Veterinary Active Pharmaceutical Ingredients Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Service Type (In-House, Contract Outsourcing), By Synthesis Type, By Animal Type, By Therapeutic Category, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM4540

- Base Year: 2024

- Historical Data: 2020-2023

Overview

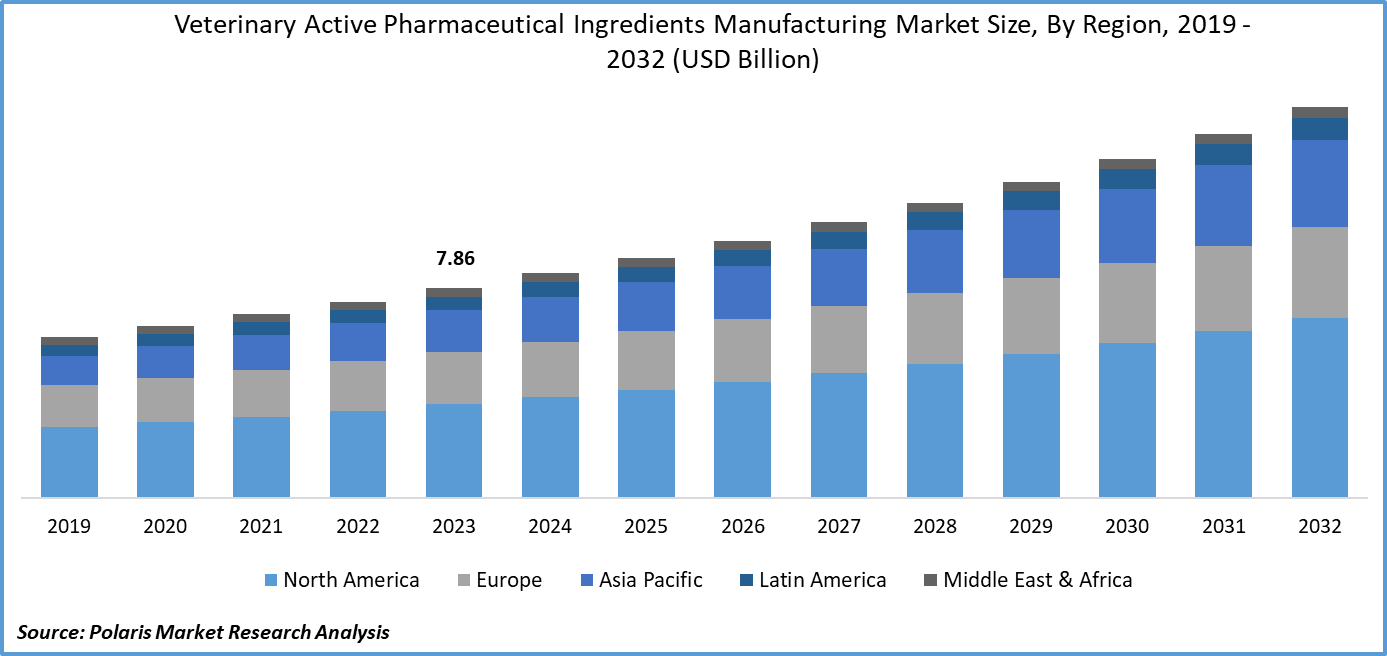

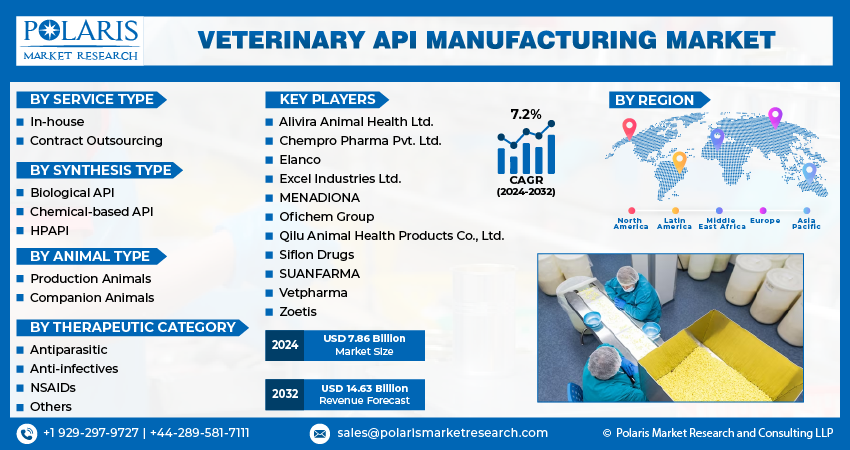

The global veterinary active pharmaceutical ingredients (API) manufacturing market size was valued at USD 8.96 billion in 2024. The market is expected to register a CAGR of 6.68 % from 2025 to 2034. Rising animal health expenditure, increasing investments in facility expansion, and growing R&D activities for new veterinary products drive the demand for veterinary API manufacturing.

Key Insights

- The in-house segment held 64.32% revenue share in 2024, due to its ability to offer control over drug production processes.

- The production animals segment held 61.32% revenue share in 2024. The growth is attributed to growing demand for poultry products, meat, and dairy.

- The North America veterinary API manufacturing market dominated the revenue share in 2024. This dominance is attributed to rising animal health expenditure.

- The U.S. held the largest revenue share in the North America veterinary active pharmaceutical ingredients manufacturing landscape in 2024. The high concentration of animal health companies investing in novel biologics and specialty drugs propels the U.S. industry.

- The Asia Pacific industry is projected to grow at the fastest pace in the coming years. Increasing pet ownership and rising spending on premium veterinary care would boost the growth.

Industry Dynamics

- Increasing investments in facility expansion by key industry players fuel the demand for high-quality active ingredients.

- Growing R&D activities for new veterinary products create the need for APIs for clinical trials and stability testing, leading to market growth.

- Rising pet ownership globally would create a lucrative market opportunity during 2025–2034.

- Stringent regulations on the quality, safety, and efficacy of pharmaceutical products and vaccines for animals restain the market growth.

AI Impact on Veterinary Active Pharmaceutical Ingredients Manufacturing Market

- AI algorithms can rapidly analyze vast biological and chemical datasets to identify potential new drug candidates for veterinary use.

- AI-powered systems such as machine learning and digital twins are used to optimize the complex chemical synthesis and fermentation processes in API manufacturing.

- Computer Vision AI systems can perform more precise and consistent quality inspections than humans. It enhances overall product quality and safety.

Market Statistics

- 2024 Market Size: USD 8.96 Billion

- 2034 Projected Market Size: USD 17.08 Billion

- CAGR (2025–2034): 6.68%

- North America: Largest Market Share

Veterinary active pharmaceutical ingredients (APIs) manufacturing involves the production of biologically active compounds used in veterinary medicines to diagnose, treat, or prevent diseases in animals. These APIs are responsible for the therapeutic effects of veterinary drugs. They are formulated into various dosage forms such as tablets, injections, and topical treatments.

The manufacturing process follows strict quality control standards, including good manufacturing practices (GMP), to ensure purity, potency, and safety. Veterinary APIs are used across livestock, companion animals, and poultry to enhance animal health, improve productivity, and support food safety by reducing zoonotic disease transmission. They play a critical role in infection control, managing chronic conditions, and promoting animal welfare. The veterinary API industry continues to grow with rising demand for animal protein and increased focus on pet health.

The global demand for veterinary active APIs revenue is driven by the rising animal health expenditure. American Pet Products Association, in its report, stated that USD 151.9 billion was spent on pets in 2024 in the U.S. compared to USD 147.09 billion in 2023. This drove pharmaceutical companies to scale up production of veterinary drugs, which required larger volumes of high-quality active ingredients. Furthermore, the growing expenditure on pets leads to funding more research and development into novel therapeutics. It prompts pharma manufacturers to develop and produce new, sophisticated APIs to meet these innovative formulations. Therefore, the growing animal health expenditure is fueling the demand for the manufacturing of veterinary active pharmaceutical ingredients.

Drivers & Opportunities

Increasing Investments in Facility Expansion: Veterinary pharmaceutical companies are building new production lines for finished veterinary drugs, such as vaccines or parasiticides. This factor is driving the need for high-quality active ingredients, as APIs form the core of veterinary drugs. In January 2023, Merck Animal Health (a division of Merck & Co., Inc.) opened a manufacturing facility in Boxmeer, Netherlands, for pet vaccine production. Moreover, facility expansion usually includes dedicating capacity for novel, complex biologics and specialized medicines, driving demand for existing and innovative APIs. Hence, the rising investments in facility expansion by key players fuel the market growth.

Growing R&D Activities for New Veterinary Products: Industry players are investing heavily in R&D activities to develop novel drugs, vaccines, and therapies. These rising activities create the need for APIs for clinical trials and stability testing. Moreover, increasing R&D activities are constantly introducing new molecular entities and advanced biologic compounds. It is compelling for veterinary API producers to expand their production capacity to meet the needs of next-generation treatments.

Segmental Insights

Service Type Analysis

Based on service type, the segmentation includes in-house and contract outsourcing. The in-house segment accounted for 64.32% of revenue share in 2024. The growth is driven by the strong preference of major veterinary pharmaceutical companies to maintain control over their production processes. Companies invested heavily in internal facilities to ensure consistent product quality, regulatory compliance, and intellectual property protection. The ability of in-house facilities to manage the entire production chain allowed veterinary pharmaceutical companies to streamline operations, reduce supply chain risks, and respond quickly to demands. Furthermore, major players such as Zoetis Inc. strengthened their in-house capabilities to develop advanced active ingredients for companion and livestock animals. The demand for in-house services is driven by the rising prevalence of animal diseases and the growing demand for high-quality veterinary therapeutics.

The contract outsourcing segment is projected to grow at a robust pace in the coming years. The growth is attributed to its ability to offer specialized expertise, advanced technology platforms, and scalable infrastructure. These services reduce the need for heavy capital investments. There is a rising pressure on pharmaceutical firms to accelerate drug development timelines. Therefore, they collaborate with contract manufacturers for faster turnaround. The segment growth is driven by the growing presence of contract development and manufacturing organizations (CDMOs) in emerging regions, where operational costs remain low and regulatory frameworks are improving.

Synthesis Type Analysis

In terms of synthesis type, the segmentation includes chemical-based API, biological API, and HPAPI. The chemical-based API segment held 72.34% of the revenue share in 2024. Chemical synthesis provided scalability, cost efficiency, and consistency. It is preferred for manufacturing drugs that target common conditions in livestock and companion animals. Rising demand for antibiotics, anti-parasitics, and anti-inflammatory drugs further strengthened the segment. The established regulatory pathways for chemically synthesized APIs also encouraged manufacturers to expand production capacity. It ensures timely market supply while minimizing compliance challenges.

Animal Type Analysis

In terms of animal type, the segmentation includes production animals and companion animals. The production animals segment held 61.32% of revenue share in 2024. Rising demand for meat, dairy, and poultry products drives segment growth. Farmers and producers invested heavily in veterinary pharmaceuticals to improve herd productivity, prevent disease outbreaks, and reduce mortality rates. The expansion of animal farming, particularly in emerging economies, boosted the consumption of active ingredients for antibiotics, antiparasitic, and growth-promoting drugs. Governments and international organizations also supported the use of veterinary anti-infectives to control zoonotic diseases common in production animals. It helps safeguard public health.

The companion animals segment is projected to grow at a rapid pace during the forecast period. Increasing pet ownership across developed and developing countries drives the growth. Pet owners consider animals as part of the family. They are willingly spending on advanced healthcare solutions, including specialized drugs for chronic conditions, pain management, and preventive care. The growth of veterinary clinics, pet insurance, and premium pet care services accelerates the demand for high-quality APIs for companion animals. Moreover, innovations in biologics, targeted therapies, and specialty formulations for dogs and cats are driving segment growth.

Therapeutic Category Analysis

In terms of therapeutic category, the segmentation includes antiparasitics, anti-infectives, NSAIDs, and others. The anti-infectives segment held the largest revenue share in 2024. The persistent threat of bacterial and viral diseases in companion and farm animals drives the segment growth. Increasing cases of antimicrobial resistance have prompted manufacturers to invest in novel API development that balances efficacy with regulatory compliance. Rising incidences of infectious outbreaks in intensive animal farming, particularly in poultry and swine, continue to drive demand for effective anti-infective APIs. Moreover, veterinarians prescribed these products widely to prevent economic losses caused by reduced productivity, mortality, and trade restrictions linked to animal health concerns. The growing focus on developing safer alternatives, including next-generation antibiotics and supportive therapies, strengthened the role of anti-infectives. Expanding animal healthcare expenditure and regulatory support for maintaining animal welfare standards contributed to the segment growth.

Regional Analysis

The North America veterinary active pharmaceutical ingredients manufacturing market led the revenue share in 2024. This dominance is fueled by the rising companion animal ownership rates. According to the American Pet Products Association, 94 million households in the U.S. had at least one pet in 2024, which increased from 82 million in 2023. Strict regulatory standards from Health Canada and the FDA further compelled manufacturers to prioritize high-quality, traceable APIs. Thus, there is a rising need for outsourcing veterinary active pharmaceutical ingredients manufacturing. A growing livestock sector also contributed to the market dominance, as livestock requires reliable APIs for vaccines and antibiotics to ensure animal health.

U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Market Insights

The U.S. held the largest revenue share in the North America veterinary API manufacturing landscape in 2024. The U.S. industry growth is attributed to intense pharmaceutical innovation and a high concentration of animal health companies investing in novel biologics and specialty drugs. The FDA's Center for Veterinary Medicine maintained rigorous approval processes that mandated superior API quality and supply chain integrity. Furthermore, rising consumer awareness about zoonotic diseases and preventative pet care fueled the need for a diverse and dependable API supply.

Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Market Trends

The market in Europe is projected to hold a substantial revenue share by 2034. The growth is driven by stringent regulations on animal medicine and medicated feed. The region's ban on antibiotic growth promoters is also shifting demand toward APIs for therapeutic and alternative treatments. A strong focus on sustainable farming and animal welfare standards in the region is further pushing the market for advanced pharmaceutical solutions made by active ingredients.

Germany Veterinary Active Pharmaceutical Ingredients Manufacturing Market Overview

A large pet-owning population and a strong willingness to spend on advanced veterinary care, including novel pharmaceuticals, drive the demand for veterinary API manufacturing in Germany. Furthermore, Germany’s export-oriented livestock sector requires a reliable, high-quality supply of APIs. API in vaccines and therapeutics helps maintain herd health, ensure food safety, and meet rigorous international trade standards.

Asia Pacific Veterinary Active Pharmaceutical Ingredients Manufacturing Market Outlook

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years. A growing middle-class population, increasing pet ownership, and rising spending on premium veterinary care boost the regional market growth. The region's massive and expanding livestock production is driving the demand for vast quantities of APIs for vaccines and feed additives. Governments of Asia Pacific are actively modernizing their regulatory frameworks to improve drug quality and safety. As a result, local manufacturers are focusing on upgrading their API production capabilities to meet new international standards.

Key Players & Competitive Analysis

The veterinary active pharmaceutical ingredients manufacturing market is a competitive and fragmented landscape. The industry is characterized by a mix of large multinational animal health corporations and specialized fine-chemical manufacturers. Key players such as Zoetis Inc. and Huvepharma leverage extensive vertical integration, controlling API production to secure their proprietary drug supply chains. These companies compete with established API specialists such as SUANFARMA, FIS, and NGL Fine-Chem. Established players offer a broad portfolio of both generic and custom synthesis services. The sector is further diversified by regional companies such as Excel Industries in India and Ofichem in Europe. The companies compete on cost-efficiency and technological expertise. Intensifying regulatory scrutiny and the demand for novel, complex biologics are driving consolidation and strategic partnerships, as manufacturers strive for compliance, scale, and innovation to gain a critical edge.

A few major companies operating in the veterinary active pharmaceutical ingredients manufacturing industry include Alivira Animal Health Limited, AMGIS Lifescience Ltd., Bimeda Inc., Chempro Pharma Private Limited, Excel Industries Limited, FIS - Fabbrica Italiana Sintetici S.p.A., Grupo Indukern S.L., Huvepharma AD, Huateng Pharma, Menadiona S.L., NGL Fine-Chem Ltd., Ofichem Group B.V., SUANFARMA S.A., and Zoetis Inc.

Key Companies

- Alivira Animal Health Limited

- AMGIS Lifescience Ltd.

- Bimeda Inc.

- Chempro Pharma Private Limited

- Excel Industries Limited

- FIS - Fabbrica Italiana Sintetici S.p.A.

- Grupo Indukern S.L.

- Huateng Pharma

- Huvepharma AD

- Menadiona S.L.

- NGL Fine-Chem Ltd.

- Ofichem Group B.V.

- SUANFARMA S.A

- Zoetis Inc.

Veterinary Active Pharmaceutical Ingredients Manufacturing Industry Developments

In January 2024, Huateng Pharma, a CDMO specializing in APIs and intermediates, introduced a comprehensive range of veterinary solutions, including Fluralaner and Sarolaner.

In July 2023, Bimeda Inc. announced the launch of the SpectoGard Sterile Solution for veterinarians and cattle producers in the U.S.

In October 2021, Zoetis invested in its biotech manufacturing and development facility in Tullamore, Ireland, to increase production capacity for single-use monoclonal antibody (mAbs) for veterinary medicines.

Veterinary Active Pharmaceutical Ingredients Manufacturing Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- In House

- Contract Outsourcing

- Contract Development

- Preclinical Development

- Clinical Development

- Contract Manufacturing

- Contract Development

By Synthesis Type Mode Outlook (Revenue, USD Billion, 2020–2034)

- Chemical-based API

- Biological API

- HPAPI

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Production Animals

- Companion Animals

By Therapeutic Category Outlook (Revenue, USD Billion, 2020–2034)

- Antiparasitics

- Anti-infectives

- NSAIDs

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Active Pharmaceutical Ingredients Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.96 Billion |

|

Market Size in 2025 |

USD 9.55 Billion |

|

Revenue Forecast by 2034 |

USD 17.08 Billion |

|

CAGR |

6.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.96 billion in 2024 and is projected to grow to USD 17.08 billion by 2034.

The global market is projected to register a CAGR of 6.68% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Alivira Animal Health Limited; AMGIS Lifescience Ltd.; Bimeda Inc.; Chempro Pharma Private Limited; Excel Industries Limited; FIS - Fabbrica Italiana Sintetici S.p.A.; Grupo Indukern S.L.; Huvepharma AD; Huateng Pharma; Menadiona S.L.; NGL Fine-Chem Ltd.; Ofichem Group B.V.; SUANFARMA S.A.; and Zoetis Inc.

The in-house segment dominated the market revenue share in 2024.

The companion animal segment is projected to witness the fastest growth during the forecast period.