Fungicide Market Size, Share, Trends, Industry Analysis Report

: By Type (Liquid and Dry), Crop Type, Product, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: pdf

- Report ID: PM3015

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

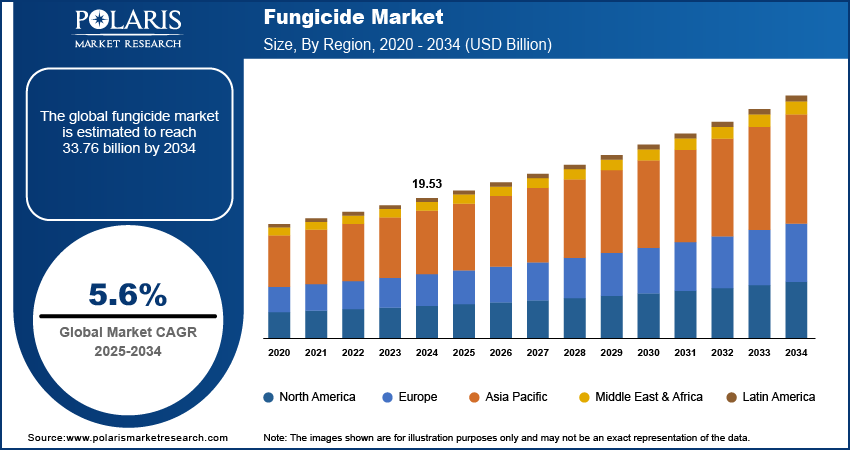

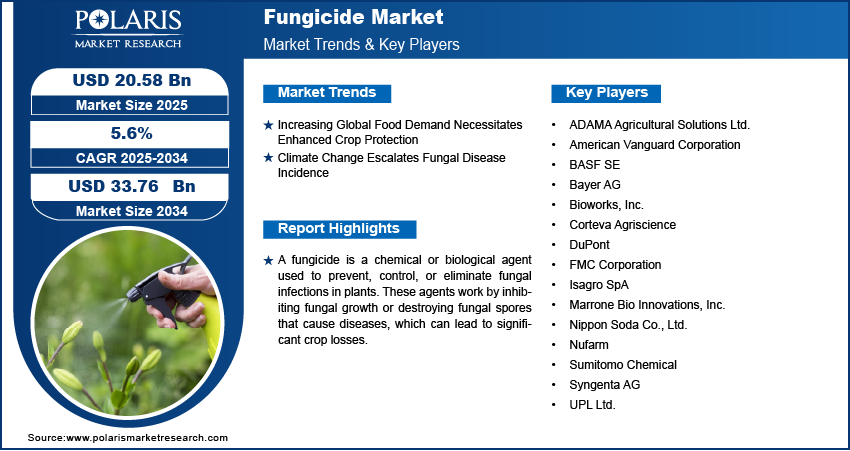

The fungicide market size was valued at USD 19.53 billion in 2024, growing at a CAGR of 5.6% during 2025–2034. Increased demand for food production and heightened risk of fungal infections due to climate change are a few of the key factors driving market expansion.

Key Insights

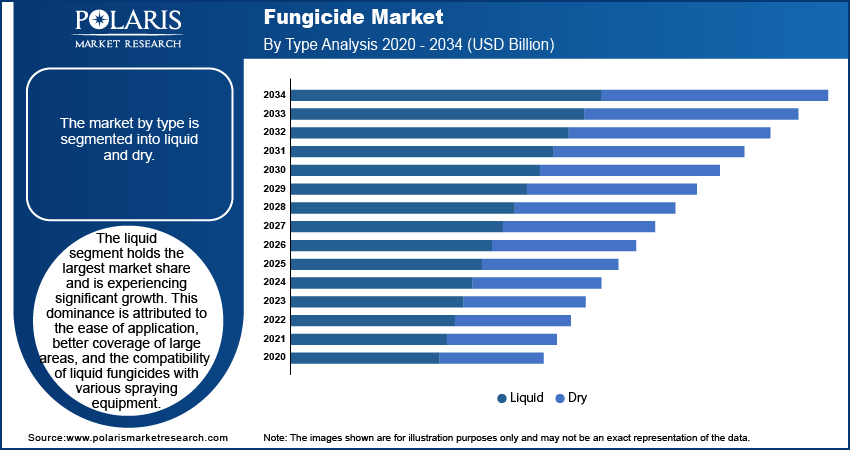

- The liquid segment dominates the market, primarily driven by the ease of application of liquid fungicides and their better coverage of large areas.

- The cereals & grains segment leads the market. The crucial role of cereals & grains in ensuring global food security and their extensive cultivation across diverse climates drive the segment’s leading market position.

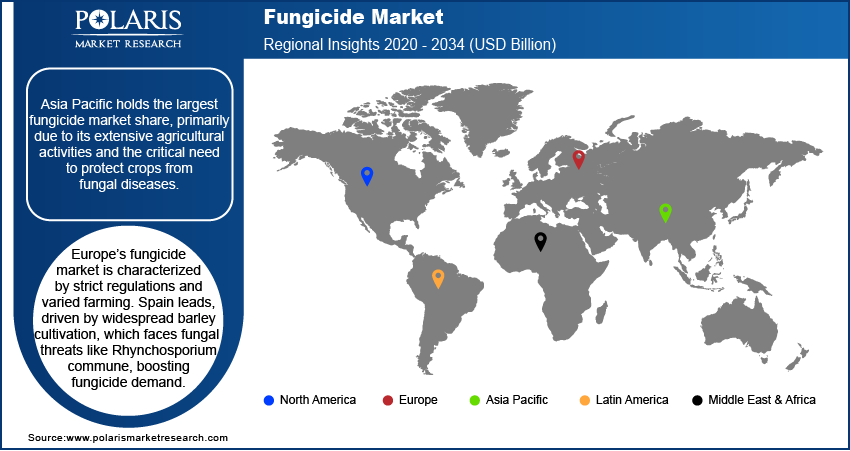

- Asia Pacific accounts for the largest market share. The extensive agricultural activities in the Asia Pacific and the crucial need for protecting crops from fungal diseases fuel the regional market dominance.

- The market for fungicides in Europe is characterized by stringent regulatory frameworks and diverse agricultural practices.

Industry Dynamics

- The rising focus on enhancing crop yields and efficiency to meet growing food production demands has increased the need for robust crop protection measures, including fungicides.

- The growing incidence of fungal disease due to climate change is fueling the usage of fungicide, thereby driving market development.

- The development of commercialization of biofungicides is expected to create several market opportunities.

- Resistance development in fungal pathogens can hinder market growth.

Market Statistics

2024 Market Size: USD 19.53 billion

2034 Projected Market Size: USD 33.76 billion

CAGR (2025-2034): 5.6%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The fungicide market focuses on the development and application of chemical and biological agents to prevent and control fungal infections in crops. These fungicides play a crucial role in ensuring high agricultural productivity by reducing crop losses caused by fungal diseases. The market encompasses a wide range of products, including contact, systemic, and biological fungicides, each serving different purposes based on crop type and fungal threats. With increasing concerns over food security and sustainable farming, the demand for effective and eco-friendly fungicides has grown significantly. The market is influenced by stringent regulatory policies, technological advancements in agrochemicals, and shifting consumer preferences toward organic farming solutions.

Several key drivers are propelling the fungicide market growth. The rising global population has led to an increased demand for food production, driving the need for effective crop protection solutions. Additionally, climate change and unpredictable weather patterns have heightened the risk of fungal diseases, further emphasizing the necessity of fungicides. Advancements in biotechnology and the development of bio-based fungicides are also contributing to market expansion, offering sustainable alternatives to synthetic chemicals.

Fungicide Market Dynamics

Increasing Global Food Demand Necessitates Enhanced Crop Protection

The rapid growth of the global population has intensified the demand for food production, compelling agricultural sectors to enhance crop yields and efficiency. This surge necessitates robust crop protection measures to prevent losses from fungal diseases. For instance, the Food and Agriculture Organization (FAO) reported that global rice production reached 520 million tons in 2021, with rice blast disease causing significant yield losses, underscoring the critical role of fungicides in safeguarding staple crops. Similarly, the United States Department of Agriculture (USDA) highlighted those fungal diseases led to substantial losses in corn and soybean production in 2021, emphasizing the need for effective fungicidal interventions. These instances demonstrate that escalating food requirements are a pivotal fungicide market driver, as they are essential in maintaining crop health and productivity, thereby driving the growth of the market.

Climate Change Escalates Fungal Disease Incidence

Climate change, characterized by shifting weather patterns and increasing temperatures, has created environments conducive to the proliferation of fungal pathogens, thereby elevating the risk of crop infestations. The Environmental Protection Agency (EPA) has observed that such climatic alterations can exacerbate the spread of plant diseases, necessitating increased fungicide applications to manage these threats effectively. This correlation between climate variability and heightened disease prevalence underscores the growing reliance on fungicides to mitigate the adverse effects of environmental changes on agriculture, thereby driving the growth of the fungicide market.

Fungicide Market Segment Insights

Assessment by Type

The fungicide market segmentation, based on type, includes liquid and dry. The liquid segment holds the largest fungicide market share. This dominance is attributed to the ease of application, better coverage of large areas, and the compatibility of liquid fungicides with various spraying equipment. Liquid formulations facilitate efficient mixing with other agricultural chemicals, enhancing their versatility in integrated pest management strategies. Additionally, the rapid absorption and immediate action of liquid fungicides contribute to their effectiveness in controlling fungal diseases, making them a preferred choice among farmers.

Evaluation by Crop Type

The fungicide market is segmented by crop type into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The cereals & grains segment holds the largest market share. This prominence is attributed to the critical role these crops play in global food security and their extensive cultivation across diverse climates, making them susceptible to various fungal diseases. Farmers prioritize effective fungicide treatments to protect yields and maintain crop quality, thereby driving demand in this segment.

Regional Insights

By region, the study provides fungicide market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest market share, primarily due to its extensive agricultural activities and the critical need to protect crops from fungal diseases. Countries such as China and India, with their vast farmlands and diverse crop cultivation, are significant contributors to this dominance. The region's tropical and subtropical climates create favorable conditions for fungal pathogens, necessitating effective fungicide solutions. Additionally, the increasing population and the need to produce more food to feed the growing population are driving the demand for fungicides in the region.

The fungicide market in Europe is characterized by diverse agricultural practices and stringent regulatory frameworks. Spain emerges as a dominant player, driven by its extensive cultivation of cereals and grains, particularly barley, which is highly susceptible to fungal diseases including Rhynchosporium commune. The country's significant olive production also contributes to the high demand for fungicides to combat diseases such as anthracnose. France exhibits substantial growth potential, underpinned by its sophisticated agricultural sector and emphasis on grain production. French farmers rely heavily on crop protection chemical fungicides to protect crops from yield losses caused by various fungal pathogens. In Russia, the vast agricultural land dedicated to crops such as wheat necessitates the use of fungicides to manage prevalent diseases such as leaf rust, which can cause significant yield reductions. Italy's position as a leading agricultural producer, particularly in soybean and tomato cultivation, drives the demand for fungicides to address challenges such as anthracnose and late blight disease.

Key Players and Competitive Insights

The fungicide market includes several prominent companies actively engaged in the development and distribution of crop protection solutions. These include Syngenta AG; Bayer AG; BASF SE; FMC Corporation; Nufarm; Corteva Agriscience; UPL Ltd.; Sumitomo Chemical; and DuPont. Other notable players are ADAMA Agricultural Solutions Ltd.; Isagro SpA; Marrone Bio Innovations, Inc.; Nippon Soda Co., Ltd.; American Vanguard Corporation; and Bioworks, Inc.

These companies offer a diverse range of fungicidal products tailored to various crops and regional requirements. For instance, Syngenta AG and Bayer AG have developed comprehensive portfolios addressing both traditional and emerging fungal threats. BASF SE focuses on innovative solutions, including bio-based fungicides, aligning with the growing demand for sustainable agricultural practices. FMC Corporation and Nufarm provide cost-effective options catering to different market segments. Corteva Agriscience emphasizes research-driven products enhancing crop resilience. UPL Ltd. and Sumitomo Chemical leverage extensive distribution networks to reach diverse agricultural markets. DuPont integrates advanced technologies into its fungicide offerings.

In this competitive landscape, companies continually invest in research and development to introduce effective and environmentally friendly fungicides. Collaborations and strategic partnerships are common, aiming to expand product portfolios and global reach. Additionally, adherence to regulatory standards and responsiveness to consumer preferences for sustainable farming practices influence market positioning. This dynamic environment drives innovation and ensures the availability of diverse solutions to meet the evolving challenges in crop protection.

Syngenta AG, headquartered in Basel, Switzerland, is a leading agricultural company specializing in crop protection and seed products. It focuses on developing innovative solutions to enhance crop yields and promote sustainable agriculture. In February 2025, Syngenta strengthened its position in agricultural biologicals by acquiring natural products and genetic strains assets from Novartis, aiming to boost its biologicals research capabilities.

Bayer AG, based in Leverkusen, Germany, operates in the life sciences sectors, including pharmaceuticals, consumer health, and crop science. The company's crop science division offers a range of fungicides, herbicides, and insecticides to support global agriculture. In November 2024, Bayer reported a €4 billion net loss for the quarter, leading to a downward revision of its earnings forecast for 2024. The loss was attributed to a decline in agricultural sales and significant impairment charges.

List of Key Companies

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Bioworks, Inc.

- Corteva Agriscience

- DuPont

- FMC Corporation

- Isagro SpA

- Marrone Bio Innovations, Inc.

- Nippon Soda Co., Ltd.

- Nufarm

- Sumitomo Chemical

- Syngenta AG

- UPL Ltd.

Fungicide Industry Developments

- June 2024: BASF Agricultural Solutions introduced Cevya, a new rice fungicide in China. It is the first isopropanol triazole fungicide approved for rice applications in two decades, specifically developed to combat rice false smut and address fungicide resistance. With mefentrifluconazole as its active ingredient, Cevya provides rice growers with an advanced solution to improve crop yields.

- August 2023: Bayer AG announced a USD 238.214 million investment in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in four decades. The facility is dedicated to developing innovative fungicides and other chemicals that emphasize environmental sustainability and human safety.

Fungicide Market Segmentation

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Liquid

- Dry

By Crop Type Outlook (Revenue-USD Billion, 2020–2034)

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Inorganics

- Biofungicides

- Benzimidazoles

- Triazoles & Diazoles

- Dithiocarbamates

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Fungicide Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.53 billion |

|

Market Size Value in 2025 |

USD 20.58 billion |

|

Revenue Forecast by 2034 |

USD 33.76 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy

The fungicide market has been segmented into detailed segments of type, crop type, and product. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the fungicide market focus on growth and marketing strategies that include product innovation, strategic partnerships, and expansion into emerging markets. Many firms invest in research and development to introduce bio-based and environmentally friendly fungicides in response to regulatory pressures and consumer demand for sustainable agriculture. Strategic mergers and acquisitions help companies strengthen their market presence and diversify their product portfolios. Digital marketing, precision agriculture solutions, and direct engagement with farmers and distributors play a crucial role in market penetration. Additionally, expanding distribution networks and forming collaborations with agrochemical firms enhance the accessibility and adoption of fungicide products globally.

FAQ's

The fungicide market size was valued at USD 19.53 billion in 2024 and is projected to grow to USD 33.76 billion by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

The fungicide market key players include Syngenta AG; Bayer AG; BASF SE; FMC Corporation; Nufarm; Corteva Agriscience; UPL Ltd.; Sumitomo Chemical; DuPont; ADAMA Agricultural Solutions Ltd.; Isagro SpA; Marrone Bio Innovations, Inc.; Nippon Soda Co., Ltd.; American Vanguard Corporation, and Bioworks, Inc.

The liquid segment accounted for the larger share of the market in 2024.

A fungicide is a type of chemical or biological agent used to prevent, control, or eliminate fungal infections in plants.