Corn Market Share, Size, Trends, Industry Analysis Report

By Nature (Organic and Conventional); By End-Use (Food & Beverages, Animal Feed, Industrial Use, Ethanol Production, Others); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4325

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

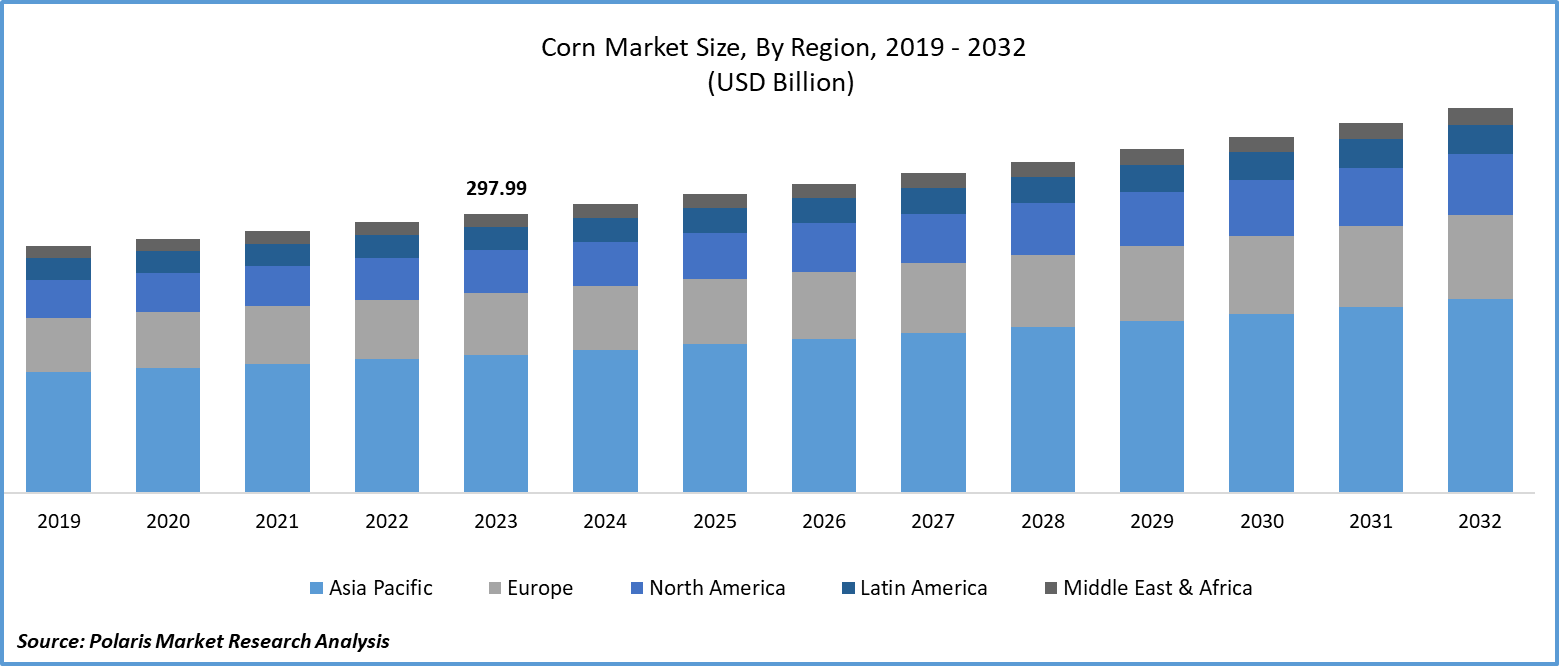

Corn market size and share was valued at USD 297.99 billion in 2023. The market is anticipated to grow from USD 307.91 billion in 2024 to USD 410.02 billion by 2032, exhibiting a CAGR of 3.6% during the forecast period.

Market Overview

The surging corn demand across various end-user industries, such as food processing, pharmaceuticals, ethanol production, cosmetics, and animal feed, is a major factor propelling the market’s growth. Also, the robust increase in ethanol production worldwide fuels the demand for corn as a primary source of production because corn is rich in starch and carbohydrates, further likely to bode well for global market growth.

For instance, according to a report by the Energy Information Administration, the U.S. ethanol production increased from about 13.6 billion gallons per year in 2011 to approx. 17.5 billion gallons per year in 2021. Also, fuel ethanol production increased each year for the last 40 years.

As cornmeal is a kind of versatile ingredient used in numerous dishes and is also a major component in several traditional recipes of different regions, contributing to its demand and growth globally. In order to cater to this growing corn demand in food applications, companies are extensively focusing on the creation of new products with innovative presentations and trendy ways to enjoy corn.

For instance, in September 2023, ANUGA announced the launch of its new product, ‘Corn Ribs,’ which offers a unique way to present corn and has a richer flavor experience. Unlike conventional or traditional corn, which could be messy to eat, these corn ribs offer a highly manageable and innovative way to enjoy corn.

Corn, also referred to as maize, is one of the most popular cereal grains in the world. First cultivated by farmers in southern Mexico about 10,000 years ago, corn comes as kernels on a cob, wrapped by a husk. Corn is a healthy grain that’s a rich source of several vitamins and minerals, including manganese, phosphorus, magnesium, zinc, and copper. Also, it contains a number of bioactive plant compounds, such as lutein, ferulic acid, zeaxanthin, and phytic acid.

There are several varieties of corn grown worldwide, with the four main types being sweet corn, flint corn, popcorn, and dent corn. Sweet corn usually comes in yellow and has a mildly sugary taste, with flint corn being harder than sweet corn and having black, blue, white, or red color. Popcorn is a type of flint corn that comes with a starchy center, with dent corn having a dent in the top of each kernel. Advances in genetic engineering have led to the development of several innovative corn varieties, impacting the corn market demand favorably.

To Understand More About this Research: Request a Free Sample Report

The research report offers a quantitative and qualitative analysis of the Corn market market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Growth Factors

Growing Technological Advancements in Agriculture Driving the Global Market

Advancements in genetic engineering gained huge traction that led to the development of several corn varieties that are highly resistant to pests, diseases, and harsh or adverse weather conditions. Also, various other techniques like CRISPR gene editing are gaining popularity worldwide as they enable precise modifications for enhancing traits such as nutrient efficiency, drought tolerance, and growth rates, which, in turn, positively influence the market’s growth.

For instance, in March 2023, Corteva Agriscience announced a new gene editing technology, which will bring added protection to the elite corn hybrids. It uses dedicated for packaging the multiple disease-resistant traits into a single location of the gene.

Rising Population That Results in Increased Demand for Corn and Corn-Based Products to Drive Market’s Growth

As the world population continues to increase significantly, the demand for corn products and by-products from various industry verticals is growing at a substantial pace. Increasing population results in greater demand for corn for both direct human consumption and indirect human consumption through dairy and meat products. For instance, as per a report by the United Nations, the global population reached 8 billion in November 2022, an increase of 1 billion people since 2010 and 2 billion since 1998. It is estimated that the world’s population will reach 9.7 billion by 2050.

Restraining Factors

Unfavorable Trade Policies & Tariffs and Weather Volatility Likely to Hamper the Market

The presence of unfavorable trade policies and constant changes in trade regulations disrupt the global supply chains and affect product availability in the international market. Also, the production of corn is highly unpredictable due to weather volatility and conditions like droughts and floods, which, in turn, negatively impact the market.

Report Segmentation

The market is primarily segmented based on nature, end-use, and region.

|

By Nature |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Nature Insights

Conventional Segment Accounted for the Largest Market Share in 2023

The conventional segment accounted for the largest share. Segment’s dominance is attributed to the significant use of various highly innovative agricultural technologies, machinery, and synthetic inputs like pesticides and fertilizers that led to higher crop yields and improved efficiency. Additionally, the conventional corn production approach is largely adopted because of its economic feasibility and greater flexibility in management practices.

The organic segment is expected to grow at the highest pace. This growth is accelerated by an increasing number of consumers inclining towards organically produced food products because of its numerous health benefits and ability to reduce environmental pollution, improve soil health, and enhance crop diversity. In addition, the rising number of favorable government initiatives and programs supporting sustainable agricultural practices is further likely to fuel demand for organic corn worldwide.

By End-Use Insights

Food & Beverages Segment Held a Significant Share in 2023

The food & beverage segment held the majority share of the market in 2023. This dominance is accelerated by a rapid increase in the global population that led to increased demand for food products and continuous change in consumer dietary preferences towards conventional foods that use corn as a versatile crop. Growing technological advancements in food processing that enable the development or creation of new corn-based products are also fostering product applications in the food industry.

The animal feed segment will grow at the highest market growth over the forecast period. Segment’s growth is attributable to a substantial rise in global livestock production and the growing consumption of meat products worldwide. The product is widely adopted as a key ingredient for animal feed because it provides essential nutrients for livestock growth, resulting in increased demand in the segment. For instance, in March 2023, the total meat production in India was about 9.29 million tonnes, with an increase of 5.62% compared to the previous year.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2023

The Asia Pacific region dominated the global market with the largest market revenue share. The region’s dominance is driven by growing human consumption of various corn-based products and the rising livestock industry across the region. Also, the availability of favorable weather patterns and climate conditions for the production of corn and supportive policies and trade regulations for corn farmers boost the overall production. For instance, In May 2022, India’s maize consumption is growing at a steady pace and is estimated to reach around 33.8 million metric tonnes in 2030, with a major contribution to industrial usage.

North America region is anticipated to emerge as the fastest growing region. The region’s growth is attributed to a rapid increase in the number of fuel ethanol production facilities in the United States and growing advances in biotechnology that include the development of genetically modified corn varieties. For instance, according to the Ethanol Producer Magazine published in September 2023, the U.S. total ethanol production capacity increased by 18 MMgy during the period of January 2022 to January 2023.

Key Market Players & Competitive Insights

Increasing Product Applications and Quality Driving the Market’s Competition

The corn market is moderately fragmented and is expected to witness competition due to several players' presence. Key companies are extensively focusing on several growth strategies, including partnerships, collaborations, acquisitions, and new product launches. Also, companies are competing on factors like improving product quality, enhancing supply chain efficiency, adopting sustainable practices, and offering competitive prices to establish a strong market presence. For instance, in May 2023, Reliance Consumer Products announced the launch of popular corn chips Alan's Bugles in India. These chips are likely to be available at a pocket-friendly price and in different flavors, including Salted, Tomato, and Cheese.

Some of the major players operating in the global market include:

- Agrium Inc. (Canada)

- Archer Daniels Midland Company (United States)

- Bunge Limited (United States)

- Cargill Incorporated (United States)

- China National Cereals (China)

- Cofco Agri Ltd. (China)

- DowDuPont (United States)

- Louis Dreyfus Company (China)

- Monsanto Company (United States)

- Syngenta AG (Switzerland)

- Wilmar International Limited (Singapore)

- Yara International (Norway)

Recent Developments in the Industry

- In October 2023, Origin Agritech introduced a new gene-editing method, which shortens cross procedures from about 4-5 years to 1 year, to develop nitrogen-efficient corn to enhance crop health & potential yield.

- In March 2023, Corteva Agriscience announced its plan for the commercial launch of the Vorceed Enlist corn products. It combines 3 modes of action for insect protection.

Report Coverage

The corn market report emphasizes key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, nature, end-use, and futuristic growth opportunities.

Corn Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 307.91 billion |

|

Revenue Forecast in 2032 |

USD 410.02 billion |

|

CAGR |

3.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Browse Our Top Selling Reports

Real-time PCR, Digital PCR, And End-point PCR Market

Veterinary Active Pharmaceutical Ingredients Manufacturing Market

Delve into the intricacies of Non-Invasive Prenatal Testing in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2029 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The global corn market size is expected to reach USD 410.02 billion by 2032

Key players in the market are Konica Minolta Sensing Europe, Solaris Technology Industry, Tata Power Solar Systems, SunPower Corporation

Asia Pacific contribute notably towards the global Corn Market

Corn market exhibiting the CAGR of 3.6% during the forecast period.

The Corn Market report covering key segments are nature, end-use, and region.