Power Management IC Market Size, Share, Industry Analysis Report

By Type (Battery Management IC, Motor Control IC, Voltage Regulator, Multi-channel Power Management IC), By End User, By Region – Market Forecast, 2025–2034.

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM1473

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The power management integrated circuit (IC) market size was valued at USD 40.73 billion in 2024 and is expected to register a CAGR of 6.7% from 2025 to 2034. The market is experiencing robust growth driven by increasing demand for portable devices, such as smartphones and laptops. Additionally, there is a growing need for energy-efficient solutions in various applications, including the automotive and industrial sectors. The power management ICs are essential for optimizing performance and reducing energy consumption in modern electronics.

Key Insights

- The multi-channel power management IC segment accounted for the largest share in 2024. It is due to its ability to manage multiple power rails and voltage levels within a single device.

- The automotive segment is expected to register the highest CAGR from 2025 to 2034. The growth is attributed to the increased manufacturing of automobiles equipped with additional features to meet the rising consumer demand.

- Asia Pacific dominated the market in 2024. The dominance is driven by the expansion of consumer electronics sectors and the widespread adoption of advanced electronic devices, including smartphones and tablets.

- North America accounted for a significant share in 2024, owing to the advanced technological infrastructure and high adoption rate of consumer electronics.

Industry Dynamics

- The increasing popularity of electric vehicles (EVs), which require complex power management systems, propels the demand for power management IC.

- The rising focus on wireless communication infrastructure and increasing demand for efficient power management in communication devices and network equipment propel the market demand.

- Growing adoption of Internet of Things (IoT) across industrial applications is expected to create lucrative opportunities for the market during the forecast period.

- High initial costs Hinder the adoption of power management IC solutions.

Market Statistics

2024 Market Size: USD 40.73 billion

2034 Projected Market Size: USD 77.60 billion

CAGR (2025–2034): 6.7%

Asia Pacific: Largest market in 2024

AI Impact on Power Management IC Market

- Artificial intelligence (AI) facilitates load balancing and real-time optimization in various industries such as consumer electronics, EVs, and data centers.

- The technology helps predict system failures and optimize maintenance. It improves reliability and reduces downtime.

- AI tools accelerate chip design for power management ICs. This benefit of AI enhances system performance and reduces power consumption.

- The integration of AI with PMICs helps extend battery life and manage thermal performance in smartphones, laptops, and other devices.

- In the automotive sector, this technology supports power management in EVs. It enables smarter battery systems and regenerative braking.

- AI enhances energy storage systems and grid stability in smart grids and IoT applications, aligning with sustainability goals.

To Understand More About this Research: Request a Free Sample Report

A power management integrated circuit (PMIC) is a specialized semiconductor device designed to manage and regulate electrical power within electronic systems efficiently. PMICs integrate multiple power-related functions-such as DC-to-DC conversion, voltage regulation, battery charging and protection, power sequencing, and power-source selection-into a single compact chip, making them essential for modern electronic devices that require various internal voltages and power sources. They can also monitor power consumption, manage startup and shutdown sequences, and extend battery life by dynamically adjusting supply levels according to system demand

Governments and manufacturers focused on developing high-efficiency systems are significant contributors to the power management IC expansion. High-efficiency systems require an advanced power management IC to manage power conversion and distribution efficiently. This has accelerated the development and adoption of advanced power management IC technologies by manufacturers for various applications. For instance, in May 2024, Dolphin Design and Raspberry Pi collaborated to develop advanced power management IC technologies for their semiconductor project. This collaboration enables optimization of performance, power efficiency, and extended battery life for various applications.

Market Dynamics

Increasing Adoption of Electric Vehicles

Power management IC demand is being driven by the increasing adoption of electric vehicles, which require complex power management systems. Electric vehicles rely on efficient power management to optimize battery usage, ensure reliable performance, and extend driving range. Power management ICs manage the power distribution within the vehicle, controlling the charging and discharging processes and maintaining battery health. Therefore, as the demand for electric vehicles rises, the need for power management ICs that can handle power management tasks also increases, driving the power management IC growth. For instance, according to the International Energy Agency (IEA) Global EV Outlook 2023, the sales of electric vehicles increased by 3.5 billion in 2023 compared to 2022, a 35% annual rise. In 2023, sales of electric cars reached 14 billion, with the majority (95%) occurring in China, Europe, and the US.

Expansion Of Wireless Communication Infrastructure

The market is experiencing significant growth, driven by the expansion of wireless communication infrastructure and the increasing demand for efficient power management in communication devices and network equipment. Power management ICs are essential in ensuring that base stations, small cells, and other communication infrastructure components operate reliably and efficiently. It manages power consumption and reduces energy waste. The rollout of 4G and 5G infrastructure networks necessitates advanced power management IC solutions to handle the complex power requirements of modern communication technologies. For instance, in June 2024, BSNL announced its plans to roll out 5G services in early 2025 and complete the rollout of 4G services by the end of 2024 in India.

The proliferation of wireless devices such as smartphones, tablets, and IoT sensors further accelerates the need for sophisticated power management solutions. These devices demand more efficient power management to extend battery life and enhance performance, driving the power management IC revenue.

Market info.png)

Segment Insights

Market Assessment by IC Type Insights

The market segmentation, based on type, includes battery management IC, motor control IC, voltage regulator, multi-channel power management IC, integrated ASSP power management IC, and others. The multi-channel power management IC segment accounted for the largest power management IC share in 2024 due to its ability to manage multiple power rails and voltage levels within a single device. Multi-channel power management IC helps optimize power distribution, reduce component count, save board space, and enhance overall system efficiency. Hence, the key players are developing and launching multi-channel power management ICs due to their versatility and efficiency. For instance, in June 2024, South Korea-based Magnachip Mixed-Signal Ltd. announced the launch of a multi-channel power management IC specifically designed for IT device display panels. The new power management IC is designed to control different voltages and signals in order to increase efficiency and reduce power consumption.

Market Evaluation by End User Insights

The market segmentation, based on end user, includes automotive, consumer electronics, industrial, computing, communication, building & automation, retail, healthcare, and others. The automotive segment is expected to register the fastest CAGR from 2025 to 2034, owing to the increased manufacturing of automobiles equipped with additional features to meet the rising consumer demand. Power management ICs enable the incorporation of advanced electronics in automobiles to manage battery power, optimize energy usage, and ensure efficient operation. Additionally, advanced driver assistance systems (ADAS), which include camera and radar technologies, rely on power management ICs for navigation, communication, and safety features, further driving the demand for power management IC solutions. This is propelling companies to develop and launch power management ICs for automotive applications. For instance, in November 2022, Renesas Electronics Corporation, a provider of advanced semiconductor solutions, launched an automotive power management IC for next-generation automotive camera applications.

Market seg.png)

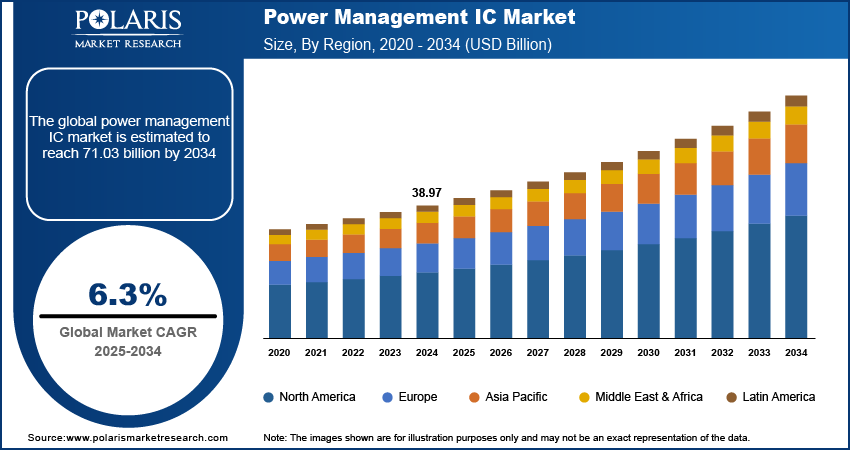

Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024, owing to the expansion of consumer electronics sectors and the widespread adoption of advanced electronic devices such as smartphones and tablets. For instance, according to the Invest India 2023 report, the total value of domestic electronics production was valued at $101 billion in India. Further, the consumer electronics segment accounted for 12% of the total domestic electronics production.

The rising demand for energy-efficient battery-powered devices and the integration of advanced technologies like IoT and AI into power management ICs are driving the market growth in the region. China accounted for a significant share owing to the expansion of the automotive sector, including rising sales of electric vehicles. For instance, in May 2023, according to the World Economic Forum, China saw an 82% rise in new EV sales in 2022 over the previous year. With 59% of all global EV sales last year, the nation solidified its lead as the top region for electric vehicles worldwide. With 64% of the global EV volume produced, China is also the world's largest EV producer.

Market reg.png)

North America accounted for a significant share owing to the advanced technological infrastructure, high adoption rate of consumer electronics, and the presence of major semiconductor companies. These companies are focused on developing advanced power management ICs to meet the rising consumer demands. For instance, in December 2023, Nordic Semiconductor launched the nPM1300 PMIC (power management integrated circuit). The PMIC comes with two load switches and integrated battery charging for battery-operated applications.

The region's demand for energy-efficient solutions across various sectors, including automotive, industrial, and telecommunications, drives the North America market. Additionally, the growing trend of smart homes and IoT devices in North America necessitates advanced power management ICs to ensure efficient energy use and battery management, contributing to the market growth.

Key Players & Competitive Insights

Major players are investing heavily in research and development in order to expand their product lines, which will help the market grow even more. Participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the market must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players include Texas Instruments Incorporated; Onsemi; Analog Devices Inc.; ROHM Co. Ltd; Vishay Intertechnology Inc.; Infineon Technologies AG; STMicroelectronics N.V.; Mouser Electronics India; NXP; and Renesas Electronics Corp.

Texas Instruments Incorporated is a global semiconductor company that designs, manufactures, tests, and sells analog and embedded processing chips. TI offers a wide range of products, including amplifiers, data converters, interfaces, motor drivers, sensors, switches and multiplexers, microcontrollers, processors, and isolation products. The company serves industrial, automotive, communications equipment, personal electronics, enterprise systems, and other sectors. TI has a global presence across the Americas, Asia Pacific, and Europe. In April 2023, Texas Instruments launched the SimpleLink series of Wi-Fi 6 companion ICs. These ICs are engineered to meet the demands of high-density and high-temperature applications.

Onsemi is a semiconductor manufacturing company. The company specializes in designing and producing a diverse range of semiconductor products and solutions, including analog, discrete, silicon carbide, power modules, memory, and ICs. Onsemi serves various sectors, such as automotive, industrial, medical, aerospace, defense, and communications. The company operates globally with 19 manufacturing facilities and 43 design centers across North America, Europe, and Asia Pacific. In May 2023, Onsemi announced a ten-year long-term supply deal of silicon carbide materials to Vitesco Technologies. The deal was valued at $1.9 billion for rapid advancement in the electrification technologies of power management IC.

List of Key Companies in Power Management IC Industry

- Analog Devices Inc.

- Infineon Technologies AG

- Mouser Electronics India

- NXP

- Onsemi

- Renesas Electronics Corp.

- ROHM Co. Ltd

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

Power Management IC Industry Developments

June 2024: Startup Orca Semiconductor sampled its first power management IC for an application-specific approach in the healthcare sector.

July 2023: Analog Devices Inc. invested $1 billion to expand its semiconductor operations based in Oregon. The company aims to increase its production capacity in industries such as consumer electronics, healthcare, and communications.

March 2023: Texas Instruments introduced the power management IC designed to filter electromagnetic interference. The company expanded its line of analog products through the inclusion of TPSF12C1, TPSF12C3, TPSF12C1-Q1, and TPSF12C3-Q1.

Power Management IC Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020-2034)

- Battery Management IC

- Motor Control IC

- Voltage Regulator

- Multi-channel Power Management IC

- Integrated ASSP Power Management IC

- Others

By End User Outlook (Revenue, USD Billion, 2020-2034)

- Automotive

- Consumer Electronics

- Industrial

- Computing

- Communication

- Building & Automation

- Retail

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Power Management IC Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 40.73 billion |

|

Market Size Value in 2025 |

USD 43.36 billion |

|

Revenue Forecast in 2034 |

USD 77.60 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

· By Type · By End User |

|

Regional Scope |

· North America · Europe · Asia Pacific · Latin America · Middle East & Africa |

|

Competitive Landscape |

Power Management IC Industry Trends Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

· PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The power management IC market size was valued at USD 40.73 billion in 2024 and is projected to be valued at USD 77.60 billion in 2034.

The market is projected to grow at a CAGR of 6.7% from 2025 to 2034.

Asia Pacific held the largest share in 2024.

The key players in the market are Texas Instruments Incorporated; Onsemi; Analog Devices Inc.; ROHM Co. Ltd; Vishay Intertechnology Inc.; Infineon Technologies AG; STMicroelectronics N.V.; Mouser Electronics India; NXP; and Renesas Electronics Corp.

The multi-channel power management IC segment held a significant market share in the market.

The automotive segment is expected to witness the fastest CAGR during the forecast period.