Adhesives And Sealants Market Share, Size, & Industry Analysis Report

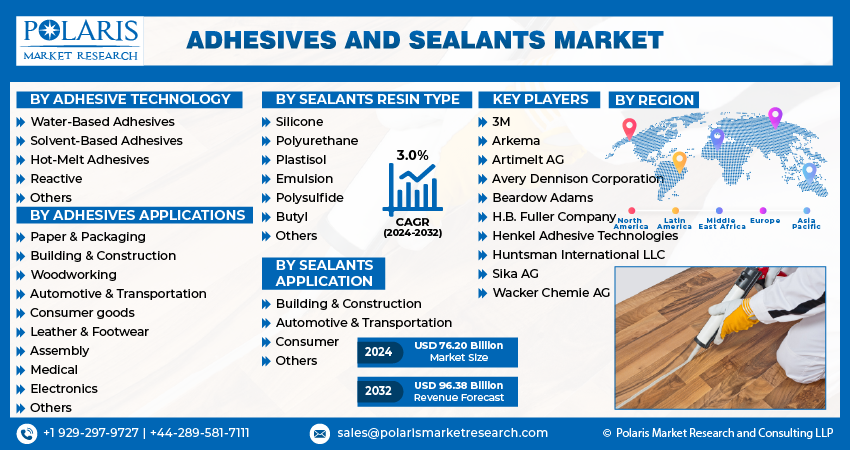

By Adhesive Technology; By Adhesives Applications; By Sealants Resin Type; By Sealants Application; By Region; Segment Forecast, 2025- 2034

- Published Date:Aug-2025

- Pages: 146

- Format: PDF

- Report ID: PM1164

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

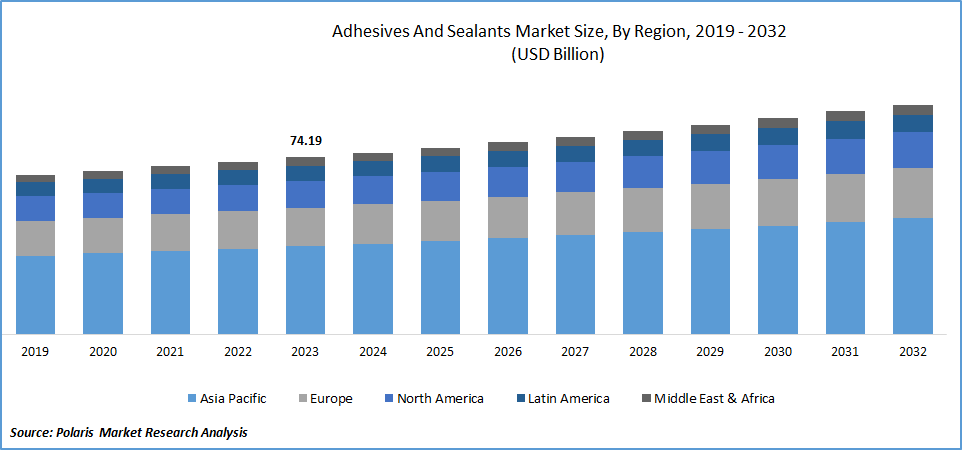

The global adhesives and sealants market was valued at USD 132.65 billion in 2024 and is projected to grow at a CAGR of 10.10% from 2025 to 2034. The market is rising owing to its wide applications in various industries for security and seal purposes.

Key Insights

- In 2024, water-based adhesives led the market due to their eco-friendly nature, using water as the primary carrier instead of harmful organic solvents that impact the environment and human health.

- The paper and packaging segment held the largest market share in 2024, driven by urbanization and changing consumer habits increasing the demand for packaged goods.

- Silicone adhesives accounted for the biggest market share in 2024, supported by strong demand across multiple industries.

- The Asia Pacific region dominated adhesive and sealant revenues in 2024, fueled by rising local demand, higher income levels, and abundant resource availability.

- North America is projected to experience the fastest growth in the adhesives and sealants market, due to easy raw material access and the reopening of manufacturing facilities in the region.

Industry Dynamics

- Growing demand for eco-friendly and high-performance adhesives is driving market expansion across industries such as automotive, construction, and packaging.

- Increasing application of adhesives in flexible packaging and medical devices is opening new growth avenues in specialized sectors.

- Regulatory pressures on volatile organic compounds (VOCs) and health concerns challenge the use of solvent-based adhesives, promoting water-based and bio-based alternatives.

- Technological advancements in adhesive formulations, including UV-curable and pressure-sensitive adhesives, enhance product performance and broaden application scope.

Market Statistics

- 2024 Market Size: USD 132.65 billion

- 2034 Projected Market Size: USD 339.71 billion

- CAGR (2025-2034): 10.10%

- Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Sealants possess properties such as resistance to corrosion and insolubility, which aid in the filling of gaps and voids. Adhesives and sealants find applications in diverse industries, including automotive, construction, packaging, industrial, marine, aerospace, and electronics, among others. The automotive industry, in particular, has witnessed a significant demand for adhesives and sealants. These versatile substances are employed in a wide range of applications across various industries. They play a crucial role in connecting and securing materials ranging from plastic and metal to ceramics and advanced glass and are essential components in numerous manufacturing processes.

- For instance, in April 2024, Flow Materials, a Swiss-based adhesive manufacturer, unveiled a new range of adhesives tailored to the evolving needs of the flexible packaging industry, emphasizing innovation and tailored customer support for sustainable production.

Moreover, the adhesives and sealants market has made notable progress in achieving sustainability. Numerous companies led the way by introducing innovative technologies and methods aimed at minimizing environmental effects. These advancements included the utilization of bio-based components and the development of wash-off adhesives, resulting in creative solutions that effectively reduced emissions, energy consumption, and waste management, all while maintaining optimal performance standards.

However, cutting-edge robotic systems with adaptability, artificial intelligence, and increased load-bearing capacity are now operating in harsh environments. These advanced machines can carry out intricate tasks for extended durations, with applications spanning from space exploration to automotive production, electronic assembly, and precision cutting.

Adhesives and Sealants Market Dynamics

Market Drivers

Rising Incorporation of Nano-Fillers in Adhesives and Sealants

The rising awareness among key players and buyers across the globe regarding the various types of additives, both organic and inorganic, are frequently employed to alter adhesives. These additives include nanomaterials such as nanotubes, cellulose nano-crystals, nanofibers, nano-alumina, and nano-silica. Nano-fillers offer numerous benefits, such as enabling thinner bonding lines and reducing the risk of embrittlement within bulk adhesive formulations. Due to its nano-based adhesive bonding it is in industries such as automotive, aerospace, and active electronic components, due to its low specific density, cost-effectiveness, excellent damping characteristics, and consistent strength across the bond.

Rise in Demand for Building & Construction Industry

The growing need for permanent housing is consequently fueling the demand for adhesives and sealants. Adhesives and sealants are essential in various applications within the construction industry, including tiling, exterior insulation systems, securing curtain wall panels, and insulating glass units. Factors like globalization, urbanization, improving living standards, increasing purchasing power parity (rising incomes), infrastructural development, and the rising demand for constructing metro cities in emerging countries are fueling the growth of this market.

Market Restraints

Stringent Environmental Rules and Regulations

The stringent environmental regulations in the adhesives and sealants impede industry growth by focusing on reducing volatile organic compound (VOC) emissions, restricting hazardous substances, implementing product labeling safety standards, and encouraging sustainable manufacturing practices. Adhering to these regulations requires the creation of low-VOC or VOC-free formulations, the reduction or elimination of hazardous substances, clear product labeling for safe use and disposal, and participation.

Report Segmentation

The market is primarily segmented based on adhesive technology, adhesives applications, sealants resin type, sealants application, and region.

|

By Adhesive Technology |

By Adhesives Applications |

By Sealants Resin Type |

By Sealants Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Adhesives And Sealants Industry Segmental Analysis

By Adhesive Technology Analysis

Water-based adhesives dominated the market in 2024, largely attributable to their properties such as eco-friendly as they utilize water as the main carrier instead of organic solvents, which can be damaging to the environment and human health. They are also safe and non-toxic, making them easier and safer to work with. Additionally, the properties of water-based adhesives can be customized to meet specific requirements, such as viscosity, drying time, and bond strength. By incorporating additives, these adhesives can also be enhanced for better performance in terms of heat resistance, flexibility, and adhesion to different substrates.

The solvent-based adhesives segment is projected to grow at a CAGR during the projected period, mainly driven by its application in various industries such as packaging, tapes, automotive, food packaging, graphics, and medical fields due to their exceptional resistance to environmental conditions and compatibility with different surfaces. These adhesives are suitable for porous and non-porous materials, ensuring strong adhesion once the solvent evaporates, leaving behind only the adhesive.

By Adhesives Applications Analysis

The paper and packaging segment dominated the market in 2024, owing to emerging urbanization, which led to changes in consumer habits, resulting in an increased need for packaged products. Furthermore, the rise of e-commerce is playing a significant role in driving this expansion. As incomes are projected to increase, consumer spending on packaged items is forecasted to rise further.

The building and construction segment is anticipated to grow at the fastest CAGR owing to its role in connecting and uniting different components and materials to the primary structure and to each other. Its function is to enhance the performance of commercial and residential buildings by effectively sealing out water, humidity, UV rays, and other elements.

By Sealants Resin Type Analysis

The silicone segment accounted for the largest market share in 2024, owing to its demand in various industries. The increasing use of silicone sealants in various automotive bonding applications, including sealing joints, gaps, and cracks, creating low-temperature gaskets, replacing windscreens, and bonding different automotive components like headlamps, tail lamps, fog lamps, lamp covers, caps, and bulb mounting sockets, is fuelling the growth of this segment.

The polyurethane segment is expected to grow at the fastest growth rate owing to its high adhesive, durability, flexibility, and versatility, which can widely be used in various industries. Polyurethane formulations are employed on substrates such as metals, plastics, wood, and composites, providing strong adhesion and resistance to environmental elements. Polyurethane compounds offer exceptional weather resistance, adhesion to diverse surfaces, and flexibility, making them perfect for sealing joints and gaps in construction, automotive, and aerospace fields.

Adhesives and Sealants Market Regional Insights

The Asia Pacific region dominated the adhesives and sealants market revenue share in 2024 due to increased local demand, higher income levels, and abundant resource availability. Moreover, it is at the forefront of global automobile production, with the automotive and transportation sector being a significant user of adhesives and sealants in the area. Economic expansion in Asia Pacific, especially in emerging economies, is spurring a rise in infrastructure developments.

The North America adhesives and sealants market is expected to be the fastest growing during the projected period, owing to the easy availability and procurement of raw materials and the resumption of manufacturing plants in this region. Rising urbanization and rising expenditure power are driven by the escalating need for both residential and non-residential construction projects within this region.

Competitive Landscape

The adhesives and sealants industry is highly competitive, with a wide range of players competing for market share through product innovation, strategic partnerships, and geographic expansion. Major companies utilize strong research and development capabilities to introduce advanced adhesive and sealant formulations tailored to different end-user industries such as construction, automotive, packaging, and electronics. With a growing focus on sustainability and environmental regulations, players focus on partnership and collaboration to gain a competitive edge over others to capture a significant market share.

List of Key Companies in the global market

- 3M

- Arkema

- Artimelt AG

- Avery Dennison Corporation

- Beardow Adams

- H.B. Fuller Company

- Henkel Adhesive Technologies

- Huntsman International LLC

- Sika AG

- Wacker Chemie AG

Recent Developments

- March 2025: H.B. Fuller introduced its industry-grade commercial roofing adhesive H.B. Fuller Millennium PG-1 EF ECO 2. According to H.B. Fuller, the high-performance adhesive utilizes naturally occurring atmospheric gases to eliminate the use of chemical blowing agents.

- February 2025: Power Adhesives announced the launch of its new biodegradable bulk adhesive Tecbond 110B-PR. The company stated that the biodegradable adhesive is designed for carton closing and high-speed case closing.

- September 2024, L&L Products announced the launch of its InsituCore foaming materials and PHASTER. adhesives. These innovations were designed to enhance composite manufacturing and bonding processes, offering improved efficiency, reduced waste, and superior adhesion performance.

- April 2024: Henkel and Kraton entered into a multi-year partnership to integrate Kraton's sustainable tackifiers and REvolution resin ester technology into Henkel's adhesive formulations. Kraton's REvolution technology enhances Henkel's Technomelt adhesives, offering eco-friendly solutions.

- June 2023, GUIBAO increased its production capabilities and innovated new product lines to cater to the evolving needs of the solar industry for premium, eco-friendly sealants. With established partnerships with various Indian module manufacturers, the company has successfully established a foothold in India.

Report Coverage

The adhesives and sealants market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, adhesive technology, adhesives applications, sealants resin type, sealants application and their futuristic growth opportunities.

Adhesives and Sealants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 145.78 billion |

|

Revenue forecast in 2034 |

USD 339.71 billion |

|

CAGR |

10.10% from 2024 – 2032 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Adhesive Technology, By Adhesives Applications, By Sealants Resin Type, By Sealants Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Adhesives And Sealants Market Size Worth USD 339.71 Billion By 2034

The top market players in Adhesives And Sealants Market Are 3M, Arkema, Artimelt AG, Avery Dennison Corporation, Beardow Adams, H.B. Fuller Company

Asia Pacific is the region contribute notably towards the Adhesives And Sealants Market

Adhesives and Sealants Market exhibiting the CAGR of 10.10% during the forecast period

Adhesives And Sealants Market report covering key segments are adhesive technology, adhesives applications, sealants resin type, sealants application and region