Waste Management Market Size, Share, Trends, & Industry Analysis Report

By Waste Type, By Service Type, By Waste Treatment, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM2472

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global waste management market size was valued at USD 1.36 trillion in 2024, growing at a CAGR of 5.6% from 2025–2034. Urbanization growth and introduction of strict sustainability policies are boosting demand for waste management solutions.

Key Insights

- MSW/household segment accounts for largest market share in 2024.

- Recycling segment is moving at the fastest CAGR under circular economy goals and sustainability initiatives.

- North America holds the largest chunk of market share in the year 2024.

- The U.S. competitive landscape consists of highly advanced separation, landfill reduction, and key players.

- The Asia Pacific region is efficient to gain the fastest CAGR due to urbanization and green technology.

- China is growing steadily with industrial waste generation and waste-to-energy projects supported by the government.

Industry Dynamics

- Urbanization and industrial growth are increasing waste volumes, boosting demand for advanced treatment and disposal.

- Sustainability regulations are driving adoption of recycling and waste-to-energy facilities.

- Digital tools, IoT systems, and automation are enhancing efficiency and reducing landfill use.

- High costs and weak segregation infrastructure in developing regions limit modern system adoption.

Market Statistics

- 2024 Market Size: USD 1.36 Trillion

- 2034 Projected Market Size: USD 2.33 Trillion

- CAGR (2025–2034): 5.6%

- North America: Largest Market Share

Waste management encompasses collection, treatment, recycling, and disposal of municipal, industrial, commercial, and healthcare waste for the purposes of minimizing environmental hazards and recovering resources. Expansion is assisted by services like networked collection systems, state-of-the-art recycling facilities, landfill management, waste-to-energy plants, and monitoring systems. These measures enhance operational efficiency, regulatory compliance, and offsetting the increasing volumes of waste in developed and developing economies. Their part in sustainable city planning and environmental conservation also sustains long-term public health and infrastructure objectives.

Advanced waste-to-energy and recycling plants are converting waste materials into usable resources as well as clean energy while engineered landfill systems are aimed at safe disposal as well as emission control. Digital and IoT-enabled platforms offer municipalities and private operators real-time monitoring, segregation, and reporting of waste streams. Automation and robotics in sorting plants enhance recovery efficiency, minimize manual reliance, as well as lower operating expenses. In June 2024, ANDRITZ collaborated with the ReWaste F project in Austria to create a smart waste plant with IoT sensors, AI-driven sorting, and computerized shredding to increase recycling levels and reduce emissions.

The waste management industry is expanding as governments implement tougher environmental regulations and sustainability policies. Increased investments in circular economy models and escalating awareness among consumers and businesses are driving adoption of recycling and recovery solutions.

Drivers & Opportunities

Global Urbanization Trends Driving Higher Waste Generation: Worldwide urbanization is fueling increased volumes of municipal, commercial, and industrial waste, with the United Nations estimating 2.5 billion additional urban dwellers by 2050. Population growth enhances solid waste, while quick industrialization contributes toxic waste, overloading current infrastructure. Increased consumer expenditure and city development create enormous volumes of packaging, plastics, and demolition wastes, which demand sophisticated disposal systems. These patterns are compelling municipalities and private operators to adopt new waste technologies and integrated service concepts.

Waste Reduction Sustainability Mandates by Governments and International Agreements: Government sustainability mandates and international agreements set the background toward waste management activity occurring in developed as well as developing markets. Higher landfill diversion targets are enforced by those regulatory authorities and in parallel are pushing recycling initiatives, waste-to-energy initiatives, and other resource recoveries. According to these regulatory changes, the investments are also diverted toward building treatment plants and smaller decentralized systems. Furthermore, international climate agreements highlight waste management as key to achieving emission reductions. Therefore, governments are increasingly working with the private sector to increase treatment capacity. These are steps taken in the furtherance of circular economy principles for long-term market development.

What is the Impact of E-Waste Recycling on the Waste Management Market?

Electronic waste (e-waste) refers to the waste of electronic devices such as computers, smartphones, televisions, and other. The e-waste contains valuable, recoverable materials such as gold, silver, copper, and rare-earth metals. Hazardous substances, including lead, cadmium, mercury, and brominated flame retardants, are also found. This makes waste recycling crucial for environmental and economic reasons. The e-waste recycling market is witnessing a range of trends and opportunities. The following table contains a few trends and opportunities in the industry.

|

Trends & Opportunities |

Description |

|

Advancements in Recycling Technologies |

Hydrometallurgy, chemical recycling, and pyrolysis for better metal recovery |

|

IoT and Smart Collection |

Smart bins and tracking enhance collection efficiency |

|

Battery Recycling |

Growth in the recycling of lithium-ion battery due to rising EV adoption |

|

Public-Private Partnerships |

Governments and private recyclers are partnering to enhance capacity |

|

Decentralized Recycling Units |

Small-scale e-waste plants in urban areas reduce transportation costs and improve efficiency |

Waste management industry players are emphasizing adopting new recycling technologies and new trends to manage e-waste. It helps them stay ahead in the competition and boost the industry growth.

Segmental Insights

Waste Type Analysis

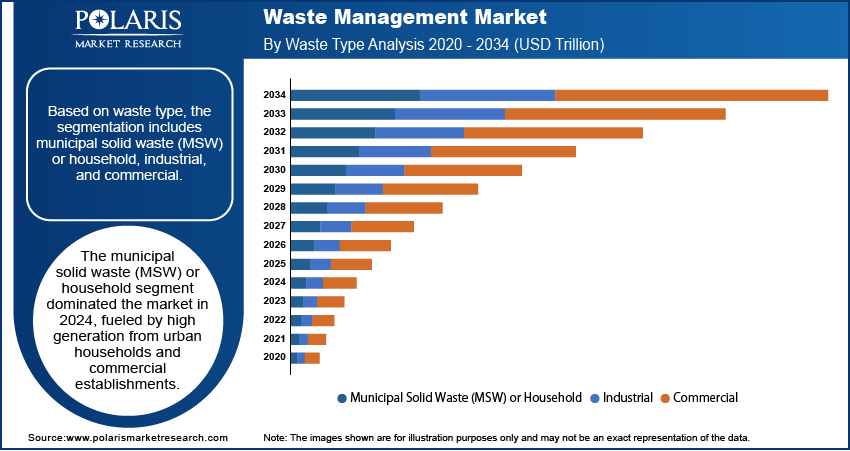

On the basis of waste type, the segmentation included municipal solid waste (MSW) or household, industrial, and commercial. The MSW segment dominated in 2024, being supported by rapid urbanization and increasing household consumption. Before wastes can be generated by various cities from food, plastic, paper, and glass, this large volume warrants some system of structured collection and disposal. Governments are discouraging landfill use and encouraging recycling and waste-to-energy projects.

The industrial segment is expected to grow at the fastest rate, driven by rising waste from manufacturing, construction, and agriculture. Increasing demolition activity is therefore adding to overall waste generation. Regulatory frameworks are also demanding industries to seek advanced treatment solutions.

Service Type Analysis

In terms of service type, the segmentation includes collection, transportation, and disposal. The collection segment led the market-locally supported by rapid growth in urban population and increasing waste volumes. Well-structured collection systems lead to better segregation and timely disposal.

The disposal segment is anticipated to grow fastest due to an increasingly stringent policy on diversion from landfills. Governments were directed to dispose of hazardous or even non-hazardous waste with safer technologies. Advanced disposal technology, especially for healthcare and industrial sector applications, is needed to prevent contamination.

Waste Treatment Analysis

Based on waste treatments, the major types include composting, incineration, controlled landfill, uncontrolled landfill, sanitary landfill, open dump, and recycling. The sanitary landfill segment held a majority in 2024 because the method still remained the most mechanical way of disposing of municipal solid waste. UNEP estimated that landfill volumes worldwide could increase from 0.64 billion tonnes in 2020 to 1.09 billion tonnes by 2050. Better protective liners, gas capture systems, and leachate control are increasing safety measures for the environment.

Thus, recycling will witness the highest growth during the forecast period, given that the recycling process is part of circular economy models that provide industries with reusable raw materials. Further, a rise in consumer appreciation for greener products and packaging fuels the facility expansions.

Regional Analysis

In 2024, the North American zone held sway in the market due to stringent regulations and mature recycling frameworks. The U.S. Environmental Protection Agency (EPA) maintains strict wasteland and hazardous waste regulations so much that it has seen increased demand for treatment and disposal facilities. There is growth support at waste-to-energy projects along with digital tracking technologies.

The U.S. Waste Management Market Insight

The U.S. retained the most significant part of the market due to high volume of municipal waste and strong recycling efforts in North America. According to Global Waste Index 2025, the U.S. generates approximately 951 kilograms of waste per capita annually (around 2.6 kilograms per day). Such federal and state regulations encouraging landfill safety, material recovery, and waste-to-energy facilities contribute largely to its growth.

Europe Waste Management Market

The European waste management market is projected to hold a considerable share by 2034. This is majorly due to the ambitious directives in the EU, which require the recycling of 55% of household waste by 2025, 60% by 2030, and 65% by 2035, with landfilling restricted to no more than 10%. The packaging recycling targets are placed as high as 70%. Thus, member states are forced to quicken building advanced recycling and treatment infrastructure.

Asia Pacific Waste Management Market

Asia Pacific witnessed the fastest CAGR during the forecast period on account of rapid urbanization and population concentration in countries such as China and India. To compete with rising municipal and industrial waste volumes in recycling, composting, etc., governments and also private players are making significant investments.

China Waste Management Market Overview

Chinese market growth is due to huge municipal waste generation and stricter landfill policies. The government is working on the promotion of waste segregation at the household level and also investing in waste-to-energy infrastructure. In March 2024, the State Council launched the plan for the establishment of a nationwide recycling system, targeted to be completed by 2025, appended with a market value of USD 697 billion annually.

Key Players & Competitive Analysis Report

The waste management industry caters to a moderately competitive environment wherein companies are competing for integrated solutions that include collection, treatment, and recycling to satisfy compliance standards. Players are increasingly expanding in areas like waste-to-energy facilities, automated sorting, and digital monitoring platforms. Pacing this innovation are municipal partnerships with private firms and technology providers, allowing the development of region-specific business models.

A few big names in the waste management industry are Waste Management, Inc., Veolia Environnement S.A., Republic Services, Remondis, Waste Connections, Inc., GFL Environmental, PreZero, FCC Group, Clean Harbors, China Everbright Environment Group (CHFFF), Paprec, and Stericycle, Inc.

Key Players

- China Everbright Environment Group (CHFFF)

- Clean Harbors

- FCC Group

- GFL Environmental

- Paprec

- PreZero

- Remondis

- Republic Services

- Stericycle, Inc.

- Veolia Environnement S.A.

- Waste Connections, Inc.

- Waste Management, Inc.

Industry Developments

- April 2025: SUEZ and CNRS entered into a five-year cooperation to drive decarbonization, resource recovery, and circular water and waste solutions, such as sludge-to-gas, PFAS reduction, and AI-based recycling.

- June 2025: Veolia planned to increase hazardous waste treatment by 530,000 tonnes by 2030, with 100,000 tonnes already operational, backed by acquisitions in the United States, Japan, and Brazil.

Waste Management Market Segmentation

By Waste Type Outlook (Revenue, USD Trillion, 2020–2034)

- Municipal Solid Waste (MSW) or Household

- Food

- Paper and Cardboard

- Plastic

- Glass

- Metal

- Others

- Industrial

- Manufacturing Waste

- Construction & Demolition Waste

- Agriculture Waste

- Other Industrial waste

- Commercial

By Service Type Outlook (Revenue, USD Trillion, 2020–2034)

- Collection

- Transportation

- Disposal

By Waste Treatment Outlook (Revenue, USD Trillion, 2020–2034)

- Composting

- Incineration

- Controlled Landfill

- Uncontrolled Landfill

- Sanitary Landfill

- Open Dump

- Recycling

By Regional Outlook (Revenue, USD Trillion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.36 Trillion |

|

Market Size in 2025 |

USD 1.43 Trillion |

|

Revenue Forecast by 2034 |

USD 2.33 Trillion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Trillion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.36 trillion in 2024 and is projected to grow to USD 2.33 trillion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

North America dominated the waste management market in 2024, driven by advanced collection infrastructure, high landfill utilization, and strict environmental regulations.

A few of the key players in the market are Waste Management, Inc., Veolia Environnement S.A., Republic Services, Remondis, Waste Connections, Inc., GFL Environmental, PreZero, FCC Group, Clean Harbors, China Everbright Environment Group (CHFFF), Paprec, and Stericycle, Inc.

The municipal solid waste segment dominated the market in 2024, fueled by rapid urbanization, rising residential waste volumes, and strong collection networks.

The recycling segment is projected to grow at the fastest CAGR, due to circular economy initiatives and government sustainability mandates.