optimize coverage and performance, addressing the increasing data demands driven by smartphones, IoT devices, and the rollout of 5G networks. Additionally, hybrid systems are becoming increasingly attractive as enterprises and municipalities seek advanced solutions to enhance connectivity in complex environments.

Regional Insights

By region, the study provides the distributed antenna system (DAS) insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the market share in 2024 due to the rapid adoption of advanced wireless technologies and the ongoing deployment of 5G infrastructure. The presence of an established telecommunications framework in the region supports the high demand for DAS across various sectors, including healthcare, education, and entertainment. The existence of major telecom operators and technology companies fuels innovation and investment in DAS network solutions, leading to enhanced coverage and performance in both urban and rural areas. The US emerged as the dominant country in this region owing to its strong economy, high smartphone penetration, and significant funding for smart city initiatives.

The market in Asia Pacific is expected to grow with a significant CAGR over the forecast period due to rapid urbanization and an expanding middle class with increasing data consumption. Countries such as China and India are at the forefront of this growth, as they invest heavily in telecommunications infrastructure to support their rising populations and urban centers. The growth of IoT devices and the demand for seamless connectivity in densely populated cities further accelerate the need for effective network solutions such as DAS. Additionally, government initiatives promoting digital transformation and smart city development create a favorable environment for the Asia Pacific distributed antenna system (DAS) market growth.

Key Players & Competitive Insights

Major players are investing heavily in research and development in order to expand their offerings, which will help the distributed antenna system (DAS) industry grow even more. Participants are also undertaking a variety of strategic activities to expand their global footprint, with important developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The distributed antenna system (DAS) market is fragmented, with the presence of numerous global and regional players. Major players include ATC TRS V LLC; AT&T Intellectual Property; Corning Incorporated; CommScope; Comba Telecom Systems Holdings Ltd.; BTI Wireless; Boingo Wireless, Inc.; Bird; Whoop Wireless; Solidgear International Co., Ltd.; Toshiba Infrastructure Systems & Solutions Corporation; and JMA Wireless.

Solidgear International Co., Ltd. is a prominent player in the telecommunications industry, specializing in advanced solutions such as distributed antenna systems (DAS). Solidgear International Co., Ltd.'s DAS system allows for the distribution of wireless signals across a designated area, effectively overcoming the limitations associated with single high-power antennas. DAS technology is essential for enhancing wireless communication in environments where traditional cellular networks face challenges, such as high-density urban areas, large buildings, and venues like stadiums and airports.

Toshiba Infrastructure Systems & Solutions Corporation is a key innovator in the field of telecommunications, particularly known for its advancements in distributed antenna systems (DAS). Recently, Toshiba introduced the ART3711, a cutting-edge 5G shared DAS designed specifically for neutral host environments. This system operates within the 3.6-4.0 GHz frequency band and utilizes advanced time division duplexing (TDD) technology, allowing multiple mobile network operators (MNOs) to share the same infrastructure. This capability not only optimizes resource utilization but also accelerates the deployment of extensive 5G networks, especially in densely populated urban areas like Tokyo, where maintaining robust wireless connectivity is essential.

List Of Key Companies

- ATC TRS V LLC

- AT&T Intellectual Property

- Corning Incorporated

- CommScope

- Comba Telecom Systems Holdings Ltd.

- BTI Wireless

- Boingo Wireless, Inc.

- Bird

- Whoop Wireless

- Solidgear International Co., Ltd.

- Toshiba Infrastructure Systems & Solutions Corporation

- JMA Wireless

Distributed Antenna System (DAS) Industry Developments

May 2024: SOLiD, a global player in cellular in-building mobile coverage, announced that systems integrator Wireless Services selected the SOLiD ALLIANCE 5G distributed antenna system (DAS) to enhance 5G connectivity in the New Orleans Ernest N. Morial Convention Center (NOENMCC).

January 2024: Toshiba Infrastructure Systems & Solutions Corporation, an innovator in technologies that support cellular telecoms, introduced ART3711, a new 5G distributed antenna system for neutral hosts.

March 2024: AT&T, a global telecommunications company that provides a range of services, introduced AT&T Internet Air for business that delivers reliable internet for a low price.

Distributed Antenna System (DAS) Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020 - 2034)

- Hardware

- Services

By DAS Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Passive

- Active

- Hybrid

By Coverage Outlook (Revenue, USD Billion, 2020 - 2034)

- Indoor

- Outdoor

By Ownership Outlook (Revenue, USD Billion, 2020 - 2034)

- Neutral Host

- Carrier

- Enterprise

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Carrier Wi-Fi

- Small Cells

By User Facility Outlook (Revenue, USD Billion, 2020 - 2034)

- >500K FT2

- 200K–500K FT2

- <200K FT2

By Vertical Outlook (Revenue, USD Billion, 2020 - 2034)

- Commercial

- Public Safety

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Distributed Antenna System (DAS) Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.28 Billion |

|

Market Size Value in 2025 |

USD 15.81 Billion |

|

Revenue Forecast in 2034 |

USD 40.49 Billion |

|

CAGR |

11.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global distributed antenna system market size was valued at USD 14.28 billion in 2024 and is projected to grow to USD 40.49 billion by 2034.

The global market is projected to register a CAGR of 11.00% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are ATC TRS V LLC; AT&T Intellectual Property; Corning Incorporated; CommScope; Comba Telecom Systems Holdings Ltd.; BTI Wireless; Boingo Wireless, Inc.; Bird; Whoop Wireless; Solidgear International Co., Ltd.; Toshiba Infrastructure Systems & Solutions Corporation; and JMA Wireless.

The hybrid segment is projected for significant growth in the global market during the forecast period.

The neutral host segment dominated the market in 2024.