Agriculture Silos & Storage Systems Market Size, Share, Trends, & Industry Analysis Report

By Silo Type (Flat Bottom, Hopper, Grain Bins, Square, Other), By Construction Material, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5847

- Base Year: 2024

- Historical Data: 2020-2023

Overview

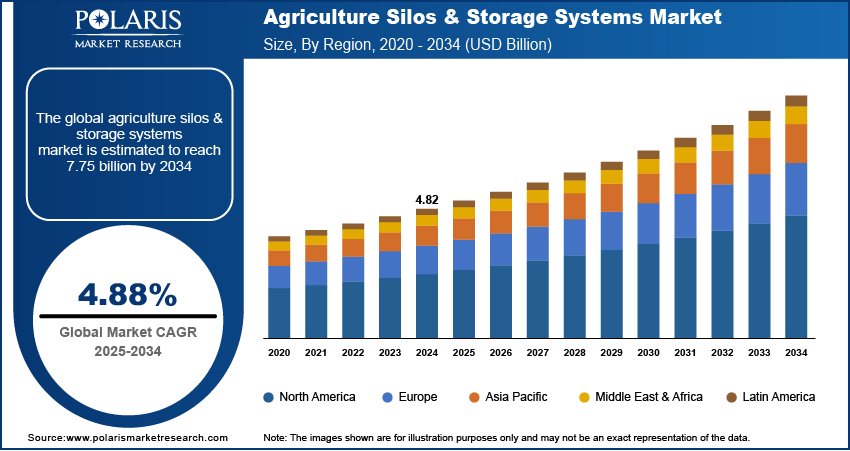

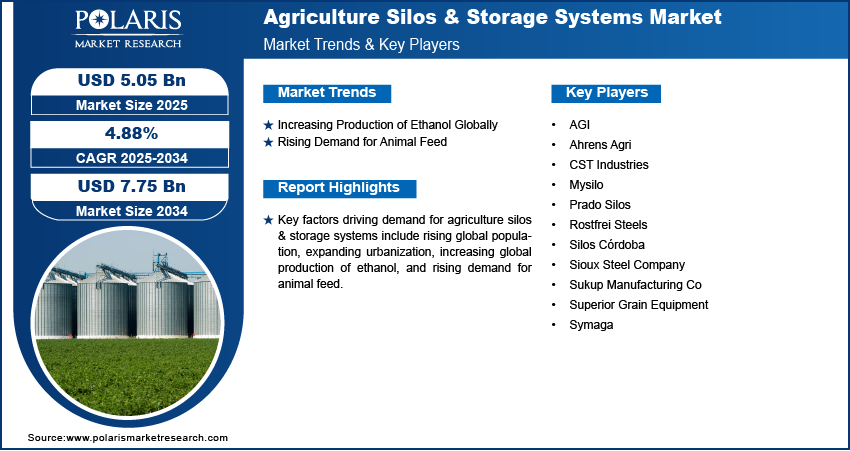

The global agriculture silos & storage systems market size was valued at USD 4.82 billion in 2024, growing at a CAGR of 4.88% from 2025–2034. Key factors driving demand for agriculture silos & storage systems include rising global population, expanding urbanization, increasing global production of ethanol, and rising demand for animal feed.

Agriculture silos and storage systems are specialized structures designed for the bulk storage and preservation of grains, silage, and other agricultural commodities, playing a crucial role in modern farming and food supply chains. The primary function of these systems is to extend the shelf life of harvested crops by providing a controlled environment that minimizes spoilage, maintains quality, and reduces post-harvest losses. Some agriculture silos and storage systems are equipped with advanced features such as temperature and humidity monitoring, automated loading and unloading mechanisms, and pest-resistant designs to ensure safe storage of agricultural products.

The rising global population is driving the market growth. The United Nations, in its report, stated that the world's population is projected to grow over the next 50 to 60 years, peaking at approximately 10.3 billion by mid-2080. This increasing population is driving demand for staple crops such as rice, wheat, and corn, which is fueling farmers and governments to produce, store, and distribute larger quantities of staple crops. This is creating pressure on agricultural supply chains to reduce post-harvest losses and maintain food quality year-round. To meet these challenges, government and private entities are investing in agriculture silos & storage systems that offer protection from pests, moisture, and spoilage.

To Understand More About this Research: Request a Free Sample Report

The agriculture silos & storage systems demand is driven by the expanding urbanization globally. World Bank, in its report, stated that the urban population is expected to more than double by 2050. Urban populations drive greater food consumption, pushing agribusinesses and governments to invest in modern storage silos and systems to minimize post-harvest losses, stabilize food supplies, and ensure consistent quality. Additionally, urbanization encourages the adoption of advanced storage systems to support bulk handling, reduce waste, and improve distribution efficiency in densely populated areas. Therefore, as urbanization expands globally, the demand for agriculture silos & storage systems is estimated to rise.

Industry Dynamics

Increasing Production of Ethanol Globally

The increasing global production of ethanol is raising demand for agriculture silos and storage systems as ethanol primarily comes from crops like corn and sugarcane, which require large-scale storage after harvest. U.S. Energy Information Administration in its report stated that the total production capacity of ethanol in the US increased from 13.6 billion gallons per year in 2011 to about 17.7 billion gallons per year by the end of 2022. Additionally, price volatility in ethanol industry encourages stockpiling, further boosting demand for silos and storage systems that preserve corn and sugarcane quality over extended periods. Therefore, as production of ethanol increases globally, the adoption of agriculture silos & storage systems rises.

Rising Demand for Animal Feed

Growing meat consumption globally is pushing feed manufacturers to secure and preserve bulk raw materials, driving investments in efficient storage solutions to prevent spoilage and maintain nutritional quality. Climate fluctuations and seasonal production cycles is also compelling feed suppliers to stockpile grains during peak harvests, further boosting demand for silos that ensure long-term storage stability. Additionally, stricter food safety regulations are encouraging the adoption of advanced storage systems that protect feed from pests, mold, and contamination, ensuring consistent supply for the expanding animal agriculture industry. Therefore, the rising demand for animal feed is driving the demand for agriculture silos & storage systems.

Segmental Insights

Silo Type Analysis

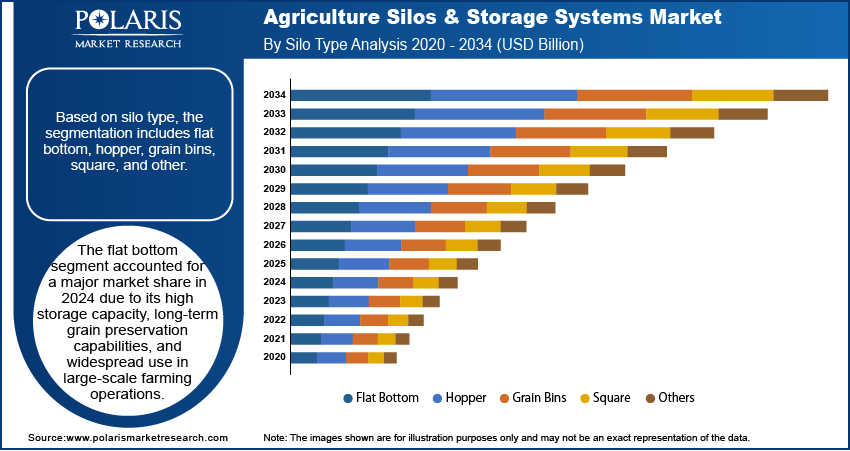

Based on silo type, the segmentation includes flat bottom, hopper, grain bins, square, and other. The flat bottom segment accounted for a major market share in 2024 due to its high storage capacity, long-term grain preservation capabilities, and widespread use in large-scale farming operations. Farmers and agribusinesses preferred flat bottom silos for bulk storage of grains such as wheat, corn, and barley, especially in regions with high grain production like North America and Asia Pacific. These silos provided an efficient solution for storing harvests before processing or export, and their compatibility with automated unloading systems further enhanced their utility. The robust design of flat bottom silos also allowed for better pest control and reduced spoilage, which made them a cost-effective and reliable storage option for producers handling seasonal harvest surpluses.

The grain bins segment is projected to grow at a rapid pace in the coming years, owing to the rising demand for short-term, flexible, and accessible on-farm storage solutions. Grain bins offer farmers more agility in managing crop quality during post-harvest stages, particularly in regions witnessing unpredictable climate conditions and volatile commodity prices. The growing adoption of precision agriculture practices and the integration of IoT-based monitoring systems in grain bins are contributing to their rising appeal.

Construction Material Analysis

In terms of construction material, the segmentation includes steel, concrete, and others. The steel segment dominated the market share in 2024 due to its superior strength-to-weight ratio, durability, and ease of installation. Steel silos offered enhanced resistance to weather conditions and pests, making them ideal for both short- and long-term grain storage. The modular construction of steel allowed for quick assembly and scalability, which appealed to large agribusinesses seeking cost-effective solutions for expanding storage capacity. Additionally, steel’s recyclability and lower maintenance requirements made it a preferred choice in regions with advanced agricultural infrastructure, such as North America and Europe.

Application Analysis

In terms of application, the segmentation includes food storage, farm products, processing & industrial use, and others. The food storage segment held the largest market share in 2024 due to growing global concerns around food security, rising grain consumption, and increased investments in post-harvest infrastructure. Governments, cooperatives, and private agribusinesses prioritized safe and efficient storage solutions to minimize food loss and stabilize prices amid supply chain disruptions. Countries with large populations, such as China, India, and Brazil, have heavily invested in centralized storage facilities to handle food grains like rice, wheat, and maize and ensure availability and price stability.

The processing & industrial use segment is projected to grow at a robust pace in the coming years, owing to the rising demand for animal feed, ethanol, plant-based proteins, and processed food products. Industrial grain users require storage systems with precise environmental control and high throughput capacity to ensure consistency in processing operations. Manufacturers of animal feed and ethanol are increasingly adopting automated silos integrated with IoT-based monitoring and grain-handling systems to enhance operational efficiency and maintain ingredient quality. The growth of the biofuel industry in North America and the rapid expansion of food processing sectors in Asia Pacific are projected to fuel demand for advanced storage infrastructure made for industrial applications.

Regional Analysis

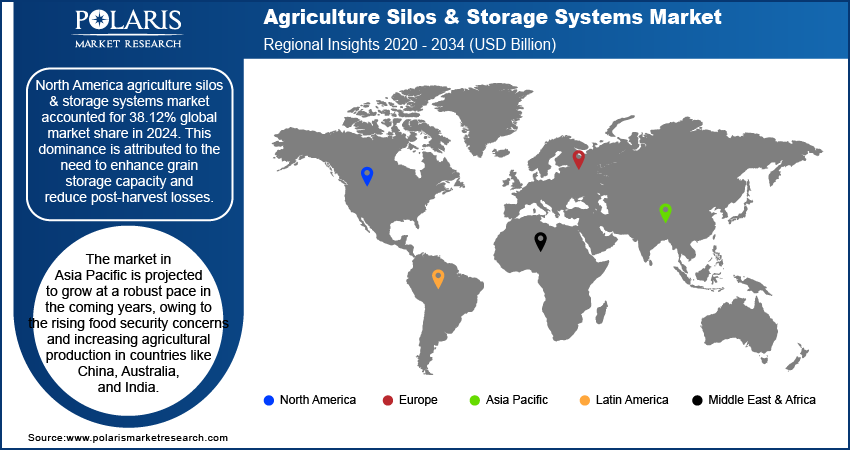

North America agriculture silos & storage systems market accounted for 38.12% global market share in 2024. This dominance is attributed to the need to enhance grain storage capacity and reduce post-harvest losses. The region's large-scale farming operations contributed to the market dominance as these farming operations require efficient storage solutions to manage surplus production, particularly for corn, wheat, and soybeans. Additionally, the adoption of smart storage technologies, including automated monitoring and IoT-based systems, fueled the market expansion. Government subsidies and incentives for modernizing farm infrastructure further supported market growth in the region.

US Agriculture Silos & Storage Systems Market Insight

US held 34.52% North America agriculture silos & storage systems market share in 2024 due to its major stake in grain exporting which require robust storage infrastructure to maintain quality and meet international standards. The rise of precision farming and smart storage technologies, such as temperature and moisture monitoring systems, also propelled the market growth in the US. Additionally, increased production of ethanol and biofuel in 2023 drove demand for grain storage solutions. IEA Bioenergy in its report stated that the U.S.’ biofuel production capacity rose to 23.8 billion gallons per year (BGPY) in 2023, a growth of over 1.7 billion gallons compared to 2022.

Asia Pacific Agriculture Silos & Storage Systems Market Trend

The market in Asia Pacific is projected to grow at a robust pace in the coming years, owing to the rising food security concerns and increasing agricultural production in countries like China, Australia, and India. Governments in the region are investing in modern storage infrastructure to reduce post-harvest losses. The expansion of contract farming and the need for bulk storage for export-oriented crops such as rice and palm oil are driving the demand for agriculture silos & storage systems. Additionally, expanding urbanization is fueling the industry expansion in the region by shrinking arable land, necessitating more efficient storage to maximize yield utilization. The urban population in Asia is expected to grow by 50% by 2050, as stated in the United Nations Human Settlements Programme report.

India Agriculture Silos & Storage Systems Market Overview

In India, the demand for silos and storage systems is increasing due to government initiatives like the Warehousing Development and Regulatory Authority (WDRA) and the PM Kisan SAMPADA Yojana, which aim to modernize storage infrastructure. India faces significant post-harvest losses, especially for grains and perishables, driving the need for advanced storage solutions. The growth of organized retail and food processing industries in the country is also driving demand for storage facilities. Additionally, growing private sector investments in silo storage for wheat and rice under the National Agricultural Market (e-NAM) scheme are boosting market expansion.

Europe Agriculture Silos & Storage Systems Market Outlook

The market in Europe is projected to hold a substantial market share in the coming years, owing to stringent EU food safety and quality regulations. The region’s focus on sustainable agriculture is further driving demand for energy-efficient and climate-controlled silos. Countries like Germany, France, and Ukraine are investing in modern storage to handle large harvests and ensure supply chain resilience. Additionally, the growth of organic farming in the region is creating the need for specialized storage to prevent contamination, further propelling market demand.

Key Players & Competitive Analysis Report

The global agriculture silos and storage systems market is highly competitive, with key players such as AGI, Ahrens Agri, CST Industries, Mysilo, Prado Silos, Rostfrei Steels, Silos Córdoba, Sioux Steel Company, and Symaga dominating the industry. These companies compete on factors such as technological innovation, product durability, customization, and geographic reach. AGI is known as a market leader due to its extensive product portfolio, including steel grain bins, hopper bins, and material handling systems, supported by a strong global distribution network. CST Industries and Sioux Steel Company are prominent in North America, offering high-quality bolted and corrugated steel storage solutions known for their longevity and resistance to harsh weather conditions. Meanwhile, Symaga and Silos Córdoba lead in Europe and Latin America, specializing in efficient grain storage systems with advanced aeration and temperature control technologies.

Sustainability and smart storage technologies are becoming key competitive differentiators, with major players integrating IoT-based monitoring systems for real-time grain condition tracking. Price competitiveness remains crucial, particularly in developing regions, where local manufacturers challenge global brands with lower-cost alternatives. Mergers, acquisitions, and strategic partnerships are common as companies aim to enhance their market share and technological capabilities.

Major companies operating in the agriculture silos & storage systems industry include AGI, Ahrens Agri, CST Industries, Mysilo, Prado Silos, Rostfrei Steels, Silos Córdoba, Sioux Steel Company, Sukup Manufacturing Co, Superior Grain Equipment, and Symaga.

Key Players

- AGI

- Ahrens Agri

- CST Industries

- Mysilo

- Prado Silos

- Rostfrei Steels

- Silos Córdoba

- Sioux Steel Company

- Sukup Manufacturing Co

- Superior Grain Equipment

- Symaga

Industry Developments

June 2025: Indian Union Minister Pralhad Joshi launched a 50,000 metric tonnes grain silo in Bihar's Khagaria to resolve foodgrain storage issue.

April 2024: Embratel launched "Smart Silo," an innovative solution for monitoring grain storage in agribusiness.

Agriculture Silos & Storage Systems Market Segmentation

By Silo Type Outlook (Revenue, USD Billion, 2020–2034)

- Flat Bottom

- Hopper

- Grain Bins

- Square

- Other

By Construction Material Outlook (Revenue, USD Billion, 2020–2034)

- Steel

- Concrete

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food Storage

- Farm Products

- Processing & Industrial Use

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agriculture Silos & Storage Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.82 Billion |

|

Market Size in 2025 |

USD 5.05 Billion |

|

Revenue Forecast by 2034 |

USD 7.75 Billion |

|

CAGR |

4.88% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.82 billion in 2024 and is projected to grow to USD 7.75 billion by 2034.

The global market is projected to register a CAGR of 4.88% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AGI, Ahrens Agri, CST Industries, Mysilo, Prado Silos, Rostfrei Steels, Silos Córdoba, Sioux Steel Company, Sukup Manufacturing Co, Superior Grain Equipment, and Symaga.

The flat bottom segment dominated the market share in 2024.

The processing & industrial use segment is expected to witness the fastest growth during the forecast period.