Active Electronic Components Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Semiconductor Devices, Vacuum Tube, Display Devices, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM1465

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

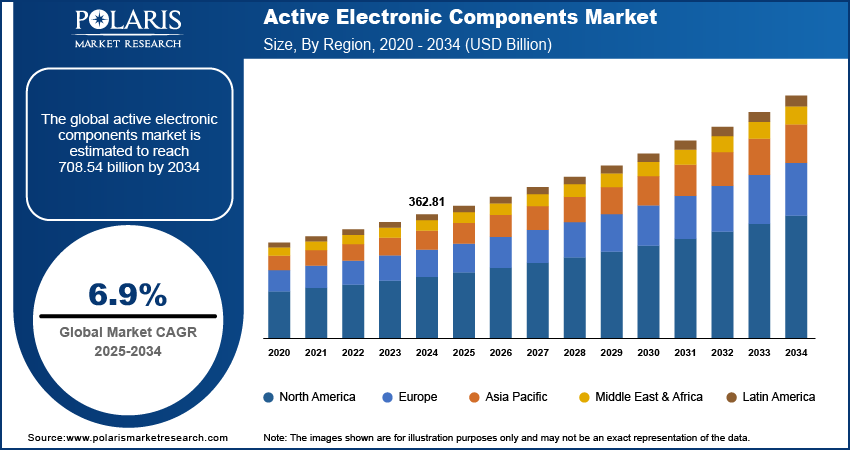

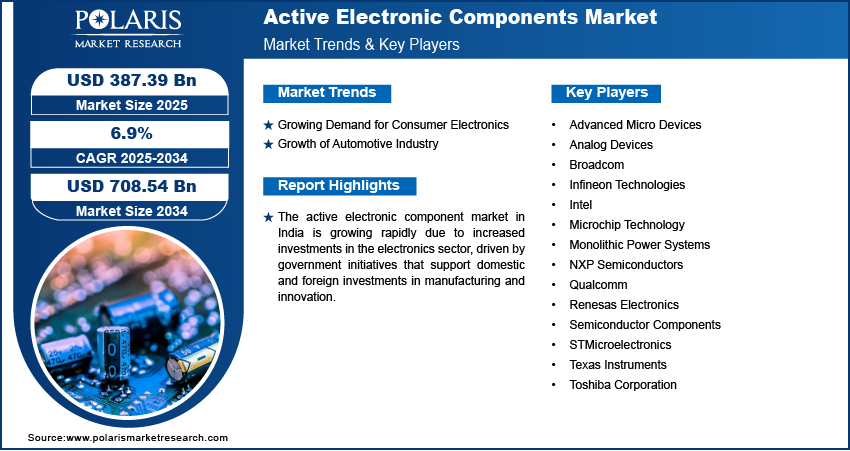

The active electronic components market size was valued at USD 362.81 billion in 2024. The market is projected to grow from USD 387.39 billion in 2025 to USD 708.54 billion by 2034, exhibiting a CAGR of 6.9% during 2025–2034. The worldwide rollout of 5G networks is driving the market demand.

Key Insights

- The semiconductor device segment accounted for the largest market share in 2024.

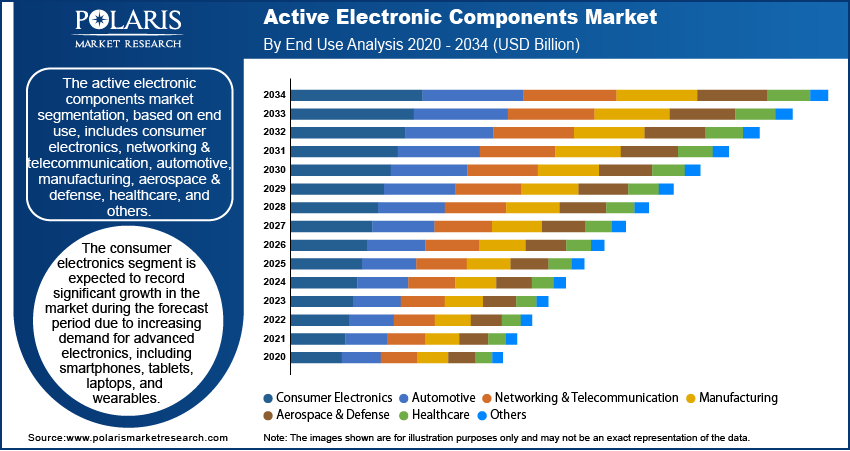

- The consumer electronics segment is anticipated to register notable growth in the market during the forecast period because of growing demand for advanced electronics involving smartphones, tablets, laptops, and wearables, which drives the demand for advanced electronics such as processors, sensors, and memory chips.

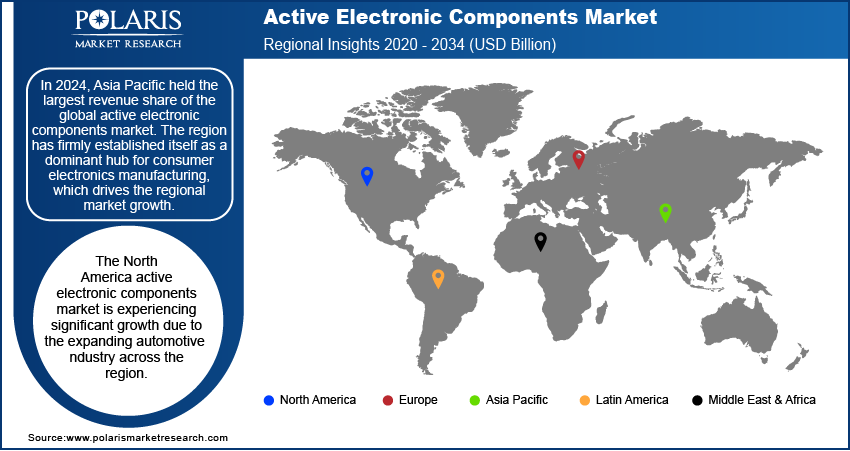

- The Asia Pacific active electronic components market held the largest share in 2024 due to its being a prominent hub for consumer electronics manufacturing.

- North America is encountering notable growth due to the augmenting automotive industry in the region.

Industry Dynamics

- The growing adoption of consumer electronics has led to growing dependence on advanced components such as microchips, transistors, and integrated circuits to operate seamlessly, which is fueling market expansion.

- The growing complexity of automotive parts, along with rising automotive sales, is boosting the market demand.

- Innovations in semiconductor technologies enabling the development of compact, faster, and more efficient components present notable opportunities.

- High manufacturing costs and fluctuating raw material prices may hinder market growth.

Market Statistics

2024 Market Size: USD 362.81 billion

2034 Projected Market Size: USD 708.54 billion

CAGR (2025-2034): 6.9%

Asia Pacific: Largest Market in 2024.

AI Impact on Active Electronic Components Market

- AI facilitates intelligent design automation, enabling faster prototyping and optimization of active components like transistors, diodes, and ICs.

- AI algorithms predict component behavior under varying conditions, enhancing reliability and reducing the need for extensive physical testing.

- Machine learning accelerates defect detection during manufacturing, improving yield rates and minimizing material waste.

- AI supports real-time performance monitoring and adaptive control in electronic systems, driving demand for AI-compatible active components.

To Understand More About this Research: Request a Free Sample Report

An active electronic component is a device that requires an external power source to operate and can amplify or control electrical signals. Transistors, diodes, and integrated circuits are a few examples of active electronic components. These components can modify voltage, current, or power in a circuit.

The global rollout of 5G networks is driving the active electronic components market demand. 5G services requires high-performance active components such as radio frequency (RF) amplifiers, power management ICs, and processors that handle faster speeds and higher data transmission. These components are critical for the infrastructure of 5G, including base stations, antennas, and mobile devices. Additionally, countries are adopting 5G technology, and telecommunications companies are upgrading their networks, due to which the demand for active electronic components is increasing.

Technological advancements are expected to drive the active electronic component market development during the forecast period. Innovations in semiconductor technology enable the production of smaller, faster, and more efficient components. For example, small transistors are anticipated to process more data at higher speeds while consuming less power. These advancements support manufacturers to create powerful devices such as 5G smartphones, computers, and wearables that are more efficient and compact, due to which the demand for active electronic components is anticipated to increase during the forecast period.

Market Dynamics

Growing Demand for Consumer Electronics

Consumer electronic devices, including smartphones, tablets, laptops, and wearables, rely heavily on active components such as microchips, transistors, and integrated circuits to function smoothly. Additionally, rising consumer demand for better performance, longer battery life, and enhanced features has increased the demand for active components. The constant innovation in consumer electronics, driven by the need for faster processors, better displays, and more efficient power management, is fueling the demand for active electronic components. Therefore, the growing demand for consumer electronics is significantly driving the active electronic component market growth.

Growth of Automotive Industry

The rising complexity of automotive components, coupled with growing automotive sales, is driving the demand for active electronic components in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers, automotive sales rose by 12% in 2023 from 2022, showcasing the growth of the automotive industry. Additionally, technological advancements in the automotive sector and the rise of electric vehicles are fueling the demand for active electronic components, thereby fueling the active electronic component market growth.

Segment Analysis

Active Electronic Components Market Assessment by Product Type Outlook

The active electronic components market segmentation, based on product type, includes semiconductor device, vacuum tube, display devices, and others. The semiconductor device segment accounted for the largest share in 2024. Semiconductor devices, such as transistors, diodes, and integrated circuits, are essential for powering and controlling electronic systems across various industries. These components are the building blocks of modern electronics, enabling devices such as smartphones, computers, cars, and industrial machines to function efficiently. Additionally, the growth of technologies such as 5G, electric vehicles, and IoT technology drives the demand for semiconductor devices, fueling the segment growth.

Active Electronic Components Market Evaluation by End Use Outlook

The active electronic components market segmentation, based on end use, includes consumer electronics, networking & telecommunication, automotive, manufacturing, aerospace & defense, healthcare, and others. The consumer electronics segment is expected to record significant growth in the market during the forecast period. Increasing demand for advanced electronics, including smartphones, tablets, laptops, and wearables, drives the need for active components such as processors, sensors, and memory chips. Continuous technological advancements and consumer preferences for devices with better features, longer battery life, and improved efficiency are fueling the demand for active electronic components for consumer electronics.

Regional Insights

By region, the study provides the active electronic components market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific held the largest share of the active electronic components market revenue. The region has firmly established itself as a dominant hub for consumer electronics manufacturing, driven by several advantageous factors such as competitive labor costs, an extensive pool of highly skilled labor, robust foreign direct investment inflows, proactive government policies favoring the production of electronic components, and favorable trade agreements with Europe and North America. Consequently, the region has solidified its status as the leading region for electronics manufacturing and exports. China, India, Vietnam, and Malaysia serve as critical contributors to this ecosystem, playing significant roles in the expansion of the electronics sector, thereby driving the active electronic component market growth.

The active electronic component market in India is experiencing significant growth due to increasing investments in the electronics sector. The government initiatives, such as "Make in India" and "Atmanirbhar Bharat," are encouraging domestic and foreign investments in electronics manufacturing and innovation. For instance, according to the India Brand Equity Foundation, USD 1.16 billion worth of investment was allocated to electronics manufacturing under the government scheme. This influx of investment is driving the demand for essential active components such as semiconductors, microchips, and sensors, which are used in smartphones, consumer electronics, industrial equipment, and other products. The growing focus on building a strong electronics manufacturing base in India is boosting the active electronic component market in the region.

The North America active electronics component market is experiencing significant growth due to the expanding automotive industry in the region. The rising adoption of electric vehicles (EVs) and advancements in autonomous driving technologies are increasing the demand for active components such as sensors, microcontrollers, and power management chips. These components are crucial for improving vehicle performance, safety, and energy efficiency. Automakers are integrating more electronics into vehicles to enable features such as advanced driver-assistance systems (ADAS) and electric powertrains. This shift is leading to a higher demand for high-performance active components, further boosting the active electronics component market expansion in North America.

Key Players and Competitive Analysis

The active electronic components market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the active electronic components market are Advanced Micro Devices, Analog Devices, Broadcom, Infineon Technologies, Intel, Microchip Technology, Monolithic Power Systems, NXP Semiconductors, Qualcomm, Renesas Electronics, Semiconductor Components, STMicroelectronics, Texas Instruments, and Toshiba Corporation.

Qualcomm Incorporated is an American multinational corporation based in San Diego, California, founded in 1985. The company specializes in designing and manufacturing digital wireless telecommunications products and services, with a focus on semiconductors and software. Qualcomm is recognized for its contributions to mobile communications, particularly through the development of CDMA technology and its involvement in the standards for 4G and 5G networks. The company's product range includes integrated circuits and system software for mobile devices. Key offerings are chipsets that consist of processors, modems, and radio frequency transceivers. One of its prominent product lines is the Snapdragon platform, which provides system-on-chip (SoC) solutions for smartphones, laptops, IoT devices, and automotive applications. Qualcomm operates through various business segments. For instance, Qualcomm CDMA Technologies (QCT) focuses on semiconductor products; Qualcomm Technology Licensing (QTL) manages licensing agreements related to its extensive patent portfolio; and Qualcomm Internet Services (QIS) offers internet-related services. The company has a global presence with operations in multiple regions. North America, particularly the US, serves as its primary market. In Asia Pacific, significant operations are located in China, Japan, South Korea, and India. The company also has a presence in Europe, with offices in countries such as Germany and France. The company has a workforce of over 45,000 employees worldwide.

Intel Corporation, an American multinational technology company, is engaged in the design and manufacturing of computer processors, chipsets, and various semiconductor components. Intel produces various products and services, including microprocessors, system-on-chip (SoC) products, chipsets, and memory and storage solutions. The company's processors are used in multiple devices, from personal computers and laptops to servers and data centers. Intel's chipsets connect processors and other components, while its memory and storage solutions include solid-state drives (SSDs) and other storage devices. In addition to its hardware products, Intel also offers a range of software and services. These include software development tools, operating systems, and security solutions. Intel also provides consulting and support services to help customers optimize their computing systems and applications. The company invests heavily in R&D to develop new technologies and improve its products. It has also been at the forefront of several key technological advances in the industry, including developing the first microprocessor and introducing the x86 architecture, which has become the standard for most personal computers. It has also significantly contributed to advancing artificial intelligence and machine learning. The company has developed several specialized processors specifically designed for AI applications, such as the Intel Movidius Neural Compute Stick and the Intel Nervana Neural Network Processor. Intel has also invested in AI startups and has collaborated with universities and research institutions to advance the field of AI.

List of Key Companies

- Advanced Micro Devices

- Analog Devices

- Broadcom

- Infineon Technologies

- Intel

- Microchip Technology

- Monolithic Power Systems

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Semiconductor Components

- STMicroelectronics

- Texas Instruments

- Toshiba Corporation

Active Electronic Components Industry Developments

In June 2023, NXP introduced a breakthrough in 5G radio technology with their new top-side cooling packaging. This innovative technology allows for more compact and lightweight radio units, making it easier and faster to deploy 5G base stations. The new top-side cooling for RF power enables smaller and thinner radios, streamlining the implementation of 5G infrastructure.

In June 2023, STMicroelectronics unveiled a series of octal high-side switches with integrated galvanic isolation to enhance durability. These switches offer a low RDS (on) of under 260 mΩ, resulting in improved energy efficiency. Additionally, they come with protection diagnostics, enhancing reliability and facilitating troubleshooting processes.

Active Electronic Components Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- Semiconductor Devices

- Diode

- Transistors

- Integrated Circuits (ICs)

- Optoelectronics

- Vacuum Tube

- Display Devices

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Consumer Electronics

- Networking & Telecommunication

- Automotive

- Manufacturing

- Aerospace & Defense

- Healthcare

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Active Electronic Components Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 362.81 billion |

|

Market Size Value in 2025 |

USD 387.39 billion |

|

Revenue Forecast by 2034 |

USD 708.54 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 362.81 billion in 2024 and is projected to grow to USD 708.54 billion by 2034.

The global market is projected to register a CAGR of 6.9% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Advanced Micro Devices, Analog Devices, Broadcom, Infineon Technologies, Intel, Microchip Technology, Monolithic Power Systems, NXP Semiconductors, Qualcomm, Renesas Electronics, Semiconductor Components, STMicroelectronics, Texas Instruments, and Toshiba Corporation.

The semiconductor devices segment accounted for the largest share in 2024 due to the increasing demand for transistors, diodes, and integrated circuits for powering and controlling electronic systems across various industries

The consumer electronics segment is expected to record significant growth in the market during the forecast period due to Increasing demand for advanced electronics, including smartphones, tablets, laptops, and wearables.