Oil & Gas Analytics Market Share, Size, Trends, Industry Analysis Report

By Service (Professional, Cloud, Integration); By Deployment (On-premise, Hosted); By Application (Upstream, Midstream, Downstream); By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2025

- Pages: 149

- Format: PDF

- Report ID: PM2282

- Base Year: 2024

- Historical Data: 2020 - 2023

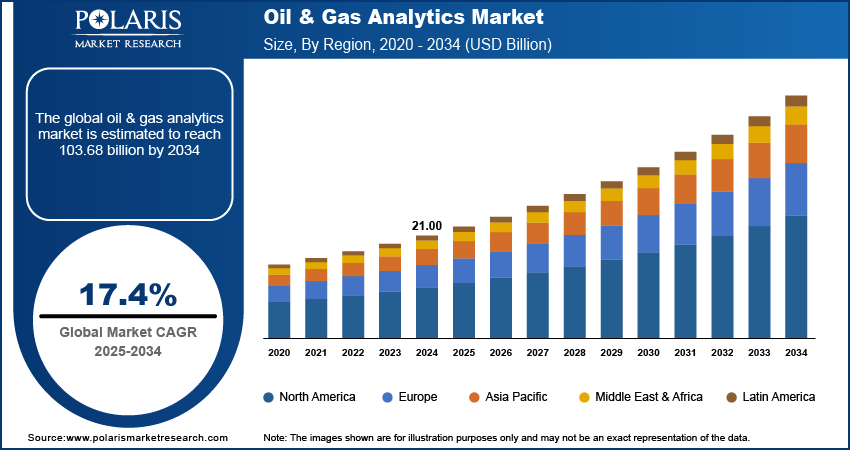

The global oil & gas analytics market was valued at USD 21.00 billion in 2024 and is expected to grow at a CAGR of 17.4% during the forecast period. The use of analytics tools and advanced business intelligence in the oil & gas industry enables effective and efficient operations. Various companies globally utilize analytic tools to obtain and gain insights from real-time data to minimize risks and reduce production costs.

Key Insights

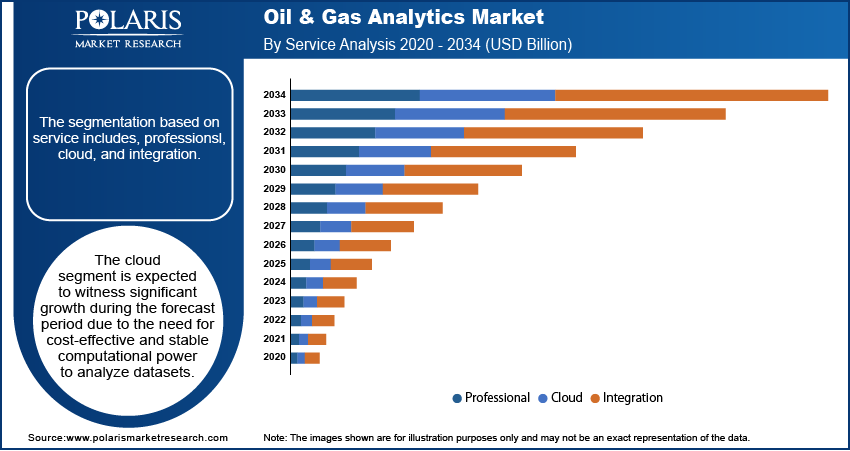

- The cloud segment is expected to witness significant growth during the forecast period. This is due to the need for cost-effective and stable computational power to analyze datasets.

- The upstream segment accounted for the largest share in 2024. This is due to the presence of companies that identify, extract, and produce raw materials.

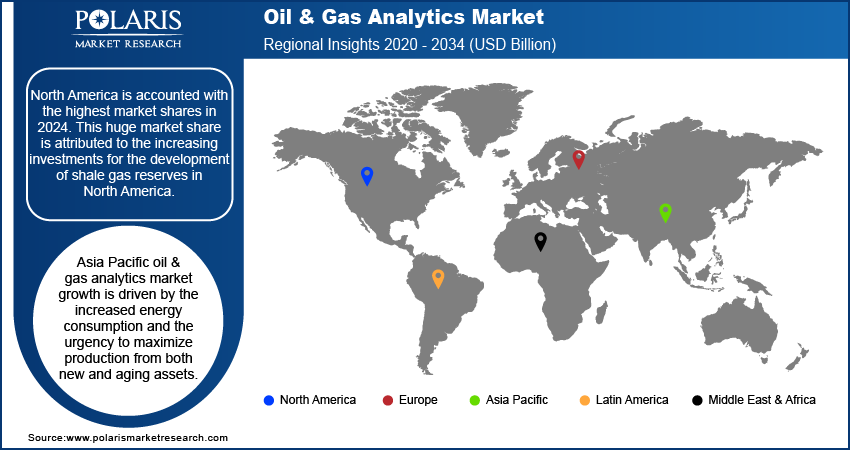

- North America accounted for the largest market share in 2024. This is attributed to the increasing investments in the development of shale gas reserves in North America.

- Asia Pacific oil & gas analytics market growth is driven by the increased energy consumption and the urgency to maximize production.

Industry Dynamics

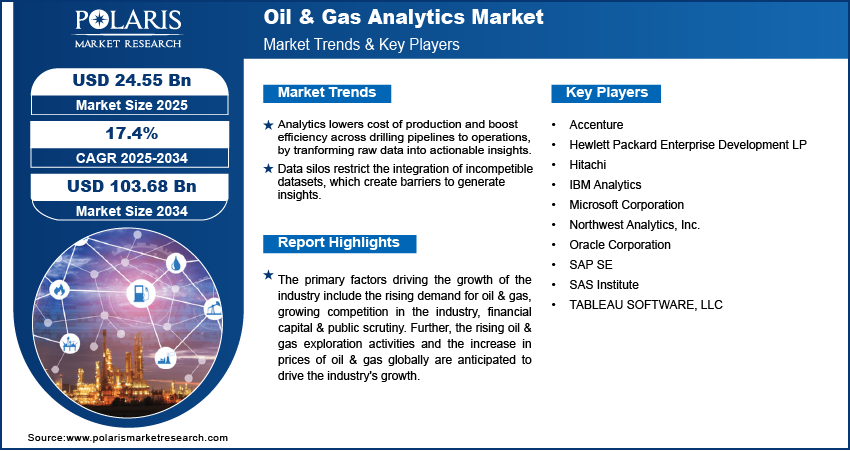

- Analytics lowers cost of production and boost efficiency across drilling pipelines to operations, by tranforming raw data into actionable insights.

- NLP and analytics analyze unstructured data to identify patterns needed for external trends and proactive management of capital planning.

- Data silos restrict the integration of incompetible datasets, which create barriers to generate insights.

- Integration of predective analytics and AI creates opportunity to explore efficiency in activites such exploration, production, and maintainance.

Market Statistics

- 2024 Market Size: USD 21.00 billion

- 2034 Projected Market Size: USD 103.68 billion

- CAGR (2025-2034): 17.4%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The primary factors driving the growth of the industry include the rising demand for oil & gas, growing competition in the industry, financial capital & public scrutiny. Further, the rising oil & gas exploration activities and the increase in prices of oil & gas globally are anticipated to drive the industry's growth. The use of analytic-powered programs in the industry can further assist the companies in gathering insights pertaining to investment decisions and much more.

The companies are developing platforms using AI (Artificial Intelligence) and ML (Machine Learning), to ease the uncertainty related to the industry’s mergers & acquisitions during the pandemic. The pandemic has caused uncertainty for the planned M & M&A in the sector, as the virus spread is causing disruptions in demand and supply chain globally. Further, the need for the industry is projected to bounce back as governments across nations are lifting lockdown restrictions.

Industry Dynamics

Growth Drivers

The production costs of the companies globally are influenced by a variety of external and internal factors ranging from drilling to pipeline operations. The use of data analytics to harness this data and to utilize it to gain actionable insights is anticipated to drive the growth of the oil & gas analytics market as the use of data analytics lowers production costs and further improves efficiency. NLP (Natural Language Processing) of both external & internal sources is utilized in the unstructured data.

It helps in identifying the latest customer, regulatory, geopolitical, and other industry trends that impact the company’s financial standing, reputation, capital planning decisions, production, shareholder value, and much more. These benefits offered by analytics in the industry are anticipated to drive the growth of the industry. Further, the companies are using analytics such as condition-based monitoring & variable analysis to create scenario-based simulations to identify future maintenance events and make the necessary changes before the equipment gets damaged. Hence, these factors are significantly accelerating the industry demand globally.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of service, deployment, application, and region.

|

By Service |

By Deployment |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Service Analysis

The segmentation based on service includes, professionsl, cloud, and integration. The cloud segment is expected to witness significant growth during the forecast period due to the need for cost-effective and stable computational power to analyze datasets. Cloud replaces upfront capital expenditure on IT infrastructure with a flexible expense structure. Moreover, these platforms provide connections across teams and remote sites by providing secure and centralized access to analytics. The scalability of cloud allows companies to adopt Artificial Intelligence, advanced analytics, and machine learning models for exploration, production, and deployment activities without facing technical issue. This shift towards cloud platforms boosts the expansion opportunities.

Application Analysis

Based on application, the segmentation includes, upstream, midstream, and downstream. The upstream segment is recorded to hold the largest shares in 2024 and is expected to lead the oil & gas analytics market in the forecasting years. This upstream oil & gas production is done by companies to identify, extract and produce raw materials. The rising oil & gas exploration activities globally are anticipated to drive the growth of the segment. The geospatial & exploration solutions enable the companies to search for new oil reserves in remote locations.

Further, infrastructure analytics solutions offer construction insights for drilling and extraction. The large application of analytics in upstream production is anticipated to drive the growth of the segment. The Midstream and Downstream segments are projected to show progressive growth rates in the forecasting years. The mid & downstream production engages in post-production along with transportation and storage services.

The use of analytics has huge potential in this segment as these processes are extremely crucial due to their complex supply chain of combustible materials. The use of video analytics offers a complete surveillance solution for oil pipelines across the supply chain. Further, the adoption of pricing analytics solutions helps in forecasting the price elasticity that fuels the segment growth in the near future.

Geographic Overview

Geographically, North America is accounted with the highest market shares in 2024. This huge market share is attributed to the increasing investments for the development of shale gas reserves in North America. The presence of key market players in the US, along with the rising focus on the benefits of analytics usage, is anticipated to boost the growth of the market. Major enterprises operating in the region across the sector are utilizing several platforms to promote efficiency while reducing production costs.

Further, the rise in activities pertaining to unconventional fuel production is estimated to stimulate the growth of the industry. The US has a maximum number of strategic oil storage reserves and is further involved in the export of the same. This is projected to present lucrative market growth opportunities.

Moreover, the Middle Eastern and African market is anticipated to exhibit progressive growth over the forecasting years. The fast growth of the market in this region can be attributed to the rich deposits of oil & gas that lead to huge opportunities for the industry in the region. Further, the increasing prices of oil & gas are anticipated to boost the application of the industry of the region.

The companies are looking out for strategies to improve production efficiency while reducing costs. Moreover, the acceptance of digital technologies by companies in the industry is anticipated to offer huge market growth opportunities. The growing oil & gas exploration activities in the region are further anticipated to drive the growth of the market in the Middle East and Africa.

Asia Pacific oil & gas analytics market growth is driven by the increased energy consumption and the urgency to maximize production from both new and aging assets. Countries such as China and India with upstream activities are progressively adopting digital solutions to improve operational efficiency and increase recovery rates. Furthermore, increased investment to expand downstream and midstream infrastructure has created a demand for advanced analytics to optimize complex supply chains and understand project feasibility. In this rapidly industrializing terrain, with a strong regulatory focus on energy security, there is an opportunity and space for the advancement of data-driven technologies across the sector.

Competitive Insight

The oil and gas analytics market landscape is witnessing an increase in investments from players in the market, as well as startups attracted to the expansion opportunities, which is making the competitive landscape start to change. Vendors are now aiming for solutions that are specifically designed for small and medium-sized businesses, where there is a latent demand for and opportunity for growth. There has been a noticeable growth in mergers and acquisitions as market players look to consolidate talent and knowledge, which further supports their product offerings. Moreover, rapid advances in technology, such as AI and machine learning, are a real differentiator. Vendors can support buyers through their digital solution and jointly face the ongoing supply chain issues and subsequent search for more sustainable value chains.

Some of the major players operating in the global market include Accenture, Hewlett Packard Enterprise Development LP, Hitachi, IBM Analytics, Microsoft Corporation, Northwest Analytics, Inc., Oracle Corporation, SAP SE, SAS Institute, and TABLEAU SOFTWARE, LLC.

Industry Developments

September 2024: Huawei launched an AI Application for the oil and gas upstream sector. This collaboration focuses on large model construction, refined exploration, and intelligent oilfield reconstruction, aiming to enhance industry quality, increase reserves and production, ensure safety.

January 2024: SLB and Nabors Industries collaborated to boost the adoption of automated drilling solutions for oil and gas operators and drilling contractors. This collaboration provides customers with access to a broader suite of drilling automation technologies and greater flexibility.

Oil & Gas Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.00 billion |

| Market size value in 2025 | USD 24.55 billion |

|

Revenue forecast in 2034 |

USD 103.68 billion |

|

CAGR |

17.4% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Service, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Accenture, Hewlett Packard Enterprise Development LP, Hitachi, IBM Analytics, Microsoft Corporation, Northwest Analytics, Inc., Oracle Corporation, SAP SE, SAS Institute, and TABLEAU SOFTWARE, LLC. |

FAQ's

The global market size was valued at USD 21.00 billion in 2024 and is projected to grow to USD 103.68 billion by 2034.

• The global market is projected to register a CAGR of 17.4% during the forecast period.

• North America dominated the global share in 2024.

• A few of the key players in the market are Accenture, Hewlett Packard Enterprise Development LP, Hitachi, IBM Analytics, Microsoft Corporation, Northwest Analytics, Inc., Oracle Corporation, SAP SE, SAS Institute, and TABLEAU SOFTWARE, LLC.

• The upstream segment is recorded to hold the largest shares in 2024.

• The cloud segment is expected to witness significant growth during the forecast period.