U.S. Laundry Detergent Market Size, Share, Trends, & Industry Analysis Report

By Product (Powder, Liquid), By Content, By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6434

- Base Year: 2024

- Historical Data: 2020-2023

Overview

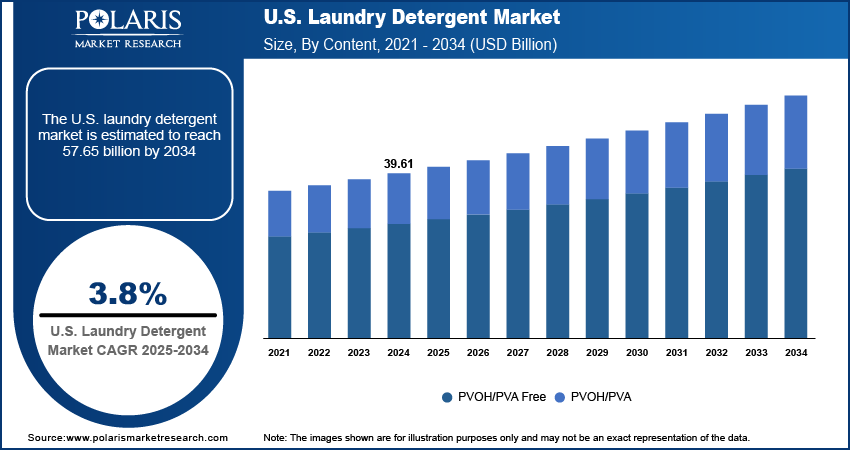

The U.S. laundry detergent market size was valued at USD 39.61 billion in 2024, growing at a CAGR of 3.8% from 2025–2034. Key factors driving demand is expanding e-commerce and retail network, and rising demand for eco-friendly detergents.

Key Insights

- The liquid detergent segment is projected to expand at a CAGR of 3.5% during the forecast period, driven by its user-friendly format, quick dissolving capability, and high effectiveness in stain removal.

- The PVOH/PVA-free segment is anticipated to capture a notable market share, supported by growing consumer awareness about the health and environmental risks linked to microplastics and synthetic polymers.

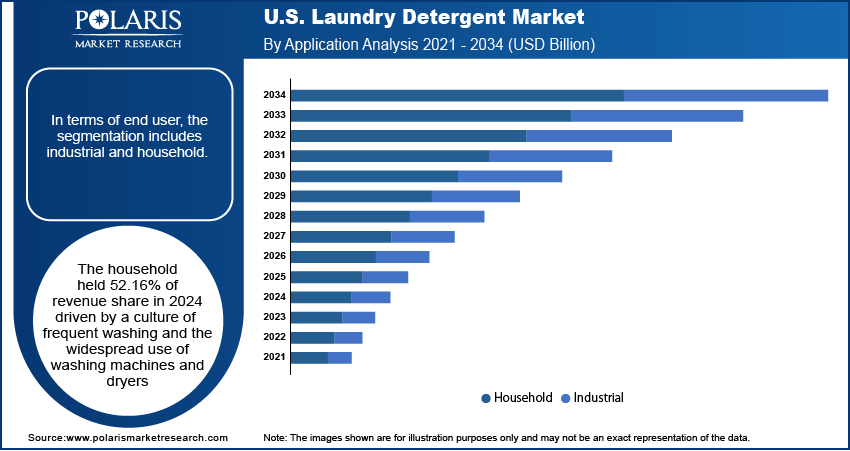

- The household segment accounted for 52.16% of the total revenue in 2024, largely due to the frequent washing habits and the extensive use of washing machines and dryers in U.S. households.

- The industrial segment held a significant revenue share in 2024, fueled by rising demand from hotels, hospitals, laundromats, senior care facilities, and commercial cleaning services, all requiring high-efficiency, large-volume detergent solutions.

Industry Dynamics

- Expanding e-commerce and retail network are driving the accessibility of product.

- Rising demand for eco-friendly detergents is driving the U.S. laundry detergent market

- There is an increasing demand for specialty detergents in the U.S., including products formulated for sensitive skin, baby clothes, and athletic wear.

- Stringent environmental regulations and growing concerns over chemical ingredients in detergents are restraining the market growth.

Market Statistics

- 2024 Market Size: USD 39.61 Billion

- 2034 Projected Market Size: USD 57.65 Billion

- CAGR (2025-2034): 3.8%

Laundry detergent is a cleaning agent designed specifically to remove dirt, stains, and odors from clothing and fabrics during the washing process. It typically contains surfactants, enzymes, and other ingredients that break down grease and grime. Available in liquid, powder, pod, and sheet forms, laundry detergent is essential for effective fabric care and hygiene.

The U.S. is experiencing a steady shift from powder to liquid and concentrated detergents due to their ease of use and superior cleaning performance. Concentrated formulas reduce packaging waste and storage space, aligning with consumer preferences for convenience and sustainability. Liquid detergents further dissolve easily in cold water, helping consumers save energy during laundry. The availability of various scents, formulas for sensitive skin, and compatibility with high-efficiency washers further boost their popularity in American households.

There is an increasing demand for specialty detergents in the U.S., including products formulated for sensitive skin, baby clothes, and athletic wear. Consumers are becoming more aware of specific laundry needs and prefer detergents that cater to allergies, skin conditions, or fabric types. For example, hypoallergenic and fragrance-free detergents have gained popularity among families with young children or individuals with sensitive skin. Detergents designed to preserve technical fabrics in sportswear further attract fitness-conscious consumers, thereby fueling the adoption.

Drivers & Opportunities

Expanding E-Commerce and Retail Network: The growing online sale in the country is fueling the accessibility of the laundry detergent product. People in the country are adopting e-commerce website due to convenience and access to a wider selection of products at potentially lower prices and better deals. Major online retail platforms such as Amazon, Walmart, Etsy, and Target provide same day delivery along with discounted prices, which fuels the accessibility and appeal of the product. Additionally, strong network of the retailers in the country further fuels the demand in rural, urban, and semi-urban regions, where delivery is not possible, thereby fueling the growth of the industry.

Rising Demand for Eco-Friendly Detergents: Growing environmental awareness in the U.S. is driving consumers toward eco-friendly laundry detergents made with biodegradable ingredients and sustainable packaging. People are increasingly concerned about the impact of harsh chemicals on health and the environment. Consequently, many brands are offering plant-based, phosphate-free, and cruelty-free detergents. This trend is especially strong among millennials and Gen Z, who prioritize sustainability. Retailers are responding by expanding their green premium product offerings, making eco-friendly detergents more accessible and affordable across the country, thereby fueling the growth.

Segmental Insights

Product Analysis

Based on product, the segmentation includes powder, liquid, fabric softeners, detergent tablets, washing pods, sheets, and natural/eco-friendly detergents. Liquid segment is projected to grow at a CAGR of 3.5% over the forecast period driven by their ease of use, ability to dissolve quickly, and effective stain removal. American consumers prefer liquid formats for their versatility across cold and warm washes and compatibility with high-efficiency washing machines, which are common in U.S. homes. Liquid detergents further offer a wide variety of scents, skin-sensitive options, and concentrated formulas, making them more appealing. Convenience and product variety, combined with strong retail availability in both physical stores and online, are fueling the growth of this segment.

Content Analysis

Based on content, the segmentation includes PVOH/PVA free, and PVOH/PVA. PVOH/PVA free segment is expected to witness a significant share over the forecast period as more consumers become aware of the environmental and health concerns associated with microplastics and synthetic polymers. Eco-conscious shoppers are increasingly seeking biodegradable, plant-based formulations that align with their values. Regulatory discussions around banning microplastics in household products are further influencing product development. U.S. brands are responding with plastic-free pods, sheets, and refillable liquids, helping drive the shift toward sustainable cleaning.

End User Analysis

In terms of end user, the segmentation includes industrial and household. The household held 52.16% of revenue share in 2024 driven by a culture of frequent washing and the widespread use of washing machines and dryers. U.S. households are seeking detergents that clean effectively, smell pleasant, and are safe for sensitive skin, due to growing awareness around health, hygiene, and fabric care. Post-pandemic habits have reinforced the need for clean, germ-free clothing, pushing families to invest in trusted and high-performing detergent brands. Marketing around multi-functionality and value further appeals strongly to U.S. consumers in this segment.

The industrial segment held significant revenue share in 2024 driven by strong demand from hotels, hospitals, laundromats, care homes, and commercial cleaning services. These industries require bulk, high-efficiency detergents that offer powerful stain removal and disinfecting properties. The growth of the hospitality and healthcare sectors, along with strict cleanliness standards, is pushing for specialized formulations that ensure sanitization, fabric care, and cost-effectiveness. Additionally, industrial users in the U.S. are increasingly looking for eco-friendly bulk options to meet internal sustainability goals, further driving growth in this segment.

Key Players & Competitive Analysis

The U.S. laundry detergent market is dominated by several well-established global and domestic players who compete on the basis of brand recognition, innovation, sustainability, and product performance. Procter & Gamble leads the market with household names like Tide and Gain, known for their strong cleaning power and extensive product lines. Unilever and Henkel AG & Co. KGaA also maintain significant market share with brands like Persil and All, offering premium and budget-friendly options. Church & Dwight, with its Arm & Hammer brand, appeals to value-focused consumers and those seeking baking soda-based or sensitive-skin formulations. Reckitt Benckiser’s Woolite caters to niche segments focused on fabric care. Emerging eco-conscious brands like Method Products, PBC, and CARROLLCLEAN are gaining traction with plant-based, non-toxic, and refillable solutions. Kao Corporation and Lion Corporation, though based in Asia, are expanding into the U.S. with high-efficiency and environmentally friendly products, intensifying competition.

Key Players

- CARROLLCLEAN

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- Method Products, PBC

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Unilever

Industry Developments

March 2025, Henkel launched concentrated formulas for all, Persil, and Snuggle reducing plastic use, water consumption, and CO₂ emissions. The initiative demonstrated Henkel’s sustainability commitment and enhanced product efficiency through smaller packaging and recycled materials.

U.S. Laundry Detergent Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Powder

- Liquid

- Fabric Softeners

- Detergent Tablets

- Washing Pods

- Sheets

- Natural/Eco friendly detergents

By Content Outlook (Revenue, USD Billion, 2021–2034)

- PVOH/PVA Free

- PVOH/PVA

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Industrial

- Household

U.S. Laundry Detergent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 39.61 Billion |

|

Market Size in 2025 |

USD 41.09 Billion |

|

Revenue Forecast by 2034 |

USD 57.65 Billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, Countrys, and segmentation. |

FAQ's

The market size was valued at USD 39.61 billion in 2024 and is projected to grow to USD 57.65 billion by 2034.

The market is projected to register a CAGR of 3.8% during the forecast period.

A few of the key players in the market are CARROLLCLEAN; Church & Dwight Co., Inc.; Henkel AG & Co. KGaA; Kao Corporation; Lion Corporation; Method Products, PBC; Procter & Gamble; Reckitt Benckiser Group PLC; Unilever.

The liquid segment dominated the market revenue share in 2024.

The industrial segment is projected to witness the fastest growth during the forecast period.