AI Data Center Market Size, Share, Trends, Industry Analysis Report

: By Component (Hardware and Software), By Data Center Type, By Industry, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5622

- Base Year: 2024

- Historical Data: 2020-2023

AI Data Center Market Overview

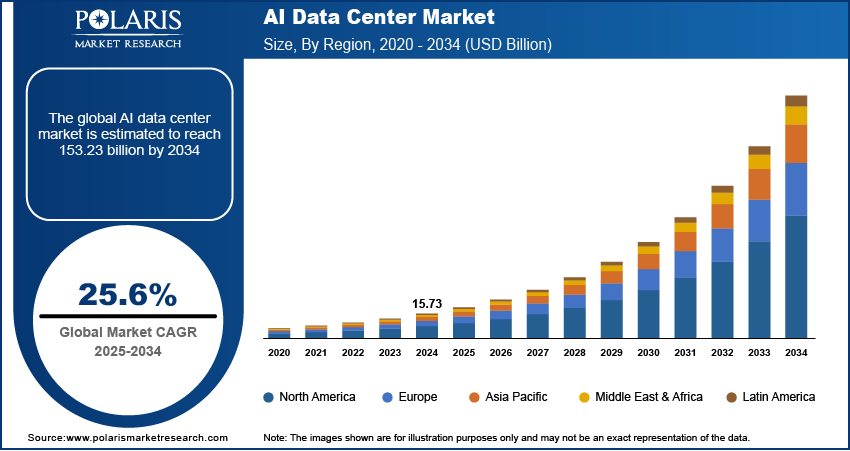

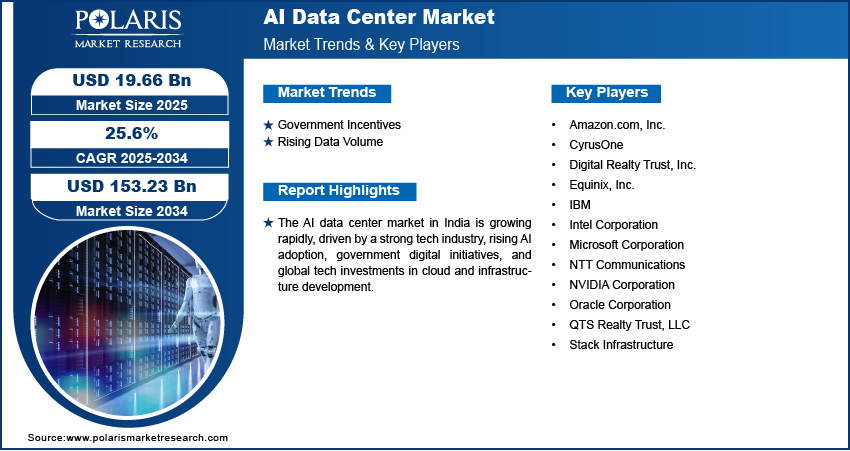

AI data center market size was valued at USD 15.73 billion in 2024. The market is projected to grow from USD 19.66 billion in 2025 to USD 153.23 billion by 2034, exhibiting a CAGR of 25.6% during the forecast period.

An AI data center is a specialized facility designed to support the high-performance computing needs of artificial intelligence workloads, such as machine learning and deep learning. It features advanced infrastructure including powerful GPUs, liquid cooling systems, and high-speed networking to efficiently process large volumes of data.

Artificial Intelligence is becoming a major technology in various industries, including healthcare, banking, retail, and transportation. According to the San Diego National University report, 77% of businesses are either utilizing or exploring AI application into their businesses. From virtual assistants and chatbots to predictive analytics and autonomous vehicles, AI is being used to improve efficiency, decision-making, and customer experience. These applications require large amounts of data and computing power, which standard data centers do not always handle. Consequently, there's a growing demand for AI-optimized data centers that are designed specifically to manage the intense workloads of machine learning and deep learning models, thereby driving the data center growth.

To Understand More About this Research: Request a Free Sample Report

Cloud computing has made AI tools more accessible to businesses of all sizes. Companies no longer need to build their infrastructure. Instead, they use services offered by cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These platforms offer powerful AI tools that run on massive cloud data centers. As demand for these services increases, cloud providers are expanding their data center capacity with AI-focused upgrades. This shift toward cloud-based AI is boosting the growth of data centers.

Market Dynamics

Government Incentives For Data Center

Governments around the world recognize the importance of AI for future growth and competitiveness. Many are introducing policies, funding programs, and infrastructure projects to support AI development. These include investments in AI research, tax incentives for building data centers, and sustainability regulations that encourage green infrastructure. For instance, according to the India Investment Grid, India's Ministry of Information Technology is preparing to launch attractive incentives as part of a comprehensive national policy framework aimed at fostering the development of data centers. This government support boosts private investment in technology companies, encouraging the development of more AI-capable data centers, fueling the expansion of data center.

Rising Data Volume

The volume of data generated from sources such as smartphones, social media, smart devices, video streaming, and sensors is growing at an unprecedented rate. According to the World Economic Forum, one hundred and eighty-one zettabytes amount of data is expected to be created by 2025, which is three times of data created in 2020. This vast and diverse data holds valuable insights, but extracting meaningful information requires advanced AI tools supported by high-performance computing infrastructure. Traditional data centers lack the capability to manage the scale and speed demanded by AI-driven analytics. Due to this, the demand for AI data centers to efficiently store, process, and analyze massive datasets is growing, thereby driving the market demand.

Segment Analysis

AI Data Center Market Assessment by Data Center Type

The segmentation, based on data center type, includes hyperscale data center, colocation data center, edge data center, and others. The hyperscale data center segment is expected to witness the fastest growth during the forecast period, driven by the rising demand for large-scale AI workloads, which require massive computing power, high-speed networking, and advanced cooling systems. Hyperscale facilities, typically operated by cloud giants such as Amazon, Microsoft, and Google, offer the scalability and efficiency needed for training and deploying complex AI models. Their ability to handle vast amounts of data and support AI innovation are driving the segmental growth in the market.

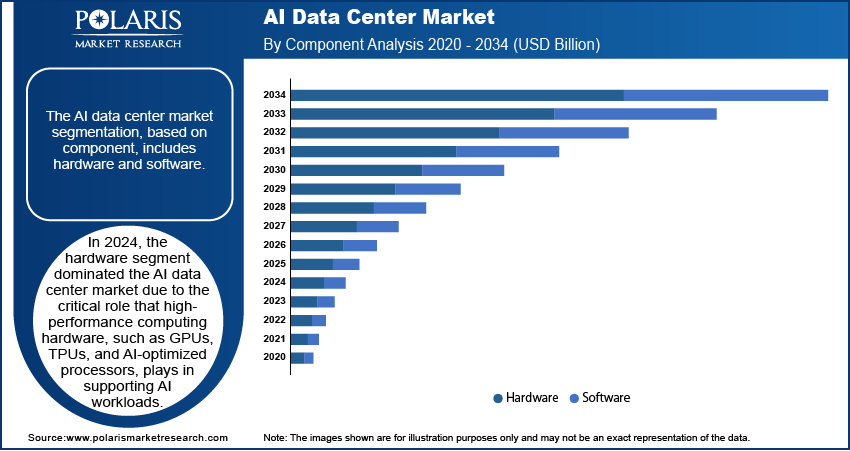

AI Data Center Market Evaluation by Component

The market is segmented by component into hardware and software. The hardware segment dominated in 2024 due to the critical role that high-performance computing hardware, such as GPUs, TPUs, and AI-optimized processors, plays in supporting AI workloads. These hardware components are essential for training AI models, running complex algorithms, and processing large datasets at high speed. The demand for advanced and powerful hardware to support these applications continues to rise as AI adoption grows across industries, driving segmental dominance in the market.

Regional Insights

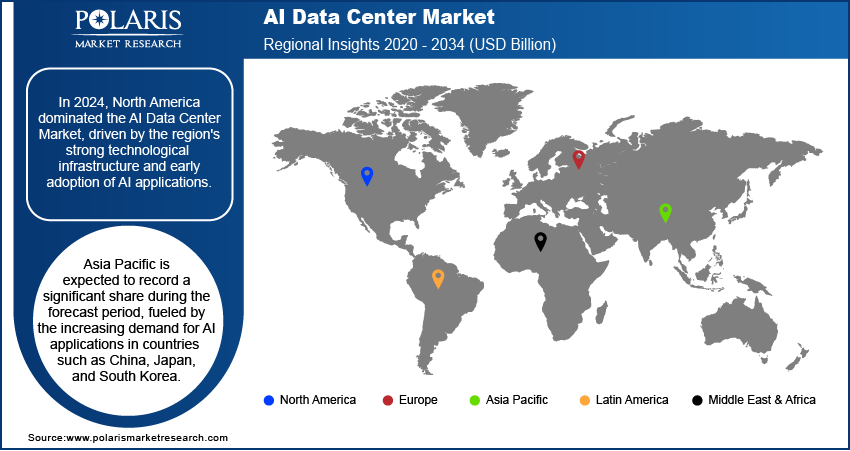

By region, the study provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market, driven by the region's strong technological infrastructure and early adoption of AI applications. The US and Canada have some of the largest cloud providers such as Amazon, Microsoft, and Google, which heavily invest in building and expanding AI-optimized data centers. The demand for AI-powered applications, along with government initiatives supporting AI innovation, contributes to the growth of data centers, thereby driving the expansion of the data center in North America.

Asia Pacific is expected to record a significant market share during the forecast period, driven by the increasing demand for AI applications in countries such as China, Japan, and South Korea. These nations are investing heavily in AI research and development, creating a strong need for advanced data center infrastructure. The rapid digital transformation in industries such as manufacturing, healthcare, and e-commerce in the region further drives the adoption of AI technologies. Additionally, the growing demand for cloud-based AI services and government support for AI innovation is accelerating the construction of AI data centers in Asia Pacific, driving regional growth.

AI data center demand in India is experiencing substantial growth due to the rapidly expanding digital landscape and a booming tech industry. The country's IT sector, along with increasing investments in AI research, is driving demand for AI infrastructure. Many global tech companies are setting up data centers in India, offering AI-powered cloud services. According to the India Investment Grid, the country consists of 80 third-party data. Additionally, the government’s push for digitalization and initiatives such as "Smart Cities" are increasing the need for advanced data center facilities. India is experiencing significant growth, with an increasing number of AI startups and enterprises using AI for diverse applications.

Key Players & Competitive Analysis Report

The AI data center market statistics is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the analysis, this competitive environment is amplified by continuous progress in product offerings. Major players in the market include Amazon Web Service.; CyrusOne; Digital Realty Trust, Inc.; Equinix, Inc.; IBM; Intel Corporation; Microsoft Corporation; NTT Communications; NVIDIA Corporation; Oracle Corporation; QTS Realty Trust, LLC; and Stack Infrastructure.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software, Infrastructure services, hardware, and IT services. The organization handles 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. For instance, the company is responsible for 50% of all wireless and 90% of all credit card transactions. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. IBM Watson, introduced in 2010, is a supercomputer that utilizes Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. IBM provides Cloud data centers that are built for local access, low latency, and certified security. Benefit from high availability, fault tolerance, and scalability with IBM's availability zone design. Optimized for space, power, and network, the company's secure locations offer redundant resources and meet stringent government regulations.

Amazon Web Services (AWS), a subsidiary of Amazon.com, Inc., is a provider of cloud computing services that has offered a range of solutions since 2006. AWS offers over 200 services, encompassing computing, storage, networking, and AI capabilities, serving a diverse global customer base comprising businesses, government entities, and individual developers. Its on-demand model allows users to access and scale resources as needed, reducing the complexities of managing physical infrastructure. Headquartered in Seattle, Washington, AWS supports various sectors, including healthcare, finance, and education. AWS’s core offerings are segmented into key areas. Compute services featuring Amazon Elastic Compute Cloud (EC2) provide scalable virtual servers. Storage services, such as Amazon Simple Storage Service (S3), provide data storage and backup solutions. Database services provide managed database solutions, such as Amazon RDS, simplifying database management. Networking and content delivery services, such as Amazon CloudFront, facilitate content distribution and network isolation within a Virtual Private Cloud (VPC). Additionally, AWS provides deep learning and AI tools, such as AWS SageMaker, which facilitate the development and deployment of AI models. The global infrastructure of AWS spans 33 geographical regions, each with multiple Availability Zones (AZs). Key regions include eight in North America, one in South America, eight in Europe, three in the Middle East, one in Africa, and twelve in the Asia Pacific region. This widespread infrastructure supports availability, disaster recovery options, and compliance with regional regulations.

Key Companies in AI Data Center Market

- Amazon Web Service

- CyrusOne

- Digital Realty Trust, Inc.

- Equinix, Inc.

- IBM

- Intel Corporation

- Microsoft Corporation

- NTT Communications

- NVIDIA Corporation

- Oracle Corporation

- QTS Realty Trust, LLC

- Stack Infrastructure

AI Data Center Market Developments

February 2025: Cisco launched new AI infrastructure and data center solutions to support high-bandwidth, energy-efficient AI connectivity. These solutions enable service providers to evolve networks and reduce emissions through sustainable, modular architecture.

December 2024: AWS launched a series of advanced data center components to enhance AI workload support. These components focus on power, cooling, and design, improving efficiency and sustainability across global facilities.

AI Data Center Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

By Data Center Type Outlook (Revenue USD Billion, 2020–2034)

- Hyperscale Data Center

- Colocation Data Center

- Edge Data Center

- Others

By Industry Outlook (Revenue USD Billion, 2020–2034)

- Healthcare

- Retail

- IT and Telecom

- BFSI

- Automotive

- Media & Entertainment

- Manufacturing

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

AI Data Center Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.73 billion |

|

Market Size Value in 2025 |

USD 19.66 billion |

|

Revenue Forecast in 2034 |

USD 153.23 billion |

|

CAGR |

25.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 15.73 billion in 2024 and is projected to grow to USD 153.23 billion by 2034.

The global market is projected to register a CAGR of 25.6% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Amazon Web Service; CyrusOne; Digital Realty Trust, Inc.; Equinix, Inc.; IBM; Intel Corporation; Microsoft Corporation; NTT Communications; NVIDIA Corporation; Oracle Corporation; QTS Realty Trust, LLC; and Stack Infrastructure.

The hardware segment dominated the AI data center market in 2024 due to the critical role that high-performance computing hardware, such as GPUs, TPUs, and AI-optimized processors, plays in supporting AI workloads.

The hyperscale data center segment is expected to witness fastest growth during the forecast period due growing data traffic worldwide.