Europe Laundry Detergent Market Size, Share, Trends, & Industry Analysis Report

By Product (Powder, Liquid), By Content, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6435

- Base Year: 2024

- Historical Data: 2020-2023

Overview

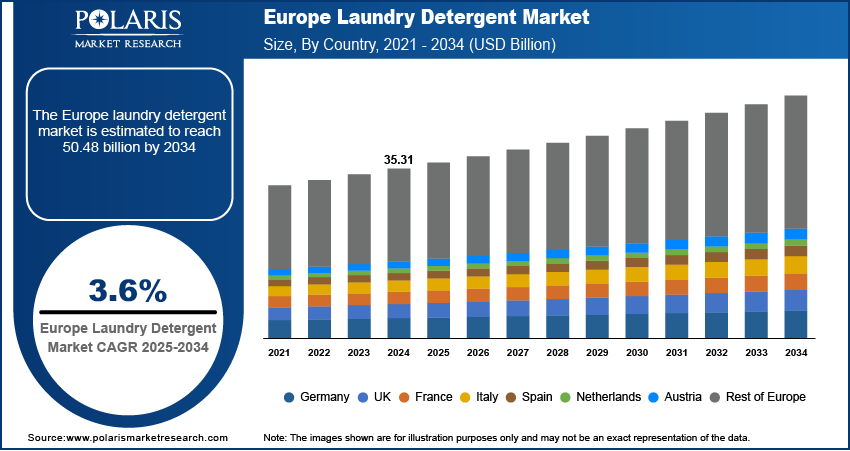

The Europe laundry detergent market size was valued at USD 35.31 billion in 2024, growing at a CAGR of 3.6% from 2025–2034. Key factors driving demand is strong growth in private label and discount retail chains, and urbanization and lifestyle changes.

Key Insights

- The liquid detergent segment is expected to grow at a CAGR of 3.2% during the forecast period, supported by its ease of use, convenience, and effective performance in low-temperature wash cycles, which are commonly preferred in European households.

- The industrial segment captured a significant share of the market in 2024, driven by growing demand from commercial laundries and coin operated laundries, hospitals, hotels, and care facilities, all of which require large volumes of high-performance detergents to meet hygiene and efficiency standards.

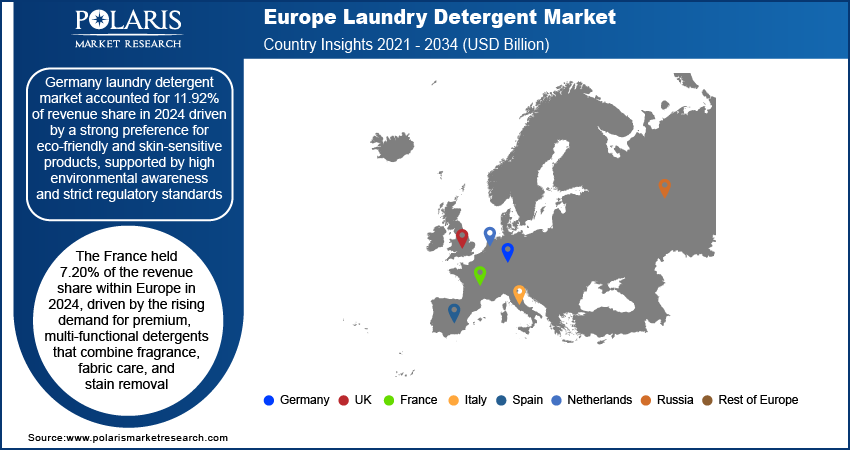

- Germany accounted for 11.92% of the European laundry detergent market revenue in 2024, primarily due to a strong consumer preference for eco-friendly and skin-sensitive products, backed by high environmental awareness and strict chemical regulations.

- France contributed 7.20% of the regional market share in 2024, fueled by increasing demand for premium, multi-functional detergents that offer a combination of fragrance, stain removal, and fabric care in a single solution

Industry Dynamics

- Strong growth in private label and discount retail chains are driving the demand.

- Urbanization and lifestyle changes is driving the Europe laundry detergent market

- The industry is witnessing globalization in the sector, as more and more global vendors are branching out in Europe to increase their revenues.

- Stringent environmental regulations and growing concerns over chemical ingredients in detergents are restraining the market growth.

Market Statistics

- 2024 Market Size: USD 35.31 Billion

- 2034 Projected Market Size: USD 50.48 Billion

- CAGR (2025-2034): 3.6%

- Germany: Largest Market Share

AI Impact on the Industry

Laundry detergent is a cleaning agent designed specifically to remove dirt, stains, and odors from clothing and fabrics during the washing process. It typically contains surfactants, enzymes, and other ingredients that break down grease and grime. Available in liquid, powder, pod, and sheet forms, laundry detergent is essential for effective fabric care and hygiene.

The widespread adoption of high-efficiency and front-load washing machines in Europe is influencing detergent demand. These machines typically require low-sudsing, high-performance detergents that clean effectively at lower temperatures and with less water. This shift is driving innovation in detergent formulations tailored for cold or short wash cycles. Detergent brands that perform well under these conditions are seeing increased penetration as energy efficiency becomes a household priority due to rising electricity costs and climate concern, thereby driving the demand for advanced, low-temperature detergents in the region.

European consumers are shifting from traditional powder detergents to liquid and concentrated formats. These products are perceived as more convenient, easier to dose, and better at dissolving in cold water, which aligns with energy-efficient washing habits in Europe. Concentrated formulas further reduce packaging waste and transport emissions, which appeals to environmentally conscious consumers. Major brands are focusing on liquid detergent innovation and compact packaging, making this format a major driver. Moreover, the convenience and environmental benefits of liquid detergents are helping reshape the laundry habits of European households.

Drivers & Opportunities

Strong Growth in Private Label and Discount Retail Chains: Europe has a highly competitive retail environment, with a strong presence of private label and discount supermarkets like Lidl, Aldi, and Tesco. These retailers offer quality laundry detergents at affordable prices, increasing accessibility for cost-conscious consumers. Private label brands are continuously improving product quality and sustainability to compete with premium brands. Their growing popularity is expanding the market by reaching price-sensitive segments without compromising on performance. This trend supports overall volume growth, thereby fueling the industry expansion in the region.

Urbanization and Lifestyle Changes: Urbanization across Europe is leading to smaller households and faster-paced lifestyles, which directly influence laundry habits. Consumers are seeking convenient, time-saving solutions such as pre-measured pods, quick-wash formulas, and multifunctional detergents that combine stain removal, fragrance, and fabric care. Working professionals and young families are driving demand for smart, all-in-one solutions that simplify laundry routines. Additionally, urban living often involves limited storage space, making compact packaging and efficient products more attractive. These lifestyle changes are encouraging detergent manufacturers to develop more targeted and efficient solutions for the evolving needs of modern European consumers.

Segmental Insights

Product Analysis

Based on product, the segmentation includes powder, liquid, fabric softeners, detergent tablets, washing pods, sheets, and natural/eco-friendly detergents. Liquid segment is projected to grow at a CAGR of 3.2% over the forecast period driven by their convenience, ease of use, and superior performance in low-temperature wash cycles which is common in European households. Consumers prefer liquids because they dissolve quickly, leave no residue, and are ideal for modern front-load washing machines. Additionally, liquid detergents are easier to use for pre-treating stains and work well in quick wash cycles. Manufacturers are further introducing concentrated liquid formulas in green packaging, aligning with Europe’s sustainability goals. These features make liquid detergents a preferred choice among environmentally and performance-conscious European consumers.

Content Analysis

Based on content, the segmentation includes PVOH/PVA free, and PVOH/PVA. PVOH/PVA free segment is expected to witness a significant share over the forecast period due to increasing awareness around microplastic pollution and chemical sustainability. PVOH, commonly used in detergent pods and films, is under scrutiny as studies question its biodegradability in natural environments. Environmentally conscious consumers and NGOs are pressuring manufacturers to remove synthetic polymers and switch to plant-based or biodegradable alternatives. Brands offering PVOH-free detergents are gaining competitive advantage with the EU pushing forward on green regulations and plastic reduction strategies. This is particularly strong in countries like Germany, the Netherlands, and the Nordic countries.

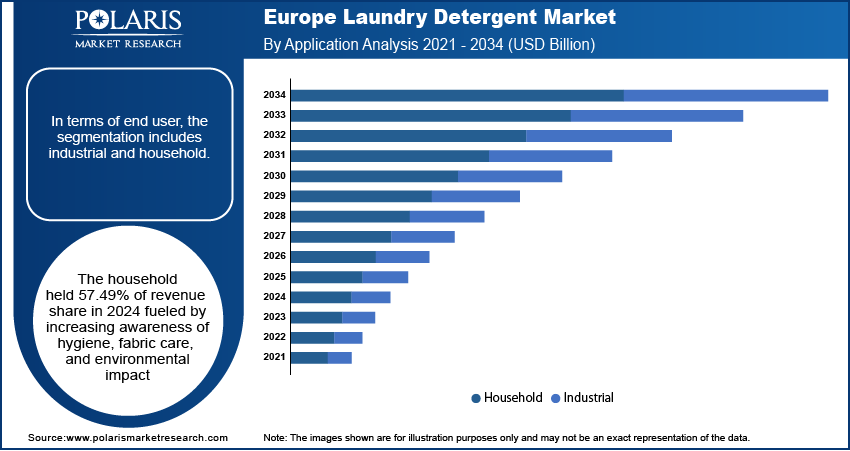

End User Analysis

In terms of end user, the segmentation includes industrial and household. The household held 57.49% of revenue share in 2024 fueled by increasing awareness of hygiene, fabric care, and environmental impact. Consumers are becoming more selective, preferring products that are skin-safe, allergen-free, and eco-certified green premium products. Smaller households and apartment living further influence buying preferences, with demand rising for compact, multi-functional products. Marketing focused on family safety, environmental friendliness, and product efficiency is especially effective. Additionally, ongoing innovation in packaging such as refill packs and recyclable containers supports household adoption. These evolving lifestyle patterns are driving detergent sales across Europe’s residential sector.

The industrial segment held significant revenue share in 2024 driven by rising demand from commercial laundries, hospitals, hotels, and care facilities that require large volumes of high-performance detergents. These institutions prioritize hygiene, cost-efficiency, and compliance with stringent EU cleaning standards. The COVID-19 pandemic heightened awareness of infection control, leading to increased detergent usage across industrial settings. Moreover, sustainability requirements from corporate clients are pushing suppliers to offer eco-friendly, phosphate-free, and biodegradable detergent solutions in bulk formats. This demand for reliable and compliant cleaning products is driving Europe’s industrial laundry detergent sector.

Country Analysis

Germany laundry detergent market accounted for 11.92% of revenue share in 2024 driven by a strong preference for eco-friendly and skin-sensitive products, supported by high environmental awareness and strict regulatory standards. Consumers actively seek detergents that are biodegradable, free from microplastics, and dermatologically tested. The popularity of certified organic and natural brands is further on the rise, reflecting the country's deep-rooted sustainability culture. Additionally, Germany's widespread use of energy-efficient, low-temperature washing machines increases the demand for cold-wash compatible and liquid detergent formulations. Regulatory backing through the EU Ecolabel and innovations in refillable packaging are further propelling the growth.

France Laundry Detergent Market Insight

The France held 7.20% of the revenue share within Europe in 2024, driven by the rising demand for premium, multi-functional detergents that combine fragrance, fabric care, and stain removal. French consumers are increasingly drawn to luxury scents and natural ingredients, creating opportunities for brands to differentiate through sensorial appeal and clean label formulations. The country’s strong organic product movement further extends into home care, boosting the popularity of plant-based and allergen-free detergents. Government efforts to reduce packaging waste are encouraging innovation in recyclable and refillable detergent solutions. These factors collectively drive the shift toward high-quality, eco-conscious detergent products in France.

UK Laundry Detergent Market

The market in UK is expected to register a CAGR of 3.8% during the forecast period driven by convenience and sustainability. Busy urban lifestyles have boosted demand for pre-measured formats like pods and capsules, while increasing environmental concerns are pushing consumers toward plastic-free, refillable, and cruelty-free options. The UK government’s push for a circular economy and reduction in single-use plastics is further influencing buying behavior. Additionally, the growing popularity of subscription-based detergent services and eco startups is reshaping the industry, especially among younger, environmentally conscious consumers. These shifts are fueling innovation and driving demand for efficient, sustainable, and easy-to-use detergent solutions.

Netherlands Laundry Detergent Market Overview

The demand in Netherlands is rising, driven by strong environmental values and a culture of sustainable living. Dutch consumers actively support brands that promote zero-waste packaging, refill stations, and plastic-free formulations. The high level of awareness around water pollution and chemical use encourages demand for PVOH-free, biodegradable, and non-toxic detergent products. In urban areas, small households prefer concentrated, compact detergents that are both space-saving and efficient. Additionally, the Dutch government supports green initiatives, encouraging retailers and manufacturers to adopt more sustainable practices. This eco-driven mindset is shaping the laundry detergent demand.

Key Players & Competitive Analysis

The Europe industry features a highly competitive landscape dominated by global and regional players focusing on innovation, sustainability, and brand loyalty. Key multinationals like Procter & Gamble, Unilever, and Henkel AG & Co. KGaA maintain strong market presence through well-established brands such as Ariel, Persil, and Surf, supported by extensive distribution networks and consistent product innovation. Companies like Reckitt Benckiser and Church & Dwight are also strengthening their footprint with niche offerings and eco-friendly solutions. Rising consumer demand for sustainable and skin-sensitive products has led brands like Method Products and CARROLLCLEAN to gain traction, especially among environmentally conscious consumers. Kao Corporation and Lion Corporation, though based in Asia, are strategically entering the European market with high-performance, low-impact formulations. Competitive strategies increasingly focus on concentrated formulas, refillable packaging, and allergen-free variants to meet Europe’s strict environmental and health regulations, intensifying the race for sustainable product leadership.

Key Players

- CARROLLCLEAN

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- Method Products, PBC

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Unilever

Industry Developments

March 2025, Henkel launched concentrated formulas for all, Persil, and Snuggle reducing plastic use, water consumption, and CO₂ emissions. The initiative demonstrated Henkel’s sustainability commitment and enhanced product efficiency through smaller packaging and recycled materials.

Europe Laundry Detergent Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Powder

- Liquid

- Fabric Softeners

- Detergent Tablets

- Washing Pods

- Sheets

- Natural/Eco friendly detergents

By Content Outlook (Revenue, USD Billion, 2021–2034)

- PVOH/PVA Free

- PVOH/PVA

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Industrial

- Household

By Country Outlook (Revenue, USD Billion, 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Laundry Detergent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 35.31 Billion |

|

Market Size in 2025 |

USD 36.57 Billion |

|

Revenue Forecast by 2034 |

USD 50.48 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, Countrys, and segmentation. |

FAQ's

The market size was valued at USD 35.31 billion in 2024 and is projected to grow to USD 50.48 billion by 2034.

The market is projected to register a CAGR of 3.6% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are CARROLLCLEAN; Church & Dwight Co., Inc.; Henkel AG & Co. KGaA; Kao Corporation; Lion Corporation; Method Products, PBC; Procter & Gamble; Reckitt Benckiser Group PLC; Unilever.

The liquid segment dominated the market revenue share in 2024.

The industrial segment is projected to witness the fastest growth during the forecast period.