5G Services Market Size, Share, Trends, Industry Analysis Report

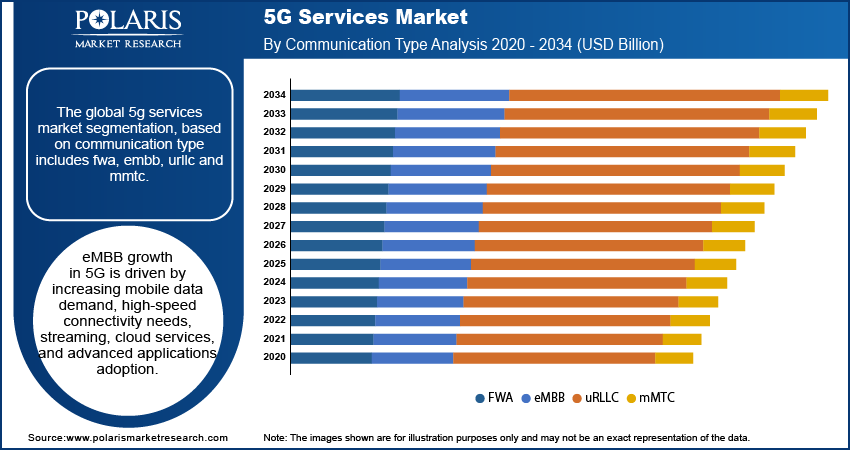

By Communication Type, By End Use (Smart Cities, Connected Workers, Connected Vehicles, Connected Factories, Smart Buildings, Smart Utilities, Connected Healthcare), By Industry Vertical, and By Region -Market Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM1705

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

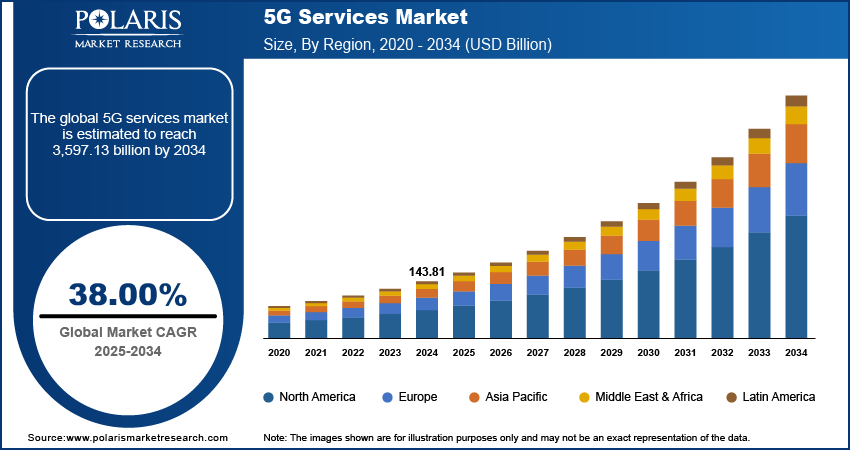

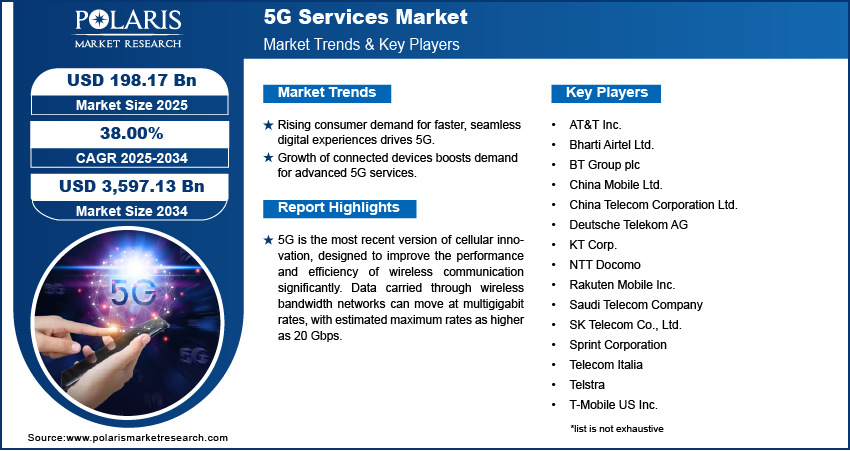

The global 5G services market size was valued at USD 143.81 billion in 2024. The market is projected to grow at a CAGR of 38.00% during 2025 to 2034. Key factors driving demand for 5G services include the proliferation of Internet of Things (IoT) devices, growing adoption of autonomous vehicles, industrial automation, and remote surgery, and increasing enterprise digital transformation and smart city initiatives.

Key Insights

- The IT & telecom segment held the largest revenue share in 2024 and is anticipated to lead the market over the forecast period. This is due to the rising need for faster speeds, lower latency, and massive connectivity to support new applications such as the Internet of Things (IoT) and artificial intelligence (AI).

- The manufacturing segment is anticipated to grow at a considerable pace in the coming years, due to the rising adoption of IoT and other related technologies in order to increase productivity and efficiency.

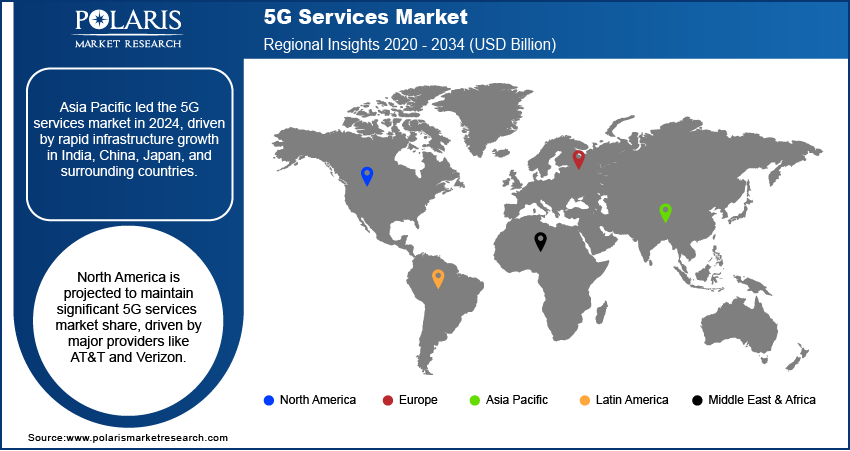

- Asia Pacific dominated the global 5G services market in 2024 and is anticipated to maintain its dominance throughout the forecast period. Rapid infrastructural development in countries such as India, China, Japan, and others has contributed to regional dominance.

- North America is expected to hold a significant market share in the global 5G services market throughout the forecast period due to the presence of large 5G services providers such as AT&T and Verizon.

Industry Dynamics

- The global 5G services market is fueled by the rising consumer expectations for faster downloads, smoother streaming, and minimal lag in online gaming.

- The growing number of connected devices and sensors in smart homes, manufacturing, healthcare, and logistics is also anticipated to increase demand for 5G services.

- Urban development initiatives, including intelligent transportation systems and smart grids, are creating a lucrative market opportunity.

- The high cybersecurity risks may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 143.81 Billion

- 2034 Projected Market Size: USD 3,597.13 Billion

- CAGR (2025-2034): 38.00%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on 5G Services Market

- Enhances 5G network performance by predicting traffic patterns and optimizing resource allocation.

- Detects potential network failures, reducing downtime and improving reliability.

- Helps in automated network management, lowering operational costs and human intervention.

5G is the most recent version of cellular innovation, designed to improve the performance and efficiency of wireless communication significantly. Data carried through wireless bandwidth networks can move at multigigabit rates, with estimated maximum rates as higher as 20 Gbps. Bandwidth speeds are faster than landline network connections and have a latency of fewer than five milliseconds (ms), which is beneficial for businesses that demand real-time input. Increasing demand for low network latency rate, high-speed transmission along with increasing connected devices trends are among several factors expected to increase demand for the 5G services market throughout the projected period.

Industry Dynamics

Growth Drivers

The global 5G services market is fueled by the rising consumer expectations for faster downloads, smoother streaming, and minimal lag in online gaming. Collaboration among smartphone makers, semiconductor vendors, and telecom operators is further projected to aid in developing operational 5G networks, which is increasing the demand for 5G services. Innovative infrastructure such as smart power networks, smart cities, intelligent buildings, and others need reliable internet connections, whcih is increasing the deployment and usgae of 5G netowrks. This is increasing the demand for advanced 5G services. Moreover, the government's significant expenditures and digital transformation intiatives in many parts of the world are fueling the expansion of the 5G cellular services market. The growing number of connected devices and sensors in smart homes, manufacturing, healthcare, and logistics is also anticipated to increase demand for 5G services.

Report Segmentation

The market is primarily segmented based on communication type, end use, industry vertical, and region.

|

By Communication Type |

By End Use |

By Industry Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Industry Vertical

The IT & telecom segment held the largest revenue share in 2024 and is anticipated to lead the market over the forecast period. This is due to the rising need for faster speeds, lower latency, and massive connectivity to support new applications such as the Internet of Things (IoT) and artificial intelligence (AI). 5G also hepls in creating new revenue streams for telecom operators, which contributed to the high adoption of 5G services in IT & telecom.

The manufacturing segment is anticipated to grow at a considerable pace in the coming years, due to the rising adoption of IoT and other related technologies in the manufacturing sector in order to increase productivity and efficiency. Furthermore, cyber-physical technologies and IoT are projected to power Industry 4.0 in manufacturing which is projected to increase need of 5G services connections.

Insight by End Use

The smart cities segment held the largest revenue share in 2024. Smart cities need 5G services to support massive numbers of IoT devices and enhance public safety, smart energy grids, and improve waste management. The growing investment in smart cities acorss the globe, particualry in emerging countries such as India further contributed to the segment's dominance. The Government of India launched Smart Cities Mission (SCM) to enhance the quality of life in India's cities through smart, sustainable solutions, with an investment of ₹1,47,704 crore.

Geographic Overview

Asia Pacific dominated the global 5G services market in 2024 and is anticipated to maintain its dominance throughout the forecast period. Rapid infrastructural development in countries such as India, China, Japan, and others has increased the demand for these services in order to improve connectivity. Moreover, the massive internet userbase and rising demand for smartphones with higher internet speeds have contributed to a consistent supply of 5G-enabled devices across the region, which increased the demand for 5G services.

Europe is expected to grow at a significant pace due to the increasing adoption of fifth generation services across the region. For instance, by the end of March 2021, 24 EU-27 nations had implemented 5G commercial services, including Austria, France, Belgium, Germany, and Greece.

North America is expected to hold a significant market share in the global 5G services market throughout the forecast period due to the presence of large 5G services provider such as AT&T and Verizon. Furthermore, increasing investments made by these players in order to provide 5G services across major countries, including the U.S. and Canada, are expected to propel market growth. For instance, in January 2021, AT&T began 5G services in several parts of Tampa, U.S., including the Tampa Airport and the Channel District.

Competitive Insight

Major market players operating in the global 5G services market include AT&T, Inc., Bharti Airtel Ltd., BT Group plc, China Mobile Ltd., China Telecom Corporation Ltd., Deutsche Telekom AG, KT Corp., NTT Docomo, Rakuten Mobile Inc., Saudi Telecom Company, SK Telecom Co., Ltd., Sprint Corporation, Telecom Italia, Telstra, T-Mobile USA Inc., Verizon Communications Inc., and Vodafone Group.

These market players are investing in research & development and securing the required spectrum. Furthermore, marketing strategies adopted by these players such as mergers & acquisitions and partnerships & collaboration in order to capture more consumers and enlarge their footprints. For instance, In January 2021, AT&T introduced its 5G+ services in prominent Tampa regions and venues such as Channel District, Raymond James Stadium, and Tampa International Airport in the United States.

5G Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 143.81 billion |

| Market size value in 2025 | USD 198.17 billion |

|

Revenue forecast in 2034 |

USD 3,597.13 billion |

|

CAGR |

38.00% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key Companies |

AT&T, Inc., Bharti Airtel Ltd., BT Group plc, China Mobile Ltd., China Telecom Corporation Ltd., Deutsche Telekom AG, KT Corp., NTT Docomo, Rakuten Mobile Inc., Saudi Telecom Company, SK Telecom Co., Ltd., Sprint Corporation, Telecom Italia, Telstra, T-Mobile USA Inc., Verizon Communications Inc., and Vodafone Group. |

FAQ's

• The global market size was valued at USD 143.81 billion in 2024 and is projected to grow to USD 3,597.13 billion by 2034.

• The global market is projected to register a CAGR of 38.00% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market include AT&T, Inc., Bharti Airtel Ltd., BT Group plc, China Mobile Ltd., China Telecom Corporation Ltd., Deutsche Telekom AG, KT Corp., NTT Docomo, Rakuten Mobile Inc., Saudi Telecom Company, SK Telecom Co., Ltd., Sprint Corporation, Telecom Italia, Telstra, T-Mobile USA Inc., Verizon Communications Inc., and Vodafone Group.

• The IT & telecom segment dominated the market revenue share in 2024.