Veterinary Anti-infectives Market Size, Share, Trends, & Industry Analysis Report

By Animal Type (Livestock and Companion), By Drug Class, By Route of Administration, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6056

- Base Year: 2024

- Historical Data: 2020-2023

Overview

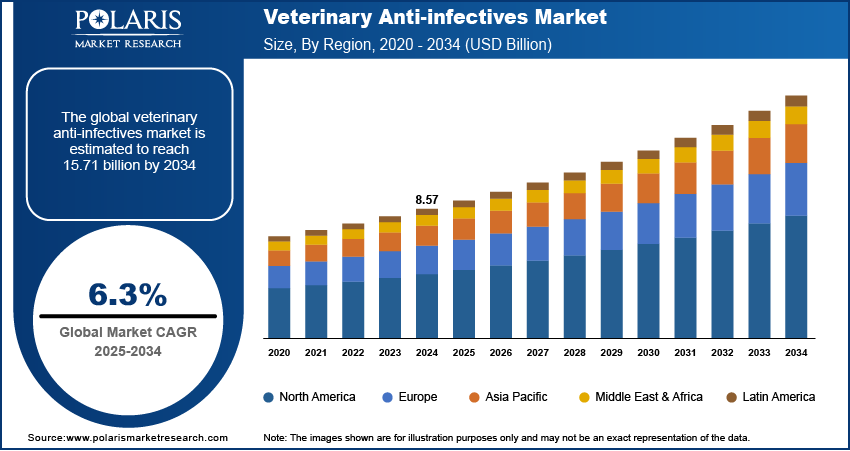

The global Veterinary anti-infectives market size was valued at USD 8.57 billion in 2024, growing at a CAGR of 6.3% from 2025–2034. Surge in zoonotic and infectious diseases in animals coupled with the growing veterinary healthcare infrastructure is boosting demand for veterinary anti-infectives worldwide.

Key Insights

- The livestock segment accounted for largest revenue share in 2024, due to the widespread prevalence of bacterial, viral, and parasitic infections in cattle, poultry, and swine

- The antimicrobial segment held the largest revenue share in 2024, owing to the rising adoption across broad-spectrum applications across numerous animal diseases

- The oral segment held the largest revenue share in 2024, due to ease of administration, in livestock production, where medicated feed and water delivery systems enable mass treatment

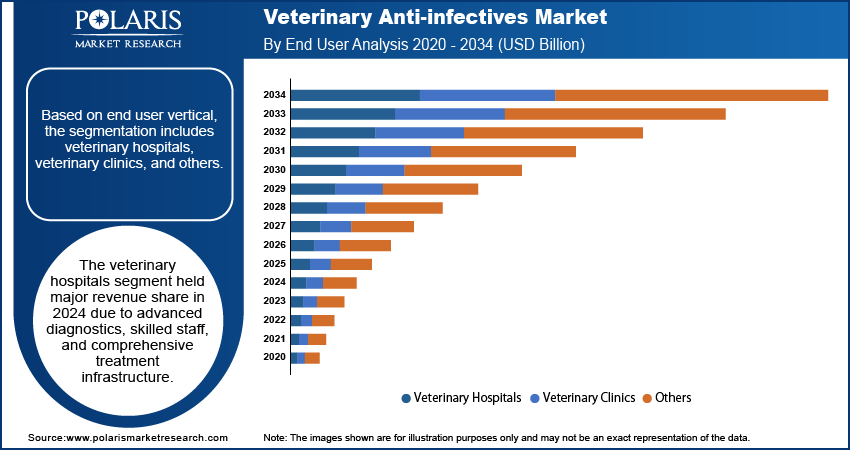

- The veterinary hospitals segment held the largest revenue share in 2024, owing to the availability of comprehensive diagnostic and treatment infrastructure, skilled veterinary staff, and advanced medical equipment

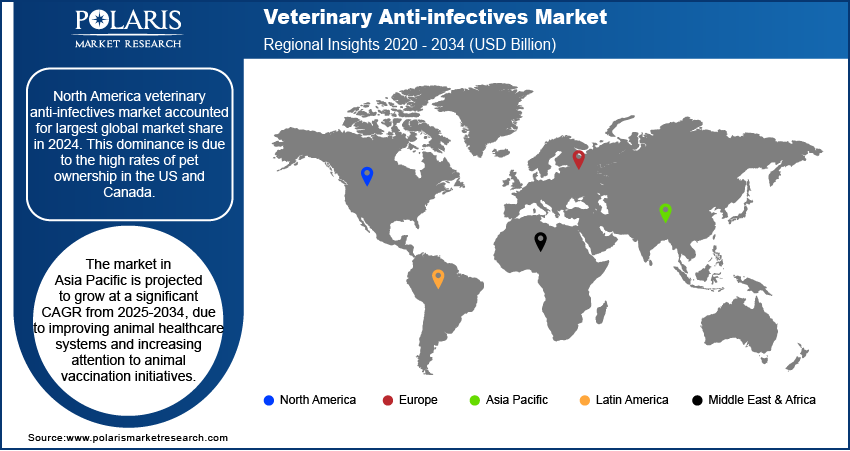

- North America veterinary anti-infectives market accounted for largest global market share in 2024. This dominance is due to the high rates of pet ownership in the US and Canada.

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to improving animal healthcare systems and increasing attention to animal vaccination initiatives.

Industry Dynamics

- Rising cases of zoonotic and infectious diseases in animals are driving demand for anti-infectives in regions with high livestock density and limited biosecurity.

- Expansion of veterinary healthcare infrastructure is increasing access to diagnostics, clinics, and professional care, supporting broader use of veterinary anti-infective treatments.

- Price sensitivity in developing markets remains a key restraint, limiting access to advanced therapies and shifting demand toward lower-cost alternatives.

- Advancements in nanotechnology-based drug delivery offer strong growth potential by enabling targeted treatment, improved efficacy, and reduced side effects in livestock and companion animals.

Market Statistics

- 2024 Market Size: USD 8.57 Billion

- 2034 Projected Market Size: USD 15.71 Billion

- CAGR (2025-2034): 6.3%

- North America: Largest market in 2024

Veterinary anti-infectives include a wide range of products such as antibiotics, antivirals, antifungals, and antiparasitics used to prevent and treat infections in companion and food-producing animals. These medications are integrated into animal health management programs to ensure timely disease control, enhance livestock productivity, and improve the overall well-being of pets. The increasing demand for effective veterinary treatments, coupled with advancements in animal health and pharmaceutical formulations, is fueling the growth of the market across global veterinary practices.

Growing pet ownership and increasing expenditure on pet health are significantly contributing to the demand for veterinary anti-infectives. Growing emotional attachment between households and companion animals is driving increased focus on timely vaccinations, preventive healthcare, and rapid treatment of infections. According to the American Pet Products Association, the global pet industry contributes approximately USD 303 billion to the economy and grown by 16% since 2022. This growth is influencing pharmaceutical companies to expand their portfolios of anti-infective medications tailored for small animal practices.

In addition, favorable government initiatives and structured animal vaccination programs are accelerating the adoption of veterinary drugs, thus fueling the market growth. Governments across the globe are investing in livestock immunization campaigns to curb the spread of economically significant infections and promote sustainable farming. For instance, under the Assistance to States for Control of Animal Disease (ASCAD) program, the Indian government is supporting states and union territories in controlling major livestock and poultry diseases. The initiative focuses on immunization, upgrading veterinary biological production units and diagnostic labs, and providing in-service training to veterinarians and para-veterinarians. These national efforts coupled with support from global organizations toward animal health, are boosting the integration of anti-infectives into routine animal healthcare systems.

Drivers & Opportunities

Surge in Zoonotic and Infectious Diseases in Animals: The rising incidence of zoonotic and infectious diseases among livestock and companion animals is increasing the veterinary anti-infectives market growth. Infectious outbreaks are triggering rapid responses from animal health authorities and producers, leading to higher demand for effective antimicrobial agents. For instance, India, a major dairy-producing nation, experienced a significant outbreak of Lumpy Skin Disease in 2022, affecting nearly 2.95 million cattle and causing more than 155,000 deaths across 15 states. Also, in March 2024, a multistate outbreak of HPAI A(H5N1) bird flu was reported in US dairy cows, the first known instance of this virus affecting cattle. Since 2022, USDA APHIS identified H5N1 infections in over 200 mammalian cases across the country. These rising cases of infectious diseases are pushing health authorities and farmers to increase reliance on anti-infective drugs to control the spread of disease and protect livestock assets.

Growing Veterinary Healthcare Infrastructure: The expansion of veterinary healthcare infrastructure and the rising number of qualified veterinary practitioners are further propelling the market growth. For instance, in June 2024, the US National Institute of Food and Agriculture (NIFA) announced a USD 3.8 million investment under the Veterinary Services Grant Program. This initiative aims to support rural veterinary services, enhance infrastructure, and address shortages of veterinary professionals in underserved areas across the US. These efforts are strengthening veterinary service delivery and accelerating the adoption of anti-infective treatments worldwide.

Segmental Insights

Animal Type Analysis

Based on animal type, the segmentation includes livestock and companion. The livestock segment accounted for largest revenue share in 2024, due to the widespread prevalence of bacterial, viral, and parasitic infections in cattle, poultry, and swine. Commercial producers are adopting anti-infective drugs to ensure animal health, meet productivity targets, and comply with food safety regulations. Government-supported vaccination programs and early treatment protocols are further contributing to segment dominance in major livestock-producing regions. According to the Ministry of Fisheries, Animal Husbandry & Dairying, over 272.1 million cattle were vaccinated or re-vaccinated against Lumpy Skin Disease across India as of January 2025.

The companion animal segment is expected to grow at the fastest pace during the forecast period. Increasing pet adoption and rising awareness of pet health are increasing spending on preventive and therapeutic treatments. Veterinary clinics are witnessing more cases of skin infections, respiratory issues, and internal parasites in dogs and cats, which is driving demand for prescription anti-infective therapies. The expanding base of pet clinics and the growth of premium veterinary services are further fueling the growth of the market.

Drug Class Analysis

By drug class, the market includes antimicrobial agents, antiviral agents, antifungal agents, and antiparasitic agents. The antimicrobial segment held the largest revenue share in 2024, owing to the rising adoption across broad-spectrum applications across numerous animal diseases. These agents are widely used for treating respiratory, gastrointestinal, and post-surgical infections in livestock and companion animals. Established clinical effectiveness and availability in diverse formulations are accelerating veterinary anti-infectives as a preferred treatment option among veterinarians globally.

The antiparasitic agents segment is projected to grow at the fastest rate during the forecast period. The persistent burden of parasitic diseases such as helminthiasis and ectoparasitic infestations in animals is driving sustained use of antiparasitic therapies. Increased awareness of parasite management protocols and rising demand for combination therapies and long-acting formulations are contributing to this segment’s rapid expansion.

Route of Administration Analysis

By route of administration, the market includes oral, parenteral, and topical. The oral segment held the largest revenue share in 2024, due to ease of administration, in livestock production, where medicated feed and water delivery systems enable mass treatment. Oral anti-infectives are widely preferred in pet care for their convenience and broad availability in palatable forms such as tablets and liquids. Cost-effectiveness and high compliance rates are further fueling the market dominance.

The parenteral segment is anticipated to expand at the fastest CAGR through 2034. Injectables are preferred in acute or severe infections where rapid drug absorption is needed. In veterinary hospitals and emergency settings, injectable formulations are administered for immediate therapeutic action. Also, increasing use of long-acting injectables in livestock and improved delivery devices are fueling the segment growth.

End User Analysis

By end user, the market includes veterinary hospitals, veterinary clinics, and others. The veterinary hospitals segment held the largest revenue share in 2024, owing to the availability of comprehensive diagnostic and treatment infrastructure, skilled veterinary staff, and advanced medical equipment. These institutions typically handle a higher volume of complex or referred infection cases, which demand intensive care and the use of advanced anti-infective therapies. The ability to offer inpatient services, emergency care, and specialized treatments further boosting the dominance of veterinary hospitals in driving the market growth.

The veterinary clinics segment is projected to grow at the fastest rate over the forecast period. Clinics serve as primary access points for routine pet care and livestock health services, where infections are diagnosed and treated early. The growing number of clinics in urban and semi-urban areas, combined with increasing veterinary awareness among pet owners and farmers, is increasing the demand for anti-infective products.

Regional Analysis

North America veterinary anti-infectives market accounted for largest global market share in 2024. This dominance is due to the high rates of pet ownership in the US and Canada. According to the American Pet Products Association (APPA) 2025 State of the Industry Report, pet ownership in the US is growing, with 51% of households (68 million) owning a dog and 37% of households (49 million) owning a cat. Companion animal owners in the region are increasingly seeking timely diagnosis and treatment for infections such as dermatitis, respiratory diseases, and parasitic conditions. This is leading to a sustained demand for prescription-based anti-infective drugs in veterinary clinics and hospitals. The presence of strong veterinary healthcare infrastructure, including diagnostic laboratories, advanced treatment centers, and large veterinary networks, ensures accessibility to modern therapeutics, further propelling the market growth.

The US Veterinary Anti-infectives Market Insight

The US held significant market share in the North America veterinary anti-infectives landscape in 2024, driven by the increasing investments in veterinary pharmaceutical R&D are supporting innovation in anti-infective products. Major industry players are actively developing next-generation therapies to reduce antibiotic resistance while maintaining clinical efficacy. For example, in March 2025, Dechra launched DuOtic, the first FDA-approved antibiotic-free otic gel formulated to treat yeast-driven otitis externa in dogs, particularly caused by Malassezia pachydermatis. Such innovations reflect a growing trend toward safe, targeted treatments for companion animals and boosting the country’s leadership in advancing veterinary medicine.

Asia Pacific Veterinary Anti-infectives Market

The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to improving animal healthcare systems and increasing attention to animal vaccination initiatives. Governments across the region are strengthening disease surveillance and vaccination programs to minimize the risk of zoonotic and production-limiting diseases in livestock. Supportive policies and public-private collaborations are increasing the use of veterinary antimicrobials across commercial farming operations. Furthermore, the growing emphasis on livestock health coupled with the need to enhance export competitiveness, is further propelling the market growth across the region.

India Veterinary Anti-infectives Market Overview

The market in India is expanding due to the increasing government investment in animal health and disease control programs. In the Union Budget, the Department of Animal Husbandry and Dairying received an allocation of USD 527.53 million for 2023–24, marking a significant rise from the previous year’s revised allocation of USD 378.50 million. This increase in funding reflects a strong policy focus on improving livestock healthcare, supporting immunization drives, and upgrading veterinary infrastructure. Broader access to treatment in rural and underserved areas is further increasing the demand for veterinary anti-infective solutions.

Europe Veterinary Anti-infectives Market

The veterinary anti-infectives landscape in Europe is projected to hold a substantial share in 2034, driven by a stringent regulatory environment that prioritizes animal-derived food safety and judicious use of antibiotics. Regulatory bodies such as the European Medicines Agency (EMA) and European Food Safety Authority (EFSA) enforce rigorous guidelines on antimicrobial use, driving demand for compliant and well-regulated anti-infective therapies. Additionally, the region’s strong focus on One Health initiatives which integrate human, animal, and environmental health, is propelling coordinated action against antimicrobial resistance and emerging infectious diseases. Veterinary health programs in countries such as Germany, France, and the UK are increasingly aligned with public health goals, accelerating the responsible and strategic use of anti-infective agents in pets and farm animals.

Key Players & Competitive Analysis Report

The veterinary anti-infectives market is moderately consolidated, with competition revolving around product innovation, efficacy, and strategic partnerships across the animal health sector. Leading players are heavily investing in research and development, leveraging advanced technologies such as precision medicine, biologics, and novel delivery systems to develop effective and targeted anti-infective solutions. Companies are focusing on expanding product portfolios with broad-spectrum antibiotics, antifungals, antivirals, and antiparasitic to address diverse animal health needs, including companion animals, livestock, and poultry. Strategic initiatives include collaborations with veterinary clinics, academic institutions, and agricultural organizations to enhance product accessibility and regional market penetration. Additionally, players are adopting sustainable manufacturing practices and exploring alternative monetization models, such as subscription-based veterinary services and bundled health solutions, to improve profitability and customer retention. The growing emphasis on animal welfare, regulatory compliance, and the rising demand for safe and effective treatments in livestock and companion animal care are driving the need for innovative veterinary anti-infective solutions.

Prominent companies in the market include Biogénesis Bagó S.A., Boehringer Ingelheim GmbH, Calier S.A., Ceva Santé Animale S.A., Dechra Pharmaceuticals Plc., Elanco Animal Health Incorporated, Intervet International B.V. (a subsidiary of Merck & Co., Inc.), Merck & Co., Inc., Norbrook Laboratories Ltd., Phibro Animal Health Corporation, Vetoquinol S.A., Virbac S.A., Zoetis Inc., Bayer AG, Bimeda Animal Health Limited.

Key Players

- Biogénesis Bagó S.A.

- Boehringer Ingelheim GmbH

- Calier S.A.

- Ceva Santé Animale S.A.

- Dechra Pharmaceuticals Plc.

- Elanco Animal Health Incorporated

- Intervet International B.V. (a subsidiary of Merck & Co., Inc.)

- Merck & Co., Inc.

- Norbrook Laboratories Ltd.

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Virbac S.A.

- Zoetis Inc.

- Bayer AG

- Bimeda Animal Health Limited

Industry Developments

- January 2025: The Federation of Veterinarians of Europe initiated the Alternatives to Veterinary Antibiotics (AVANT) project. This ongoing effort seeks to decrease reliance on antimicrobials in livestock by developing and promoting effective non-antibiotic alternatives, prioritizing enhanced animal health and welfare alongside sustainable farming practices.

- April 2024: Virbac acquired Sasaeah to bolster its presence in the veterinary antibiotics market, particularly in the cattle sector. Through this acquisition, Virbac aims to provide manufacturing and R&D facilities in Japan and Vietnam.

- March 2024: Zoetis acquired a 21-acre manufacturing facility in Melbourne to expand its vaccine production for livestock and companion animals, strengthening its operations in Australia.

Veterinary Anti-infectives Market Segmentation

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Livestock

- Companion

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- Antimicrobial Agents

- Antiviral Agents

- Antifungal Agents

- Antiparasitic Agents

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral

- Parenteral

- Topical

By End User Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Veterinary Hospitals

- Veterinary Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Anti-infectives Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.57 Billion |

|

Market Size in 2025 |

USD 9.09 Billion |

|

Revenue Forecast by 2034 |

USD 15.71 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.57 billion in 2024 and is projected to grow to USD 15.71 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Biogénesis Bagó S.A., Boehringer Ingelheim GmbH, Calier S.A., Ceva Santé Animale S.A., Dechra Pharmaceuticals Plc., Elanco Animal Health Incorporated, Intervet International B.V. (a subsidiary of Merck & Co., Inc.), Merck & Co., Inc., Norbrook Laboratories Ltd., Phibro Animal Health Corporation, Vetoquinol S.A., Virbac S.A., Zoetis Inc., Bayer AG, Bimeda Animal Health Limited.

The livestock segment dominated the market in 2024.

The antimicrobial segment is expected to witness the fastest growth during the forecast period.