Barley Market Share, Size, Trends, & Industry Analysis Report

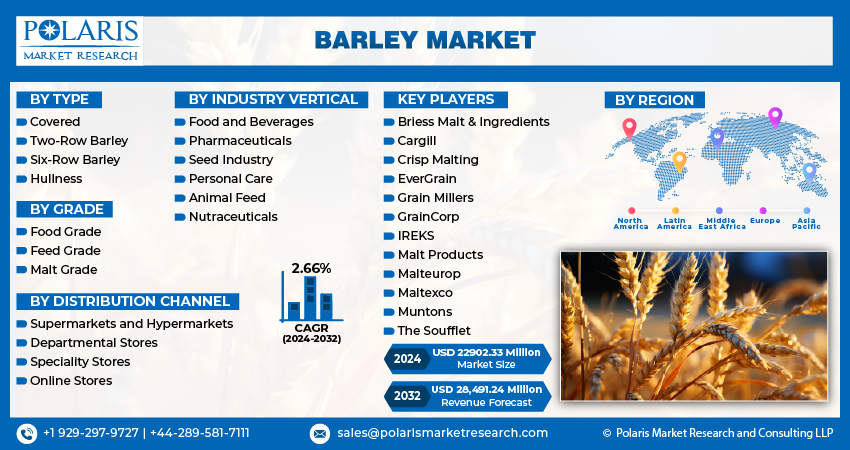

By Type (Covered, Two-Row Barley, Six-Row Barley, Hullness); By Grade; By Distribution Channel; By Industry Vertical; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM3474

- Base Year: 2024

- Historical Data: 2020-2023

The global barley market size was valued at USD 156.33 billion in 2024, exhibiting a CAGR of 3.50% during 2025–2034. The market is driven by expanding food and beverage applications, increased demand from livestock feed industries, and rising interest in barley-based health foods.

Key Insights

- The covered barley segment is expected to grow rapidly due to its high fiber content and low glycemic index, appealing to health-conscious consumers.

- The malt grade segment held the largest share in 2024, as it is essential for producing beer, whiskey, and malted food products.

- Supermarkets and hypermarkets are gaining revenue share by offering convenient access to barley products.

- The food and beverages segment is projected to grow strongly, driven by the increasing use of barley in various food and beverage products.

- Asia dominates the global barley market, with China accounting for 35% of imports, due to high demand for feed and malt barley.

- Latin America, particularly South America, is the fastest-growing importer region, driven by the expansion of livestock and dairy industries in Argentina, Brazil, and Chile.

Industry Dynamics

- The increasing demand for barley in the brewing and animal feed industries is driving market growth.

- Rising health awareness and growing use of barley in functional foods further boost consumption.

- Climate change and unpredictable weather patterns have a negative impact on barley crop yields.

- Advancements in barley breeding and cultivation techniques offer opportunities for higher productivity and disease resistance.

Market Statistics

- 2024 Market Size: USD 156.33 billion

- 2034 Projected Market Size: USD 220.52 billion

- CAGR (2025-2034): 3.50%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The growing world barley production is driving the growth of the barley market due to the increasing demand for food products, the increasing popularity of beer and other alcoholic beverages, the increasing demand for animal feed, the increasing use of barley in the biofuel industry, and the increasing adoption of sustainable agricultural practices.

The United States Department of Agriculture (USDA) forecasts that the world's barley production will reach 149.53 Billion metric tonnes in 2022/2023, up about 0.53 Billion tonnes from the estimate made last month. The amount of barley produced in the last year was 145.47 Billion tonnes. This will further create a wide range of opportunities for the growth of the market in the years to come.

Industry Dynamics

Growth Drivers

Barley is an important ingredient in animal feed, particularly for livestock such as cattle and pigs. As global demand for meat products increases, so does the demand for animal feed, driving up demand for barley. The United Nations Food and Agricultural Organization (FAO) projects that between 2010 and 2050, production of animal proteins will increase by about 1.7% annually, with meat production expected to increase by 90% in aquaculture, 55% in dairy, and almost 70% in agriculture. By 2050, the FAO predicts that there will be a 60% increase in global food demand. Barley is a nutritious and high-energy feed ingredient for livestock, making it an important crop for the animal health industry. As the demand for meat and other animal products, such as milk and eggs, continues to grow, so does the demand for animal feed, including barley. The increasing demand for animal feed is driving the growth of the barley market.

Report Segmentation

The market is primarily segmented based on type, grade, distribution channel, industry vertical, and region.

|

By Type |

By Grade |

By Distribution Channel |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Covered Barley Segment is Expected to Witness Fastest Growth During Forecast Period

Covered barley segment is projected to experience faster growth in the study period. This type of barley is considered as a healthy food due to its high fiber content and low glycemic index, which makes it a popular choice for health-conscious consumers. As more people adopt plant-based diets, the demand for grains such as covered barley is expected to increase. Covered barley is an ancient grain that has been cultivated for thousands of years, and it is gaining popularity as a result of the growing interest in traditional and heritage grains. As consumers seek to diversify their diets and try new foods, covered barley is likely to benefit from increased awareness and exposure. These factors will further drive the growth of the market in coming years.

Malt Grade Segment Witnessed Largest Market Share in 2024

Malt Grade segment registered with the larger market share in 2024, It is a key ingredient in the production of a variety of food and beverage products, including beer, whiskey, malted milk, and malted breakfast cereals. As the demand for these products increases, so does the demand for malt-grade barley. It has specific characteristics that make it ideal for malting, including high enzyme content and low protein content. This makes it easier to extract fermentable sugars during the malting process, which is crucial for the production of beer and other malt-based products. This barley typically commands a premium price compared to feed-grade barley, due to its specific characteristics and use in high-value products. This premium pricing provides an incentive for farmers to produce more malt-grade barley, which in turn drives market growth.

Supermarkets and Hypermarkets Segment is Expected to Hold the Significant Revenue Share in 2024

Supermarkets and Hypermarkets segment is projected to witness larger revenue share for the market in coming years. These have a wider distribution network than smaller retailers, which allows for greater market penetration and exposure for barley products. Consumers are increasingly looking for convenience and accessibility when shopping for groceries, and supermarkets and hypermarkets offer a one-stop shopping experience that is convenient for many shoppers. These distribution channels also have strong brand recognition and consumer trust, which can increase the likelihood that consumers will purchase barley products from these retailers. Supermarkets and hypermarkets often invest in promotional activities and advertising campaigns to promote their products, including barley products. This can increase awareness and drive sales for barley products.

Food and Beverages Segment is Expected to have a Higher Growth in the Study Period

Food and Beverages segment is projected to witness higher growth in coming years. Barley is a healthy and natural ingredient that is rich in fiber, protein, and other nutrients. As consumers become increasingly health-conscious and seek out natural ingredients in their food and beverages, the demand for barley-based products is expected to increase. It has a diverse range of applications in the food and beverage industry, including as a cereal grain, flour, and malt. It can be used in a variety of products, such as bread, breakfast cereals, snacks, and beverages. The non-alcoholic beverages market is experiencing significant growth, and barley-based beverages such as barley water and barley tea are gaining popularity as healthy alternatives to traditional soft drinks.

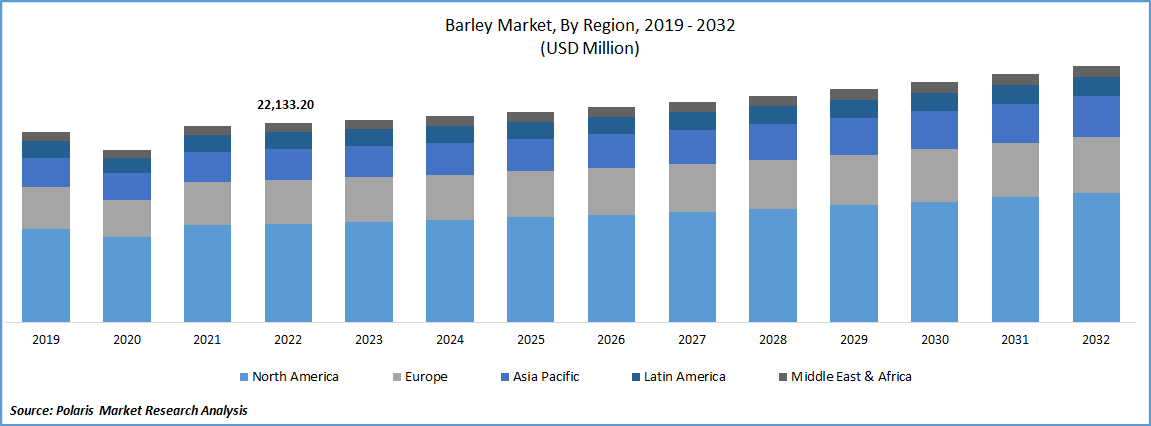

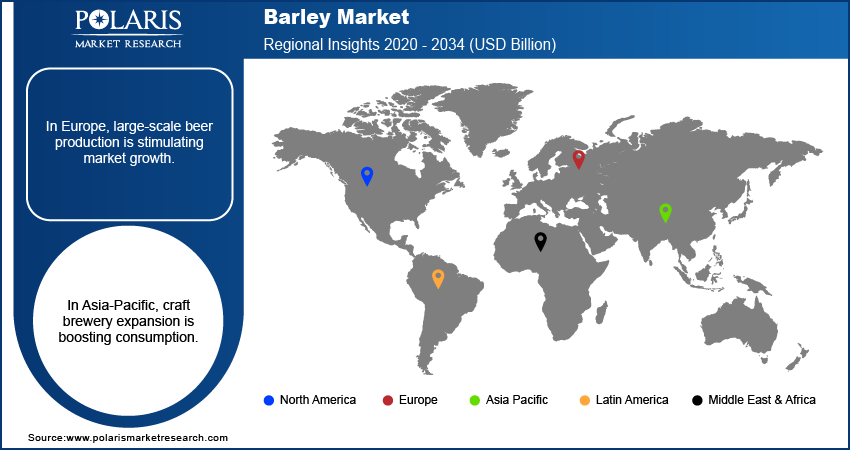

Regional Insights

The Asia Pacific barley market dominates the global landscape, driven by rapid urbanization, increasing health consciousness, and a growing middle class. Countries like China, India, and Australia are leading contributors. China and India have experienced a surge in barley consumption, driven by the growth of the brewing industry and increasing demand for plant-based foods. Australia, a major barley exporter, plays a vital role in supplying both regional and international markets. Government initiatives to boost agricultural output and rising demand for nutritional grains further support the region's dominance.

The Europe barley market remains strong, with countries like Germany, France, and the UK being among the world’s top barley producers. Europe is a global leader in malt production, largely driven by its well-established beer industry. The region benefits from favorable climatic conditions, efficient agricultural practices, and EU policies that support sustainable grain cultivation.

The North America barley market also holds a notable share, led by the United States and Canada. Demand is driven primarily by the animal feed and brewing sectors. Technological advancements in crop management and a growing preference for health foods are supporting market growth in this region.

Competitive Insight

Some of the major players operating in the global market include Briess Malt & Ingredients, Cargill, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco, Muntons & The Soufflet.

Recent Developments

- May 2025: GB Pant University scientists introduced UPB 1106, a six-row barley strain, after 12 years of research. Approved for cultivation across 12 Indian states, UPB 1106 ensures higher yields, improved disease resistance, and protein content of 12.3%. The strain thrives best under irrigated and timely sown conditions.

- In November 2024, EverGrain (a subsidiary of Anheuser-Busch InBev and AB InBev) launched EverPro—an upcycled barley protein—by introducing REBBL ready-to-drink protein shakes featuring this sustainable, high-protein ingredient, marking a significant innovation in barley-based functional foods

- In January 2023, James Wilks, champion of Ultimate Fighter, and EverGrain, InBev's sustainable ingredient company, announced the introduction of FYTA, the first portfolio of high-performance sports nutrition powders created from recycled barley protein.

- In January 2023, EverGrain, a sustainable ingredient company, collaborated with an AI pioneer PIPA to investigate into the nutritional potential of up-cycled barley protein.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 161.85 Billion |

|

Revenue forecast in 2034 |

USD 220.52 Billion |

|

CAGR |

3.50% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Grade, By Distribution Channel, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Briess Malt & Ingredients, Cargill Incorporated, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco, Muntons & The Soufflet. |

FAQ's

key companies in barley market are Briess Malt & Ingredients, Cargill, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco.

The global barley market is expected to grow at a CAGR of 3.50% during the forecast period.

The barley market report covering key segments are type, grade, distribution channel, industry vertical and region.

key driving factors in barley market are increasing awareness about the health benefits.

The global barley market size is expected to reach USD 220.52 Billion by 2034.